Supplier Management

The supplier management allows you to record, organize, and manage supplier information, enabling you to keep track of supplier transactions and payments, payment deadlines, and contact information. You can monitor due invoices, paid invoices, and the account balance for each supplier, as well as the total open balance.

Supplier management is one of the features of Banana Accounting Plus available in all accounting applications.

Supplier master data settings include both revenue and cash management. Foreign currency supplier accounts can also be managed.

The function of making supplier invoice payments via e-banking is only available in the Advanced plan.

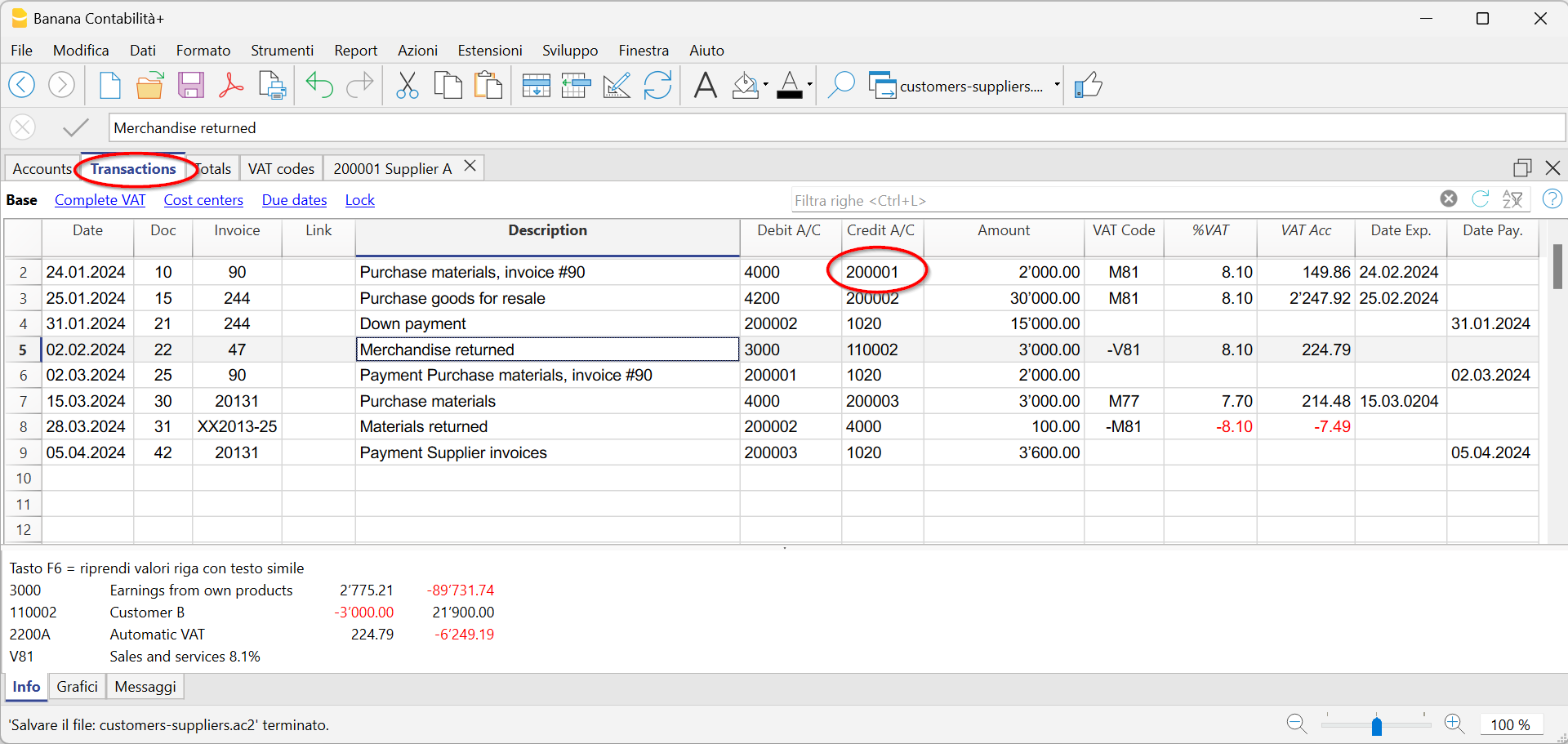

Recording Supplier Transactions

The Transactions table is the heart of Banana Accounting and is used to record all operations, including supplier transactions, simply by specifying the supplier's account. You can work quickly because you can select, copy, and paste supplier transactions that have been entered previously. If you make any mistakes, you can always correct them.

