Multi-currency accounting

Multi-currency accounting is based on the double-entry accounting method and can also manage accounts and transactions in foreign currencies.

Many topics of the multi-currency accounting are the same as the double-entry accounting. In order to find missing lessons or in-depth information, we advice you to consult our internet pages on the Double-entry accounting.

Characteristics

- Manages the accounts also in foreign currency

- Use of any currency, standard or freely defined coin codes (to use any virtual currency)

- Decimal currency configurable from 0 to 28. Usually you use 2 decimals, but you can set the accounting to use 0 decimals, or 3 decimals (Tunisia) or more if you use for crypto currencies. 9 decimals (Bitcoin) or 18 (Ethereum)

- Calculates the conversion automatically, based on the exchange rate inserted in the Exchange rate table

- Calculates the exchange rate differences automatically

- Offers Balance Sheets and Profit and Loss Statements in a second currency as well

In order to change from a double-entry accounting file to a multi-currency accounting file, check the Convert to new file command.

Information

Chart of accounts, file properties and exchange rates table

We suggest to choose one of the already configured examples and to personalize it according to your needs. Please note that the chart of accounts must include the account for profit and loss from exchange rate variation and there must be accounts in foreign currencies.

- Setup the chart of accounts

- Groups and subgroups

- File properties - foreign currencies tab

- Setup the Exchange rate table

Transactions

Accounting transactions must be entered in the same way as the double-entry accounting transactions

Printouts

Convert double-entry accounting into multi-currency accounting

In order to add multi-currency features to a double-entry accounting file, please visit the Convert to new file page.

How to start a multi-currency accounting

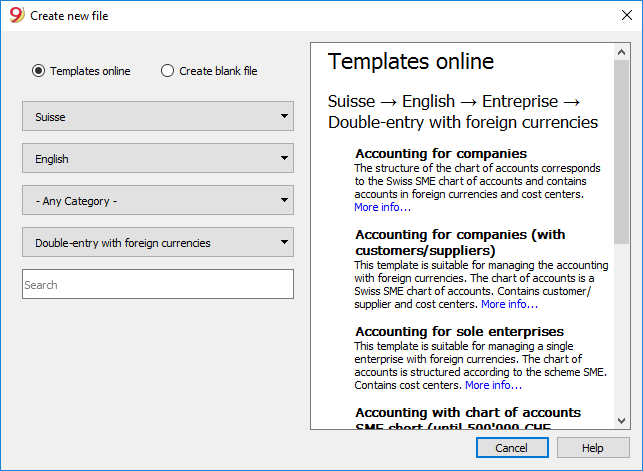

Creating an accounting file, starting from a template

Proceed as follows:

- File menu, New command

- Select the region, the language, the category and the accounting type

- From the list of the templates that appears, select the template that is closest to your own needs.

- Click on the Create Button

In the Search area, when entering a key word, the program displays the templates that contain the entered key word.

It is equally possible to start from a blank file, by activating the Create blank file option. In any case, in order to facilitate the start and avoid grouping errors, we recommend that you always start from an existing model.

More information on how to create a new file is available on the Create New File page.

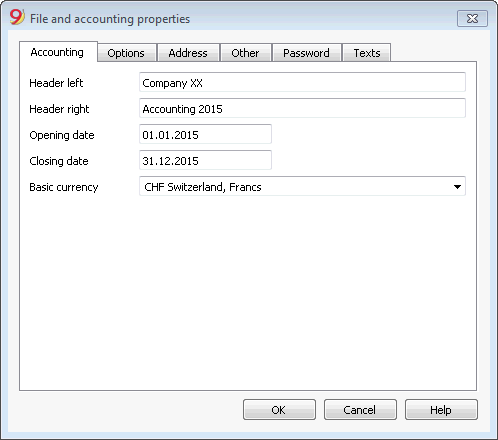

Setting up the file properties (basic data)

- From the File menu, File properties command,

Accounting tab

- Indicate the company name that will appear in the headers of the printouts and on the other data.

- Select the basic currency, with which the accounting will be kept.

With the File-> Save As command, save the data and also assign an name to the file. The typical save dialog of your operating system appears.

- It is advisable to use the name of the company followed by the year "Company-2020." to distinguish it from other accounting files.

The program will add the "ac2" extension. - You can keep as many accounting files as you need, each will have its own name.

- You can choose the folder you want, (for example, Documents -> Accounting) or the support you want like a disk, usb or cloud.

If you also expect to have documents linked to the current year's accounts, it is suggested that you create a separate directory for each accounting year having to group all the files.

General use of the program

Banana Accounting inspires itself from Excel. The user directions and the commands are kept as similar as possible to the ones of Microsoft Office.

For more information on the general use of the program, we refer to the explanations on our page Program interface.

The accounting is being contained in tables; all of them have the same way of operating.

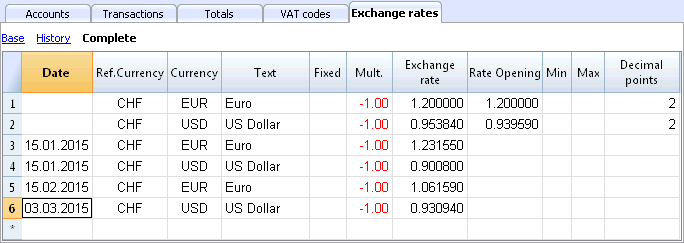

Exchange rates table

Before entering multi-currency transactions it is necessary to define the parameters of the used currencies in the Exchange rates table.

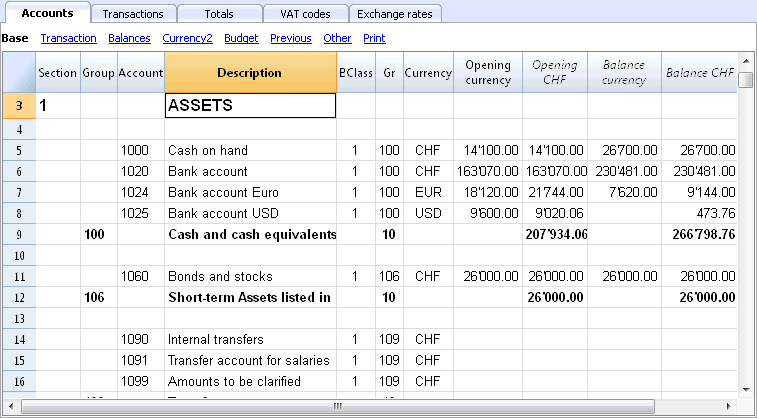

Customizing the Chart of accounts

In the Accounts table, customize the Chart of accounts and adapt it to your own needs:

- Add accounts and /or delete existing accounts (see Adding new rows)

- Modify the account numbers, the descriptions (for example, enter the name of your own Bank account), enter other groups, etc.

- To create subgroups, please consult our Groups page.

In the Chart of accounts, you can also define Cost centers or Segments, used to attribute the amounts in a more detailed or specific way.

The Transactions table

The multicurrency transactions have to be entered into the Transactions table; together they compose the Journal.

Speeding up the recording of the transactions

In order to accelerate the recording of the transactions, you can use

- the Smart fill function that allows the automatic autocomplete of data that have already been entered at an earlier date

- the Recurring transactions function, used to memorize recurring transactions into a separate table

- the import of your bank or post statement from e-banking

Checking customer and supplier invoices

Banana allows you to keep an eye on the invoices to be paid and the receivable, issued invoices. Please consult:

The Account card

The Account card automatically displays all the transactions that have been recorded on the same account (for example, cash, bank, clients, etc).

To display an account card, just position yourself with the mouse on the account number and click on the small blue symbol that appears.

Account card by period

To display the account card with the balances referring to a specific period, click on the Account1 menu, Account card command, and in the Period section, activate Period Selected, entering the Start and the End date of the period.

For more details, consult the page Period.

Printing the Account card

In order to print one account card, just display the card from the Accounts or the Transactions table and launch the print from on the File menu.

To print several or all account cards, click on the Account1 menu, Account card command, and select the account cards that need to be printed. By means of the Filter, all the account cards, or only a part of all of them (for example, only accounts, cost centers, segments), that need to be printed can be automatically selected.

For more details, consult the page Account Card.

