VAT Report 2024

Banana Accounting Plus provides the extensions to obtain the 2024 VAT Report (paper facsimile or Xml file) for both the effective method and the flat tax rate method.

The Banana Accounting Plus extensions to obtain the VAT Report from 2024 only work with the Advanced plan

The documentation in English is only partial: the full documentation is available in German, French or Italian.

We provide two distinct extensions to obtain both the paper facsimile or the Xml file of the VAT Report:

- Effective Method - VAT Extension 2024/2018 - See documentation in German, French or Italian

- Flat tax rate Method - VAT Extension 2024/2018 - See documentation in German, French or Italian

The VAT Report, paper facsimile, in Banana Accounting Plus, Advanced plan, allows you to declare the amounts with the 2018 rates and those from 2024.

For users of Banana Accounting 9 or earlier versions

If you have Banana Accounting 9 or earlier, in order to be able to prepare the paper facsimile of the VAT Return or have the Xml file for the electronic submission of data to the FTA, you need to upgrade to the new version of Banana Accounting Plus, Advanced plan.

If you do not wish to switch to the new version, you can still manage VAT; from Banana Accounting you can obtain the VAT Summary and enter the data manually on the paper form or on the FTA website.

More information can be found on the page Update Programme and Plan.

Transition to 2024 VAT rates

From 1st January 2024, the new VAT rates in Switzerland are applied.

Updating your accounting file with the VAT Codes 2024

To be able to record VAT movements with the new rates, you must first update the VAT Codes 2024 table in your accounting files.

- Download the latest version of Banana Accounting Plus (to easily update the VAT Codes table).

- Update the VAT Codes table with the 2024 rates

Before updating VAT Codes, however, we recommend that you make back-up copies of your accounting files, in case you need to revert to previous versions.

2024 VAT Extensions to obtain the VAT Report

The documentation in English is only partial: the full documentation is available in German, French or Italian.

We provide two distinct extensions:

- Effective Method - VAT Extension 2024/2018 - See documentation in German, French or Italian

- Flat tax rate Method - VAT Extension 2024/2018 - See documentation in German, French or Italian

The 2024 extensions allow reporting using both the rates in force as of 2018 (e.g. 7.7%) and those in force as of 2024 (e.g. 8.1%).

The Swiss VAT extensions 2024 are installed automatically and replace the Swiss VAT extensions 2018.

Banana Accounting Plus Advanced Plan

The Swiss VAT extensions 2024 require Banana Accounting Plus, Advanced plan.

- Those who use the Professional or Free plans, from 1 July 2024 will receive a notice that the Advanced plan is required. More information...

VAT extension incompatibility notice 2024 for Banana 9 users

- In Banana Accounting 9 (and previous versions), the new Swiss VAT 2024 extensions are warning that they are no longer compatible. More information...

How to keep using the 2018 VAT extension

- The Swiss VAT 2018 extensions are still available. However, they must be reinstalled manually. More information...

Useful Links

Updating the VAT Codes table with the 2024 VAT rates

It is necessary to have downloaded and installed the latest version of Banana Accounting Plus.

Import 2024 VAT codes

All users who have their own coding for VAT codes must update the VAT Codes table according to the new rates with their respective reference figures. We recommend consulting the VAT Codes table in Banana Accounting Plus.

To update the VAT Codes table in your accounting file, proceed as follows:

- Make a backup copy of your file to be safe

- Open your accounting file

- Select from the menu Actions > Import to accounting > Import VAT codes

- Select Switzerland New VAT Rates 2024

- Confirm by clicking on the OK button

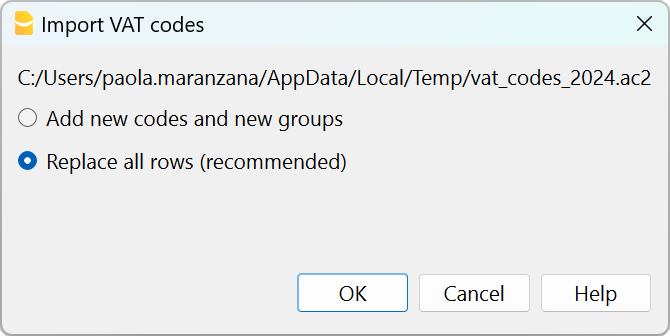

- From the dialog that appears there are two options:

- Add new codes and new groups

To be used when you want to maintain your VAT codes. In this case the program adds the new VAT codes leaving the existing ones unchanged. If the VAT codes to be added already exist in the table, but have a different rate or grouping, they will be inserted by adding '-1' to the name. - Replace all rows (recommended choice)

Use this command if you don't need to maintain the existing VAT code page.

