Partnerships (general partnerships and limited partnerships) | Double-entry multi-currency accounting | VAT

Partnerships (general partnerships and limited partnerships) | Double-entry multi-currency accounting | VATIdeal template for a partnership. It includes all the columns and features to manage foreign currency accounts and VAT in compliance with the 2024 regulations. Automatic calculations and exchange rate differences.

Create your file

- Open the template with the Banana Accounting Plus WebApp

- From the File > File Properties menu, set the period, your company's name and the base currency in any currency you prefer.

- From the File > Save As menu, save the file. It is helpful to include the company name and year in the file name. For example "Rossi-SA-20xx.ac2".

- In the Exchange Rates table, set up the foreign currencies always with reference to the base currency and the rates. Opening exchange rates are set only the first time you use Banana Accounting. When moving to a new year, these will be automatically carried forward based on the closing exchange rates entered on 31.12.

WARNING: if you close your browser without saving, you will lose all entered data. Always save the file on your computer.

To reopen the saved file, click File > Open.

For VAT management with the new rates, you can find detailed information on the web page VAT Management.

Some features require a subscription to the Advanced plan of Banana Accounting Plus, such as generating the preview or the XML file for the VAT Report, and using the new features for Rules, Filter, and Temporary Row Sorting. See all features of the Advanced plan.

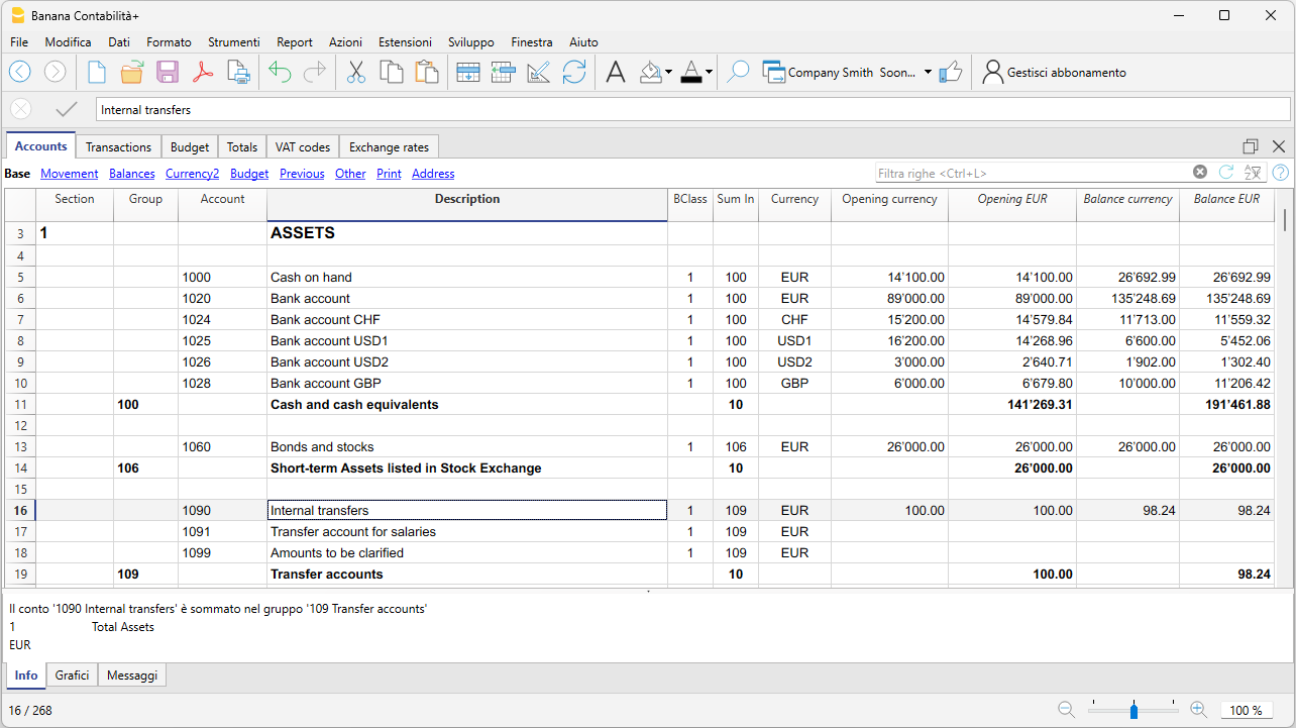

Accounts Table

In the Accounts table, customize the chart of accounts to your needs and add your customer and supplier accounts with all the necessary data, using the columns in the Address view.

The first time you use Banana Accounting, you need to enter the opening balances in the Opening column, which should match the closing balances from the previous year.

In the following year, when you move to the new accounting period, the program will automatically bring forward the closing balances from the previous year into the Opening column.

Project management can also be done using Segments and Cost Centers.

Transactions Table

In the Transactions table, daily entries are recorded. For quick data entry, refer to the web pages Text entry, editing and smart fill, and Recurring transactions.

