在此文中

Accounting combined with Accounting report for Balance sheet in accordance with art. 959 code of obligations

How to obtain the presentation of the Balance sheet according to article 959 of the Swiss Code of obligations without modifying your own Chart of accounts.

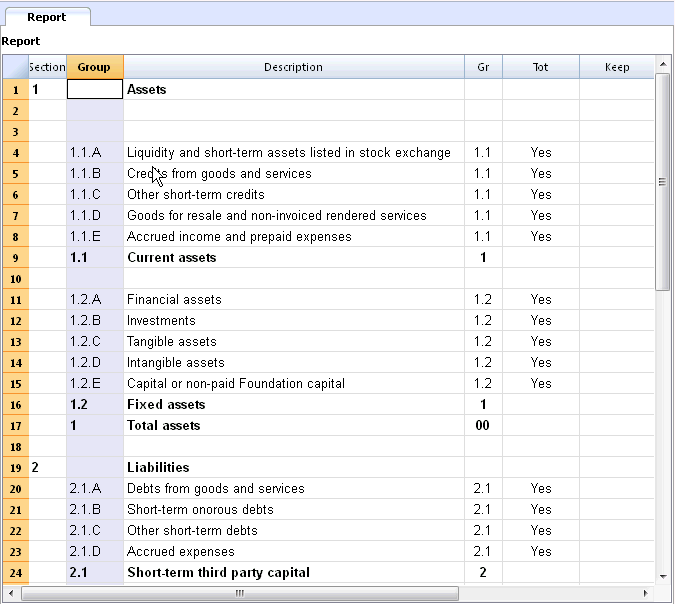

模板文件

This accounting report file groups the accounts of the balance sheet according to the new Swiss Code of obligations (Art. 959a e 959b CO).

Thanks to this resport is therefore possible to keep using a personal accounts grouping organization (or the old system) and then print the Balance Sheet according to the new system.

For more information you can also visit the Accounting report file page.

Saving the Accounting report file on your computer

- Download the Accounting report file or open it from the program

- Save the file under a new name

- As a reference, use the numbering of the Group column

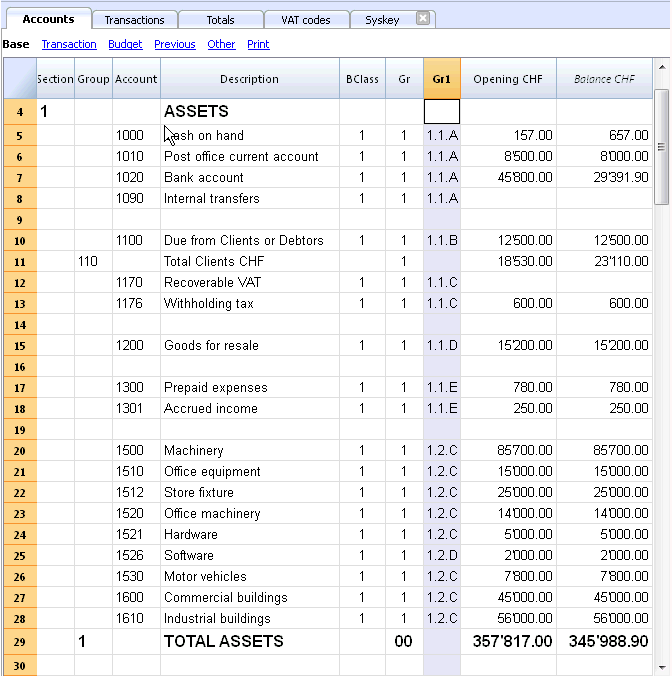

Assigning the GR1 of the new system to the existing accounts

- Open your own accounting file

- Make the Gr1 column visible, from the Data menu, Columns setup command

- For each account of the your chart of accounts, enter the corresponding number of the accounting report in the Gr1 column.

- Example: in the cell (Gr1 column) corresponding to the cash account, enter the 1.1.A numbering that groups Liquidity and short-term assets listed in stock exchange, as shown in the accounting report.

