在此文中

In accounting, the recording of profit distribution takes place when the shareholders' meeting or the competent body formally approves the allocation of the profit resulting from the financial statements.

Year-End Closing

At the end of the year, accounts are closed and the profit (or loss) for the year is determined.

- Operating profit = the positive result of operations (revenues > costs).

- The profit is recorded in the Income Statement and carried over to Equity in the Retained Earnings account.

The distribution of profits is the allocation of this result among various items, established by the shareholders' meeting.

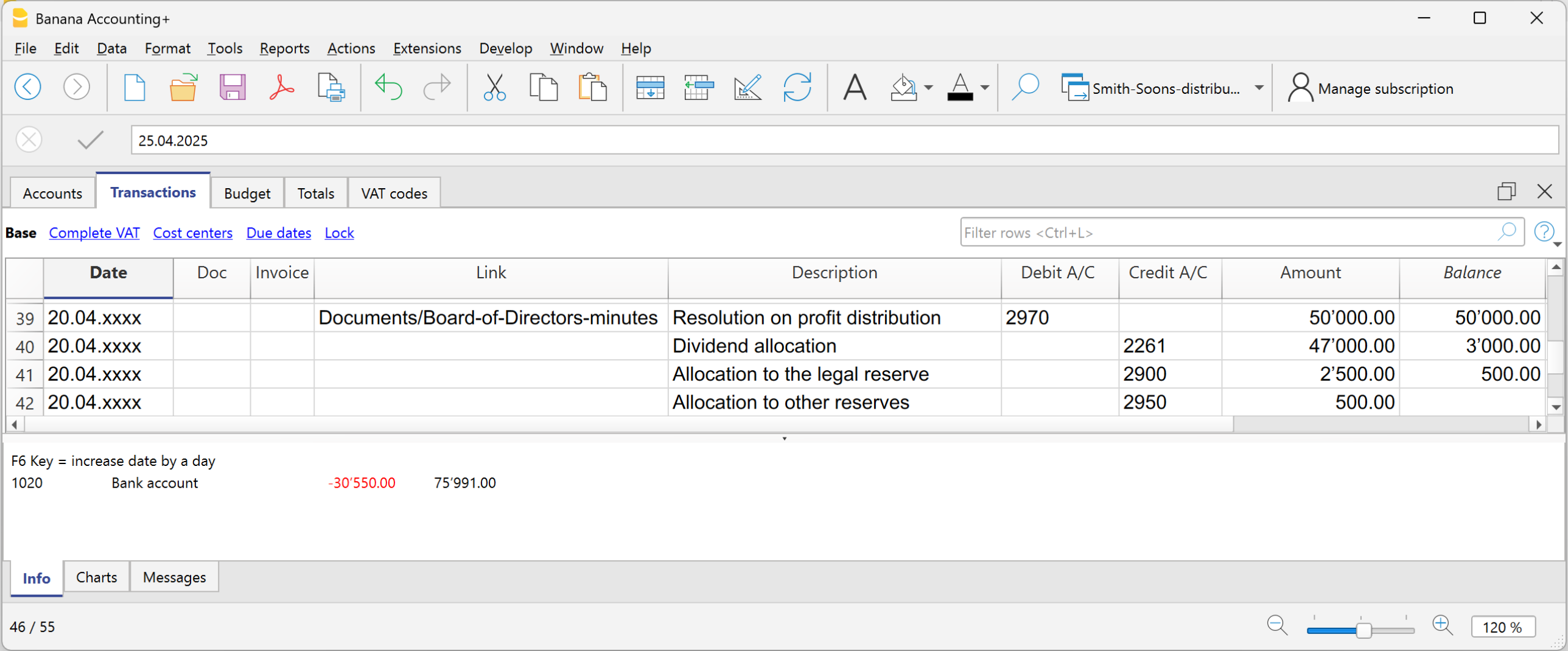

Resolution on Profit Allocation

The shareholders' meeting decides how to allocate the profit.

Below we provide some general practice recommendations, but we suggest consulting your trusted professional.

Example of accounts for profit distribution:

- Legal reserve

- Other reserves

- Dividends to shareholders

- Retained earnings

The distribution is not recorded at the time of payment, but on the official decision date (resolution). The payment is only the subsequent phase of settling the debt to the shareholders.

- From the Retained earnings account, the amounts are transferred to the various accounts established by the resolution.

