Transactions with VAT

Supplier customers with VAT on turnover

Set up the accounts of the ledger

To set up the Customers / Suppliers register consult the Customers setup with the accrual method page.

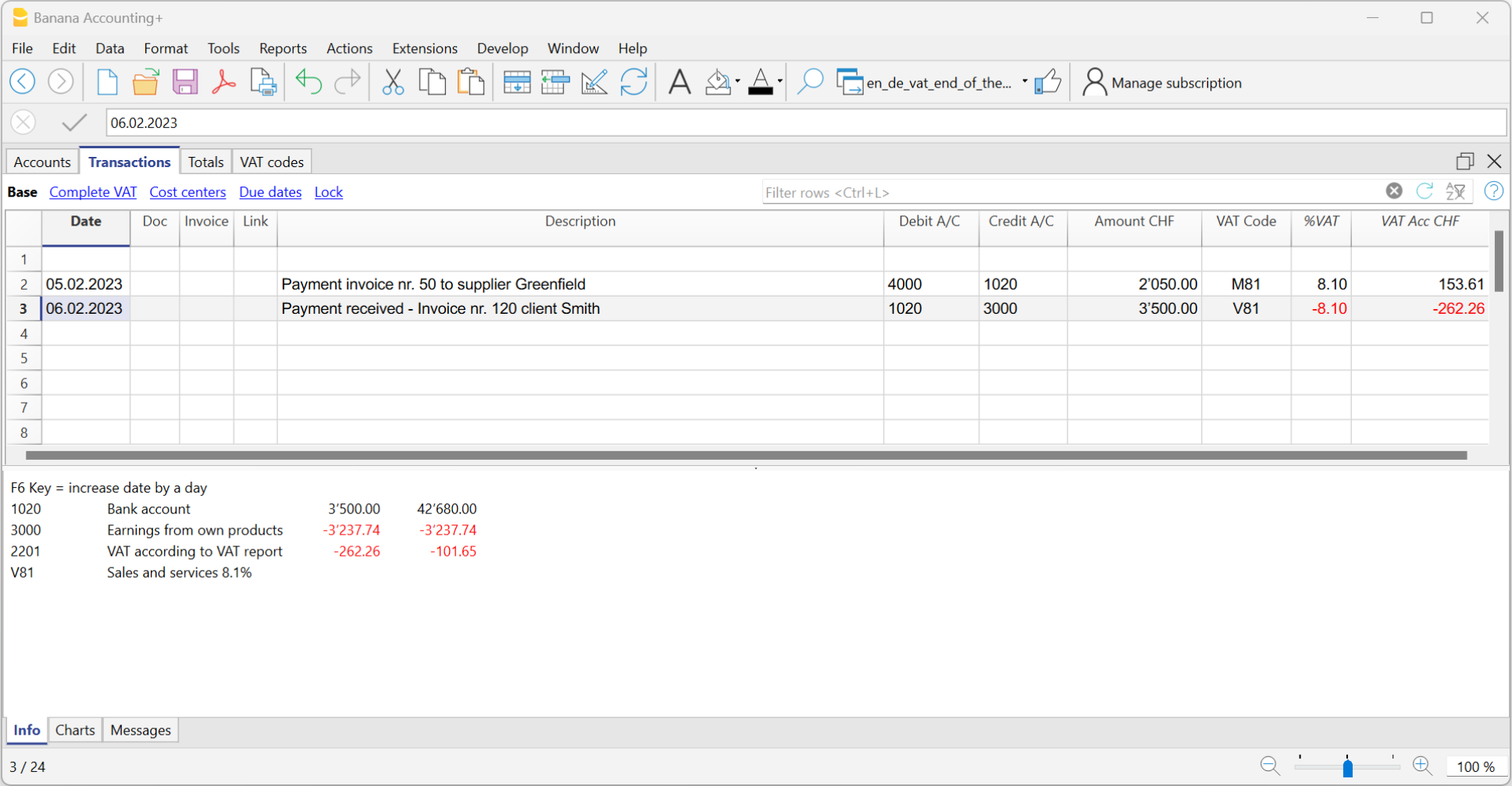

VAT registration on turnover

With the system of VAT on turnover, the Customers / Suppliers register will be kept. Therefore, the invoices issued and received are recorded, posting the costs and revenues and entering the corresponding VAT code.

Clients and suppliers with VAT, using the Cash principle

With the system of the VAT on cash received, there is no provision for entering transactions on the clients/suppliers accounts, for the expenses and income are being entered at the moment the payment is made or received. Only at that moment, the VAT code is being entered. However, in spite of this rule, it is still possible to enter the issued and received invoices by using the cost centers.

Procedure:

- Insert the clients' and suppliers' accounts as cost center CC3, defined with the semicolon in two different groupings, one for clients, another one for suppliers.

Entering the invoices of clients and suppliers

For the issued and received invoices:

- Position yourself in the Transactions table, Cost centers view;

- Enter the date, the document number and the invoice number in the respective columns;

- Enter the description;

- Enter the amount of the issued or received invoice in the Amount column, the Debit and Credit columns have to remain empty.

- Enter the cost or profit center in the CC3 column: in positive when it concerns an invoice issued to a client; preceded by the minus sign (in negative) when it is an invoice received from a supplier.

When the payment for an invoice is received or made:

- Position yourself in the Transactions table, Cost centers view;

- Enter the date, the document number and the invoice number in the respective columns;

- Enter the description;

- If it concerns a payment received, enter a liquidity account in the Debit column and a revenue account in the Credit column;

When it's about a payment that has been made, enter an expense account in the Debit column and a liquidity account in the Credit column; - Enter the amount;

- Enter the appropriate VAT code;

- Enter the cost or profit center in the CC3 column, preceded by the minus sign (in negative) when it is a payment received (customer) and in positive when it concerns a payment made to a supplier.

In the Account card of the cost center, the transactions of the customer or supplier are being displayed.

Related documents

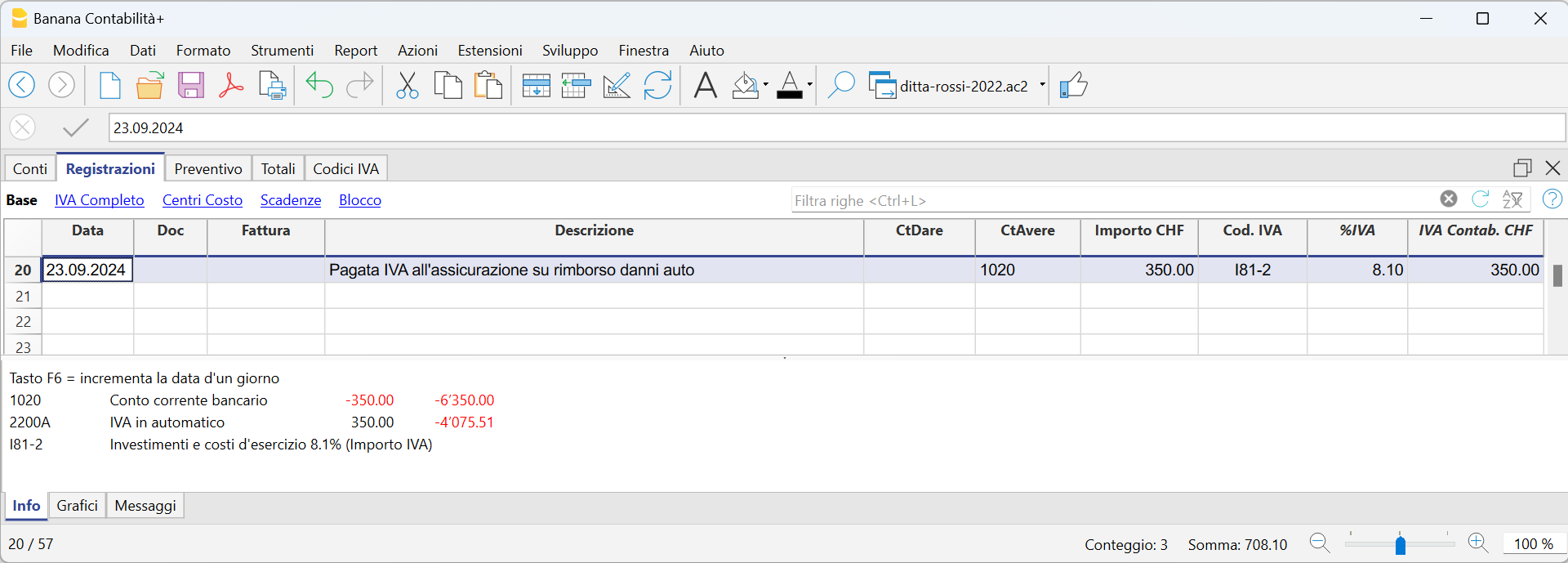

How to record only the VAT amount

There are cases where you only need to record the VAT amount, such as when you receive compensation from your car insurance.