Printing the Report

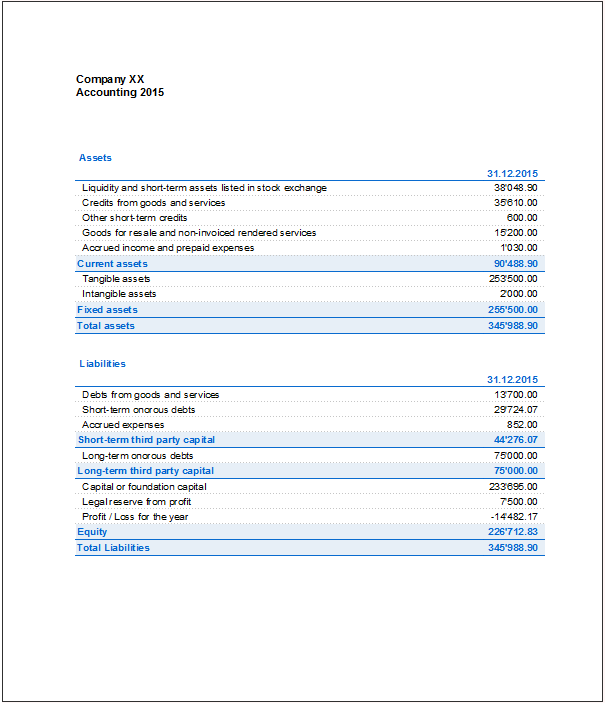

- Once the numbering of the Gr1 column is finished, launch the Enhanced Balance sheet with groups command (from the Account1 menu)

- Under Chart of accounts -> Sections, activate the External accounting report checkbox and select Gr1 as Grouping column,