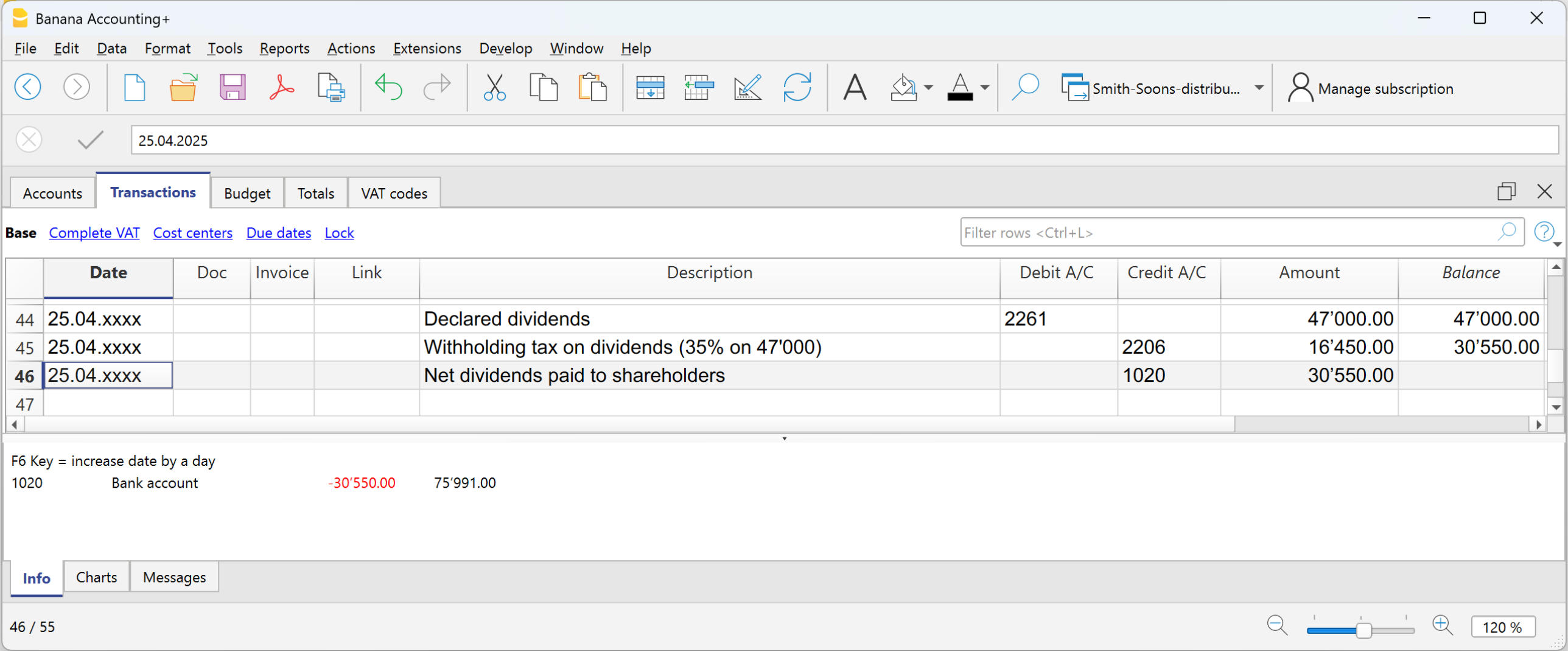

Withholding Tax on Dividends in Switzerland

In Switzerland, when a company distributes dividends to its shareholders, it must withhold a tax called “withholding tax” equal to 35% of the distributed amount.

It is called “withholding” because it is collected at the source, meaning immediately, at the time of payment, before the shareholder receives the money.

The withholding tax on dividends is a mandatory 35% tax deduction, which serves two purposes:

- Ensure tax revenue (the State receives the tax immediately).

- Prevent tax evasion (those who do not declare dividends do not recover the withholding).

Dividend Payment

At the time of dividend payment, the company withholds 35% as withholding tax.

The withholding tax must be declared on the official portal and subsequently paid to the Swiss Federal Tax Administration (SFTA).

Refund of Withholding Tax on Dividends

- Shareholders residing in Switzerland can recover the full withholding by filing a tax return (the tax office offsets it against taxes due).

- Shareholders abroad can recover it partially, depending on the double taxation treaties between Switzerland and the country of residence.