You can make either simple transactions (one debit and one credit on the same row), or compound transactions (multiple debits and/or credits across several rows).

The Transactions table includes specific columns for multi-currency transactions.

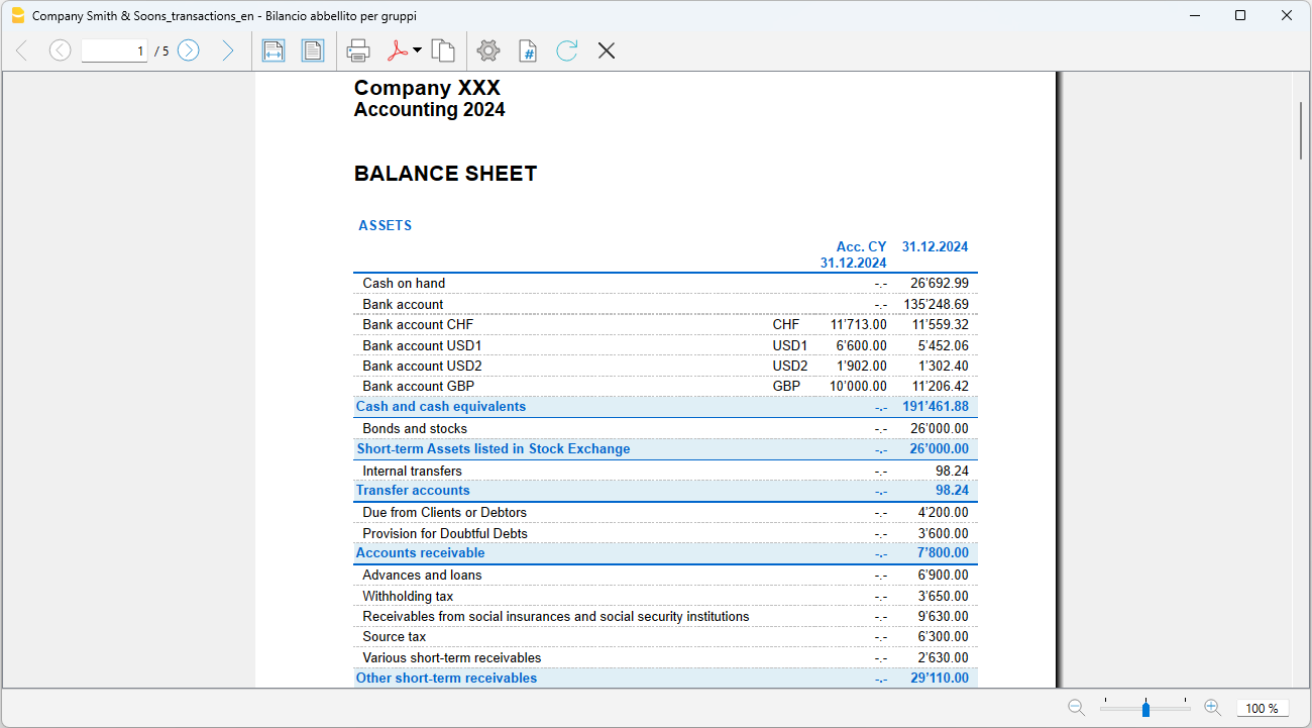

Balance Sheet

The Balance Sheet is generated from the Reports > Enhanced Balance Sheet by Groups menu and can be customized in its presentation. Each layout can be saved through Customizations, allowing you to reuse it as needed (e.g., quarterly, semi-annual balance sheet, audit, etc.).