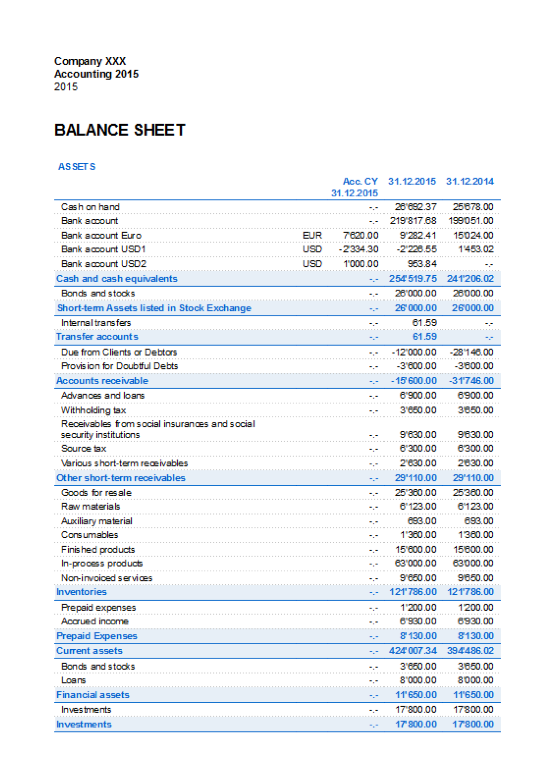

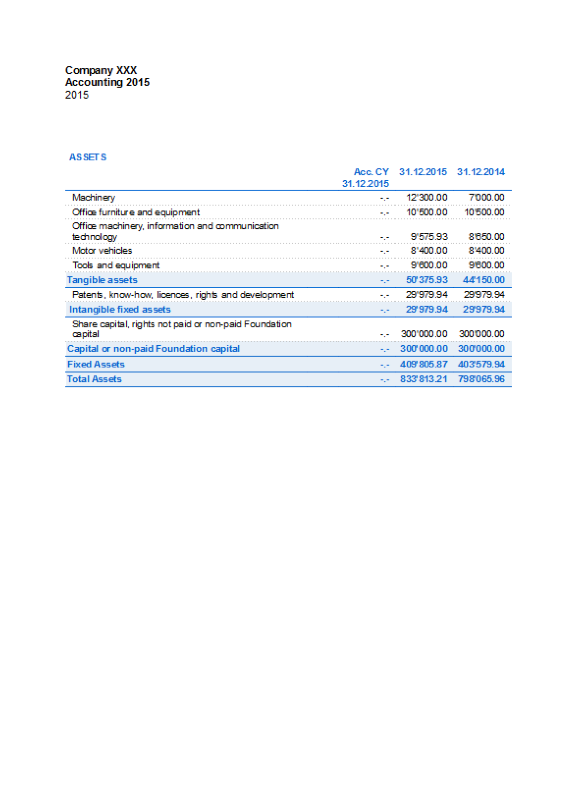

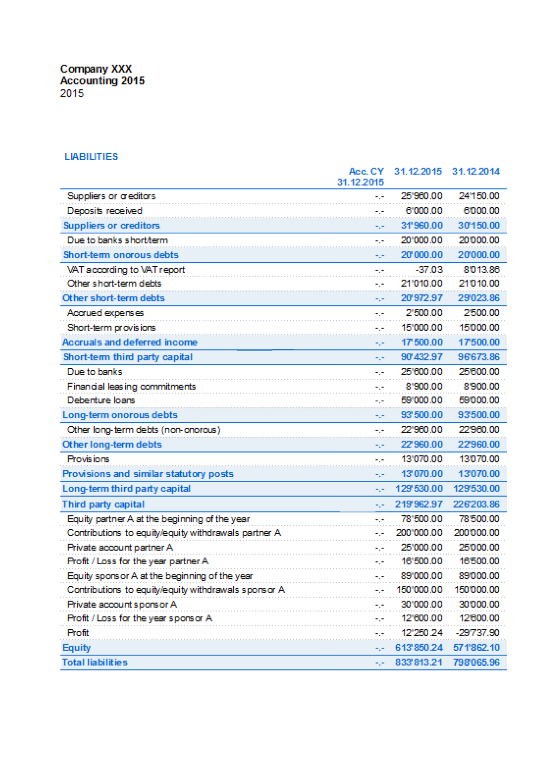

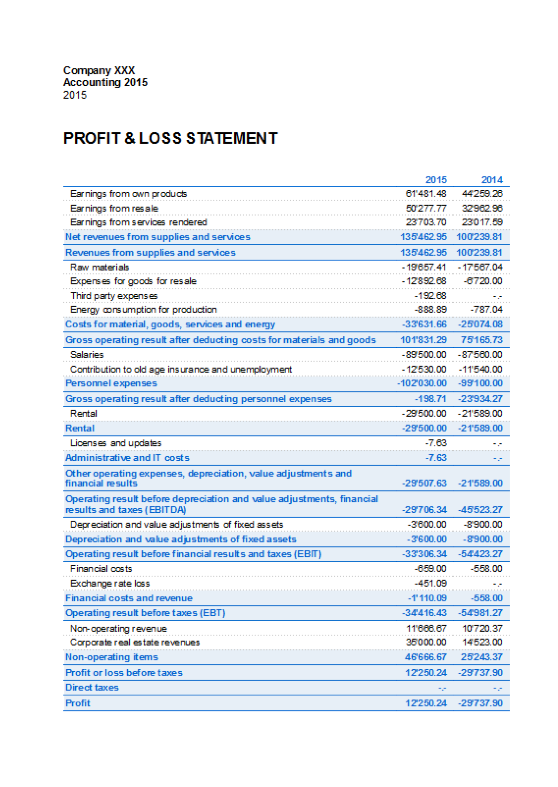

The Balance Sheet and Profit and Loss Statement

The Balance sheet shows the balances of all the estate accounts, Assets & Liabilities. The difference between the Assets and the Liabilities determines the Share capital.

The display and the printing of the Balance Sheet is being executed from the Account1 menu, commands Enhanced Balance Sheet or Enhanced Balance Sheet with groups.

- The Enhanced Balance Sheet command simply lists all the accounts without distinguishing Groups and Subgroups

- The Enhanced Balance Sheet with groups command lists all the accounts while subdividing Groups and Subgroups; besides, it presents numerous features to customize the presentation, functions that are not provided in the Enhanced Balance Sheet.

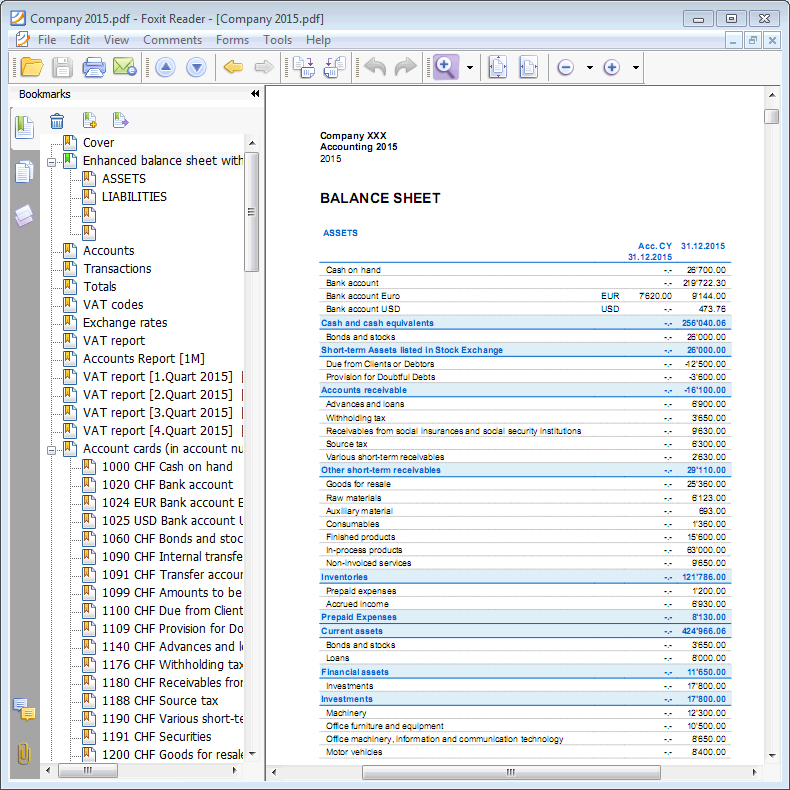

Data archiving in PDF format

At the end of the year, when the entire accounting has been completed, corrected and audited, all the accounting data can be archived with the Create PDF dossier command of the File menu.

The Budget

- Accounts table, Budget column. For each account, the annual budget amount is being indicated.

In this case, when you set up the Budget from the Account1 menu, Enhanced Balance Sheet with groups command, the Budget column displays the amounts that refer to the entire year. - In the Budget table, that can be activated through the Tools menu, Add new functionalities command.

In this table, you can enter all the budgeted costs and revenue by means of entering transactions. If you activate this table, the column of the accounts table will be automatically deactivated.In this case you can set up a detailed budget, taking into account the possible variations over the year and in different periods of the year.

For more details, consult the Budget page.

Theory of multi-currency accounting

In this part, the basic theoretical notions about currency exchange are being explained.

Exchange rates and accounting issues

Every nation has its own currency and to obtain another currency it is necessary to buy it using the appropriate exchange. The price of a currency compared to another is called the exchange rate. To change money means to convert the amounts of one currency to another. The exchange (exchange rate) varies constantly and indicates the rate of conversion.

For example, on January 1st

- 1 Euro (EUR) was equal to 1.32030 US Dollar (USD)

- 1 US Dollar was equal to 0.7580 Euro

- 1 EUR was equal to 1.60970 Swiss Franc (CHF)

- 1 EUR was equal to 157.2030 Japanese Yen (JPY)

Multi-currency Accounting One talks about multi-currency accounting or multi-value accounting when accounts in different currencies are kept. It is necessary to have multi-currency accounting when a company has bank, cash, and debtors’ accounts in more than one currency. Even if just one account is in a foreign currency it is necessary to administer a multi-currency accounting.

Basic Currency

The amounts referring to different currencies cannot be totaled directly. It is necessary to have a basic currency to refer to and to use for the totals. The main point of accounting is that the totals of the “Debit” balances must correspond to the totals of the “Credit” balances. To verify that the accounting is balanced, there must be a single currency with which to do the totals. If there are different currencies, the basic currency must be indicated before anything else. Once the basic currency has been chosen and some operations have been executed, the basic currency can no longer be changed. To change the basic currency, the accounting must be closed and another opened with a different basic currency. The basic currency is also used to establish the Balance Sheet and to calculate the profit or loss of theoperation.

Each amount has its equivalent in basic currency

To be able to add the totals and verify that the operations balance, it is necessary to have the equivalent in basic currency for every transaction. In this way you can check that the total of the Debit entries is the same as the total of the Credit ones. If the basic currency is Euros and there are transactions in US Dollars, there needs to be an exchange value in Euros for every transaction in US Dollars. All the Euro amounts will be totaled to verify that the accounting balances.

Account currency

Each account has its own currency symbol which indicates in which currency the account will be administered. You must therefore indicate what the currency of the account will be. Each account will then have its own balance expressed in its own currency. Only entries in this currency will be permitted on this account. If the account is in Euro, then there can only be Euro entries on this account; if the account is in USD, then there can only be entries in the specified USD currency on this account. When you have to administer entries in YEN, then you have to have an account whose symbol is the YEN.

Account Balance in basic curency

For each account, alongside the balance in the account’s own currency, the balance in basic currency will also be kept, in order to calculate the balance sheet in basic currency.

The account card for the USD bank account has to correspond exactly to the bank statement as far as the USD amounts are concerned.

The value in basic currency will always be specified for each accounting entry. If the account is in USD, in the entries there will be, beyond the amounts in USD, also its value in EUR. The EUR balance will be given by the sum of all the entries expressed in EUR. The actual balance in basic currency will depend on the exchange rate factors used to calculate the exchange value of each, single entry to EUR.

If on a given day you take the actual balance in USD and convert it to EUR at the daily exchange rate, you will get an exchange value that differs from the balance of the account in basic currency. This difference is due to the fact that the exchange rate used for entries on a daily basis is different from the actual daily exchange rate.

Thus there is a difference between the actual value at the daily exchange rate and the accounting balance in basic currency. This accounting difference is called the exchange rate difference.

The difference between the balance in basic currency and the calculated value has to be registered, when the accounting is closed, as an exchange rate profit or loss.

Balances in another currency (currency2)

All the accounting reports will be calculated in basic currency. If you take the basic currency values and change them to another currency, you will get the balance in another currency. The program has a Currency2 column where all the values are automatically entered and presented in the currency specified as Currency2. The logic for the conversion of the amounts is the following:

- If Currency2 is the same as the account or operation currency, then the original value will be used.

- If the account is in USD and Currency2 is USD, the USD amount will be used.

- In all other cases the basic currency amount will be used and changed into Currency2.

- The daily exchange rate is used. Even for past entries, the exchange value in Currency2 will be expressed on the basis of the most recent exchange rate, and not on the historical one used on the day of the entry.

You need to pay attention to the fact that a balance converted to another currency will show small differences in the totals. Often the converted value of a total is not equal to the sum of split exchange values, as can be seen from the following example:

|

Moneta base EUR |

Moneta 2 USD |

|

|

Cash |

1.08 |

1.42 |

|

Bank |

1.08 |

1.42 |

|

Total Assets |

2.16 |

2.84 |

|

Personal capital |

2.16 |

2.85 |

|

Total Liabilities |

2.16 |

2.85 |

In the basic currency, total assets are equal to total liabilities. It is permitted to present a Balance Sheet that contains differences only if they are understandable and if it is indicated that they were due to calculations from another currency.

