在此文中

With the Advanced plan of Banana Accounting Plus, you have tools designed for audit and accounting professionals. Faster checks, reliable financial statements, and automated processes: less time on controls, more time to deliver value to your clients.

Why choose the Advanced plan of Banana Plus

The Advanced plan combines reliability, automation, and control. It's the ideal solution for professionals who want to work with more precision and less effort. It's not just about managing numbers, but about getting a system that works with you, reducing errors and increasing the value of your service.

Main benefits:

- Efficiency – Automatic checks and verifications that drastically reduce audit times.

- Precision – Features that prevent errors and instantly detect inconsistencies.

- Added value – More time for complex mandates and consulting activities.

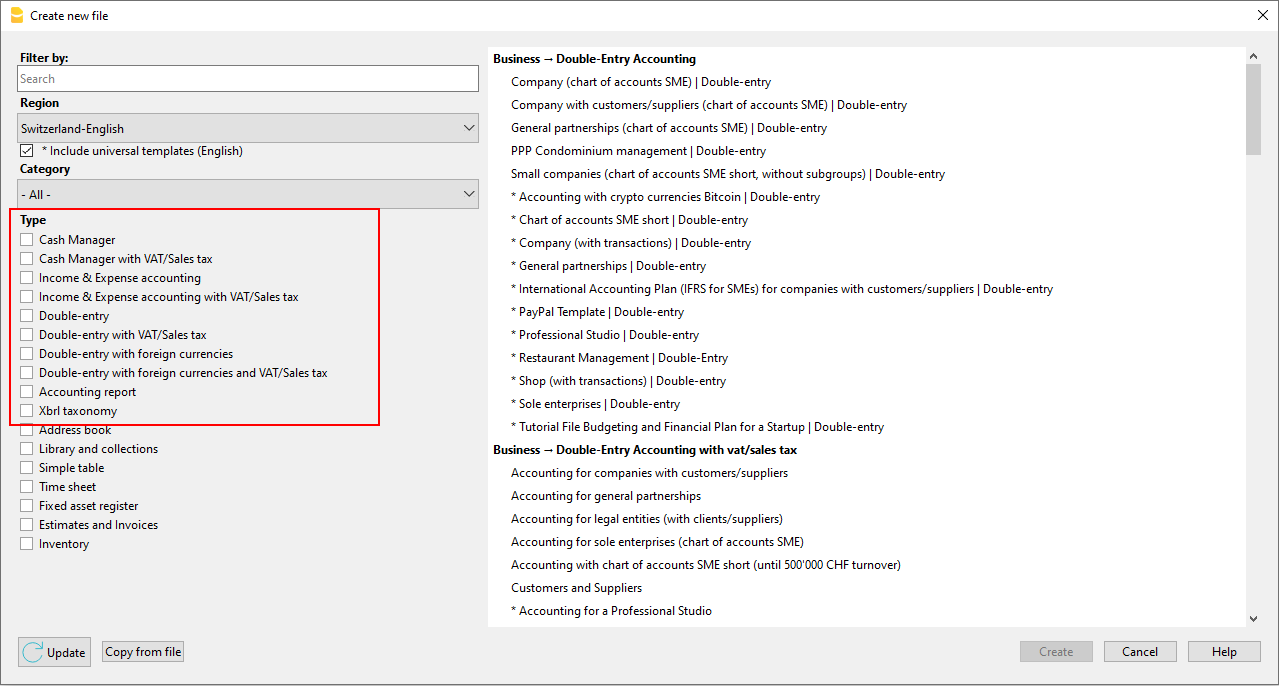

Set up your client's accounting in just a few minutes

Thanks to the predefined templates of Banana Accounting Plus, you can start working immediately with a ready-to-use chart of accounts, configured based on language, legal form, and business sector. Of course, you can then customize every detail to suit your client's specific needs.

Simplify your client's accounting with automation

Many clients enter transactions independently, but they don't always have in-depth accounting knowledge.

With Banana Accounting Plus, you can set up rules and automations that ensure consistent data and reduce the time spent on manual checks.