In this case, the VAT code table is completely replaced with the new table.

Existing VAT accounts are retained and need to be reviewed after the update. The default VAT account can be changed via the File Properties dialog (basic data).

- Add new codes and new groups

- Check the accounting

From Actions menu > Check accounting.

If there are incorrect VAT codes in the transactions table, you need to update them according to the new VAT Codes table.

To replace the old VAT codes in the Transactions table, you can use the command from the menu Data > Search and replace.

If the VAT codes have also been entered in the Accounts table, to associate the VAT codes to the accounts, these must be updated.

Update the VAT Codes table in the Estimates and Invoices application

It is not possible to automatically update the VAT Codes table in the Estimates and Invoices application, as explained in the previous paragraphs.

ID codes and percentage VAT rates must be updated manually each time there are changes.

Alternatively, you can also follow this procedure:

- Open a new Banana template for Estimates and Invoices, which has updated VAT codes

- Go to the VAT Codes table

- Copy and paste the entire table from the template to your Estimates and Invoices file.

For more details, refer to the VAT Codes table in Estimates and Invoices page.

2024 Swiss VAT Codes description in Banana Accounting+

Swiss VAT codes changed as of 1 January 2024. Below you will find what changed in the Banana Accounting Plus programme

Changes due to the 2024 rates

New codes have been added to the VAT Codes table for the VAT rates for 2024 (8.1, 2.6, 3.8).

In particular, new codes have been added for the calculation of the tax on the VAT form, Section II, for transactions subject to VAT from 01.01.2024; the VAT codes relating to the old rates and valid for transactions subject to VAT up to 31.12.2023 remain unchanged.

For the newly added VAT Codes, the references for the figures that must appear on the VAT form as of 01.01.2024 have been inserted. The figure references for the previous VAT Codes valid until 31.12.2023 remain unchanged.

For more information, please consult the detailed description of the VAT codes on this page.

For users of Banana Accounting 9 or previous versions

Those who have previous versions of Banana Accounting can add the VAT codes manually, but it is not possible to create the paper or XML facsimile for the automatic forwarding of the data to the FTA. We recommend upgrading to Banana Accounting Plus, Advanced plan.

If you have updated the VAT Codes table, the table is set as follows:

- V = Sales (200)

- VS = Discount sales and services (235)

- B = Acquisition tax (383 - 382)

- M = Expenses for material and services (400)

- I = Investments and other operating expenses (405)

- K= Corrections (410, 415, 420)

- Z = Not considered (910)

Gr1 Grouping

The GR1 column (visible in the Complete view) shows the figures of the VAT form, where the amounts are grouped according to the relevant VAT code.

For the programme, these indications are essential for the preparation of the VAT form (facsimile) and the Xml file for the electronic submission of VAT data on the portal of the Federal Administration.

There are VAT codes that must appear in several boxes for the figures on the form. For example, the sales taxable amount must appear in digit 200 (Turnover figure) and also in digit 303 (Tax calculation). In these cases, the figures separated by a semicolon (200;303) are entered in column Gr1.

If a VAT code, which is present in the table VAT Codes, is used in the table Recording and does not have a grouping in the column GR1, when printing the VAT form, the programme will report an error. If a VAT code is not to appear in any figure on the VAT form, 'xxx' must be indicated in column Gr1; thus no error is reported.

Gr1 codes till end of 2023 and from 2024

In the VAT form with the Effective method, in the Calculation of tax part, there are boxes up to 31.12.2023 (302, 312, 342, 382) and boxes from 1.1.2024 (303, 313, 343, 383).