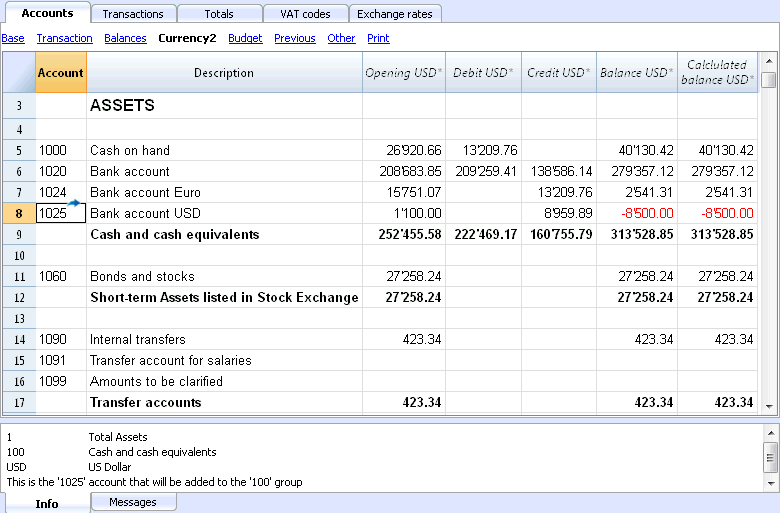

Accounts table, Currency 2 view

Converting currencies

Variability of exchange rates

The purchase/sale of currencies occurs in a free market. The price (exchange rate) is based on the law of supply and demand. The differences in the exchange value can be more or less important according to the fluctuations of the exchange rate.

|

Date |

Exchange rate EUR/USD |

Equivalent in EUR |

Equivalent value difference compared to 01-01 |

|

01-01 |

1.32030 |

1'320.03 |

|

|

31-03 |

1.33350 |

1'333.50 |

13.47 |

|

30-06 |

1.34750 |

1'347.50 |

27.47 |

|

30-09 |

1.42720 |

1'427.20 |

107.17 |

The exchange rate

The exchange rate refers to the basic currency. There are always two different exchange values between two currencies, according to the currency that is used as the basic currency.

For the USD and Euro currency, there are therefore two different exchange rates:

- If the basic currency of the exchange is EUR then the exchange rate is 1.32030

1 Euro (EUR) corresponds to 1.32030 US Dollars (USD) - If the basic currency of the exchange is USD then the exchange rate is 0.75800

1 US Dollar corresponds to 0.75800 Euros

In the current document, the Euro will be regularly used as the basic currency, to which other currencies will be compared.

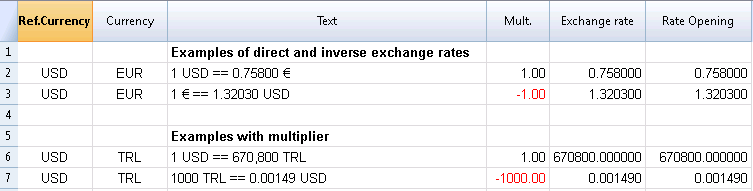

Inverse exchange rate

Having the exchange of EUR/USD at 1.32030, it is possible to find the exchange rate of USD/EUR by dividing 1 by the exchange rate.

| Exchange rate |

Inverse exchange rate 1/exchange rate |

Inverse exchange rate rounded to 6 digits |

|

EUR/USD 1.32030 |

0.75800 |

0.758000 |

The exchange values calculated with an inverse exchange can turn out to be different from the originals because of the roundings.

| Exchange rate |

Inverse exchange rate |

Exchange value 10000 x original exchange rate |

Exchange value 10000 x inverse exchange rate |

Difference |

|

EUR/USD 1.32030 |

0.75800 |

13'203.00 |

13'192.61 |

10.39 |

Don't use inverse exchanges rates in order to avoid differences.

For example, for the transition to Euros, it was prohibited to use inverse exchange rates.

Multiplier

There are currencies that have very large exchange rates.

Always on January 1st

- 1 US Dollar = 670,800 Turkish Lira

- 1 Turkish Lira (TRL) = 0.00000149 US Dollar (USD)

Instead of using so many zeros, it can be said that

- 1000 Turkish Lira (TRL) = 0.00149 US Dollar (USD)

In this case, the multiplier is 1000 instead of 1.

Precision

As a rule, an exchange rate is specified with a precision of at least 6 figures after the decimal.

There are, however, cases where it is necessary to use more precision.

- 1 Turkish Lira (TRL) = 0.00000149 US Dollar (USD)

When the precision is changed and the exchange is rounded in a different way, the amounts also change. The precision with which the exchange is specified is very important.

Lowest denomination

For coin and paper money, especially, low denominations are used. As a rule the lowest denomination for Swiss francs is five centimes (0.05). When an exchange occurs, for example EUR/CHF:

1 EUR = 1.60970 CHF

| EUR |

Exchange rate |

Actual exchange value in CHF |

Rounded to lowest CHF denomination |

Difference |

Effective exchange rate |

|

10.00 |

1.60970 |

16.09 |

16.10 |

0.01 |

1.61 |

Calculation of exchange rates and values

When the Euro is the basic currency

The exchange factor for EUR/USD is1.32030

1 Euro (EUR) is equal to 1.32030 US Dollars (USD).

Calculation of the exchange value:

Multiply the basic currency amount by the exchange factor:

EUR 100 x 1.32030 = USD 132.03

Calculate the basic currency amount:

Divide the destination currency by the exchange rate:

USD 132.03 / 1.32030 = EUR 100

Calculate the exchange factor:

Divide the basic currency amount by the destination currency amount:

EUR 100 / USD 132.03 = 0.7574

Exchange rates for purchases and sales

Banks carry out the purchase and sale of currencies and maintain a margin of earnings. They apply different exchange rates depending on whether a determined value is being bought or sold.

Sale: the bank receives domestic money and gives (sells) foreign money.

Purchase: the bank receives (purchases) foreign money and gives domestic money.

Currency exchange and banknotes exchange (premium)

Currency exchange: exchange for written transactions (from one account to the other).

Banknote exchange: exchange for banknotes.

Premium: commission for converting a written amount to cash.

To exchange currency, the banks maintain a lesser margin (the difference between purchase/sale) compared to exchanging banknotes. When a written value is to be transformed (credit on the account) into cash currency, the bank applies a commission, called a premium.

Differences when changing back to basic currency

When an amount is exchanged into another currency, it is expected that the reverse exchange will render the same amount as it was originally.

| Basic amount |

Exchange rate |

Exchange value |

Return |

|

100.00 |

1.32030 |

132.03 |

100.00 |

However, you do not always come up with the same amount when converting currency back. Because of rounding errors, there can be cases where the same return value cannot be obtained.

| Basi amount EUR |

Exchange rate |

Exchange value in USD |

Retourn in EUR |

Differece in EUR |

|

328.67 |

1.32030 |

433.94 |

328.66 |

|

|

328.68 |

1.32030 |

433.95 |

328.67 |

0.01 |

|

328.69 |

1.32030 |

433.96 |

328.68 |

0.01 |

Differences of totals through splitting

The total exchange value of the components of an amount does not always give the same exchange value as the overall amount.

In this example, the amount of 2.16 EUR gives an exchange value in USD of 2.03. By splitting the amount and adding the two exchange values, 2.04 can be obtained.

| Amount in EUR |

Exchange rate |

Exchange value in USD |

|

2.16 |

1.32030 |

2.85

|

|

|

|

|

|

1.08 |

1.32030 |

1.42 |

|

1.08 |

1.32030 |

1.42 |

|

Totale 2.16 |

|

2.84 |

|

Differenza |

|

0.01 |

These mathematic differences cannot be eliminated if they are not recorded properly.

Revaluations and exchange rate differences

Exchange rates vary all the time and therefore also the exchange value to basic currency varies. Between one period and another, there will inevitably be exchange rate differences.

Exchange rate differences are not accounting errors but simple adjustments of the values made necessary in order to keep the accounting figures in step with normal fluctuations.

As you open the accounting, the figures in the balance column are equal to those present in the opening column. When there are entries, these will update the figures in the balance column.

The calculated balance column contains the exchange value to basic currency for the account balance, at the daily exchange (on the exchange rate table). The difference between the balance in basic currency and the calculated balance is the exchange rate difference.

|

|

Currency at opening |

Exchange value at opening in EUR |

Basic currency balance in EUR |

Calculate balance at 30.03.200xx in EUR |

Exchange rate difference |

||

|

Exchange rate |

|

|

1.32030 |

1.32030 |

1.30150 |

|

|

|

|

|

|

|

|

|

||

|

Cash |

EUR |

93.80 |

93.80 |

93.80 |

93.80 |

|

|

|

Bank |

USD |

100.00 |

75.74 |

75.74 |

76.83 |

1.09 |

|

|

Real estate |

EUR |

1'000.00 |

1'000.00 |

1'000.00 |

1'000.00 |

|

|

|

Total Assets |

|

|

1'169.54 |

1'169.54 |

1'170.63 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loan |

USD |

-500.00 |

-378.70 |

-378.70 |

-384.17 |

-5.47 |

|

|

Personal capital |

EUR |

-790.84 |

790.84 |

-790.84 |

-790.84 |

|

|

|

Total Liabelities |

|

|

-1'169.54 |

-1'169.54 |

-1'175.01 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss |

|

|

|

|

-4.38 |

|

|

At March 30th the EUR/USD exchange rate is different from the one at the beginning of the year. In the above example there were no accounting entries during the three-month period. The situation, from an accounting point of view, has not changed since the beginning of the year. Despite this the total of the updated balance, using the rate at the end of March, is different when compared to the beginning of the year. The credit bank balance and the loan in USD have a different value in EUR. There are therefore consequences for the accounting even though there have been no entries.

In the above example, you will notice that the Euro is now worth less against the dollar compared to the beginning of the year. The dollar is therefore worth more against the Euro.

The exchange value of the balance on the account in USD is greater than it was at the beginning of the year. You have a greater estate and therefore a profit on the exchange rate.

On the debit side there is a USD 500.00 loan. Now the exchange value in EUR is greater compared to the value input at the beginning of the year. The value of the loan has increased and brings about a loss due to the exchange rate difference.

In the following example we shall use the hypothesis that there has been the opposite development. We imagine that the Euro has increased in value and is therefore worth more against the USD. The exchange value in EUR of an amount in dollars is less than the one at the beginning of the year.

|

|

|

Currency at opening |

Exchange value at opening EUR

|

Calculate balance at 30.03.20XX Eur (Hypothetical) |

Exchange rate differece |

|

Cambio |

|

|

1.32030 |

1.36150 |

|

|

|

|

|

|

|

|

|

Cash |

EUR |

93.80 |

93.80 |

93.80 |

|

|

Bank |

USD |

100.00 |

75.74 |

73.44 |

-2.30 |

|

Real estate |

EUR |

1'000.00 |

1'000.00 |

1'000.00 |

|

|

Total Assets |

|

|

1’169.54 |

1'167.24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loan |

USD |

-500.00 |

-378.70 |

-367.24 |

11.46 |

|

Personal capital |

EUR |

-790.84 |

-790.84 |

-790.84 |

|

|

Totale Liabelities |

|

|

-1’169.54 |

-1'158.08 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit |

|

|

|

9.16 |

9.16 |

As a consequence of an increase in the Euro/dollar exchange rate, you have a USD bank deposit with an exchange value in EUR which is less than at the beginning of the year. The total worth has diminished and there is therefore a loss.

The USD loan has a lower exchange value in EUR. A lesser liability is an advantage for the company and there is thus an exchange rate profit.

Exchange rate profit

You have an exchange rate profit when:

- The exchange value of your assets increases (increase of the investments)

- The exchange value of the liabilities decreases (decrease of the loans).

Exchange rate losses

You have an exchange rate loss when:

- The exchange value of your assets decreases (decrease of the investments)

- The exchange value of the liabilities increases (increase of the loans).

Accounting features foe exchange rate differences

Exchange rates can evolve in different ways. Often they rise, only to fall again. The principle rule for accounting is that the figures written on the Balance Sheet must be true ones. When you present your Balance Sheet, the exchange values of foreign currency accounts must be made at the exchange rate on the day of presentation.

The exchange rate difference is calculated as if you had to definitively convert the amount to basic currency. In reality there is no definitive conversion so you are only dealing with a correction to the accounting.

Closing exchange rate

At the end of each year it is necessary to prepare the complete Balance Sheet. The exchange rates thus have to be updated with the closing exchange rates. It is also necessary to enter the exchange rate differences once and for all; if these are not entered, then there will be differences in the opening balances.

Enter the exchange rate diferences

|

|

|

Currency balance |

Account balance EUR |

Calculate balance at 30.03.200xx EUR (hypothetical) |

Exchange rate difference |

|

Exchange |

|

|

1.32030 |

1.36150 |

|

|

|

|

|

|

|

|

|

Bank |

USD |

100.00 |

75.74 |

73.44 |

-2.30 |

|

|

|

|

|

|

|

|

Exchange rate difference |

EUR |

|

-2.30 |

|

|

|

|

|

|

|

|

|

|

Bank |

USD |

100.00 |

73.44 |

73.44 |

0.00 |

As can be seen from the above example, the bank balance is USD 100.00. For the accounting it has been valued at 75.74 EUR. Today’s actual exchange, though, is only EUR 73.44. There is a difference of EUR 2.30 EUR in basic currency. The entry must therefore decrease the EUR amount. You proceed with a transaction that debits the bank account and credits the exchange rate loss account by EUR 2.30. As you can see, the actual bank account balance of USD 100.00 has not been altered. The entry only alters the basic currency balance.

When entering the exchange rate difference, you need to be sure that the exchange value in basic currency corresponds to the actual exchange value, calculated at either the daily exchange rate or the closing one.

The figures in the account currency must not be altered. You must therefore proceed to make an entry that only alters the basic currency balance on the specific account.

As the account on the other side you will have the exchange rate profit or loss account.

Transactions with exchange rates at the time of purchase

Enties on account valued with the exchange rate of the time of purchase

When the positions, valued with exchange rates of the time of purchase (historical ones) are increased or decreased, you have to calculate the exchange of the exchange rate table, taking into account the development of the amounts being brought forward.

|

|

USD amount |

Exchange |

EUR exchange value |

Total USD |

Total EUR |

Historical Exchange |

|

Acquisition of shares |

100'000.00 |

0.9416 |

106'202.00 |

100'000.00 |

106'202.00 |

0.9416 |

|

Increase of shares |

50'000.00 |

0.8792 |

56'870.00 |

150'000.00 |

163'072.00 |

0.919839 |

Investiments and special exchange rates

Investments valued at the exchange rate of the time purchase

Certain investments (shares, real estate abroad) are valued using the exchange rate of the time of purchase (historical exchange) and not the current one. The exchange rate profit and loss is not accounted for until it is actually realized. You must therefore make certain these accounts do not get valued using the current exchange rate.

In order to input a fixed, historical exchange, you need to create a supplementary currency on the account table (e.g. USD1) with a fixed exchange rate. This currency will then only be used for this account with a fixed rate. If you have to make a transfer from the USD account to the USD1 account, you proceed exactly as if you were working with two different currencies. For this reason you will have to use a two-line entry.

Opening with special exchange rates

Inputting the opening balances in the “opening” column, foreign currency amounts will be converted to basic currency at the opening exchange rate.

If this system proves not to be flexible enough (you need various special rates or there are rounding differences) the opening can be done manually by making normal entries, indicating the amounts and the exchange rates you want for each account. In this case, the “opening” column of the Accounts table will be left blank.

Caratteristiche della Contabilità multimoneta

Con Banana Contabilità multi-moneta lavori facilmente a livello internazionale nella lingua che vuoi e con i conti in valuta estera di cui hai bisogno. La struttura è sempre a tabelle, simile a Excel e con tutte le facilitazioni degli altri applicativi Banana. Il funzionamento si basa sulla metodologia della Contabilità in partita doppia. Nel caso hai bisogno della gestione IVA puoi sempre attivare le funzionalità dell'IVA.

Si rivela particolarmente interessante per coloro che hanno delle attività con l'estero, per le associazioni che in genere operano in tutto il mondo o hanno dei progetti o semplicemente per coloro che nella propria contabilità hanno dei conti in moneta estera.

Tante funzioni per la Multi-moneta

- Gestisci quanti conti vuoi in moneta estera

Non hai bisogno di avere gestioni separate per gestire conti in altre monete. Nel piano contabile dove hai tutti i conti della contabilità, inserisci i conti in moneta estera, per le differenze di cambio imposti i cambi nella tabella cambi e sei pronto a registrare. - Puoi impostare qualsiasi moneta, codici monete standard o definiti liberamente (per usare qualsiasi moneta virtuale).

- Decimali moneta configurabili da 0 a 28. Generalmente si usano 2 decimali, ma si può impostare la contabilità per usare 0 decimali, oppure 3 decimali (Tunisia) o di più se si usa per le cryptovalute. 9 decimali (Bitcoin) o 18 (Ethereum)

- Stessa metodologia della contabilità in partita doppia

Lavori con lo stesso metodo della contabilità in partita doppia, pertanto registri i dare e in avere e avrai tutti i report e i dettagli di una contabilità professionale. - Calcolo automatico del cambio

Nel momento in cui registri un conto in moneta estera, non hai bisogno di calcolare manualmente il controvalore in moneta estera, il programma calcola il cambio automaticamente. Puoi inserire il cambio sia aggiornando il cambio nella tabella Cambi, sia direttamente nella tabella Registrazioni nella colonna Cambio. - Registrazioni in diverse monete

Puoi registrare tutti i casi possibili di registrazione in moneta estera, anche giroconti e operazioni che non includono la moneta base. Questo permette di avere nella contabilità operazioni anche complesse. - Report completi con Bilancio, Conto Economico

Nel Bilancio e Conto Economico, per i conti in moneta estera hai la visualizzazione dei saldi sia in moneta estera, sia del controvalore nella moneta base (moneta nazionale).

Se hai rapporti di lavoro con l'estero e devi presentare il bilancio e il conto economico in una seconda moneta, questo è possibile senza creare report separati in Excel, basta andare nella tabella Conti, nella vista moneta2 e hai la visualizzazione di tutti i conti nella seconda moneta e anche nella moneta base. - Schede conto con importi in moneta estera e moneta base

Le schede conto puoi visualizzarle con le colonne degli importi in moneta base e in moneta estera. Questo permette di valutare i saldi in entrambe le monete.

Cambi liberi nella tabella Cambi

Puoi impostare i cambi per le varie esigenze: cambi variabili, cambi fissi, cambi diversi per una stessa moneta per gestire per esempio gli investimenti e senza influenzare conti con la stessa moneta.

- Differenze di cambio in automatico

Quando necessiti di calcolare le differenze di cambio, basta aggiornare il cambio nella tabella Cambi e impartire il comando; le differenze verranno inserite automaticamente nella tabella Registrazioni. - Preventivi possibili anche con la Multi-moneta

Nel file della contabilità Multi-moneta puoi preventivare la liquidità anche dei conti in moneta estera, nonché tutte le previsioni legate agli aspetti patrimoniali ed reddituali. Puoi stampare Bilanci e report previsionali, oppure combinati, con le colonne del Peventivo, Consuntivo e relativi scostamenti. - Controllo automatico per differenze di cambio non registrate

Se usi il comando Controlla Contabilità non avrai più differenze di cambio non registrate, perché nel caso queste sussistano, ti verranno segnalate. La funzione si rivela particolarmente importante per evitare di avere differenze di cambio nei saldi di apertura quando crei il nuovo anno. - Bilanci, Conti economici e Report, anche in una seconda moneta.

La contabilità multi-moneta, basandosi sulla partita doppia ha tante altre caratteristiche identiche alla partita doppia, che trovi alla pagina seguente:

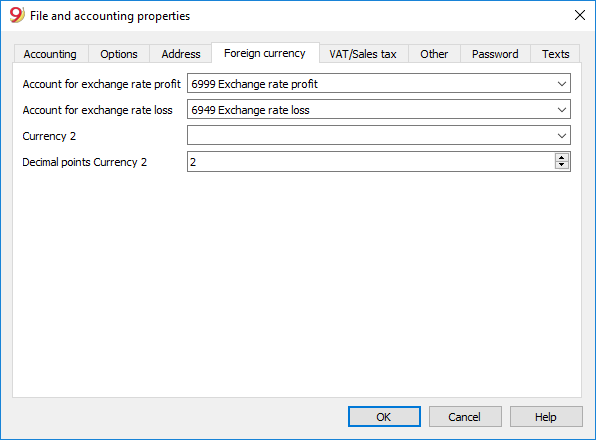

File properties multi-currency accounting

Account for exchange rate profit

From the accounts list, select the one for the exchange rate profit present in the Chart of Accounts.

Account for exchange rate loss

From the accounts list, select the one for the exchange rate loss present in the Chart of Accounts.

Currency2

It is possible to select a second currency in order to view the balances in a currency different from the basic one.

It is possible to add new currencies that might be missing from the list, please proceed as follows:

- in the Exchange rates table enter a new row; in the Ref.Currency column enter the basic currency for your accounting file, in the Currency column enter your desidred currency

- From the File menu -> File and accounting properties... command, in the Currency tab the new currency (that you entered in the Exchange rates table) will be visible, and it can be chosen as Currency2.

Decimal points Currency2

This is the number of decimal points to be used when rounding the amounts in currency2.

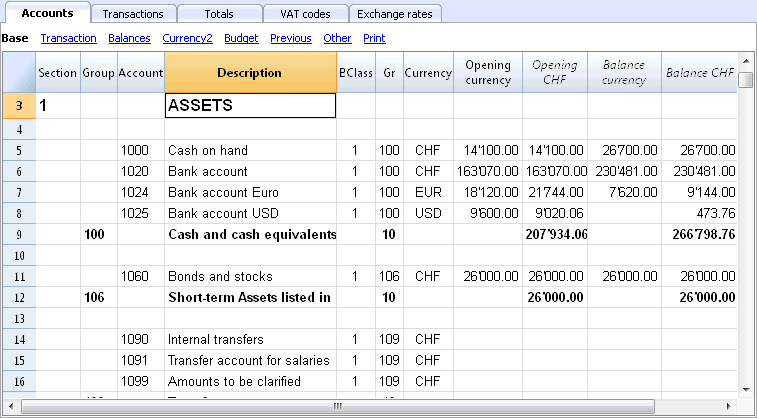

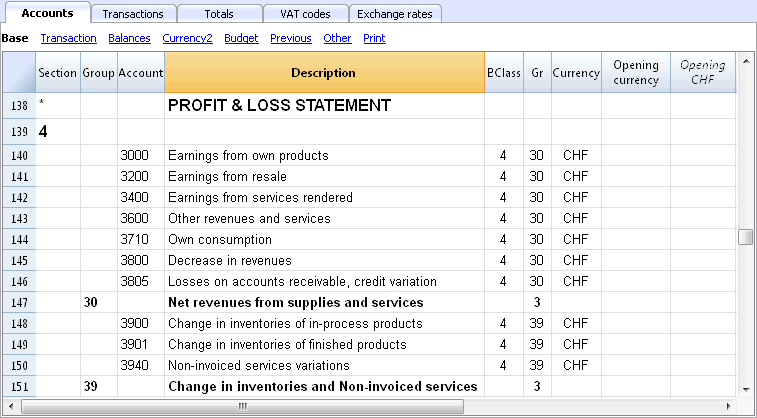

The multi-currency chart of accounts

The Chart of accounts of the multi-currency accounting is the same as the one of an accounting without foreign currency, except for the specifics that are indicated here below.