Thanks to the automatic features, you can:

- Automatically create recurring transactions

- Store recurring transactions

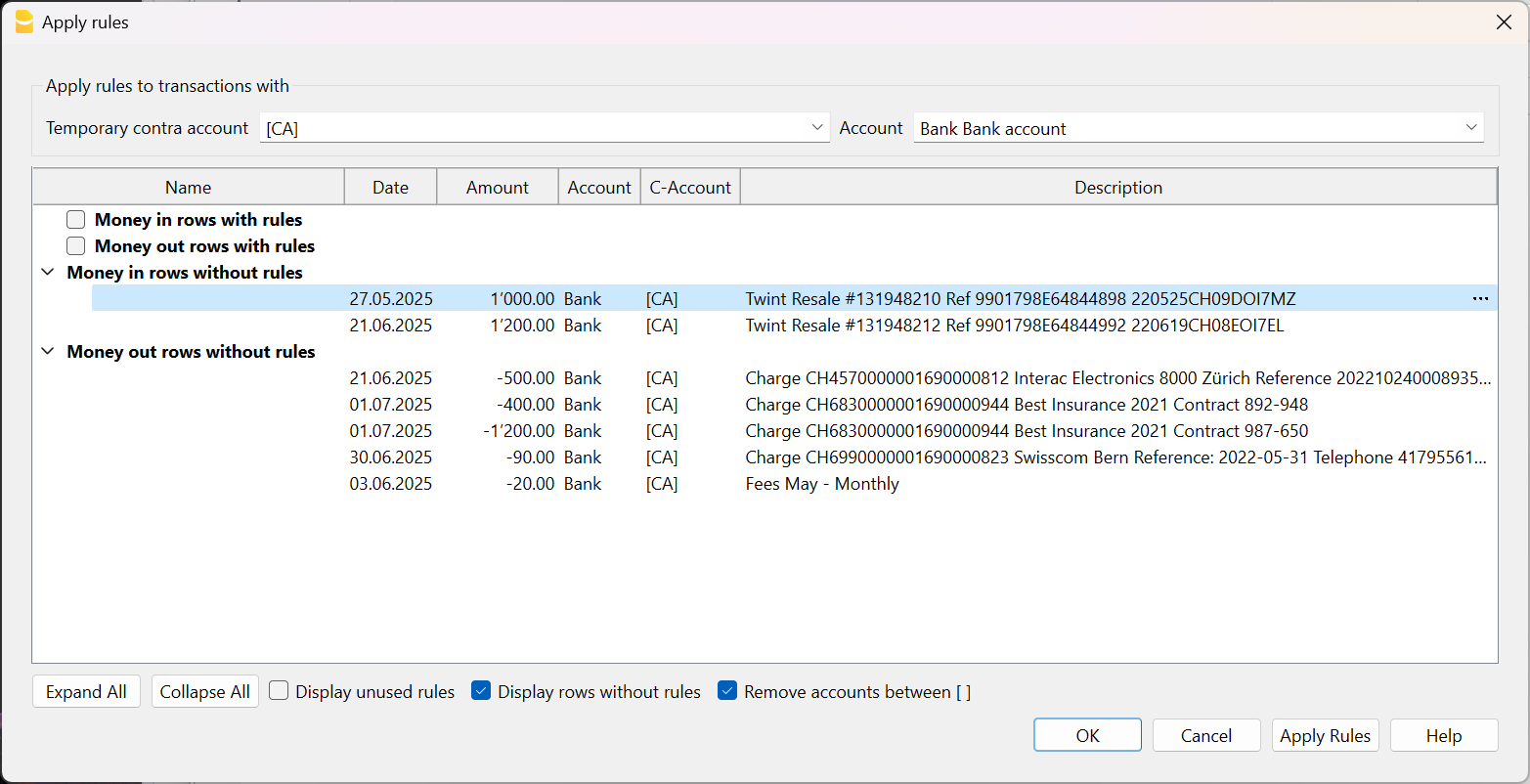

- Set rules to automatically complete imported transactions from bank statements.

Fewer errors, more efficiency, and more time to dedicate to your clients.

Set up your clients' accounting in no time

If you manage accounting for several clients, you can significantly speed up transactions by importing them directly from bank statements.

- With the Advanced plan of Banana Accounting Plus, you have import filters compatible with .csv files from major Swiss banks.

- With the Professional plan, on the other hand, you can only import files in the ISO 20022 standard format.

In addition, by setting Rules for completing imported transactions, the program automatically enters the counterpart accounts, VAT codes, and other accounting elements (feature available only in the Advanced plan).

This way, you’ll have more time to:

- Handle more mandates

- Focus on more complex accounting

- Offer targeted analysis and consulting

▶ Video: Rules for completing imported transactions (Apply rules dialog).