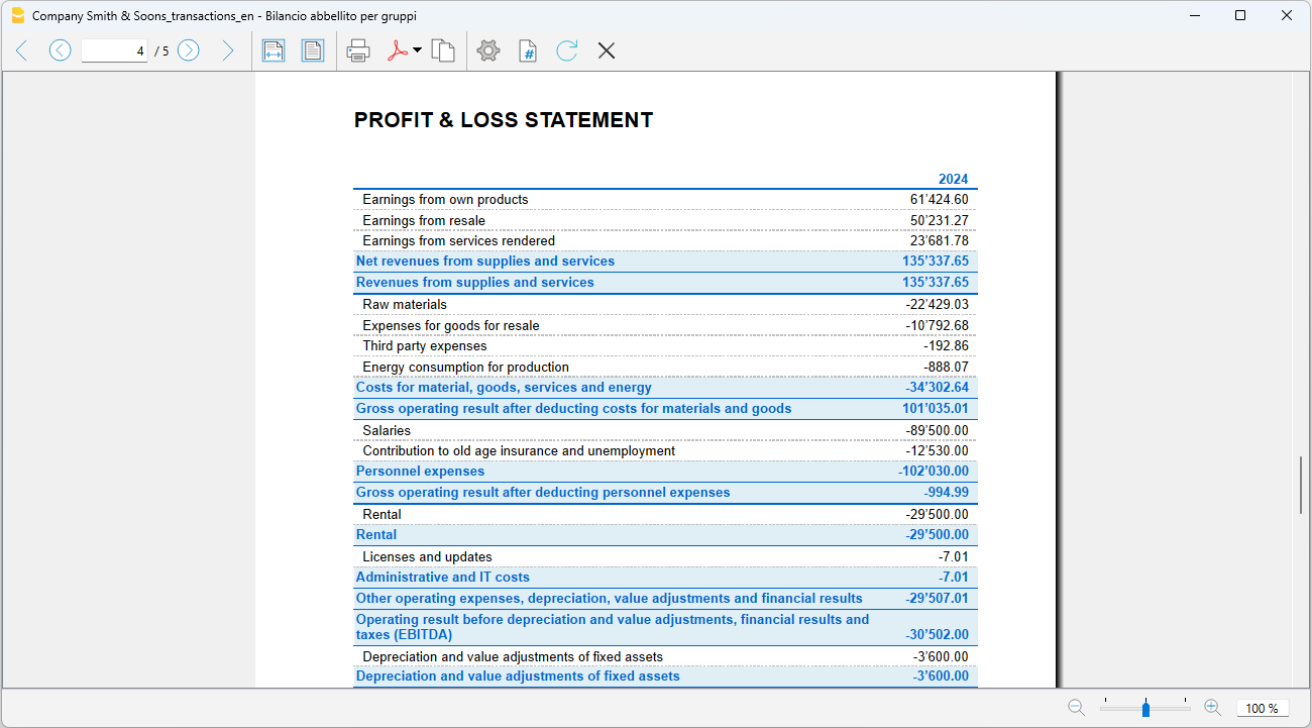

Profit and Loss Statement

The Profit and Loss Statement is generated from the Reports > Enhanced Balance Sheet by Groups menu and can be customized in its presentation. Each layout can be saved through Customizations, allowing you to reuse it as needed (e.g., quarterly, semi-annual balance sheet, audit, etc.).

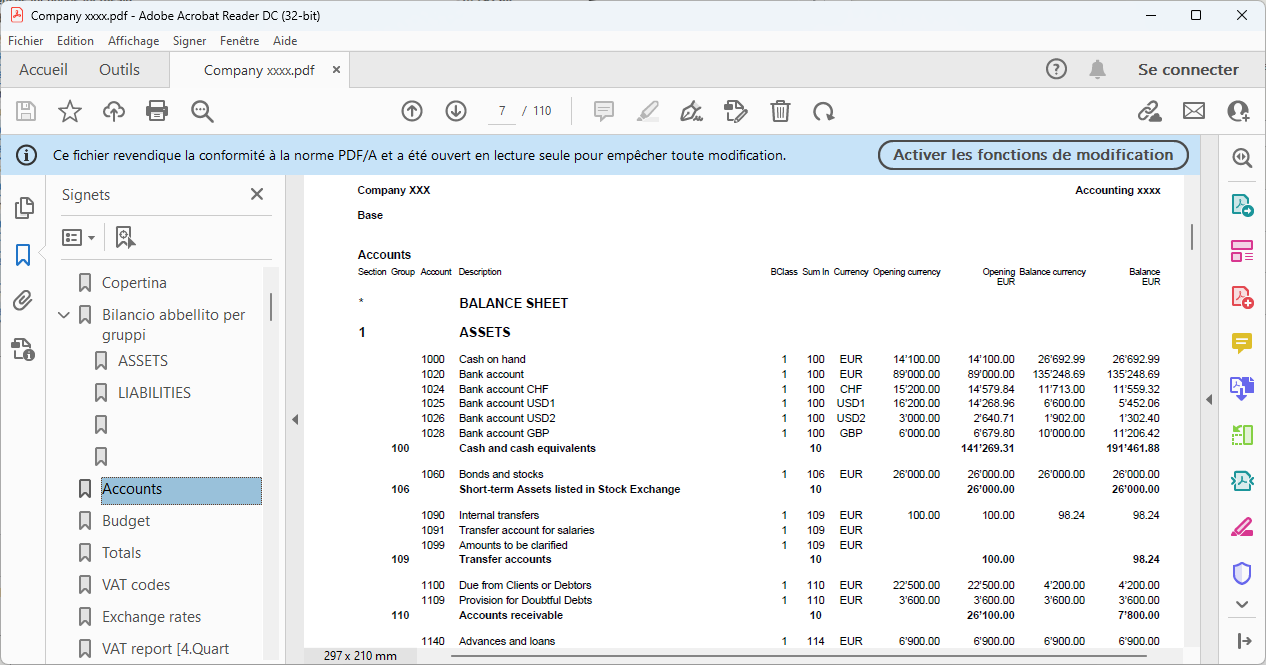

PDF Archive

At the end of the year, or whenever needed, you can archive all your accounting data by creating a PDF file from the File > Create PDF dossier menu.

The PDF dossier can be sent via email to the auditor and reused in case of tax inspections.

Additional Resources

In our Documentation you will find all insights and topics related to multi-currency accounting, in particular: