En este artículo

There are cases where you only need to record the VAT amount, such as when you receive compensation from your car insurance.

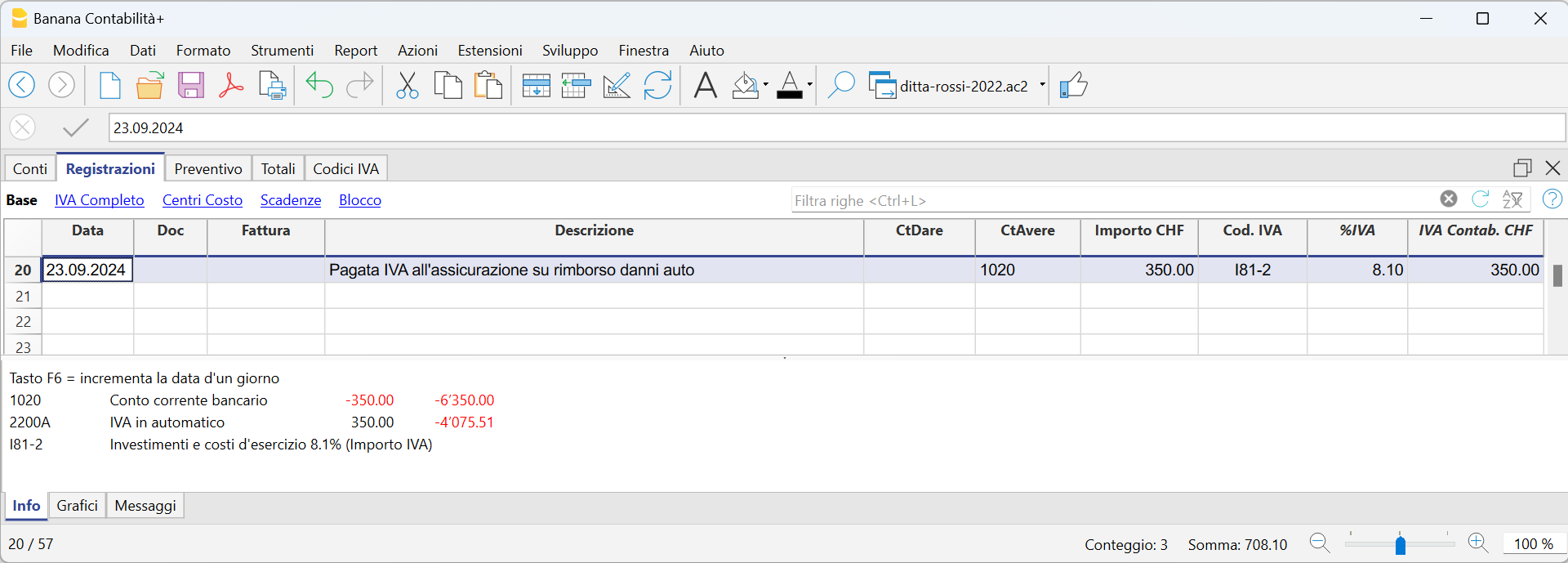

You record as follows:

- Enter the date, document number and the description in the columns provided.

- In the Credit column, enter the account with which the VAT amount is paid (the Debit account remains empty)

- In the Amount column, enter the VAT amount to be paid

- In the VAT code column, enter the VAT code I77-2 (VAT code relating to the VAT amount 100%)