The supplier transactions recorded in the Transactions table include the following:

- Receiving invoices

- Making invoice payments

- Receiving credit notes or refunds

- Managing payments via e-banking

There are columns where you can enter various pieces of information, including:

- Date of the Transaction, Due Date, and Payment Date.

- Invoice number.

- Debit and Credit Accounts where you specify the supplier's account (Credit) and the counterpart account (Debit).

- Amount.

- VAT codes for the automatic calculation of VAT

- Links to Digital Documents (such as the invoice received from the supplier or PDF annotations).

Supplier Accounts

Supplier accounts are used to record all transactions related to a company's suppliers.

The main functions of supplier accounts are as follows:

- Create an Account for Each Supplier and Track All Transactions.

- Record Received Invoices for Each Supplier.

- Create an E-banking Payment Order Directly from the Supplier Invoice.

- Record Payments to Suppliers and Associate Them with Received Invoices.

- Generate Lists for Payment Verification.

In Banana Accounting Plus:

- Supplier accounts and their Addresses (name, surname, company name, address, VAT number, etc.) are set up in the Accounts table.

- Accounting transactions related to these accounts are entered in the Transactions table.

- After each entry, all supplier account balances (Accounts table) are automatically updated, providing an immediate overview of outstanding balances yet to be paid.

Recording Received Invoices

The invoice received from the supplier is used for accounting and tax purposes as it allows for the accurate recording of a company's costs and expenses, as well as the calculation of VAT.

In Banana Accounting, invoices are recorded in the Transactions table by:

- Entering the date and description.

- Adding an invoice number.

- Recording the cost account in the Debit column and the supplier account in the Credit column.

- Specifying the VAT code for goods or services purchased. Calculations and VAT amounts are automatically inserted.