In the VAT Form for Flat Tax Rate method, there are boxes up to 31.12.2023 (321, 331, 381) and boxes from 1.1.2024 (322, 332, 382) in the Calculation of tax part.

The Print VAT Form command inserts the values of the boxes according to the figure contained in Gr1. If a new code is added, the VAT form reference figure must therefore be entered correctly.

Turnover / Taxable Amount

Initial letter V is used for codes relating to Turnover.

Reference 200 - Total amount of agreed or collected consideration

All transactions related to turnover, whether subject or not to VAT, must be reported here. Exempt sales are to be indicated with the appropriate VAT code.

Codes for exempt transactions or supplies provided abroad must be grouped in reference 200 and simultaneously reported in the relative deduction reference number.

The VAT codes related to turnover are:

- V81, V26, V38 (valid from 01.01.2024)

- V77, V25-N, V37 (valid until 31.12.2023).

Sales subject to VAT must be grouped not only in the figure 200 but also in the respective positions according to the rate (302, 303, 312, 342, 343, 382, 383).

Reference 205 - Consideration exempt from tax where option for taxation has been exercised

These transactions must be indicated under reference number 200, but must also figure under reference no 205.

They carry a VAT code that is identical to a VAT sales code, with the additional indication in the Gr1 column that they also must be grouped in the ref 205.

In order to be able to use this position, VAT codes must be replicated from reference number 200. For simplicity, the letter B has been added to the existing VAT codes.

The following codes must be used in the VAT codes tab:

- V77 (valid until 31.12.2023)

- V81 (valid from 01.01.2024).

Reference 299 - Taxable turnover

The taxable turnover is constituted by the turnover minus the non-taxable turnover (Deductions) (221, 225, 230, 235, 280).

Decrease in Turnover

For each non-taxable or non-VATable position, there is a VAT code with a percentage of 0 (due).

Reference 220 - Tax-exempt services

Use the following code:

- V0

Reference 221 - Services provided abroad

Purchase of goods and services abroad are intended (Article 23) or when the beneficiary is not subject to tax(Article 107).

Use the following code:

- V0-E

Reference 225 - Transfers via Notification Procedure

Transfers via notification procedure (Article 38; to be submitted with form No. 764).

The code to use is the following:

V0-T

Acquisition tax (Art. 45)

Reference 381 - 382 - Acquisition tax

Services that are obtained abroad, that do not carry any customs documents, must be subject to VAT as if they were sales.

For these cases, special VAT codes are needed to calculate VAT both as VAT due and as recoverable VAT.

The VAT codes to be used are:

- B81 for transactions with VAT code type 0 (VAT amount included), valid from 01.01.2024

- B81-1 for transactions with VAT code type 1 (VAT amount excluded), valid from 01.01.2024

- B81-2 for transactions with VAT code type amount 2 (VAT amount 100%), valid from 01.01.2024

- B77 for transactions with VAT code type 0 (VAT amount included), valid until 31.12.2023

- B77-1 for transactions with VAT code type 1 (VAT amount excluded), valid until 31.12.2023

- B77-2 for transactions with VAT code type amount 2 (VAT amount 100%), valid until 31.12.2023

Recoverable taxation

Recoverable VAT is reported in this part of the (refundable VAT).

Reference 400 - Input tax on Purchase of material and services

These are purchases of goods and services that are part of the company's core business.

The codes for recoverable taxation are:

- M81, M26, M38 (valid from 01.01.2024)

- M77 (valid until 31.12.2023)

In cases where VAT has been paid at customs and there exists an invoice with the VAT amount only, VAT code type 2 (Registration Amount = VAT amount) must be used. For these cases, the following code was set up:

- M81-2 (valid from 01.01.2024)

- M77-2 (valid until 31.12.2023).

For Amount type 1 (Amount of registration = Net Amount) use the following code:

- M81-1 (valid from 01.01.2024)

- M77-1 (valid until 31.12.2023)

Reference 405 - Input tax on Investment and operating costs

These are purchases for investments and operating costs that are not part of the 400 figure.

The VAT codes are:

- I81, I26, I38 (valid from 01.01.2024)

- I81-2 to be used for obtaining services abroad, in conjunction with the codes designated for calculating the purchase tax (see page VAT on foreign services)

- I77, I37 (valid until 31.12.2023).