Basic currency

In the File and accounting properties, the basic currency should be defined and in the Exchange rates table, the foreign currencies should be defined.

In the example here below, the basic currency is the CHF, which, as can be seen, appears in the column headers with the amounts in basic currency.

Account currency

- The Assets and the Liabilities (Balance sheet accounts) can be in basic currency or in foreign currency.

-

The Costs (Expenses) and Revenue accounts must be in basic currency.

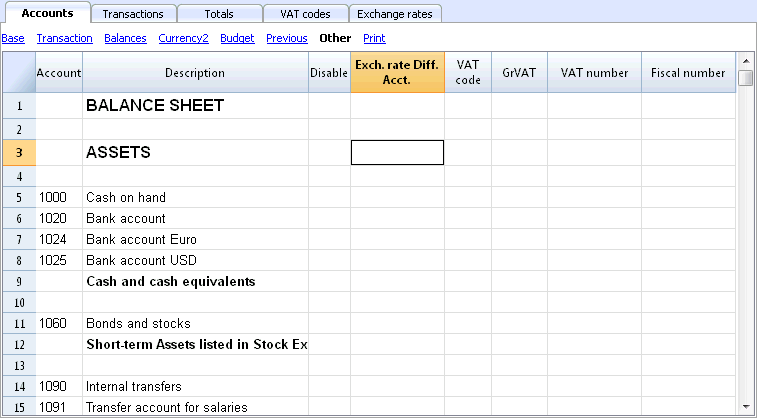

Explanation of the columns of the multi-currency accounting

- The opening balance in basic currency.

A protected column, calculated by the program based on the opening balance in currency and the opening exchange rate (exchange rate of the exchange rate table indicated in a row without date). - The current balance in currency.

Calculated by the program, using the opening balance in currency and the currency amount indicated in the transaction rows. - The current balance in basic currency.

Calculated by the program, using the opening balance in basic currency and the amount in basic currency indicated in the transaction rows. - The calculated balance

Is the balance in the account currency converted at the current exchange rate (exchange rate of the exchange rate table indicated in a row without date).

-

In the Other view from the Account table, there is the Exch. rate Diff. Acct.

In this column, for specific account/accounts, you can enter an account (or several accounts, separated by a semicolon) in order to enter the exchange rate differences. These are different accounts from those in the File and accounting properties (account for exchange rate profit and loss).

If in the Exch. rate Diff. Account column there are no accounts, the program will register exchange rate differences on the accounts indicated in the File and accounting properties; if however accounts are indicated both in the File and accounting properties and in the Exch.rate Diff.Acct. (Other view), the program will only consider the accounts indicated in the Exch.rate Diff.Acct., and ignore the File and accounting properties indications.

Opening Balances

- Before entering the opening balances, the opening exchange rates for the different currencies have to be indicated in the Exchange rate table.

The opening exchange rate is the one indicated in the Rate Opening column in the row of the exchange rate without date.

The opening exchange rate must be equal to the closing exchange rate of the preceding year. See Differences in the Opening Balances. - The Opening balances have to be inserted in the Accounts table, in the Opening currency column, Base view. This operation needs to be done for both basic currency and foreign currency accounts.

- The Opening Basic currency column is protected; the program automatically calculates the value in the basic currency on the basis of the opening exchange rate shown in the Exchange rate table.

- The opening balances for the liabilities have to be entered with the minus sign (-) in front of the amount.

- The opening balances of assets and liabilities have to balance out; for more information please visit the Recheck the accounting page.

Revaluation accounts and historical exchange rates

The basic currency amount of an account is being calculated using the opening exchange rate and the exchange rates that are indicated in the transactions. Because this value corresponds to equivalent of today's exchange rate, it is necessary to revaluate the account.

The revaluation takes place by calculating the exchange rate differences. We need to record on the account just an amount in basic currency (exchange rate difference), so that the balance in basic currency results equal to the equivalent (calculated balance)

There are accounts (related to, for example, investments) for which a so-called historic exchange rate is being used. By an historical exchange rate we mean un exchange rate that doesn't vary over time.

In order to have exchange rates that don't change, an extra currency symbol (for example EUR2) must be created in the Exchange rate table. To this currency, the same exchange rate is always being applied.

You can create as many currency symbols as you need for the different accounts with historic exchange rates.

Group totals in foreign currency

Normally, the columns with amounts in foreign currency don't have totals, as it has little sense to calculate totals for values in different currency.

If you have a group that includes only accounts in a specific currency, the currency symbol can be indicated at a group level and, in the Accounts table, the program totalizes these amounts. If there would be accounts with various currency symbols, there would be no amount indicated (the program would not report an error either).

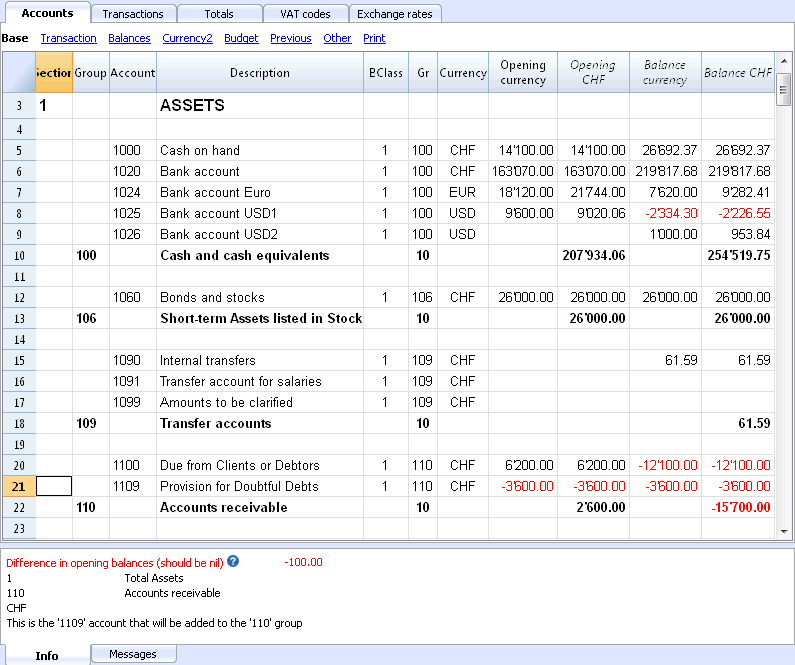

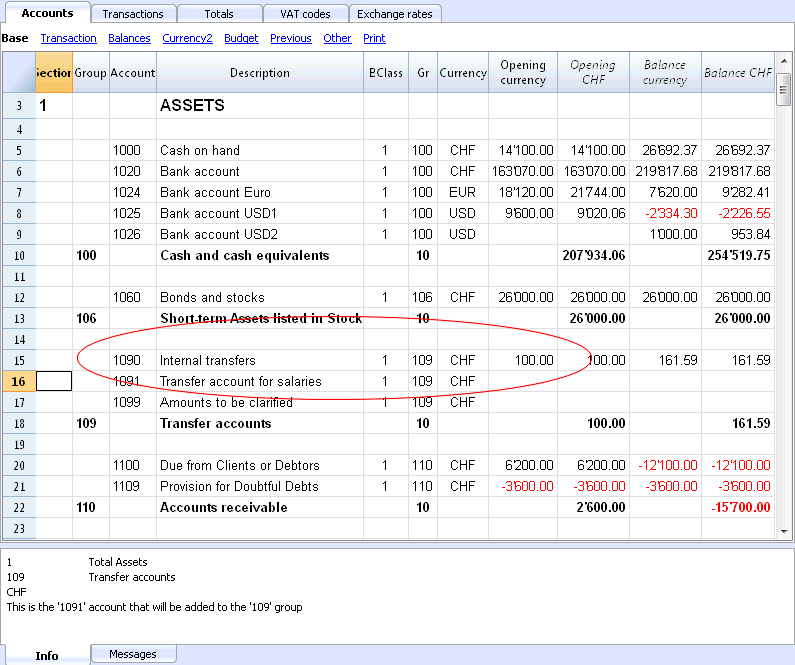

Differences in the opening balances

When, in the preceding year, the exchange rate differences have not been calculated, the program signals, in the New Year, a difference in the opening balances.

In order to resolve this problem, there are two possibilities:

- Insert in the Exchange rate table, Exchange rate column, the official exchange rates at 31.12

- Activate, from the Account2 menu, the Create transaction for exchange rate variation command

- Open the file for the New Year and update the opening balances

- Open the file of the New Year

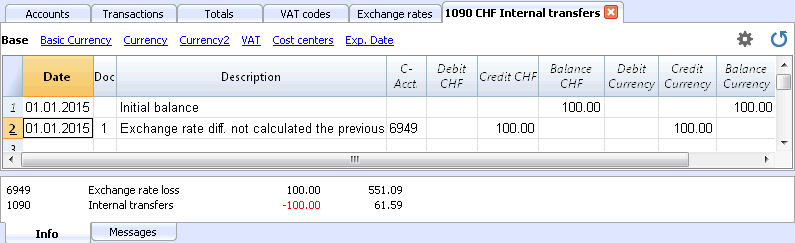

- Insert in the Assets or the Liabilities (Accounts table), according to the situation, a new account Unrecorded Exchange rate differences or record the amount in the 1090 Internal tranfers account (as in the following example)

- In the Opening Currency column, insert the amount corresponding to the exchange rate difference

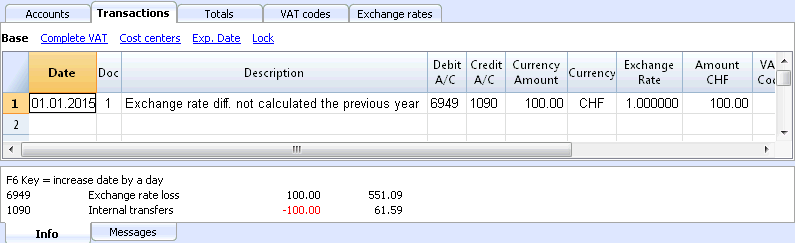

- At 01.01, the exchange rate difference account has to be put to zero by means of a transaction (Transactions table), using the account related to the exchange rate differences (Exchange rate profit/loss) of the profit/loss statement as its counterpart.

After the transaction to arrange the exchange rate differences has been made, the account that has been used should have a balance of zero, or equal to the amount corresponding to the balance prior to the transaction.

