In this article

Swiss VAT Report when base currency is EUR or USD (not CHF) [BETA]

This app converts the values in base currency to Swiss francs (CHF) and creates a transactions report with the values before and after the conversion.

These reports will report the VAT in CHF in case the the base accounting currency is in EUR, USD or another currency different from CHF.

Open source development

This report is been developed and maintained with an open source approach.

Banana makes available the development resource, but the software is maintained and upgraded only if we have users that provide help.

It is then made available with the apache license.

These reports are still in Beta version.

If you use this BananaApp and you would like to have it updated, kindly help us develop further:

- Test case file data 2017.

Kindly prepare and send us per email an accounting file that is anonymized, with real amounts that make use of all VAT codes. - Test case file data 2018.

Kindly prepare and send us per email an accounting file that is anonymized, with real amounts that make use of all VAT codes. - Development of the App for the new VAT code 2018 (VAT 7.7%).

- Test case file data 2019.

Kindly prepare and send us per email an accounting file that is anonymized, with real amounts that make use of all VAT codes. - Kindly check the results and let us know how they work (even if they work fine).

Amounts Conversion to CHF

If the base accounting currency is not CHF, the VatTaxable, VatPosted, VatAmount are in the base currency.

This Amounts are converted to in CHF using these rules:

- If the transaction currency is CHF

it will be used the exchange rate of the transactions. VAT will have the same CHF amounts. - If the transaction currency is NOT CHF

it will be used the exchange rate average monthly exchange rate.

The average monthly exchange rate is considered to be the one of the 15. of each month (2018-01-15, 2018-02-15).

You should enter in the Exchange rate table the average exchange rates for the currencies used.

If the exchange rate with 15 of the Month is not found, it will be used the one older then the 15.

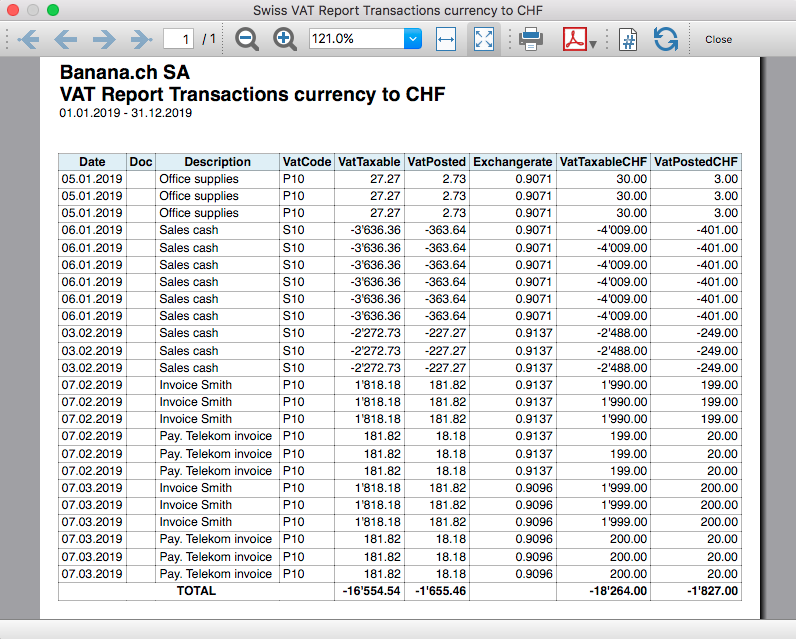

VAT Report Transactions currency to CHF

All transactions that have a VAT code are displayed in this report.

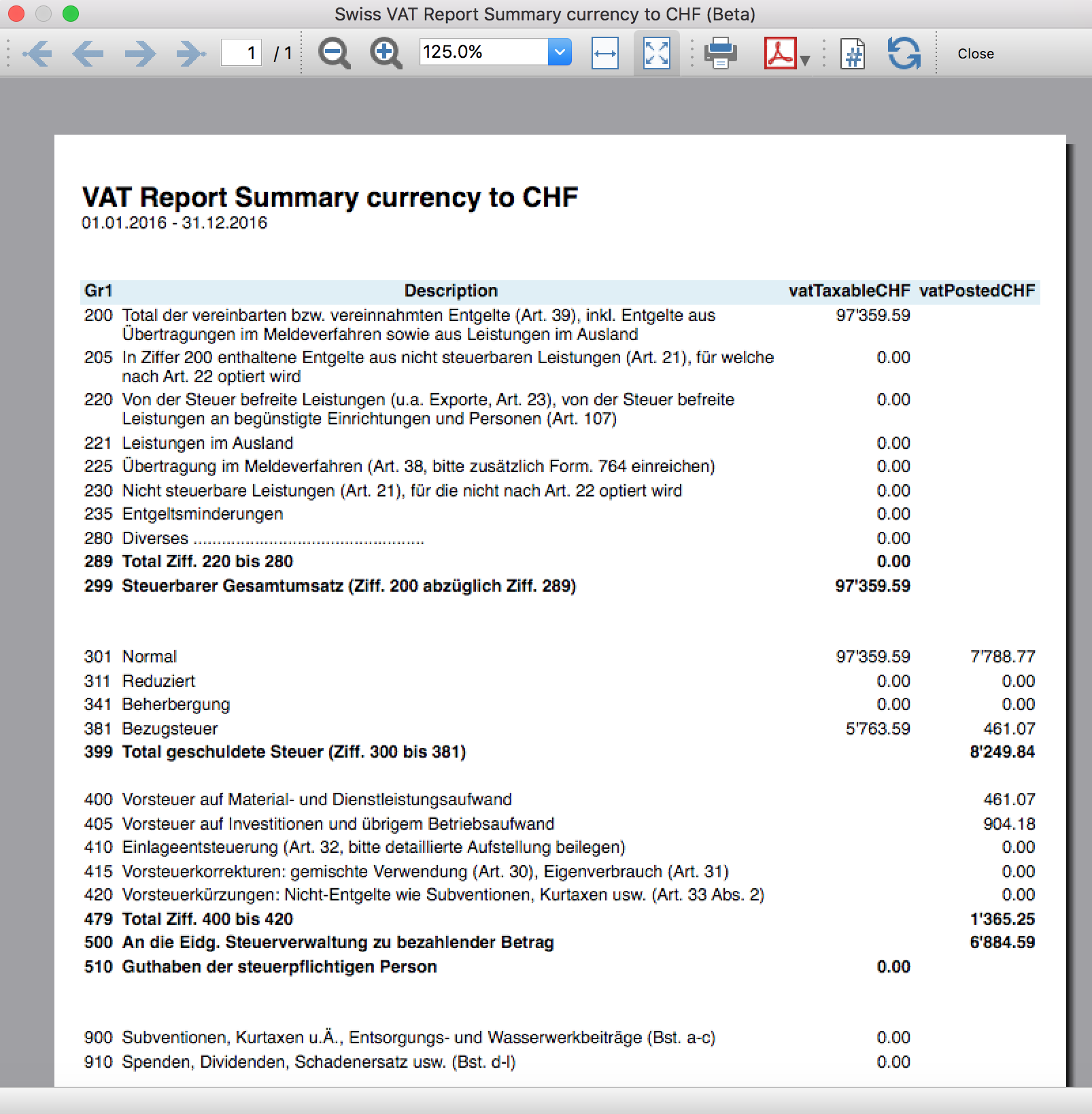

Summary report

The report is in Italian, German and French depending on the accounting language.

It sum the amounts accordingly to the VAT report using the content of the column GR1 in the VAT Table.