It might be necessary to add further codes of Amount type 2, or Amount type 1 with different rates.

Purchases without VAT should not be included in the VAT return.

In some cases (eg clarity of the review) it may be useful to identify specific transactions without VAT.

The VAT codes are:

- M0 and I0, grouped with "xxx" in order to avoid generating an error message.

Corrections and reductions (recoverable tax)

It might not be necessary for the taxpayer to use these positions. If needed, use one of the codes grouped in the Correction and adjustments Group.

From an accounting point of view, correction transactions may essentially result in a reduction of VAT deductibility.

A registration must therefore be made for the deductible VAT adjustment (as a plus or minus).

Reference 410 - De-taxation (art. 32)

You can deduct the recoverable VAT paid in previous years.

The codes are:

- K81-A (valid from 01.01.2024)

- K77-A (valid until 31.12.2023).

Reference 415 Corrections of the input tax deduction, mixed use

In cases where merchandise has not been used for corporate or taxable purposes, it is not possible to recover all previous input tax VAT.

You can do this by always using the same purchase account (both credit and debit); in this way the purchase account will be increased by the amount of non-deductible VAT.

The codes are :

- K81-B (valid from 01.01.2024)

- K77-B (valid until 31.12.2023).

Reference 420 - Reduction of the input tax deduction

These are the transactions to be deducted from deductible VAT, such as subsidies.

This position must contain the same elements as the ones in reference 900.

The codes are:

- K81-D (valid from 01.01.2024)

- K77-D (valid until 31.12.2023).

Other cash flows of financial resources

In this part, the amounts relating to the base for the calculation for VAT must be reported..

These are transactions that are not part of the turnover and are not countervailing duties.

Reference 900 - Subsidies, tourist taxes and similar

Operations in reduction the deductible VAT, such as subsidies.

The code to use in these cases is:

- Z0-A

Reference 910 - Donations, dividends, compensation for damages etc.

Out of scope transactions. Donations, dividends and all other "receipts" that do not lead to a reduction of deductible VAT.

The code to use in these cases is:

- Z0

VAT Codes - Flat tax rate

As a result of the VAT rates for 2024, in Banana Accounting, the VAT rates have also been updated using the flat tax rate method.

Column GR1 shows the figures of the VAT form where the amounts are totalled. If the amounts are to be totalled in several digits, these are separated by a semicolon.

- F1 - code provided for sales subject to 1st rate (reference 200, 323), to be used from 01.01.2024

- F2 - code provided for sales subject to 2nd rate (reference 200, 333), to be used from 01.01.2024

- FS1 - code provided for discount on sales subject to 1. rate (reference 235, 323), to be used from 01.01.2024

- FS2 - code provided for discount on sales with 2. rate (reference 235, 333), to be used from 01.01.2024

- F3 code provided for sales subject to 1. rate (reference 200, 322), to be used until 31.12.2023

- F4 code provided for sales subject to 2nd rate (reference 200, 332), to be used until 31.12.2023

- FS3 code provided for discount on sales subject to 1st rate (reference 235, 322), to be used until 31.12.2023

- FS4 code provided for the discount on sales subject to the 2nd rate (reference 235, 332), to be used until 31.12.2023

- F1050 - code provided for exports which have been annotated and declared using form 1050 (reference 470)

- F1055 - code provided for exports which have been recorded and declared by means of form No. 1055 (reference 471).

Those who run previous versions, can download the updated file of the new VAT Codes table, or enter the missing codes.

VAT account in the basic accounting data

All default Banana Accounting templates have the VAT account (2201) already set up in the File properties (File menu, VAT section). This allows the VAT calculations to be automated, so that all VAT amounts are accounted for in this account.

At the end of the quarter, the balance of this account represents the amount to be paid to the FTA (or to be recovered).

When the VAT Return account (2201) is set in the file properties, in the VAT Codes table, the VAT Account column must be empty.

If account 2201 is not set in the file properties, the previous VAT account 1, 2 and the VAT account due to each individual code can be set. In this case, the VAT is spread over three different accounts and at the end of the quarter the VAT accounts must be closed in order to determine the VAT payable to the FTA.