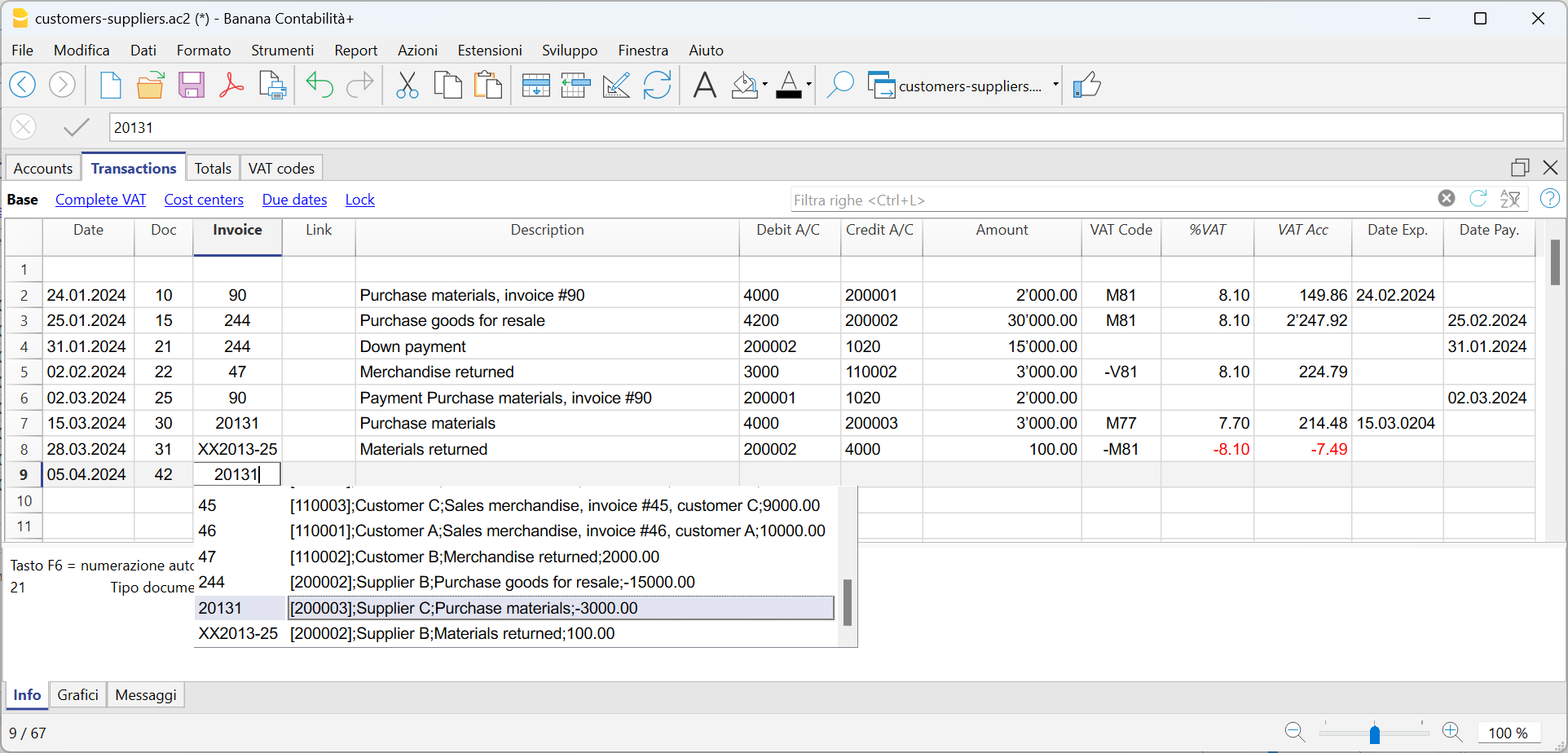

Recording Payments

In Banana Accounting, payments are recorded in the Transactions table using one of the following methods:

- Manual Recording:

- Enter the date and description.

- In the Invoice column, specify the supplier's account. A dropdown menu will display the open invoices. Simply select the invoice received from the supplier, press Enter, and the program will automatically fill in the supplier's account in the Debit column, along with the invoice amount. Basta poi Then, enter the cash account in the Credit column to complete the recording.

- Data Import from Bank Statements Using Rules

- The program imports data from ISO 20022 bank statements, and with the use of Rules, it automatically enters complete transactions, including all necessary details, without the need for manual intervention.

