In dit artikel

Credit card purchases are becoming increasingly common, not only in businesses but also in households. In order to have a better control of the expenses for credit card purchases, it is necessary to record the movements in your accounting. In this regard, it is necessary to verify that the Accounts table contains the credit card account, otherwise it should be added.

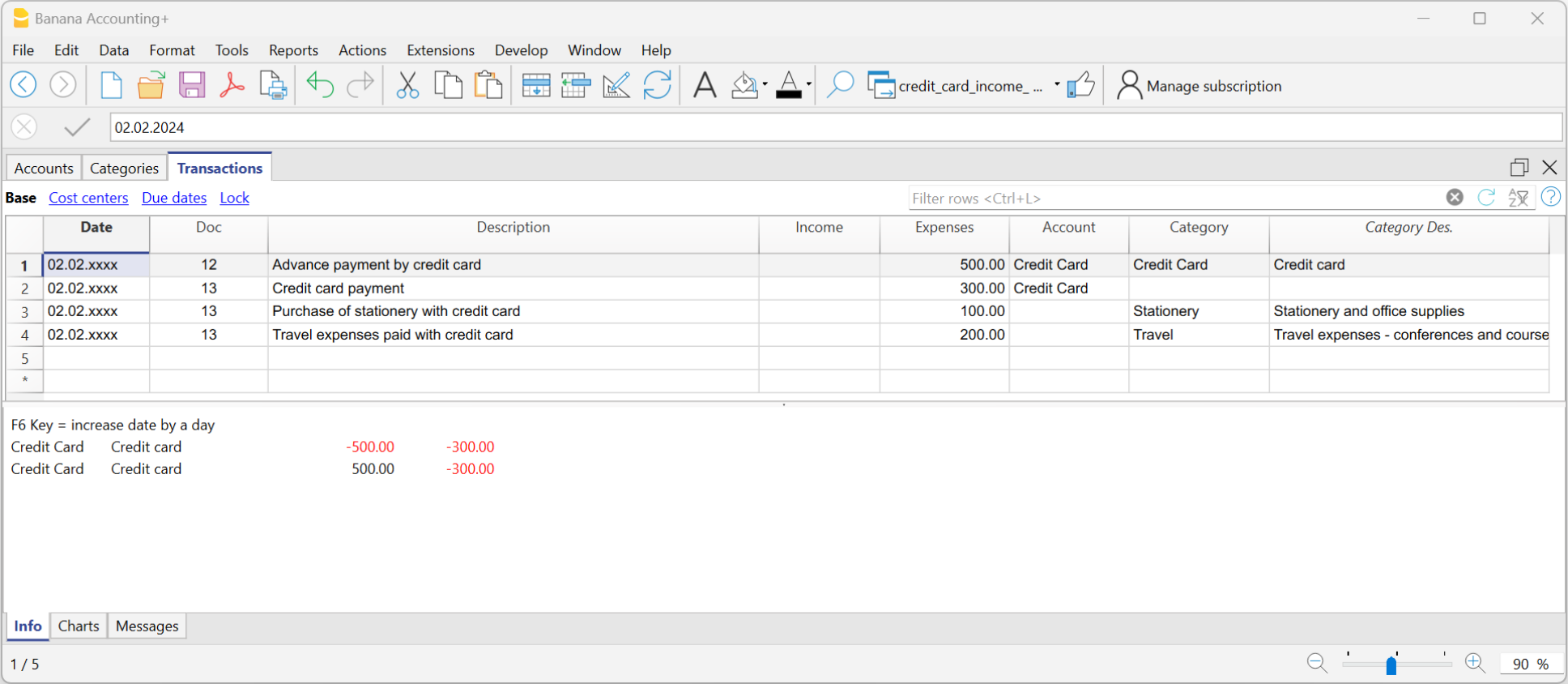

Record credit card transactions with advance payments

The credit card account is a debit account and is entered in the Account column.

In Income/Expense accounting, whenever advance payments are made on the credit card, you must record as follows:

- Enter the date, the description

- In the Expenses column, enter the expense amount

- In the Account column, enter the liquidity account (bank, post office).

- In the Category column, enter the credit card account.

When the credit card invoice arrives and the expenses are covered by the advance payments, it is necessary to record the credit card transactions to identify the costs incurred and write off the credit.

In this case you record on multiple rows:

- Enter the same date and the same Document No. for each transaction for all the rows that make up for the transaction.

- Enter the description indicating the type of expense.

- In the Expenses column enter the total amount paid by the credit card.

- In the Account column enter the credit card account.

- In the next rows to record each expense paid by credit card, record in the Expenses column the amount of the expense, and in the Category column, the category of the expense.

After all transactions have been recorded, check your credit card balance (open your credit card account card).