在此文中

VAT Report Extension for United Arab Emirates

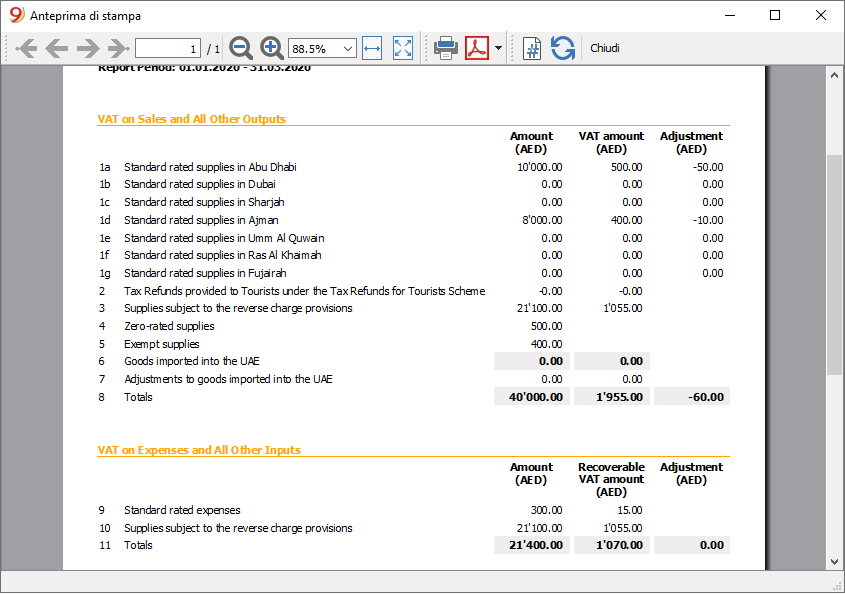

It prepares a report that is similar to the UAE online VAT return , so you can easily fill it.

New VAT reporting for small business in UAE

Businesses in the United Arab Emirates (UAE) will have to pay VAT on their sales.

A VAT tax is an indirect tax imposed on most of the goods and services commercialized by a business. After collecting the tax, businesses will transfer it to the government. In the UAE, the tax authority in charge is the Federal Tax Authority (FTA).

Every business will have to periodically calculate and report the VAT to the FTA by filling the official online form with all the necessary figures.

As you can see from the following image, the report is similar to the online VAT form. With all calculated amounts you only need to enter in the form.

Documentation for

The VAT Report for UAE require an accounting file that is correctly setup with accounts and VAT code.

See the following pages for more information:

- Documentation for UAE.

- Template Multi currency-for enterprise in UAE with VAT.

- VAT Table and VAT Codes for UAE

If you don't use the VAT table that is correctly setup, the report will not work as expected. - Transactions for VAT.

Example of transactions.

Open source collaboration

The solution has been developed with an open source concept:

- In 2018 a user of Banana Accounting in UAE has asked us if we could implement an automatic VAT reporting.

- He made available the accounting plan he was using.

- He gave us the link to the tax authority web site with all the information regarding the VAT process.

- Together with our specialist we have worked out the VAT table, with all the necessary VAT codes customized for UAE.

- Banana.ch developers has programmed a report for VAT reporting, that is similar to the filling form.

Updates

We do not have personal on UAE. If there are changes in the tax requirements or forms we kindly invite anyone to inform us.

For any questions or suggestions, please contact us at: contact form.