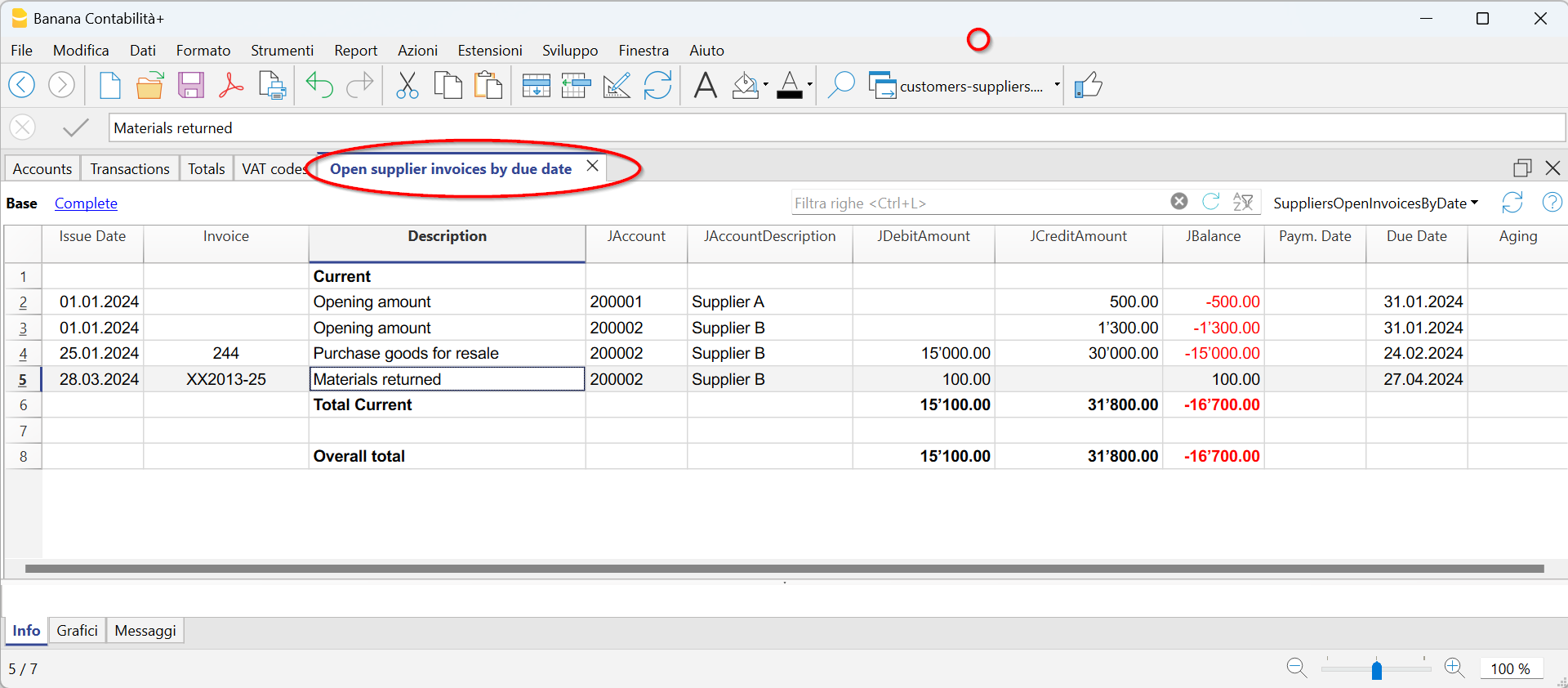

Outstanding Invoices

Outstanding invoices from suppliers are those invoices that have been received but are still pending payment.

Supplier's outstanding invoices can be managed through an accounting register that tracks issued invoices, payment due dates, and received payments. This allows the seller to monitor the financial status of each supplier and send payment reminders if invoices remain unpaid for an extended period.

It's important to note that outstanding supplier invoices have an impact on a company's liquidity, as they represent funds that need to be allocated for payment.

Banana Accounting automatically generates a report of outstanding invoices, where you can quickly verify which invoices are still pending payment, from which supplier, and the total amount of outstanding invoices.

There are two types of reports:

- Open Invoices by Supplier, where all open invoices for each supplier are listed.

2. Open Invoices by Due Date, where open invoices are listed in order of their due dates.

The due date for an invoice can be set in various ways. Further information is available on the following page: "Expiry Dates and Payment Terms."

Accounts Cards

Accounts cards are accounting documents that record the financial transactions of a company. Each card represents a specific account in the company's general ledger and contains detailed information about the transactions related to that account, such as the date of the financial transaction, the type of transaction, the amount, and the description of the transaction.

In Banana Accounting, based on the data entered in the Transactions table, the program automatically generates an Accounts Card for each supplier. These cards display the opening balance, all transactions, and the final balance. You can also generate account cards for specific time periods.

Set up and use supplier features

- Set up accounts for turnover accounting (accrual principle).

- Set up accounts for collection accounting (cash principle).

- Configure supplier settings (explanation as for customers).

- Set up the transactions table and post supplier invoices.

- Open, overdue or received supplier invoice reports.