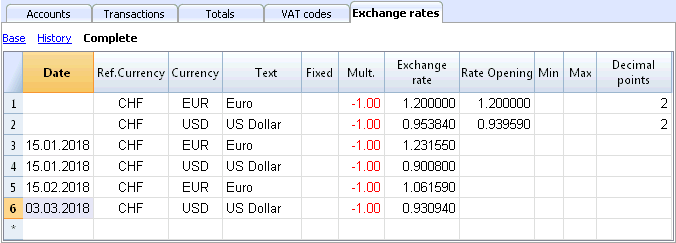

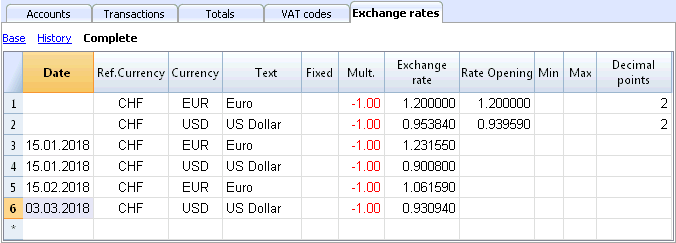

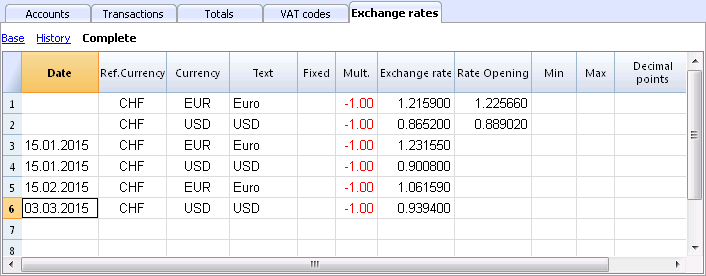

Exchange rates table

In the Exchange rates table you can define any currency and its current and opening exchange rate.

Before entering multi-currency transactions it is necessary to define the parameters of the used currencies in the Exchange rates table.

Columns of the Exchange rate table

Date

The date for the exchange rate.

-

Exchange rate rows without date. Actual and Opening exchange rate.

For each used foreign currency, it is necessary to have a row in the Exchange rate table with an exchange rate and without a date.- Exchange rate

This is the one that is considered to be the most recent and also the closing exchange rate.

It is being used for the calculation of the Balance Calculated column (Accounts table) and always when there is no historical exchange rate. - Rate Opening

It is being used to convert the opening balance amounts of foreign currencies into the opening balance amounts of the basic currency of the accounting.

- Exchange rate

-

Rows with a date (historical exchange rates)

The program chooses the exchange rate with a the date equal to the transaction row or with the closest preceding date to that row, in the following cases:- If you have an historical exchange rate, the value in the Exchange rate column will be used as default exchange rate when you insert a new transaction

- When the exchange rate differences transactions are created and the option to use the historical exchange rate is activated

- When entering an exchange rate with a date, the Opening exchange rate is not used.

Ref. Currency

This is the currency that serves as the basis for the exchange rate (the CHF in our example.)

Currency

This is the destination currency, the one into which the value of the “Ref. Currency” will be converted.

Text

A text to indicate the foreign currency that we are dealing with.

Fixed

True or false. If there is a fixed exchange rate, enter Yes in this column. The used exchange rate is specified in the Exchange Rate column.

Mult.

The multiplier is usually 1, 100 or 1000 and is used to obtain the effective exchange rate. The multiplier is used for currencies which have a very low unit value in order to avoid having to insert exchange rates with many zeros. The multiplier can also be negative (-1). In this case, the program will use an inverted exchange rate or else it will act as if the currencies inserted in the Currency and Reference Currency columns had actually been inverted. Do not alter the multiplier once there are already transactions in the same currency, otherwise the program will signal a transaction error due to erroneous exchange rates.

Exchange rate

This column shows the actual exchange rate or the closing exchange rate for the currency compared to the reference currency.

It is also being used for calculating the exchange rate differences. Before calculating the exchange rate differences or closing the accounting, this value must be updated by entering the closing exchange rate.

The exchange rate and the multiplier are being applied according to the following formulas

- With multiplier > 0

Currency amount = Ref. currency amount* (exchange rate / |mult.|)

- With multiplier < 0

Ref. currency amount = Currency amount * (exchange rate / |mult.|)

Opening Exchange rate

This is the exchange rate at the moment the accounting is opened. To be indicated only on a row without date.

- It is used to convert the opening amount of the foreign currency into the opening amount of the accounting’s basic currency.

- Should be corresponding to the closing exchange rate of the preceding year.

If the closing exchange rates are not equal to the opening exchange rates, the Assets and Liabilities might result into different totals; see Differences in the Opening Balances. - The opening exchange rate should never be changed in the course of the year, otherwise exchange rate differences are being created in the total of the opening balances.

- When creating a new year or when updating the opening balances, the program defines the opening exchange rate with the value indicated in the Exchange rate column (row without date) of the accounting of the previous year.

Minimum

This column shows the minimum exchange rate accepted. If a lesser exchange rate is used during the entry, there will be a warning.

Maximum

This column shows the maximum exchange rate accepted. If a greater exchange rate is used during the entry, there will be a warning.

Decimal Points

This column shows the number of decimal points to be used when rounding the amounts in currency2.

Modifications in the Exchange rate table

- Modification of the Opening exchange rate

The next time you recalculate the accounting, the balances in basic currency of the accounts will be recalculated with the new exchange rate. Therefore, pay attention when modifying the Opening exchange rates once you have inserted the opening balances.If you modify the Opening exchange rates and there are opening balances, it is important to recalculate the accounting.

- Modifying the multiplier

-

When changing the multiplier of a currency already used in the Transactions table, the program will report a warning as soon as the accounting is being recalculated or will move to the transaction row.The transaction amount and the correct amount in the basic currency will have to be reentered.

- When the accounting is being recalculated, as a result the opening balances in basic currency will be recalculated.

-

Direct an indirect exchange rates

- Direct exchange rates are those where the basic currency and the foreign currency are being indicated on the same row.

In the example below there are direct exchange rates USD->EUR and USD->TRL.

- Indirect exchange rates are those where a direct exchange between two currencies is not being indicated (not recommended).

The exchange rate is deducted by the programn based on other combinations of entered exchage ratesIn this example, the EUR->TRL exchange rate has not been defined, and the program relies on combining the USD-EUR and USD-TRL.

Historical exchange rates - exchange rate history

As explained above, if an exchange has a date, the program considers it to be a historical exchange rate; the program chooses the exchange rate with a date equal to the transaction row or with the closest preceding date to that row, in the following cases:

- If you have an historical exchange rate, the value in the Exchange rate column will be used as default exchange rate when you insert a new transaction

- When the exchange rate differences transactions are created and the option to use the historical exchange rate is activated

- When entering an exchange rate with a date, the Opening exchange rate is not used.

If you import several historical change rates at the end of your accounting period, that is when you have already entered accounting transactions, to make sure that the program uses the imported exchange rates instead of those entered in the transactions simply manually delete the transactions exchange rates (Exchange rate column, Transactions table).

Incompatible exchange rates from previous versions

When the basic currency is entered as the reference currency, the exchange rates with a multiplier greater than 1 can present calculation differences between Banana 9 and the previous versions. In these rare cases, while opening an accounting file of a previous version, a warning message appears and the file is being opened as "read only".

- Open the file in Banana 9 and confirm the warning message;

- Recheck the accounting (Shift + F9);

- The warning messages "Transaction multiplier is not the same as the one in the Exchange rate table" can be ignored;

- Verify whether the balances and the result of the accounting period present differences compared to those displayed in earlier versions. If there are no differences, just save the accounting under a new name; otherwise, it is necessary to proceed as follows:

- In the Exchange rate table, for the exchange rates with a multiplier greater than 1, correct the exchage rate by multiplying it with the value of the multiplier and define the multiplier as 1. For example, if we have a multiplier of 100 and an exchange rate of 0.9944608, correct the exchange rate to 99.44608 and the multiplier to 1;

- Recheck the accounting (Shift + F9);

- The warning messages "Transaction multiplier is not the same as the one in the Exchange rate table" can be ignored, or it is possible to delete them by clicking, in the corresponding transaction row, on the amount in basic currency and by pressing the F6 key;

- Verify whether the balances and the result of the accounting period correspond with the ones indicated in earlier versions;

- Save the file under a new name;

- At this time, you can define the exchange rates and the multiplier in the preferred format, reverse or direct, with or without multiplier, verifying the balances and the result of the accounting period after each modification.

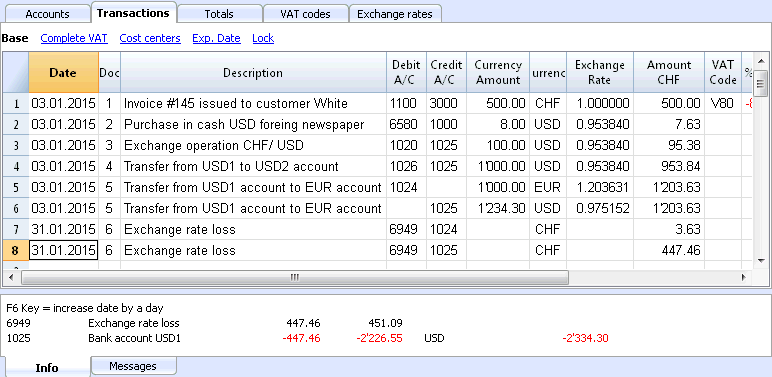

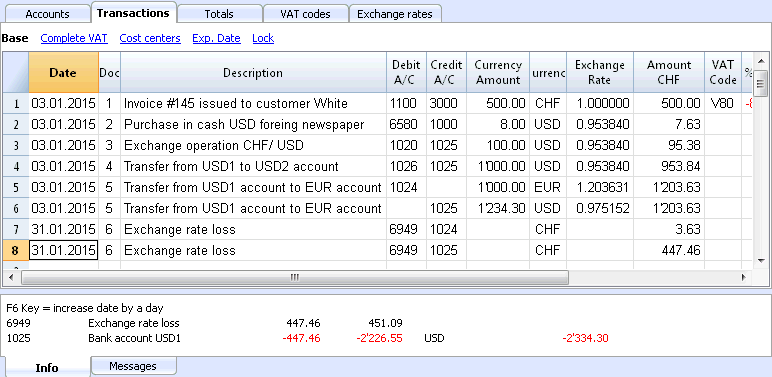

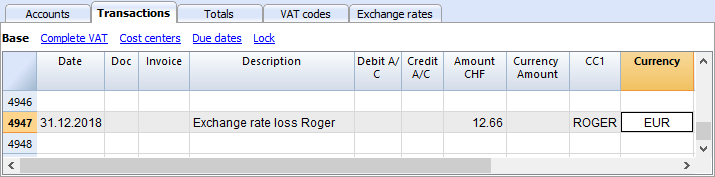

Transactions multi-currency accounting

Explanations of the columns

In the Transactions Table of the multi-currency accounting, other than the columns of the double-entry accounting, there are the following extra columns:

- Currency amount

This is the amount of the currency specified in the column with the currency symbol.

This amount is used by the program to update the balance of the related account in currency. - Currency

This is the currency symbol of the currency to which the amount refers.