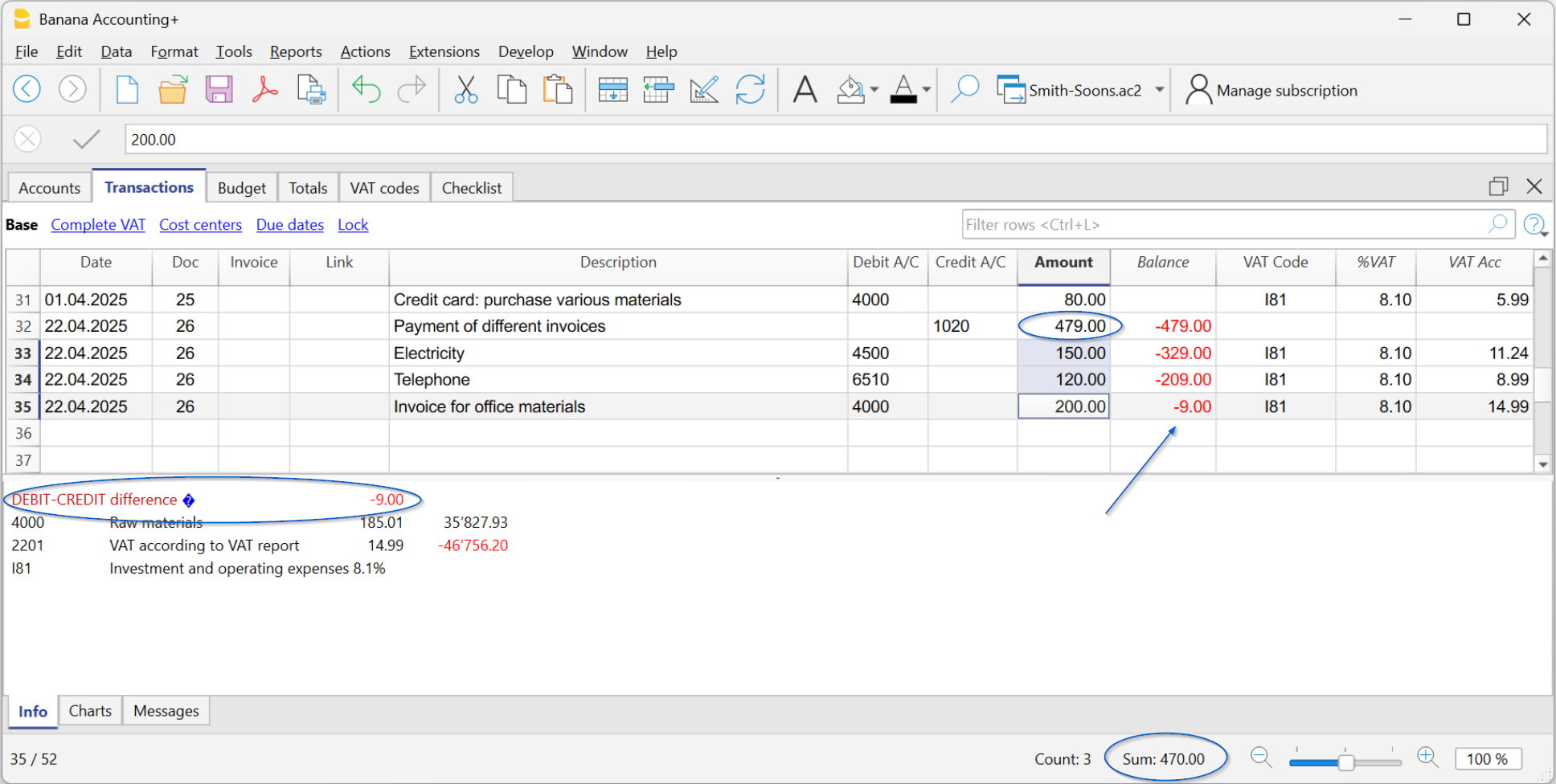

Instantly spot accounting discrepancies

The Balance column helps you immediately identify any discrepancies between Debit and Credit (or between Income and Expenses), directly highlighting the non-matching amount from the row where it occurs. This way, you can promptly correct the differences and always have accurate and reliable accounting.

Since the discrepancy is also shown in the following rows until it is corrected, keeping an eye on this column allows you to spot errors immediately and prevent them from accumulating.

▶ Watch the Video on the Balance column

Instant checks and verifications

When the client sends you the Banana file, you have everything under control. With the Check accounting command, the program automatically performs checks on:

- Errors in the chart of accounts, in case it has been modified

- Differences in opening balances (Accounts table).

- Differences in transactions (Transactions table).

- Uncalculated exchange rate differences.

- Bank balances that do not match the statement balances.

More information about balance check transactions is available on the Balance check transactions page.

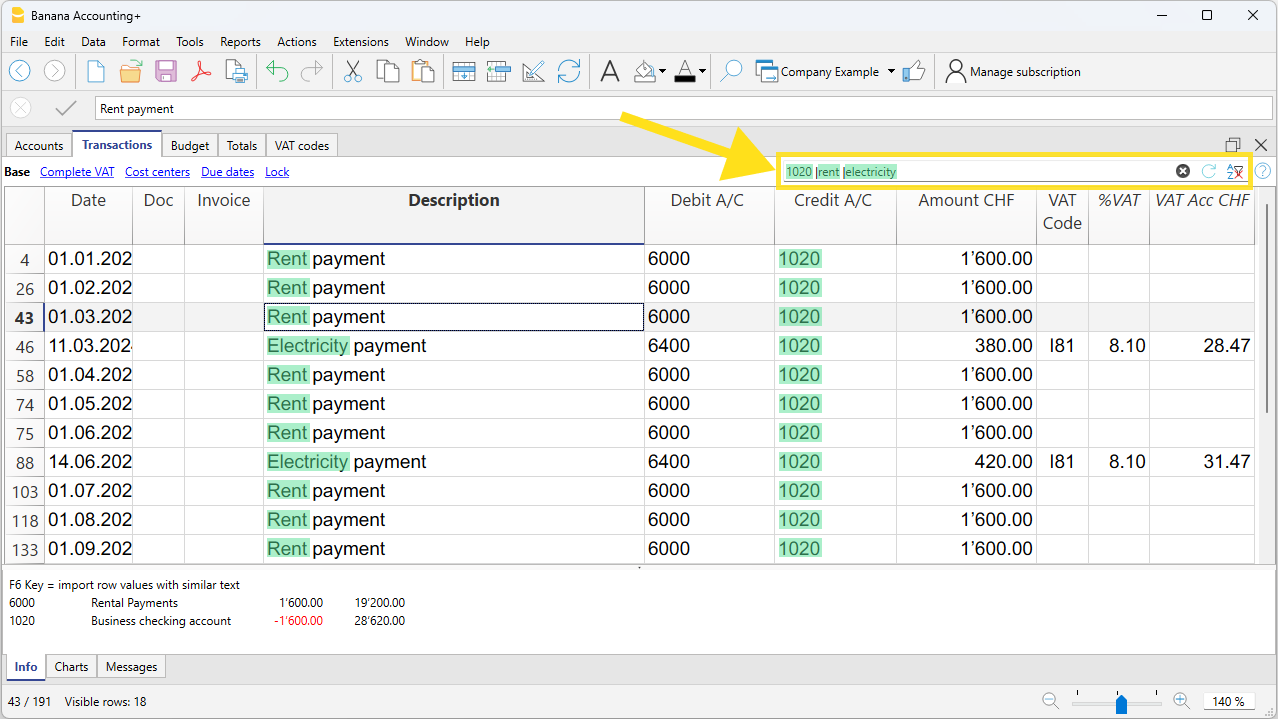

Find and fix errors in an instant

With the Temporary filter feature, you can immediately find any transaction by typing a text or an amount, saving a lot of time in searches and checks.

For example, by entering a supplier’s name, you can check if all invoices have the correct VAT code and directly edit the filtered rows.

Or, by entering a bank account number, all rows of related transactions will be displayed, just like an account card. You can edit and correct directly in the filtered rows.

Client's VAT management

Banana Accounting Plus handles VAT according to Swiss Federal Tax Administration regulations. The Swiss VAT Report is automatically generated thanks to the following extensions, included in the Advanced plan of Banana Accounting Plus:

The extensions are based on current rates and VAT codes linked to the respective boxes of the VAT report.

In Banana Accounting Plus, for accounting transactions, the VAT code entry depends on the two reporting methods provided by Swiss VAT regulations:

- Cash basis reporting (Received).

- Accrual basis reporting (Invoiced).

Professional financial statements and reports

Thanks to automated functions, you instantly get the Balance Sheet and Income Statement, automatically generated using the Report > Formatted balance sheet by groups command. You can generate, for example:

- Annual and periodic balance sheet and income statement

- Balance sheet and income statement with budget comparison

- Balance sheet and income statement with previous year or period comparison.

- Reports directly in the Accounts table, with column customization.

Forecasts and cash flow analysis

With Banana Accounting Plus, you can offer your clients a more complete and timely financial analysis service. The forecasting and cash flow management features allow you to create real-time liquidity projections, integrating budget data with actual data.

This way, you can monitor liquidity trends, identify potential issues in advance, and support your clients in strategic decision-making.