Notes

- In multi-currency accounting, the reports are based on the balances in the currency of the supplier's account, so any exchange rate differences are not taken into consideration.

- In the Invoices received table, the exchange rate differences transactions are also listed, while in the other printouts only the supplier's currency amount is valid.

- The Description column of the reports includes the first transaction row for each invoice.

- For the accounting on the collected, it is possible to set up a suppliers register with cost centers.

Example file

Managing with the accrual method

Introduction

In Banana Accounting it is possible to manage suppliers both with the accrual and cash method. A detailed explanation is available on the accounting with the accrual or cash principle page.

Below we explain how to set up the group and supplier accounts, so that you can have a separate invoice list for each supplier.

If you have few invoices and do not want to keep a detail by supplier, it is also possible to have only one account where all the invoices of the suppliers are recorded. In this case, the list of invoices will be grouped by all suppliers and not by a single supplier.

Setting up the Suppliers' register

To create the Suppliers' register, add at the end of the Chart of accounts:

- A* section (header) (see Sections)

- A 02 section for suppliers (see Sections)

- The Suppliers' accounts that are needed (see Adding a new account). Each supplier is entered on a row of the Chart of Accounts and has its own account number. The account numbering can be freely chosen (see Accounts), however it is recommended to use only numbers, in particular for the management of payments.

- A group where all the accounts payable are totaled.

- This group is in turn totaled into a group present in the liabilities.

- The total Suppliers will be totaled in the 200A summary group of the Sum in column.

- The same code or number used for the Gr (200A), must be used in the Liabilities Group column, in the row corresponding to the Total Suppliers. The groups numbering can be freely chosen (see Groups).

Record a received invoice

Record a payment

- Enter the transaction date

- Position yourself on the Invoice field and press the F2 key or double click on the cell.

The list of open invoices will be displayed. - Select the paid supplier invoice and press Enter.

The program will complete the transaction with the Description, Debit Account and Amount fields. As long as the contra account is not entered, the program will report the difference in the transactions.

Record a credit note

The same invoice number must be used for the amount to be deducted from the initial invoice. If the adjustment document (for example a credit note) has a different numbering that you still need to keep available, write this reference in another column, for example DocOriginal.

Collection management (cash principle)

Set up the suppliers register with the cost centers

For Swiss users who have VAT on their receipts, this setting allows you to manage VAT in an optimal way.

It is possible to manage the customers and suppliers register as cost centers (see also the Cost and Profit Centers page). A detailed explanation is available on the Accounting page on accrual or cash method.

- It is advisable to use the cost center CC3 (accounts preceded by a semicolon ";")

- The balances of the cost centers will therefore not appear in the balance sheet.

Transactions

The information is available on the Customers and suppliers page with VAT using the cash principle.

Miscellaneous operations

The various functions listed use the same methods as those used for clients. For further information, please refer to the relevant client pages.

View the Invoice column in the Transactions table

See Clients - Display Invoice columns.

Auto-complete

Extract invoice rows and open invoice link commands

Vedi Clients - Extract invoice rows commands.

Activating the Address columns (optional)

See Clients - Address column setup.

Configure supplier settings

- Select the Reports → Suppliers → Settings command.

- It is important to indicate in the "Group or account", the group of the chart of accounts where the various accounts of the suppliers are grouped.

- For explications of the different options see Customers/Suppliers settings.

List of supplier invoices

Displaying invoices received

Command: Reports → Suppliers → Open invoices by supplier.

All invoices that belong to the supplier register or to an individual supplier are displayed in this table.

Displaying the open invoices

Command: Reports → Suppliers → Open supplier invoices

In this table, only invoices that have an open balance are being listed.

For multi-currency accounting, if there are unrecorded exchange rate differences for a particular supplier, an 'Adjustment exchange rate differences' line will be displayed that balances the balance in the open invoice list with the balance on the account card.

Displaying invoices by due date

Command: Reports → Suppliers → Open supplier invoices by due date

Only invoices that have an open balance, are displayed in this table, grouped by due period.