You record as follows:

- Enter the date, document number and the description in the columns provided.

- In the Credit column, enter the account with which the VAT amount is paid (the Debit account remains empty)

- In the Amount column, enter the VAT amount to be paid

- In the VAT code column, enter the VAT code I77-2 (VAT code relating to the VAT amount 100%)

Jahresabrechnung und Vorauszahlungen der MWST nach der effektiven Methode

Eine Vorauszahlung buchen

Wenn Sie eine Vorauszahlung (Akonto) leisten, sollte diese korrekt in Ihrer Buchhaltung erfasst werden, um die Übersicht über bereits geleistete Zahlungen an die ESTV zu behalten. Es wird empfohlen, ein separates MWST-Konto zu verwenden, das nicht mit dem automatischen MWST-Konto verknüpft ist.

Die Buchung sollte wie folgt erfolgen:

- Geben Sie das Datum und eine Beschreibung ein.

- In der Spalte Soll tragen Sie das MWST-Konto ein.

Es wird empfohlen, ein spezielles MWST-Konto für Akontozahlungen und den Zahlungsausgleich zu verwenden. - In der Spalte Haben geben Sie das Bankkonto an, über das die Zahlung erfolgt.

- In der Spalte Betrag erfassen Sie den überwiesenen Betrag.

Beispiel für die Buchung einer Akontozahlung:

Abschlussbuchung und Zahlung

Beispiel einer Abschlussbuchung unter Berücksichtigung der Akontozahlungen:

Kontoauszug - MWST 'Konto'

Jahresabrechnung und Vorauszahlungen für die MWST-Abrechnungsmethode mit Saldo-/Pauschalsteuersatz

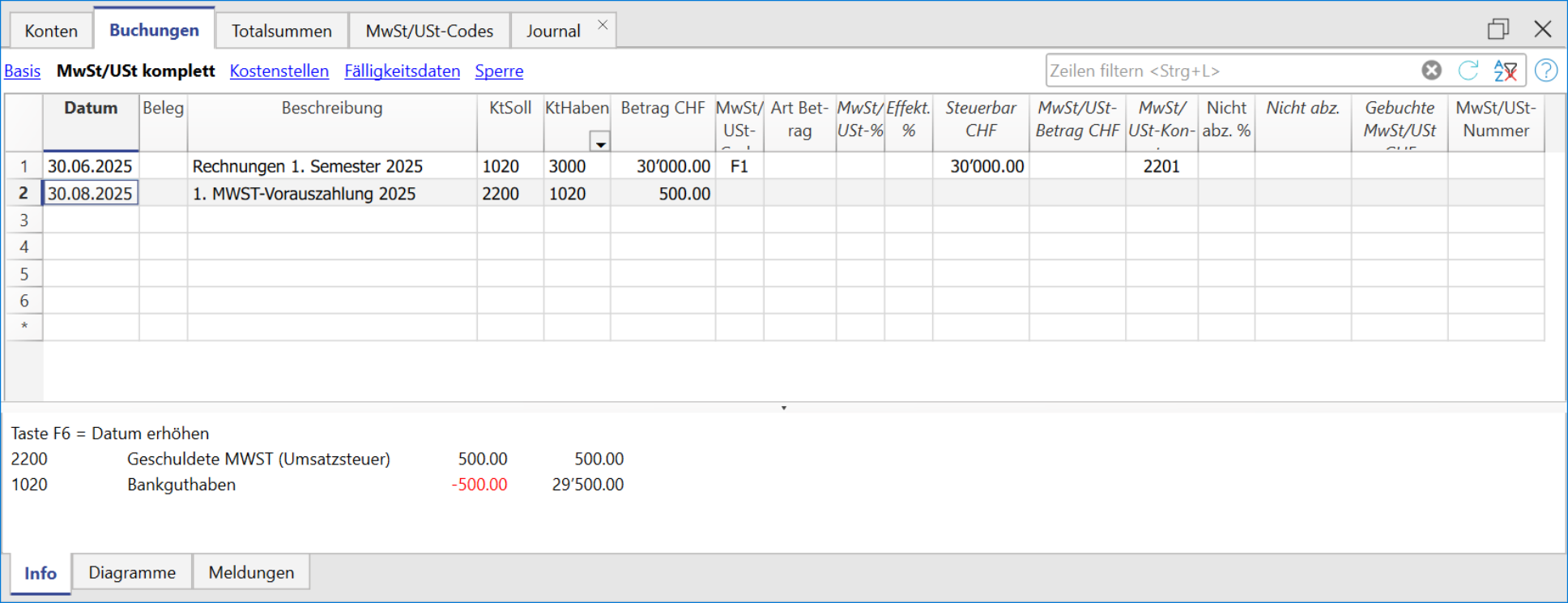

Eine Vorauszahlung buchen

Wenn Sie eine Vorauszahlung (Akonto) leisten, sollte diese korrekt in Ihrer Buchhaltung erfasst werden, um die Übersicht über bereits geleistete Zahlungen an die ESTV zu behalten. Es wird empfohlen, ein separates MWST-Konto zu verwenden, das nicht mit dem automatischen MWST-Konto verknüpft ist.

Die Buchung sollte wie folgt erfolgen:

- Geben Sie das Datum und eine Beschreibung ein.

- In der Spalte Soll tragen Sie das MWST-Konto ein.

Es wird empfohlen, ein spezielles MWST-Konto für Akontozahlungen und den Zahlungsausgleich zu verwenden. - In der Spalte Haben geben Sie das Bankkonto ein, über das die Zahlung erfolgt.

- In der Spalte Betrag erfassen Sie den überwiesenen Betrag.

Beispiel für die Buchung einer Akontozahlung:

- In der ersten Zeile wurde der Gesamtbetrag der ausgestellten und bereits bezahlten Rechnungen erfasst. Der MWST-Code F1 kennzeichnet den MWST-Betrag, der im Formular berechnet wird.

- In der zweiten Zeile wurde die Akontozahlung erfasst, die von der Eidgenössischen Steuerverwaltung (ESTV) festgelegt wurde. Diese Akontozahlung wird nicht im MWST-Formular ausgewiesen.

Abschlussbuchung und Zahlung

Für die Abschlussbuchungen verweisen wir auf die entsprechende Dokumentation:

Beispiel einer Abschlussbuchung ohne MWST-Zerlegung unter Berücksichtigung der Akontozahlungen:

Kontoauszug - Geschuldete MWST

Periodic VAT Return and Payment

Reset of Account 2201, VAT Return

At the end of the period, the balance of account 2201 VAT Return (automatic VAT account) must be reset with a reversal entry by entering:

- In the Debit column: account 2201 VAT Return

- In the Credit column: account 2200 VAT Payable

This operation involves:

- Reset of the balance of account 2201, VAT Return (automatic VAT account).

- Transfer of the VAT balance to the VAT due account (or Treasury VAT account).

- If this results in a VAT debit, the VAT balance is posted in Credit of the VAT due account; in Debit of the "VAT according to VAT report" account, the balance is set to zero.