The currency symbol has to be the basic currency, specified in the File and accounting properties (File menu), or the currency symbol of an amount indicated in the Debit A/C or Credit A/C columns.You can also use a different currency as long as the indicated Debit A/C and the Credit A/C are basic currency accounts.In this case the amount in currency is used as a reference, but will not be used for accounting purposes - Exchange rate

Used to convert the foreign currency amount in its Basic currency equivalent. - Amount in Basic currency

The transaction amount, expressed in basic currency.

This amount is used by the program to update the balance of the related account in Basic currency - Exchange rate multiplier

Normally not visible in the view, this value is multiplied by the exchange rate.

Types of entries in the multi-currency accounting

With regard to the exchange rates, multiplier and historical exchange rates, please refer to the page Exchange rates table.

Please note

All amounts, those in basic currency as well as those in foreign currency, have to always be entered into the Currency Amount column.

For each transaction, there are two accounts (debit account and credit account). In the program, only one foreign curency per transaction row can be used. So there can be the following direct combinations:

- Entries between two accounts in basic currency with the amount in basic currency (in the image, transactions n.1 in the Doc column). The account currency is the basic currency.

- Entries between two accounts in basic currency with the amount in foreign currency (Doc 2)

The indicated accounts are in basic currency, but the currency symbol and the amount in currency, indicated in the transaction row, are not in basic currency, but in a different currency.To insert the different currency, the user has to manually change the currency symbol.This is being used when one goes abroad and money is being changed in order to pay in local currency. In this case we do not have a specific account.For the calculation of the balance (both accounts being in basic currency) only the amount of basic currency column is being used. - Entries between an account in foreign currency and one in basic currency (Doc 3)

The currency needs to be the one of the account in foreign currency.

For the calculation of the balance of the account in foreign currency, the program uses the amount in foreign currency and for the balance in basic currency, the program uses the amount in basic currency. - Entries between two accounts with the same foreign currency (Doc 4)

The currency needs to be the same as account currency of both accounts. - Entries with two accounts in different foreign currencies (Doc 5)

For example, the bank makes an exchange operation between two foreign currencies:

In this case, the transaction needs to be recorded on two rows.

The amount in basic currency needs to be the same. It is useful to use an amount close to the current exchange rate to avoid excessive exchange rate differences.

In order for the amounts in basic currency to be equal, the amount in basic currency needs to be indicated manually, and the program will calculate the exchange rate. - Exchange rate differences (Doc 6)

The goal of this transaction is to realign the balance of the Basic currency account with the equivalent of the Foreign currency account at today's exchange rate.

On the Foreign currency account, only the amount in Basic currency related to the exchange rate differences is being recorded.

They are automatically generated with the Create transaction for exchange rate variation command.- For the exchange rate profits, the program automatically indicates the account to be revaluated in debit and the exchange rate profit account in credit. The exchange rate profit account is indicated in the File and Accounting properties (Basic Data), or in the specified account -> Exchange rate differences account column of the Other view (intended for one or several specific accounts).

- For the exchange rate losses, the program automatically indicates the account to be revaluated in credit and the exchange rate loss account in debit. The exchange rate loss account is indicated in the File and Accounting properties (Basic Data), or in the specified account -> Exchange rate differences account column of the Other view (intended for one or several specific accounts).

- The Currency amount is being left empty

- The Curency symbol is the basic currency

- In the Basic currency amount column, the amount of the revaluation of the account (profit or loss) is being indicated.

Establishing the exchange rate

The accountant is the one who decides which exchange rate to use for each single operation. Generally, the following rules are being applied:

- For normal operations, the exchange rate of the day is being used

- For buying or selling currency, the values indicated by a money exchange office or a bank are being used.

First the amount in foreign currency is being indicated in the program and then the amount in basic currency. The program calculates the exchange rate. The exchange rate indicated by the bank can be slightly different, because banks specify exchange rates with few figures after the decimal point and often round the amounts. - When several operations with the same exchange rate are being recorded, it is useful to update the exchange rate in the Exchange rates table, so that the program can automatically apply it.

- For operations from abroad that are subject to VAT, the national authority might impose a standard exchange rate. In this case, that exchange rate should be inserted in the Exchange rate column of the transaction

- To purchase real estate or equity investments, an historical exchange rate is being used. In that case, a currency symbol needs to be created in the Exchange rates table (for example USD1) with an historical exchange rate, that is not being subject to the fluctuations of the exchange rate.

One can create as many currency symbols as desired for all historical exchange rates.

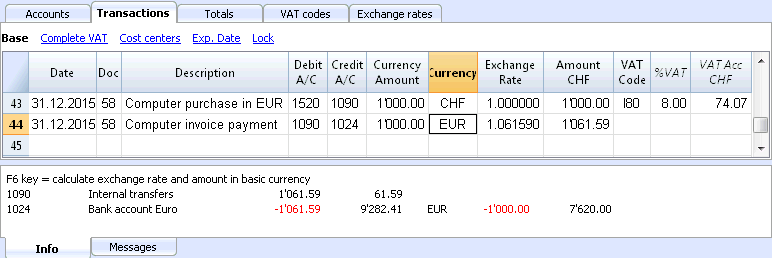

Transactions with VAT

The VAT account and the account from which the VAT is being deducted have to be in basic currency. It is impossible to use a VAT code to deduct the VAT from a foreign currency account. In order to record operations with VAT that have accounts in foreign currency as their counterpart, two transaction rows have to be used:

- First, the amount of the purchase is being recorded on an Internal transfers account in basic currency and the related VAT code is being applied. The amount in basic currency has to be calculated using an exchange rate in accordance with the requirements of the Tax administration.

- In a second row, the balance of the Internal transfers account is being put to zero; as its counterpart, the account in foreign currency should be entered.

The amount used for this transaction, both in basic currency and in foreign currency, has to be excluding VAT. Obviously, the exchange rate that has to be used is the same one as the one being used in the preceding transaction.

In the example, the basic currency is the CHF. We are dealing with a national purchase, but paid from a foreign currency account (EUR).

VAT and foreign currency transactions

In transactions with foreign currency accounts, it is possible to record VAT with a gross amount (Amount type 0, with VAT).

If you enter net values (Amount type 1, without VAT), the program indicates an error, because the calculation of the gross value would in many cases be incorrect due to the rounding up of VAT and of the exchange rate.

In these cases it is advisable to enter the gross value. See also the Explanations of the error.

Automatisms while entering multi-currency transactions

When a new transaction is being entered, the data in the above mentioned columns have to be completed.

When some values of the transaction row are modified, the program completes the transaction with the predefined values. If these values do not satisfy the user's requirements, these have to be modified in the transaction row.

The modification of the values in the Exchange rates table have no effect on already entered transaction rows. Thus, when the exchange rate in the Exchange rates table is modified, this has no influence whatsoever on already inserted transactions.

- When the amount in currency is entered and there is either a Debit A/C or a Credit A/C, and no other values are entered, the program operates as follows:

- the currency symbol is retrieved from the account in use, giving priority to the account that is not in basic currency;

- the exchange rate, defined in the Exchange rates table, is applied with the following logic:

- the historical exchange rate is applied, with a date earlier or equal to the transaction date

- tf there is no historical exchange rate to be found, the exchange rate from the row without date is applied.

- the multiplier, defined in the Exchange rates table, is applied or the number 1 if it is the basic currency;

- the amount in basic currency is calculated.

- When the amount in currency is modified (and there are already other values present), the program operates as follows:

- the amount in basic currency is calculated with the existing exchange rate

- If the currency symbol is modified the program operates as follows:

- the exchange rate with the multiplier is applied and the amount in basic currency is calculated (like above)

- If the exchange rate is modified the program operates as follows:

- the amount in basic currency is calculated using the entered exchange rate

- When the amount in basic currency is modified the program operates as follows:

- the exchange rate is recalculated.

More help

- While being positioned on the Currency Amount column and pressing the F6 key, the program rewrites all values with the earlier explained logic, as if there were no values present. This feature is useful when the Debit A/C or the Credit A/C is modified.

- If there is a registration with a single account in basis currency (in 'Multiple transactions' - see Transaction types) and its value of the Currency column has been changed manually in a currency symbol of a foreign currency, it is necessary to be positioned on the cell of the Currency column and press the F6 key in order to update the exchange rate and calculate the amount in basic currency.

- Smart fill for the Exchange rate column

The program suggests several exchange rates, picking them up from the Exchange rates table or from exchange rates previously used in the transactions.

Info window

In the info window, the program indicates:

- Differences, if any, between the Debit and Credit total movements in basic currency

- Explanation on the different uses of the F6 key

For the accounts related to the transaction row on which one is positioned, the program always indicates in the Info windows:

- the account number

- the account description

- the transaction's amount in basic currency

- the current account balance in basic currency

- the account currency symbol

- the transaction's amount in the account currency (if different from the basic currency)

- the current account balance in currency (if different from the basic currency)

Opening balances

For multi-currency accounting, when entering the opening balances in the Accounts table, the program converts the amounts into basic currency, using the opening exchange rate defined in the Exchange rates table, Opening exchange rate column.

To use historical exchange rates as opening balances, you can create another currency symbol or create transactions in the Transactions table with the opening balances. This way you can use different exchange rates for different accounts.

- Enter a single transaction for each account with an opening balance (Assets and Liabilities), indicating the initial accounting date and the Debit or Credit account.

- In the DocType column enter the "01" value to indicate that it is an opening value.

- In the Banana Accounting reports or printouts this amount will be shown as opening balance.

- However the transaction doesn't update the Opening balance column in the Accounts table

When using opening transactions, please consider that:

- In order to avoid the revaluation of the accounts with the current exchange rate, in the Accounts table, enter the "0;0" value in Exchange rate difference account column

- The software allows you to add both some opening balances in the Accounts table and some opening transactions in the Transactions table (Assets and Liabilities).

In both cases the amounts are considered in the calculations and, if it is the same account, they are added together.

We do not recommend using the two methods simultaneously to avoid hard-to-find errors and differences. - Opening transactions must be entered manually.

Any debit and credit differences are shown as a transaction difference.

Data transfer from earlier versions

In version 4 or earlier, the absence of a currency symbol in the Transactions table was being interpreted as a transaction in basic currency.

In version 7 and in version 8, each transaction needs to have its own currency symbol. Therefore, when you update from version 4 to version 7 or 8, in the accounting file, the transactions without a currency symbol need to be completed. To do this, a new Currency column must be added to the Transactions table by executing the Columns setup command from the Data menu.

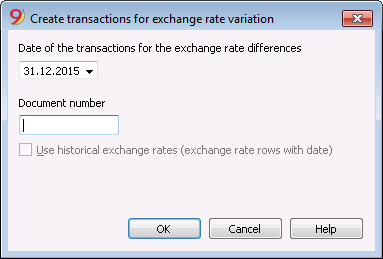

Exchange rate differences

Create transactions for exchange rate differences

For theoretical aspects please visit the Revaluations and exchange rate differences page.

- The exchange differences transactions are adjustment transactions that balance out the foreing currency account balance with the basic currency calculated balance. In essence, it is a matter of re-adjusting the values in the basic currency, taking into account exchange rate loss or gain, due to the fluctuations of the exchange rates.

- If these exchange rate differences are not recorded, there may be differences in the opening balances of the following year.

- The exchange rate differences can be calculated at the end of the closing year or during the accounting period (for example at the end of a quarter). In this case the historical changes can be useful, as they allow you to have different exchage rates at specific dates.