- Using the Browse button, enter the path of the External accounting report file

- Confirm with OK

You will obtain the Balance sheet according to the new regulations

模板预览

Company XX

Accounting 2025

Basic Currency: CHF

Double-entry with VAT/Sales tax

| Group | Account | Description | Sum In | Gr1 |

|---|---|---|---|---|

| BALANCE SHEET | ||||

| ASSETS | ||||

| 1000 | Cash on hand | 1 | 1.1.A | |

| 1010 | Post office current account | 1 | 1.1.A | |

| 1020 | Bank account | 1 | 1.1.A | |

| 1090 | Internal transfers | 1 | 1.1.A | |

| 1100 | Due from Clients or Debtors | 1 | 1.1.B | |

| 110 | Total Clients CHF | 1 | ||

| 1170 | Recoverable VAT | 1 | 1.1.C | |

| 1176 | Withholding tax | 1 | 1.1.C | |

| 1200 | Goods for resale | 1 | 1.1.D | |

| 1300 | Prepaid expenses | 1 | 1.1.E | |

| 1301 | Accrued income | 1 | 1.1.E | |

| 1500 | Machinery | 1 | 1.2.C | |

| 1510 | Office equipment | 1 | 1.2.C | |

| 1512 | Store fixture | 1 | 1.2.C | |

| 1520 | Office machinery | 1 | 1.2.C | |

| 1521 | Hardware | 1 | 1.2.C | |

| 1526 | Software | 1 | 1.2.D | |

| 1530 | Motor vehicles | 1 | 1.2.C | |

| 1600 | Commercial buildings | 1 | 1.2.C | |

| 1610 | Industrial buildings | 1 | 1.2.C | |

| 1 | TOTAL ASSETS | 00 | ||

| LIABILITIES | ||||

| 200 | Suppliers or Creditors | 2 | ||

| 2100 | Due to banks short-term | 2 | 2.1.B | |

| 2170 | Due to employees and social security institutions | 2 | 2.1.B | |

| 2200A | Automatic VAT | 2 | 2.1.B | |

| 2201 | VAT payable | 2 | 2.1.B | |

| 2300 | Accrued expenses | 2 | 2.1.D | |

| 2400 | Due to banks long-term | 2 | 2.2.A | |

| 2800 | Share capital | 2 | 2.3.A | |

| 2850 | Private account | 2 | 2.3.A | |

| 2900 | Legal reserves | 2 | 2.3.C | |

| 2970 | Profit (Loss) carried forward | 2 | 2.3.A | |

| 297 | Profit/Loss for the period | 2 | ||

| 2 | TOTAL LIABILITIES | 00 | ||

| PROFIT & LOSS STATEMENT | ||||

| REVENUE | ||||

| 3000 | Earnings from own products | 3 | 4.1 | |

| 3090 | Discounts on production | 3 | 4.1 | |

| 3200 | Earnings from resale | 3 | 4.1 | |

| 3290 | Discounts on resale | 3 | 4.1 | |

| 3400 | Earnings from services rendered | 3 | 4.1 | |

| 3809 | VAT flat tax rate | 3 | ||

| 6850 | Interest income bank and post office account | 3 | 4.7 | |

| 6892 | Exchange rate gain | 3 | 4.7 | |

| 7000 | Non-operating income | 3 | 4.9 | |

| 3 | TOTAL REVENUE | 02 | ||

| EXPENSES | ||||

| Materials costs | ||||

| 4000 | Raw materials | 4 | 4.3 | |

| 4090 | Discounts on materials | 4 | 4.3 | |

| 4200 | Expenses for goods for resale | 4 | 4.3 | |

| 4400 | Third party expenses | 4 | 4.5 | |

| 4 | Total material costs | C | ||

| Personnel expenses | ||||

| 5000 | Salaries | 5 | 4.4 | |

| 5700 | Contribution to old age insurance and unemployment | 5 | 4.4 | |

| 5720 | Contribution to pension funds | 5 | 4.4 | |

| 5730 | Contribution to accident insurance | 5 | 4.4 | |

| 5740 | Contribution to voluntary daily benefits insurance | 5 | 4.4 | |

| 5790 | Source tax | 5 | 4.4 | |

| 5820 | Travel and entertainment expenses effective | 5 | 4.4 | |

| 5830 | Travel and entertainment expense allowance | 5 | 4.4 | |

| 5880 | Other personal expenses | 5 | 4.4 | |

| 5900 | Temporary staff | 5 | 4.4 | |

| 5 | Total personnel expenses | C | ||

| Other operating costs | ||||

| 6000 | Rental | 6 | 4.5 | |

| 6200 | Repairs expenses | 6 | 4.5 | |

| 6300 | Elementary insurance or Damage by natural forces | 6 | 4.5 | |

| 6400 | Electricity | 6 | 4.5 | |

| 6500 | Office supplies | 6 | 4.5 | |

| 6600 | Advertising | 6 | 4.5 | |

| 6700 | Other costs | 6 | 4.5 | |

| 6800 | Interest expense bank overdrafts | 6 | 4.7 | |

| 6842 | Exchange rate loss | 6 | 4.7 | |

| 6900 | Amortization | 6 | 4.6 | |

| 8900 | Income Tax | 6 | 4.10 | |

| 6 | Total other operating costs | C | ||

| C | TOTAL EXPENSES | 02 | ||

| 02 | Profit/Loss for Profit & Loss Statement | 297 | ||

| 00 | Difference should be = 0 (blank cell) | |||

| CLIENTS/DEBTORS | ||||

| Clients/Debitors | ||||

| 100.A | Client A | 110A | 1.1.B | |

| 100.B | Client B | 110A | 1.1.B | |

| 100.C | Client C | 110A | 1.1.B | |

| 100.D | Client D | 110A | 1.1.B | |

| 100.E | Client E | 110A | 1.1.B | |

| 110A | Total Clients/Debitors | 110 | ||

| Suppliers/Creditors | ||||

| 200.A | Suppliers A | 200A | 2.1.A | |

| 200.B | Suppliers B | 200A | 2.1.A | |

| 200.C | Suppliers C | 200A | 2.1.A | |

| 200.D | Suppliers D | 200A | 2.1.A | |

| 200.E | Suppliers E | 200A | 2.1.A | |

| 200A | Total Suppliers/Creditors | 200 | ||

| Cost centers | ||||

| .IMB | Packaging | |||

| .MP | Raw materials | |||

| .MS | Subsidiary materials | |||

| ,BEN | Gas and oil expense | |||

| ,MAN | Maintenance machinery | |||

| VAT Code | Description | %VAT |

|---|---|---|