- If this results in a VAT credit, the VAT balance is posted in Debit of the VAT due account; in Credit of the "VAT according to VAT report" account, the balance is set to zero.

Transaction for charging the quarter balance to the Due VAT account

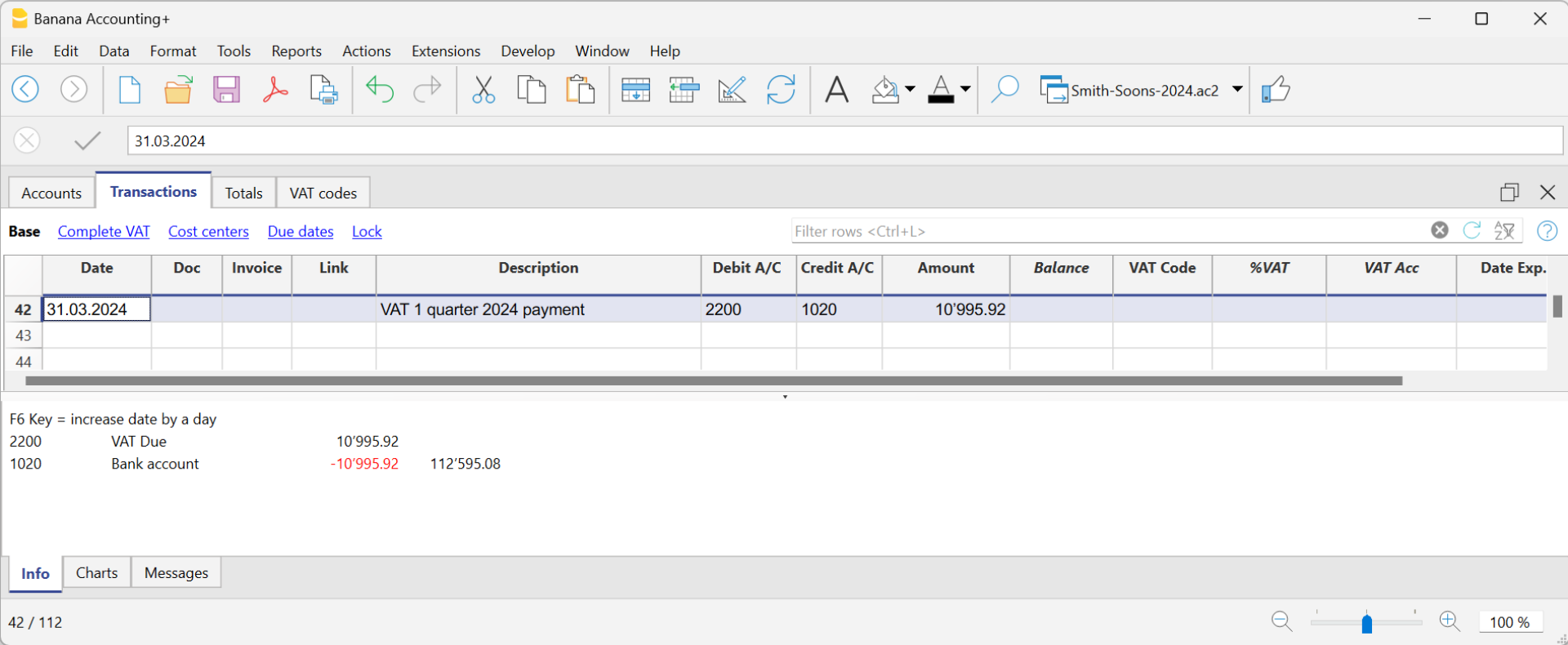

VAT balance payment

When the VAT amount is paid to the FTA (Federal Tax Administration), the balance in the VAT Due account resets to zero.

For the transaction:

- Enter the Date, Document number, and Description in the respective columns.

- In the Debit column, enter the VAT Due account.

- In the Credit column, enter the liquidity account.

- In the Amount column, enter the VAT Due amount paid.

With this system, it is possible to monitor the balance for each quarter, and in case of an error, identify the period in which the balance no longer matches.

Ledger of account 2200 VAT Payable after the payment entry

Note

The procedure explained refers to the payment of VAT recorded using the effective method and also applies to the flat-rate VAT method with VAT breakdown.

For those who have recorded VAT using the balance rate method without VAT breakdown, specific information can be found on the web page Accounting Adjustment and VAT Payment.

VAT due account card after the payment

How to register a VAT credit (Switzerland)

If at the end of a period, when calculating the VAT declaration, the previous VAT is bigger than the due VAT, your VAT report has a Debit balance.

To reset the "VAT according to VAT report" account to zero, you need to enter a transaction as follows:

- put in Debit A/C the VAT Due account

- put in Credit A/C the "VAT according to VAT report" account

Usually, in Switzerland the VAT credit is reimbursed to the company, without having to move the credit to the following period.

When your VAT is reimbursed, you need to enter a transaction as follows:

- put in Debit A/C your liquidity account

- put in Credit A/C your Due VAT account (where the balance should go to zero).

Entering VAT at customs for import

VAT paid in cash at import

Goods purchased abroad must be declared at customs and paid for in cash on the spot.

Customs issues a customs clearance document indicating the taxable amount and the VAT amount paid. VAT paid at customs can be recovered by VAT payers.

In order to recover the VAT paid at customs, the user needs to operate as follows:

To recover the VAT, register as follows:

- In the Debit column the cash account. The Debit column remains empty.

- In the Amount column, the amount paid in customs is recorded.

- In the VAT Code column, a VAT code type 2 (M77-2) is entered, which allows the VAT amount to be recorded at 100%.

Note

New codes can be added to the VAT Codes table. If you need the 2.5% VAT code, for customs VAT recovery, simply add a new code, e.g. M25-2, completing the same grouping in the column Sum in, GR1, the amount type 2 and entering 2.5 as the rate.

In the Transactions table, enter the cash account in credit, the paid VAT amount and the corresponding VAT code.

The program calculates the VAT amount at 100%, without creating differences in the recordings.

VAT paid at import by the shipping company

The procedure is the same as the previous one, except for the fact that the transaction extends itself over several rows, since, at the moment the shipper's invoice is being paid, the shipping costs and/or the customs clearance may be included.

Example:

Payment of the shipper's invoice for a total of CHF 359.- CHF 150 of which shipping costs, and CHF 209 for VAT advanced at customs.

VAT on Imports – Income/Expense accounting

VAT on goods purchased abroad must be paid directly at customs. After payment, customs issues a clearance document that shows the taxable amount and the VAT paid. VAT-registered businesses can reclaim this amount.

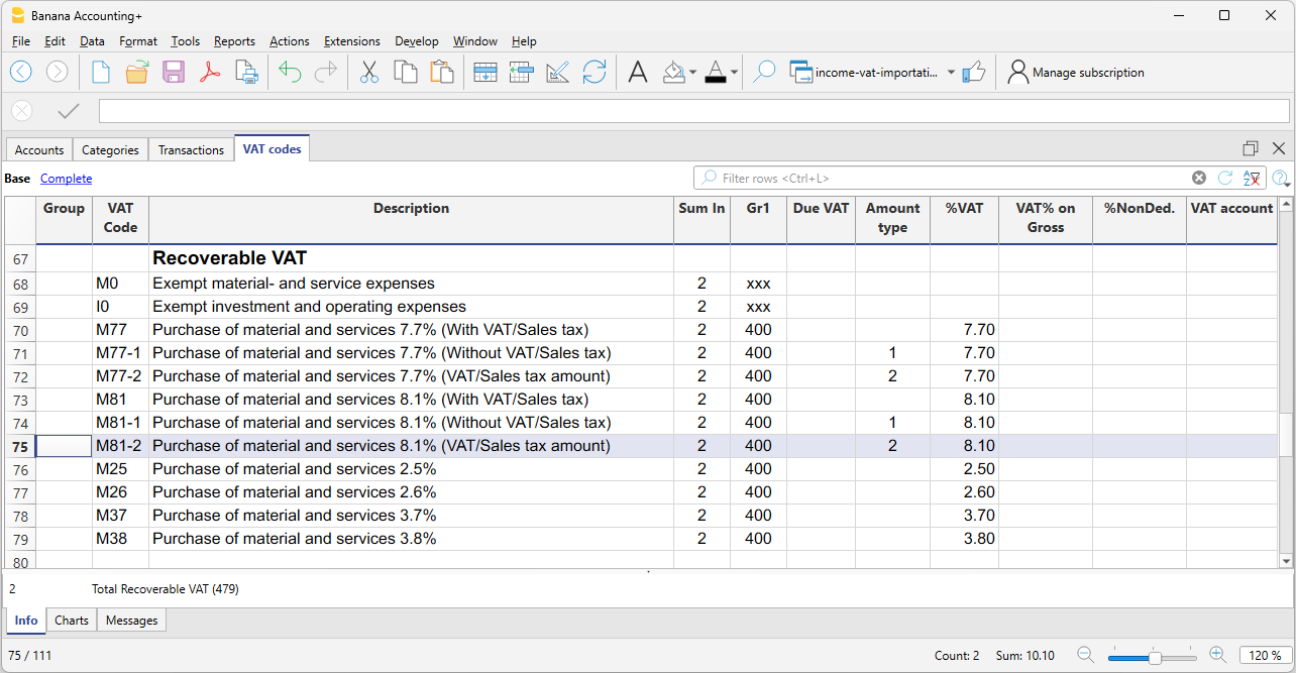

VAT codes for VAT paid at customs

All preconfigured accounting templates with VAT include a specific code for recording VAT on imported goods:

- M81-2 Purchase of goods and services 8.1% (VAT amount)

By using this code, the program considers the amount entered in the Amount column as 100% VAT. As a result, the full amount paid at customs is correctly recorded in the VAT return.

- Adding custom VAT codes

In the VAT Codes table, you can add new codes, for example to manage a different rate.

To reclaim customs VAT at 2.6%, simply:- create a new code, for example M26-2

- set the GR1 group in the Sum in column

- set amount type 2

- indicate 2.6% as the rate

Customs VAT paid in cash

When VAT on imported goods is paid in cash, to reclaim the VAT proceed as follows:

- In the Transactions table:

- enter the date, document number, and description in the respective columns

- in the Expenses column, enter the amount paid in cash

- in the Account column, enter the Cash account

- in the Category column, enter the shipping expense category

- in the VAT Code column, enter the M81-2 code, which calculates and automatically enters the full VAT amount into the VAT account.

The program posts the full VAT amount without creating discrepancies in the entries.

Customs VAT paid by the freight forwarder

In this case, VAT is advanced by the freight forwarder, who handles the transport and customs clearance of the goods. The freight forwarder’s invoice will include transport costs, customs charges, and the advanced VAT on the imported goods.

The process is similar to the previous case, but the entry is made over several rows, as the forwarder's invoice may include both transport expenses and customs VAT.

Example

Forwarder's invoice paid for a total of CHF 250, of which CHF 200 is for transport and CHF 50 is for VAT advanced at customs.

In the Transactions table:

- In the first row, record in the appropriate columns:

- the date, document number, description

- in the Expenses column, the total amount of the forwarder's invoice

- in the Account column, the bank account. The Category column remains empty

- In the second row, record in the appropriate columns:

- the date, document number, description

- in the Expenses column, the amount of transport costs with VAT code M81

- in the Category column, the shipping expense account or similar

- in the VAT Code column, enter M81 to calculate VAT on the transport costs

- In the third row, record in the appropriate columns:

- the date, document number, description

- in the Expenses column, the amount of VAT paid at customs by the forwarder

- the Account and Category columns remain empty

- in the VAT Code column, enter the code M81-2, which calculates and automatically posts the full VAT amount to the VAT account

Korrekturen der Vorsteuer in der Schweiz

Nachfolgend listen wir die wichtigsten Praxisfälle zur Erfassung eines Vorsteuerabzugs oder einer Korrektur der Vorsteuer für die schweizerische Mehrwertsteuer auf. Es ist wichtig, den korrekten MWST-Code zu verwenden, da jede Korrektur in eine spezifische Ziffer des Abrechnungsformulars (400, 405, 415, 420…) fliesst, je nach verwendetem MWST-Code.

Stornierung von Wareneinkäufen oder Betriebsaufwand

Buchung einer Gutschrift, die von einem Lieferanten für retournierte Ware ausgestellt wurde.

- Sie müssen die ursprünglich abgezogene MWST reduzieren, indem Sie denselben MWST-Code wie bei der Rechnungsbuchung verwenden, jedoch mit negativem Vorzeichen.

- Auf diese Weise wird die Vorsteuer auf Materialkosten und Dienstleistungen (Ziffer 400) oder auf Investitionen oder Betriebskosten (Ziffer 405) korrigiert.

| Datum | Beleg | Beschreibung | KtSoll | KtHaben | Betrag | MwSt-Code | Art Betrag | MwSt-% | Gebuchte MwSt |

| 01.04.2025 | Lieferantenrechnung | 4000 Warenaufwand | 1020 Bank | 10'810.00 | M81 |

| 8.10 | 810.00 | |

| 30.04.2025 | Gutschrift vom Lieferanten | 1020 Bank | 4000 Warenaufwand | 1'081.00 | -M81 |

| -8.10 | -81.00 |

- MWST-Code verwendet für die Erfassung der Rechnung:

M81 Wareneinkauf und Dienstleistungen 8.1 % (inkl. MWST), zugeordnet zur Ziffer 400 - MWST-Code verwendet für die Buchung der Gutschrift:

-M81 Wareneinkauf und Dienstleistungen 8.1 % (inkl. MWST), negativ zugeordnet zur Ziffer 400 - Falls die Korrektur in einer anderen Abrechnungsperiode erfolgt, kann die Berichtigung auf die gleiche Weise übermittelt oder ein spezifisches Korrekturformular verwendet werden – dies ist mit der Eidgenössischen Steuerverwaltung abzuklären.

Beispiel einer Stornobuchung für eine Investition

| Datum | Beleg | Beschreibung | KtSoll | KtHaben | Betrag | MwSt-Code | Art Betrag | MwSt-% | Gebuchte MwSt |

| 02.06.2025 | Kauf einer Maschine | 1500 Maschinen und Apparate | 2000 Lieferanten | 21'620.00 | I81 |

| 8.10 | 1'620.00 | |

| 30.06.2025 | Gutschrift vom Lieferanten | 2000 Lieferanten | 1500 Maschinen und Apparate | 5'405.00 | -I81 |

| -8.10 | -405.00 |

- MWST-Code verwendet für die Erfassung der Rechnung:

I81 Investition und Betriebsaufwand 8.1% (inkl. MWST), zugeordnet zur Ziffer 405 - MWST-Code verwendet für die Buchung der Gutschrift:

-I81 Investition und Betriebsaufwand 8.1% (inkl. MWST), negativ zugeordnet zur Ziffer 405 - Falls die Korrektur in einer anderen Abrechnungsperiode erfolgt, kann die Berichtigung auf die gleiche Weise übermittelt oder ein spezifisches Korrekturformular verwendet werden – dies ist mit der Eidgenössischen Steuerverwaltung abzuklären.

Eigenverbrauch oder interner Verbrauch von eingekauften Waren

Wenn Güter vom steuerpflichtigen Bereich in den privaten Gebrauch oder in von der Steuer ausgenommene Bereiche überführt werden, müssen Sie den Vorsteuerabzug korrigieren: Die MWST muss in derselben Höhe zurückerstattet werden, wie sie beim Einkauf abgezogen wurde. Die MWST wird unter der Ziffer 415 «Korrekturen der Vorsteuer: Doppelverwendung, Eigenverbrauch (Art. 31 MWSTG)» verbucht.