- The program calculates the exchange rate difference based on the balances at the specified date. It is therefore possible to calculate the exchange rate difference at a specific date, even if you have entered transactions after that date.

For further explanations, see also the Exchange rate differences not booked page

The Calculate exchange rate differences dialog

The Create transaction for exchange rate variation... command, from the Account2 menu, calculates the revaluations for the foreign currencies accounts.

Date of the transactions for the exchange rate differences

Enter the date your exchange rate differences transactions should have. The program can create the transactions for the exchange rate differences even if there are transactions past the indicated date.

- The program will suggest the final date of the current month, related to the last entered transaction.

- If there are transactions for exchange rate differences with the same date, the program asks whether they should be replaced. The program considers the transactions for the exchange rates differences as existing if they have the same date, doc, description, accounts and currency and when there is no amount in the account currency.

Document number

Enter the document number your exchange rate differences transactions should have.

Use historical exchange rates (exchange rate rows with date)

- when this option is not active

- if in your Exchange rate table there are not historical exchange rates (exchange rates with a date) this option is not active

- if the option is not checked the program will use the exchange rate in your Exchange rate table for the rows without date

- if you are using historical exchange rates for the year closure, be careful that the exchange rate used should be the same as the current one.

- when this option is active

- The program shows the date of the exchange rate, found in the Exchange rates table, that will be used to calculate the exchange rate differences. It is going to be the exchange rate with a date equal or prior to the indicated date.

- When calculating exchange rate differences at year end we suggest this option not to be activated

- When booking exhange rate difference transactions at year end, the historical exchange rate must be the same as the current exchange rate, otherwise you get an error messagge saying that the echange rate differences have not been calculated (even though they have been).

Values used to create the transactions

For more information, we refer to our page Multi-currency transactions.

Amount of the transaction

- Transactions for exchange rate differences are being created only for the accounts in foreign currency which, at the specified date, have a different balance in basic currency compared to the calculated one.

- For the amount in basic currency, the difference between the account balance in basic currency and the account balance in foreign currency converted in basic currency is being used.

Account balance

For the calculation of the exchange rate differences, the balances in the account currency and in basic currency are being used, at the specified date.

Exchange rate profit and exchange rate loss accounts

As exchange rate profit and loss accounts are being used, in order of priority:

- The indicated accounts entered in the specific column of the chart of accounts.

- The exchange rate profit & loss accounts indicated in the File and Accounting properties.

Position of inserted rows

If, while imparting the command, you find yourself in the Transactions table, the rows are being inserted at the position of the cursor.

Otherwise, they will be inserted at the end or at the previous position in case they are replacing existing transactions.

Before using the command

- In the File and Accounting properties of the File menu, Foreign Currency section, make sure that the Exchange rate profit and loss accounts are being indicated. It is equally possible to indicate the same account for both the exchange rate profits or losses.

- Make sure that the accounts in foreign currency are being updated and that the balances in foreign currency of these accounts (for exemple bank accounts) correspond with the balance indicated by the bank.

- Update the current exchange rates of the Exchange rate table.

You should indicate the closing exchange rates or those of a period's end in the rows without a date, in the Exchange Rate column (do not modify the opening exchange rate in the Rate Opening column). In order to calculate the Exchange rate differences, the program uses the exchange rates of the rows without a date. If these last ones are absent, the program gives an error message.

Exchange rates for the New Year

To have the Opening balances of the New Year in Basic currency correspond exactly with the closing balances of the preceding year, the Opening Exchange rates of the New Year, indicated in the Exchange Rate table, have to be the same as those being used for the closing of the accounting, so:

- The closing exchange rates have to be indicated in the Exchange rate column of the rows without a date;

- The opening exchange rates have to be indicated in the Rate Opening columns of the roes without a date.

The procedure of creating a new year or of the updating of the opening balances, copies the closing balances (Exchange rate column, rows without date) of the previous year into the opening exchange rates (Exchange rate table, Rate Opening column, rows without date) of the new year's file.

At the latest when the accounting period is being closed, the currencies need to revaluated in Basic currency, creating adjustment transactions for exchange rate loss or gain, due to the fluctuations of the exchange rates (for the theoretical aspects, please check Revaluations and exchange rate differences).

Differenze di cambio con i centri di costo

Il comando Crea registrazioni differenze di cambio non include eventuali differenze di cambio presenti nei centri di costo in moneta diversa da quella della contabilità. Queste differenze devono essere registrate manualmente a fine anno. La registrazione deve presentare unicamente l'importo in divisa della contabilità; indicare dapprima questo importo, poi il centro di costo interessato e la moneta del centro di costo. Al momento d'inserimento della moneta l'importo in divisa della contabilità verrà cancellato e dovrà quindi essere reinserito.

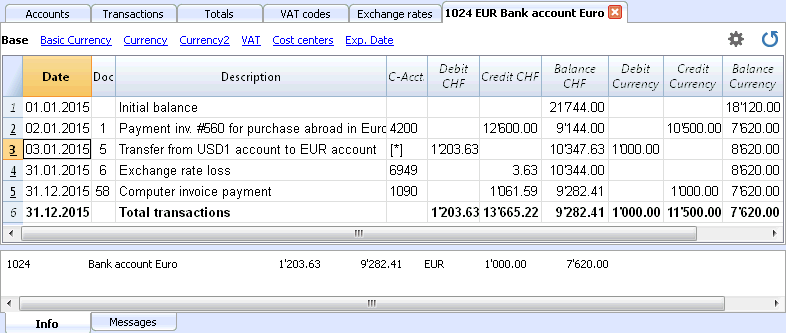

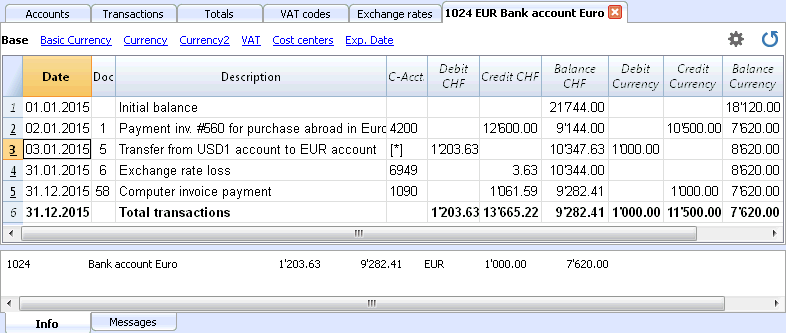

Account card multi-currency accounting

Columns and views of the account card

In the Account card, there are three groups with of columns with transactions Debit, transactions Credit and the Balance in different currencies.

- Basic currency

Indicated are the Opening Balance, the Transactions, and the Balance in Basic currency. - Account currency

The Transactions in the Account currency are being indicated.

When the accounts are in Basic currency, these values are identical to those of the Basic currency. - Currency2

For every transaction, the amount in Currency2 is being indicated. The amount in Currency2 is the equivalent of the amount in Basic currency, converted at the actual rate for the Currency2 currency symbol.

Please consult Exchange rates and accounting issues. - Base view

At the same time, the columns in Basic currency and the columns in the Account currency are visible.

In the column headers, the related currencies are being indicated.

With the appropriate commands, it is possible to modify the disposition of the columns and create other views.

Data editing

It is not possible to modify the data in the Account card. Double-click on the (underlined) row number to go back to the original corresponding row of the Transactions or Budget table. More details are available on the Account card page (paragraphe Updating the Account card).

Info Window

In the lower part of the screen, the Info window, the values of the accounts related to the active transaction are being indicated.

- Account number

- Account description

- Transaction amount of the account in Basic currency

- Actual Account Balance in Basic currency

- Account's currency symbol

- Transaction amount of the account in the Account currency

- Actual Account Balance in Account currency

Preventivo

Nella Tabella Preventivo si inserisce la pianificazione finanziaria. È impostata come la tabella Registrazioni.

Ci sono colonne per il Preventivo a dipendenza del tipo di Contabilità.

Si possono anche inserire Quantità e Prezzi e anche delle Formule di calcolo.

Per maggiori informazioni sul Preventivo, consultare la pagina Tabella Preventivo.

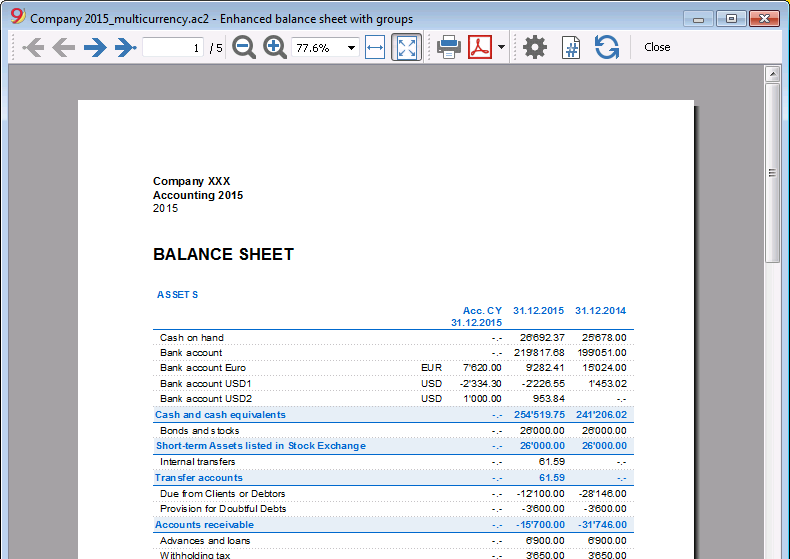

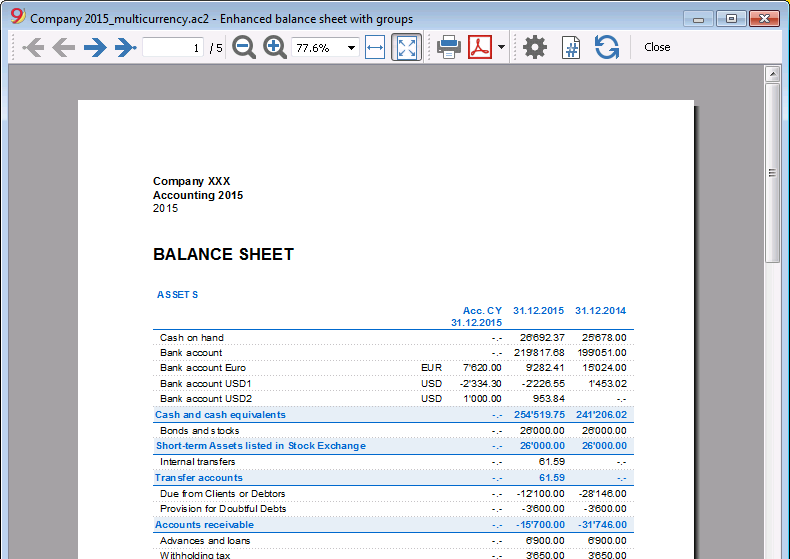

Enhanced balance sheet multi-currency accounting

The Enhanced Balance Sheet in the multi-currency accounting is done the same way as the one in double-entry bookkeeping. Information is available at the following link: Enhanced Balance Sheet.

The difference consists in the fact that the foreign currency accounts report the amounts in foreign currency as well as in the basis currency (amount converted).

Enhanced balance sheet by groups multi-currency accounting