在此文中

In Income and Expenses Accounting and the Cash manager, the functionality for Completing Imported transactions works in the same way as for Completing transactions in Double-entry Accounting.

The main difference is as follows:

- In the Income / Expenses accounting, the columns Account and Category are used.

- The Account column refers to the bank account.

- The Category column is where the category is specified. It represents the counterpart account entered automatically.

- The Income and Expense columns are where the amount for the transaction is indicated.

- In double-entry accounting, the Debit Account and Credit Account columns, along with the Amount column, are used.

Therefore, even with income and expense accounting, it is possible to create rules using one of the following methods:

- Rules from the Apply Rules dialog.

- Rules from the Transactions table.

- Rules from the Recurring Transactions table.

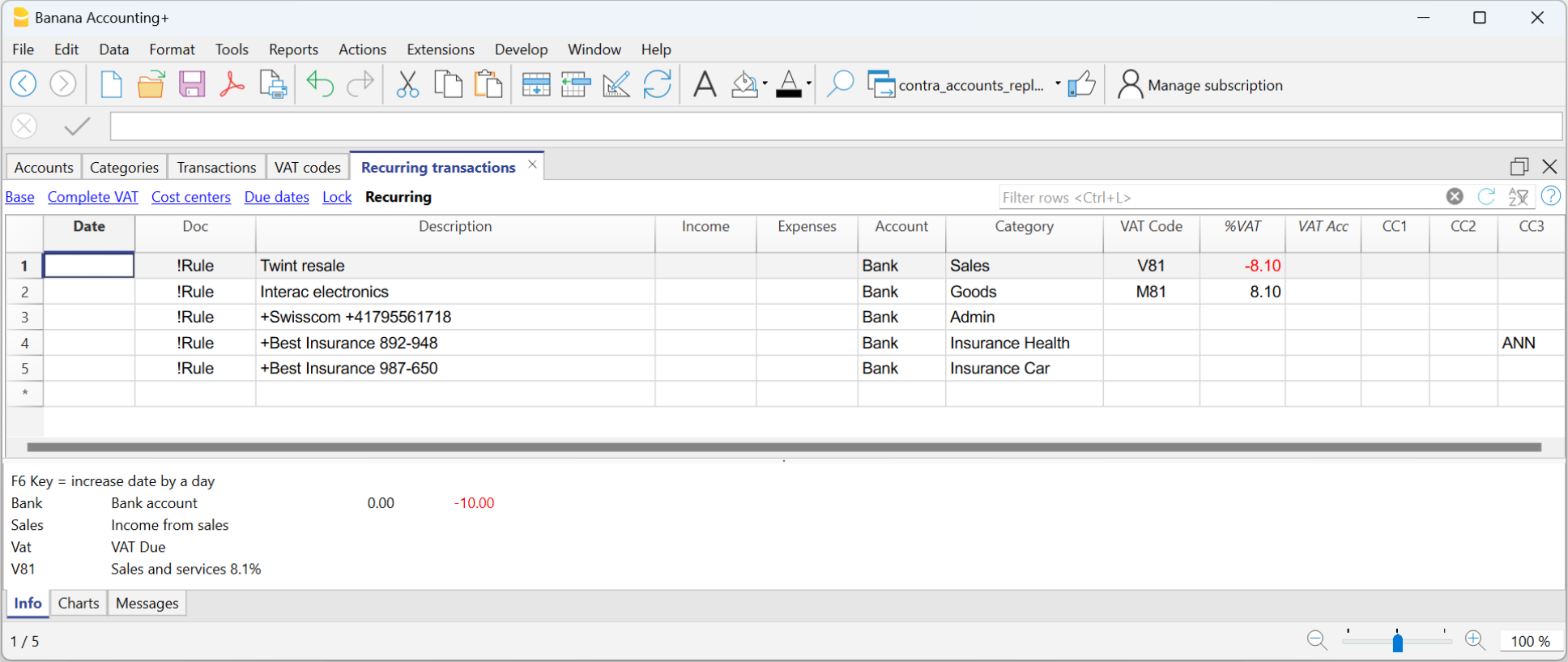

The Recurring transactions table in Income / Expenses accounting

In the Recurring Transactions table, all imported transactions to which Rules have been applied are saved:

- The columns associated with the amount are the Income and Expenses columns.

- If no amount is specified, the rule will be applied to both outgoing and incoming transactions.