VAT Extension 2024, Program update and subscription plan

On this page you will find the main news concerning the Swiss VAT rates that came into force on 1 January, 2024, as well as the latest current requirements and forecasts for the future.

Upgrading to the Advaced plan from the Professional plan

The Swiss VAT 2018 extension does not allow you to set up VAT Reports with the new rates. It is therefore automatically replaced with the 2024 extension, which allows you to set up VAT Reports with both 2018 and 2024 rates. If you have the Professional plan of Banana Accounting Plus, when trying to create the VAT Report, a message appears announcing that the Advanced plan is required.

Switch to the Advanced plan of Banana Plus

You only pay the difference between the two plans

As an alternative you can continue with the Professional or Free plan, manually reinstalling the 2018 VAT extension to get VAT Reports until the end of 2023. For 2024, you can create the VAT Summary on Banana (VAT journal by rate type) and then fill out the VAT Report manually.

Switching to the Advanced plan from the Free plan

The Swiss VAT 2018 extension does not allow you to set up VAT Reports with the new rates. It is therefore automatically replaced with the 2024 extension, which allows you to set up VAT Reports with both 2018 and 2024 rates. In order to create the VAT Report, as of July 1, 2024, the Advanced plan is required.

Purchase the Advanced plan of Banana Accounting Plus

Message of incompatibility for Banana 9 users

Banana Accounting 9 and earlier versions are no longer updated. Banana 9 allows the installation of the 2024 VAT extensions, but you will be notified that the extension is not compatible. There are two options:

- Switch to the Advanced plan of Banana Accounting Plus and use the VAT 2024 extension right away.

- Continue using Banana Accounting 9, manually reinstalling the 2018 VAT extension to get VAT Reports until the end of 2023. For 2024, you can create the VAT Summary on Banana (VAT journal by rate type) and then fill out the VAT Report manually.

The advantages of the Advanced plan of Banana Accounting Plus

Banana Accounting Plus, Advanced plan, offers all the functionalities required to prepare the online VAT Report.

Compared to the previous versions, Banana Accounting Plus also brings several improvements and new features; the Advanced plan in particular includes functions that automate and speed up bookkeeping, designed precisely for those who need to take care of several tasks and do not have much time.

The VAT 2024 extension, built into the Advanced plan, allows you to set up VAT Report with both 2018 and 2024 rates.

If you have old versions or the Professional plan, switching to the Advanced plan now is definitely the most efficient way to be ready for the VAT change.

Mandatory online VAT reporting from 2025 onwards

The Federal Tax Administration reports that as of January 1, 2025, all Swiss companies subject to VAT have to process the announcement of the start of liability and the submission of the statement in the VAT area electronically via the ePortal.

Reinstalling the Swiss VAT Extensions 2018

The 2018 VAT extensions (effective method and net tax rate method) are still available and you can file Report until 2023, with the 2018 VAT rates. You can continue working as before, but you have to install the extension manually. It is simple:

- Extensions menu > Manage Extensions.

- Search for the 2018 VAT extension you are interested in (actual method or net tax rate method).

- Click on the Install button.

- In the Extensions menu you will see the command related to the 2018 VAT Report.

Managing VAT without the Advanced plan of Banana Accounting Plus

If you are using Banana Accounting Plus with a plan other than Advanced, or if you have Banana Accounting 9 (or an earlier version), you can still manage VAT:

- You can reinstall and continue using the Swiss VAT 2018 extension (see above).

- You can update the VAT Codes table with the new codes, either manually or by following these steps:

- Download the 2024 VAT Codes Table file

- For Banana Plus Professional plan Users:

OPen the existing accounting file from the menu Actions > Import to accounting > VAT codes 2024, select format Accounting file (*.ac2). Select the VAT codes 2024 file that has been saved in the Download folder by clicking on the Browse button.

- For Banana Plus Professional plan Users:

- Download the 2024 VAT Codes Table file

- You can also enter VAT transactions using the new rates.

- You can get the VAT Summary (also called VAT Journal) and check.

- You must then manually enter the data in the VAT Summary hard copy for each rate or on the FTA ePortal.