| Explanations | ||

| V = Sales (200) | ||

| VS = Discount sales and services (235) | ||

| B = Acquisition tax (38x) | ||

| M = Expenses for material and services (400) | ||

| I = Investments and other operating expenses (405) | ||

| K = Corrections (410, 415, 420) | ||

| Z = Not considered (910) | ||

| VAT codes information (do not modify) | ||

| id=vatcodes-che-2024.20230614 | ||

| Last update: 14.06.2023 | ||

| VAT Due | ||

| V0 | Exempt services (220) | |

| V0-E | Export services abroad (221) | |

| V0-T | Transfers in the reporting procedure (225) | |

| V0-N | Non-taxable services (230) | |

| Decrease of income from services, see discounts | ||

| V0-D | Various (280) | |

| V77 | Sales and services 7.7% | 7.70 |

| V81 | Sales and services 8.1% | 8.10 |

| V77-B | Sales and services 7.7% (chosen) | 7.70 |

| V81-B | Sales and services 8.1% (chosen) | 8.10 |

| V25-N | Sales and services 2.5% | 2.50 |

| V26 | Sales and services 2.6% | 2.60 |

| V37 | Sales and services 3.7% | 3.70 |

| V38 | Sales and services 3.8% | 3.80 |

| VS77 | Discount Sales and services 7.7% | 7.70 |

| VS81 | Discount Sales and services 8.1% | 8.10 |

| VS25-N | Discount Sales and services 2.5% | 2.50 |

| VS26 | Discount Sales and services 2.6% | 2.60 |

| VS37 | Discount Sales and services 3.7% | 3.70 |

| VS38 | Discount Sales and services 3.8% | 3.80 |

| Taxable turnover (299) | ||

| F1 | 1. Flat tax rate 2024 | |

| F2 | 2. Flat tax rate 2024 | |

| FS1 | Discount Sales and services 1. Flat tax rate 2024 | |

| FS2 | Discount Sales and services 2. Flat tax rate 2024 | |

| F3 | 1. Flat tax rate 2018 | |

| F4 | 2. Flat tax rate 2018 | |

| FS3 | Discount Sales and services 1. Flat tax rate 2018 | |

| FS4 | Discount Sales and services 2. Flat tax rate 2018 | |

| Total Flat tax rate (322-333) | ||

| B77 | Acquisition tax 7.7% (With VAT/Sales tax) | 7.70 |

| B77-1 | Acquisition tax 7.7% (Without VAT/Sales tax) | 7.70 |

| B77-2 | Acquisition tax 7.7% (VAT/Sales tax amount) | 7.70 |

| B81 | Acquisition tax 8.1% (With VAT/Sales tax) | 8.10 |

| B81-1 | Acquisition tax 8.1% (Without VAT/Sales tax) | 8.10 |

| B81-2 | Acquisition tax 8.1% (VAT/Sales tax amount) | 8.10 |

| Total Tax on purchases (382-383) | ||

| Total VAT Due (399) | ||

| Recoverable VAT | ||

| M0 | Exempt material- and service expenses | |

| I0 | Exempt investment and operating expenses | |

| M77 | Purchase of material and services 7.7% (With VAT/Sales tax) | 7.70 |

| M77-1 | Purchase of material and services 7.7% (Without VAT/Sales tax) | 7.70 |

| M77-2 | Purchase of material and services 7.7% (VAT/Sales tax amount) | 7.70 |

| M81 | Purchase of material and services 8.1% (With VAT/Sales tax) | 8.10 |

| M81-1 | Purchase of material and services 8.1% (Without VAT/Sales tax) | 8.10 |

| M81-2 | Purchase of material and services 8.1% (VAT/Sales tax amount) | 8.10 |

| M25 | Purchase of material and services 2.5% | 2.50 |

| M26 | Purchase of material and services 2.6% | 2.60 |

| M37 | Purchase of material and services 3.7% | 3.70 |

| M38 | Purchase of material and services 3.8% | 3.80 |

| Investment and operating expenses | ||

| I77 | Investment and operating expenses 7.7% | 7.70 |

| I77-1 | Investment and operating expenses 7.7% (Without VAT/Sales tax) | 7.70 |

| I77-2 | Investment and operating expenses 7.7% (VAT/Sales tax amount) | 7.70 |

| I81 | Investment and operating expenses 8.1% | 8.10 |

| I81-1 | Investment and operating expenses 8.1% (Without VAT/Sales tax) | 8.10 |

| I81-2 | Investment and operating expenses 8.1% (VAT/Sales tax amount) | 8.10 |

| I25 | Investment and operating expenses 2.5% | 2.50 |

| I26 | Investment and operating expenses 2.6% | 2.60 |

| I37 | Investment and operating expenses 3.7% | 3.70 |

| I38 | Investment and operating expenses 3.8% | 3.80 |

| Corrections and adjustments | ||

| K77-A | Subsequent adjustment of prior tax 7.7% (410) | 7.70 |

| K81-A | Subsequent adjustment of prior tax 8.1 % (410) | 8.10 |

| K77-B | Corrections of prior tax 7.7% (415) | 7.70 |

| K81-B | Corrections of prior tax 8.1% (415) | 8.10 |

| K77-C | Reductions of the deduction of prior tax 7.7% (420) | 7.70 |

| K81-C | Reductions of the deduction of prior tax 8.1% (420) | 8.10 |

| F1050 | Tax computation according to form Nr. 1050 | |

| F1055 | Tax computation according to form Nr. 1055 | |

| Total Recoverable VAT (479) | ||

| Total VAT payable (500) or VAT credit (510) | ||

| Other financial flows | ||

| Z0-A | Subsidies, tourist taxes collected by the tourism offices, contributions to the institutions responsible for the elimination of waste and for the supply of water (let. a - c) | |

| Z0 | Gifts, dividends, compensation for damages etc. | |

| Not considered | ||

| Final total for control | ||