- Buchen Sie die Lieferantenrechnung mit dem üblichen MWST-Code für Einkäufe

- Buchen Sie den Eigenverbrauch der Ware, wodurch die Warenkosten reduziert werden, da die Ware nicht für den Geschäftsbetrieb verwendet wurde

- Als Gegenkonto verwenden Sie ein Privatkonto oder ein ähnliches Konto

| Datum | Beleg | Beschreibung | KtSoll | KtHaben | Betrag | MwSt-Code | Art Betrag | MwSt-% | Gebuchte MwSt |

| 01.04.2025 | Lieferantenrechnung | 4000 Warenaufwand | 1020 Bank | 10'810.00 | M81 |

| 8.10 | 810.00 | |

| 30.04.2025 | Eigenverbrauch der Ware | 2850 Privatkonto | 4000 Warenaufwand | 5'405.00 | K81-B |

| -8.10 | -405.00 |

- MWST-Code verwendet für die Erfassung der Rechnung:

M81 Wareneinkauf und Dienstleistungen 8.1 % (inkl. MWST), zugeordnet zur Ziffer 400 - MWST-Code verwendet für die Buchung des Eigenverbrauchs:

K81-B Korrekturen der Vorsteuer 8.1 % zugeordnet zur Ziffer 415

Reduktion aufgrund von Subventionen

Wenn ein Unternehmen eine Subvention (zum Beispiel kantonal oder vom Bund) erhält, ist dieser Betrag in der Regel nicht der Mehrwertsteuer unterstellt. In bestimmten Fällen kann jedoch die Pflicht zur Berichtigung der Vorsteuer entstehen, wenn mit dieser Subvention finanzierte Güter oder Dienstleistungen für mehrwertsteuerpflichtige Tätigkeiten verwendet wurden.

In solchen Fällen ist eine Korrektur der ursprünglich abgezogenen Vorsteuer erforderlich. Diese ist unter der Ziffer 420 der MWST-Abrechnung zu erfassen, wobei der entsprechende Korrektur-Mehrwertsteuercode zu verwenden ist.

| Datum | Beleg | Beschreibung | KtSoll | KtHaben | Betrag | MwSt-Code | Art Betrag | MwSt-% | Gebuchte MwSt |

| 15.04.2025 | Eingang kantonale Subvention | 1020 Bank | 3900 Subventionserträge | 10'000.00 | Z0-A |

|

|

| |

| 15.04.2025 | MWST-Korrektur, stillschweigende Steuerpflicht | 3900 Subventionserträge | 3900 Subventionserträge | 810.00 | K81-C | 2 | -8.10 | -810.00 |

- MWST-Code verwendet für die Buchung des Zahlungseingangs:

Z0-A Subventionen, durch Kurvereine eingenommene Tourismusabgaben, Entsorgungs-und Wasserwerkbeiträge 0% zugeordnet zur Ziffer 900 - MWST-Code verwendet für die MWST-Erfassung:

K81-C Reduktion des Vorsteuerabzugs 8.1 % zugeordnet zur Ziffer 420 - Die Erfassung des Zahlungseingangs erfolgt ohne effektive Mehrwertsteuer, muss jedoch aus Gründen der steuerlichen Transparenz trotzdem dokumentiert werden.

- Die zweite Buchung dient der fiktiven Besteuerung der Subvention (sogenannte stille Besteuerung), um den ursprünglich abgezogenen Vorsteuerbetrag anteilsmässig zu korrigieren.

- Es ist wichtig, bei der Korrektur den Steuertyp „2“ (MwSt.-Betrag) zu verwenden, damit der Betrag korrekt unter der Ziffer 420 der MWST-Abrechnung ausgewiesen wird.

- Die zweite Buchung muss die MwSt-Betrag manuell berechnet werden.

Weitere Korrekturbuchungen

VAT on services obtained abroad-Reverse charge- CH

All services obtained abroad must be included in the Swiss VAT report. Unlike the import of goods that are being cleared at customs, for services obtained abroad there are no customs papers, but the VAT for this type of operation must be calculated and recovered. This self-imposition and recovery operation is called Reverse Charge.

The simplified Reverse Charge operation is a new feature of Banana Accounting Plus. Thanks to the possibility of inserting in the same cell of the VAT code both the code for self-imposition and the code for recovery, it is very easy to register.

Codes to be used

In the VAT codes table, there are specific codes to be used for services obtained abroad: codes B81-1 and M81-1 or I81-1.

They are two codes with Amount type 1, where the VAT is calculated on the Net amount (without VAT).

In detail:

- the B81-1 code calculates a VAT debit amount

It is important that in the Complete view> the column Don't Warn is activated "Yes", otherwise you get an error message. - the M81-1 or I81-1 code calculates a VAT credit amount

How to enter a transaction

The entry is made by applying in the VAT code column, a double code B81-1 (self input) and I81-1 (or M81-1).

By entering the double code, the programme registers both the VAT due and the recoverable VAT in the account 2201 VAT return.

VAT on services obtained in a foreign currency

When the recording of services abroad involves a foreign currency account, the Reverse Charge must be registered onto two lines:

- Register foreign purchases in foreign currency without entering any VAT code.

- On the next line, to be able to register the Reverse Charge, register:

- In the Currency column register the amount converted to base currency.

- In the Debit and Credit column a giro account (1090) is registered.

- In the VAT Code column apply the double code B81-1 for self-imposition and M81-1 or I81-1 for recovery.

- At the end of the entries the claering account must be zero.

VAT on services obtained abroad with the Swiss flat tax rate VAT method

When adopting the Swiss flat tax rate VAT method, you need to register the purchase with the B81-1 VAT code for self-imposition.

You don't need to enter the VAT recovery transaction, as this method doesn't allow any deduction on purchases, including those occurred abroad.

VAT on cash received and transitory assets/liabilities at the end of year

There are two methods, established by the Federal Tax Administration, for the collection of the Value Added Tax (VAT):

- Turnover method - the determination of the VAT amount occurs when the suppliers' invoices are received and when invoices are issued to customers. This method involves managing both customers and suppliers.

- Method based on cash received - the determination of the VAT occurs when customer invoices are collected and supplier invoices are paid.

Recording Invoices with VAT on Cash Received

- Throughout the fiscal year, customers and suppliers should not be recorded. Only at the year-end are open items recognized, namely, invoices from customers and suppliers that remain uncollected and unpaid, respectively, as of December 31st.

- Costs and revenues must be recorded at the time of payment or collection.

- The VAT code must be entered on the same line as the cost or revenue.

Example showing how to enter transactions during the year

Customers and Suppliers with VAT on Cash Received

If you want to equally manage customers/suppliers, you can use the profit and cost centers. In this case, the clients/suppliers management remains separated from the Balance Sheet.

As for the transitory assets or liabilities (invoices issued for income/expenses, but not yet received or paid), only at the end of the year, carrying forward of the outstanding invoices of suppliers and clients is allowed. These issues are defined by the VAT regulations (Instructions for VAT, at marginal number 964, page 217).

Starting from here, we present you one of the possible solutions:

Transitory assets or liabilities as at the end of the year

At the end of the year, in order to exactly establish the profit or the loss of the accounting year, one needs to enter the transitory assets or liabilities:

- Invoices issued to customers but not yet collected.

- Invoices received from suppliers but not yet paid.

- Work in progress, to be collected or paid in the following year.

When recording suspense of open items, caution should be taken not to include the VAT code on costs and revenues. Recoverable VAT and due VAT should be reported in the VAT statement for the first quarter of the following year.

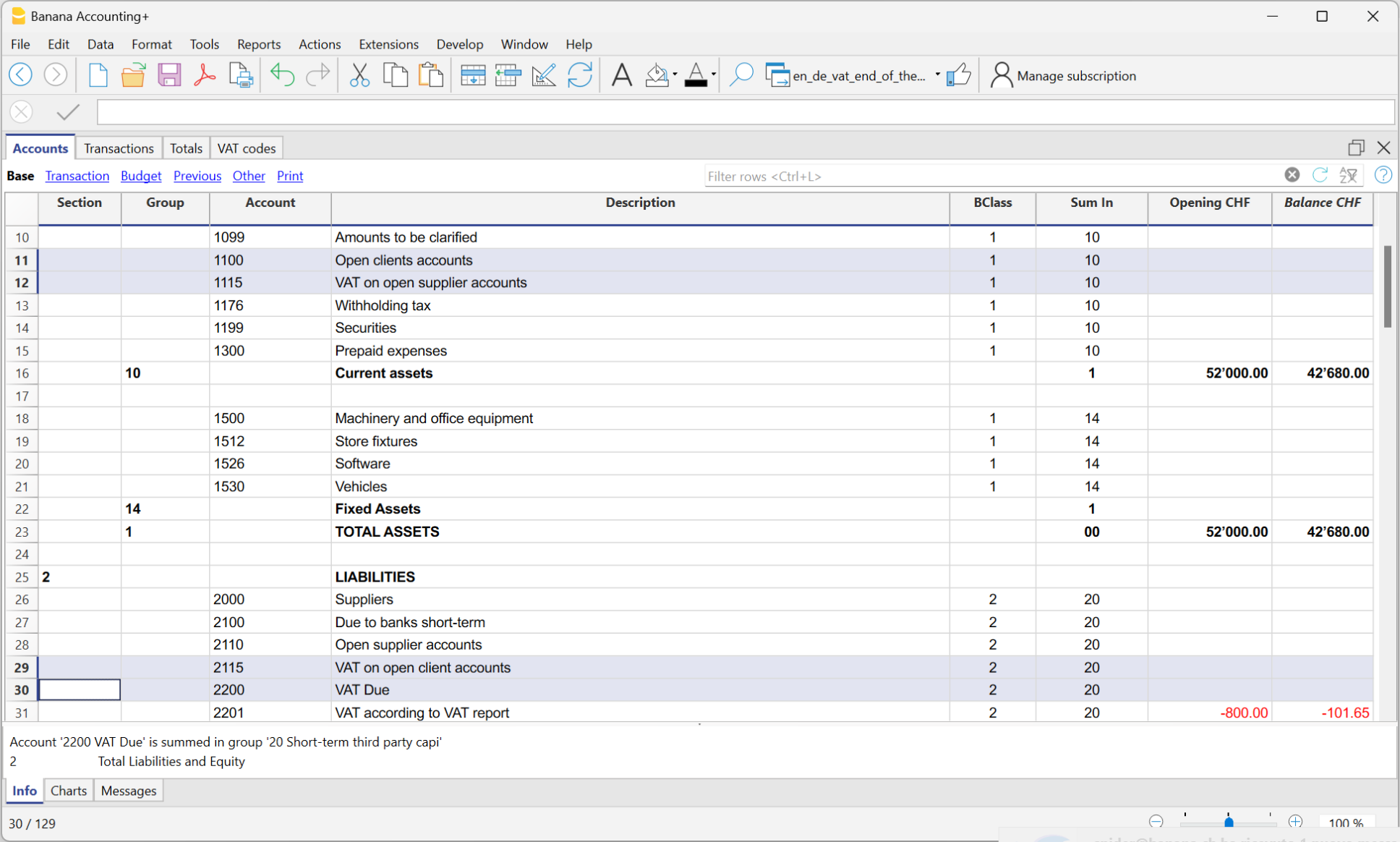

The accounts for transitory invoices

To capture only the net portion of costs and revenues (excluding VAT) at the end of the year and record it correctly, it is necessary to open the following accounts:

In the Assets and Liabilities

- In the Assets, open the account "Open client accounts"

- In the Liabilities, open the account "VAT on open client accounts"

- In the Liabilities, open the account "Open supplier accounts"

- In the Assets, open the account "VAT on open supplier accounts"

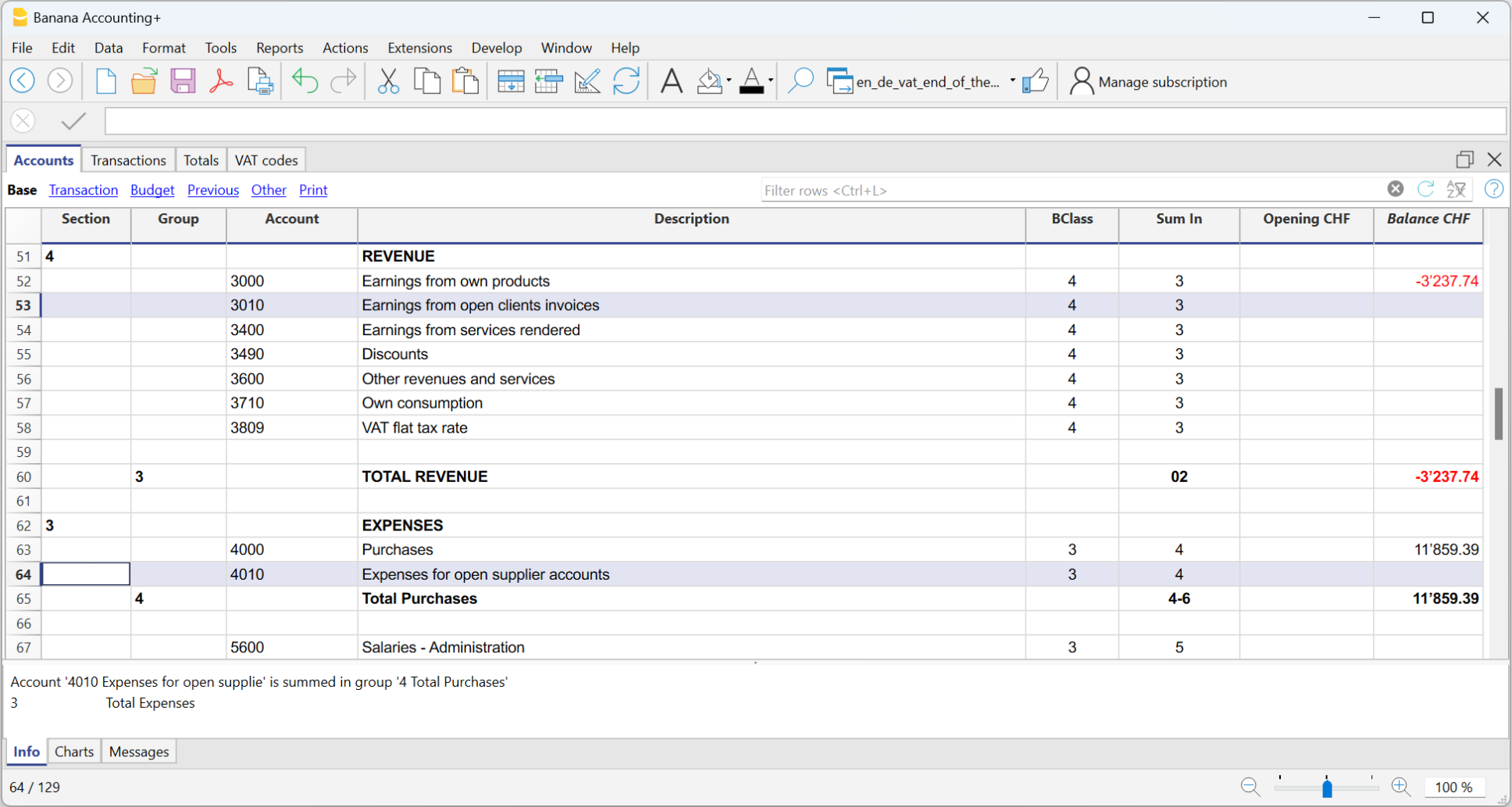

In the expenses and income

In the income statement, open the following accounts

- In the expenses, open the account "Expenses for open supplier accounts"

- In the income, open the account "Income for open client invoices"

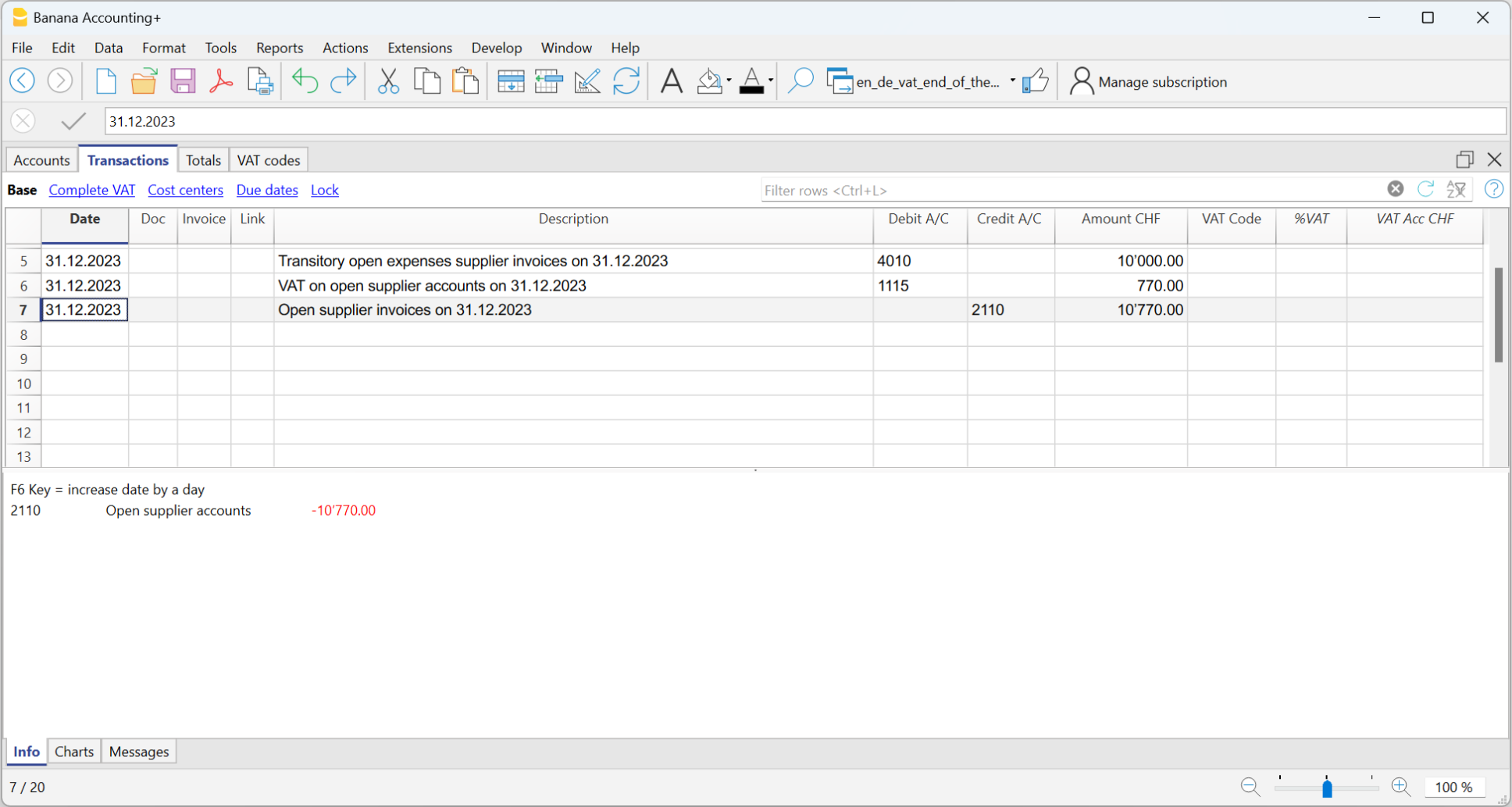

How to register transitory supplier invoices

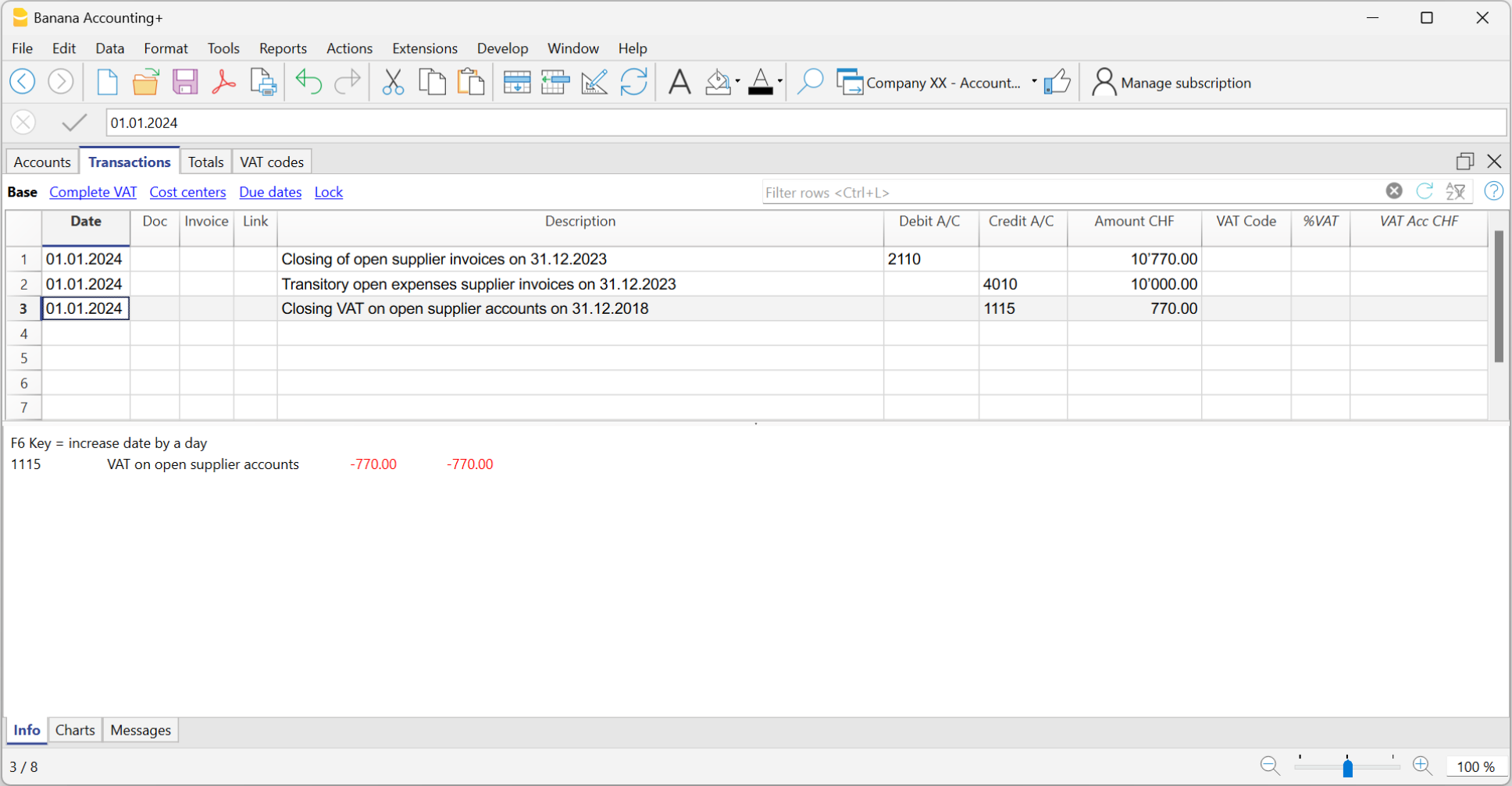

At the end of the year, open invoices from suppliers received as of December 31 are recorded as follows:

- Enter in the Debit column on the account Expenses for open supplier accounts the expense without VAT in the Amount column, without VAT code.

- Enter in Debit column in the following row, on the account VAT on open supplier accounts and in the Amount column,the recoverable VAT amount.

- Enter in Credit column in the following row, on the account Open supplier accounts and in the Amount column the total amount (VAT included)

Closing transitory invoices

To close open items on January 1st of the following year, reverse the transactions made on December 31st as follows:

- Enter in the Debit column, on the account Open suppliers accounts the total amount (VAT included).

- Enter in the Credit column on the following row, the Transitory open expenses supplier invoices and in the Amount column the expense without VAT, without VAT code.

- Enter in the Credit column on the following row, the account VAT on open supplier accounts and in the Amount column the recoverable VAT amount.

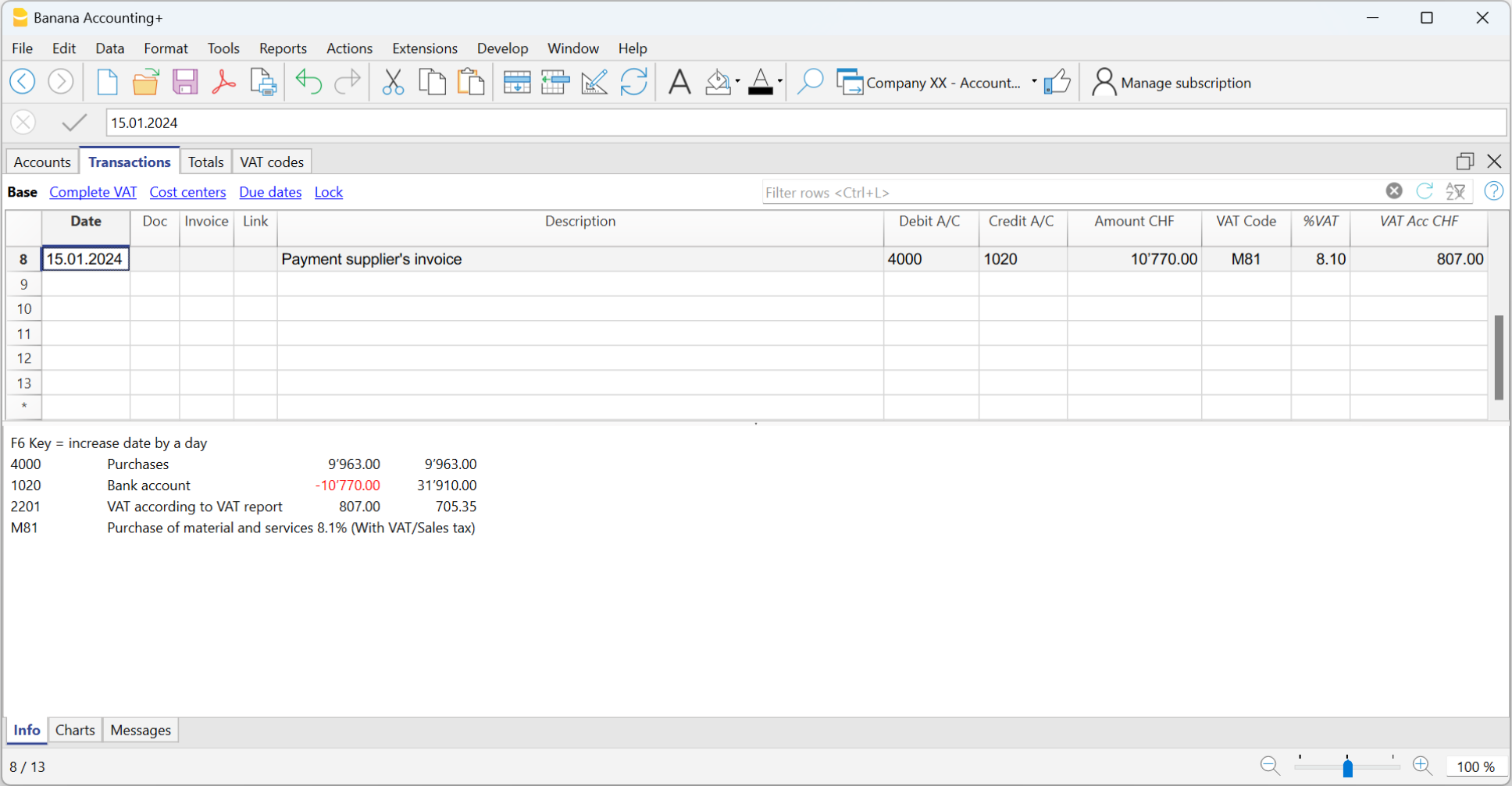

When the supplier's invoice is paid, the user has to enter the transaction as shown in the example at the beginning of this page, by inserting the VAT code as usual.

How to register the transitory client invoices

For the transitory client invoices, the same procedure needs to be applied, by entering on the preconfigured accounts related to the open client accounts.

Print invoice with VAT

VAT calculation and rounding on the Invoice

In the printing of invoices integrated into accounting, the total VAT amount corresponds to the sum of the individual VAT transactions that make up the same invoice. Since each VAT entry is rounded to the nearest cent, there may be a difference compared to the VAT calculated on the total invoice amount.

To better understand, let's consider the following example:

- Line 1: 7.7% of CHF 187.50 = CHF 14.4375 -> Rounded: CHF 14.44

- Line 2: 7.7% of CHF 875.00 = CHF 67.375 -> Rounded: CHF 67.38

- Total: 7.7% of CHF 1062.50 = CHF 81.8125 -> Rounded: CHF 81.81

On the invoice, a VAT amount of CHF 81.82 is printed instead of CHF 81.81. In fact, the amount of CHF 81.82 corresponds to the sum of the VAT calculated individually for each item (CHF 14.44 + CHF 67.38).

This logic is adopted to avoid discrepancies between the VAT amounts recorded in accounting and those shown on the invoice. In this way, the total VAT in accounting matches that reported on the invoice.

Net VAT and VAT management on a cash basis

In Banana Accounting it is possible to manage customers using both the turnover and the cash received method. However, as far as invoice printing is concerned, there are some limitations if in accounting you record the amounts net and at the same time use the cash received method.

If we want to create invoices, it is not possible to enter amounts net of VAT with the method on the cash received because, when the invoice is issued, the VAT codes must be written between square brackets and the VAT is not calculated but is only an indication for the printing of the document.

Management based on turnover

| ||

| Gross Amount | Net amount | |

| Effective VAT method | ✓ | ✓ |

| VAT Flat tax rate method | ✓ | ✗ |

Management based on cash received

More details can be found at the following page : https://www.banana.ch/doc10/en/node/9739 | ||

| Gross Amount | Net amount | |

| Effective VAT method | ✓ | ✗ |

| VAT Flat tax rate method | ✓ | ✗ |

Examples with transactions to create invoices and enter them into the accounting for both the effective VAT method and the VAT Flat tax rate method:

VAT management CHF- EU

Companies that have to make VAT/Sales tax declarations in Switzerland and the EU must keep two accounting files.

- One main file for Switzerland/Liechtenstein with all accounting transactions.

More information under Swiss VAT management- Purchases and sales in Europe must be registered with the VAT codes for export or import.

- At the time of the periodic VAT calculation for the EU (with the auxiliary file), the VAT debt is also registered in this main accounting file using no VAT code.

- An auxiliary file for European VAT management

- The basic currency is EUR

- The chart of accounts corresponds to that of the main file (this allows you to copy and paste records).

- VAT/Sales tax table with the VAT codes and rates necessary for your own situation in Europe.

When doing business with only a single nation, the VAT/Sales tax table for that nation and the automatic VAT accounting scripts can be used.

See our web pages: Germany, Austria, Italy, Holland and our webpages with templates for various other nations. - Enter the appropriate amount and VAT code in the transactions

- For the periodic VAT declaration in the EU, use the VAT/Sales tax report command (Reports Menu; Account1 menu in the old version) and total the amounts as necessary on the VAT form of the European nation in which the VAT declaration is made.

Please consult your tax advisor to ensure that this solution meets all the specific requirements of the tax authority in the EU