VAT Management

Pages with more in-depth information:

- VAT management in Switzerland

There are several pages with specific information for Switzerland, for example on how to set up the VAT codes table, enter the VAT transactions and prepare the declaration. - VAT management in Italy - this page is in Italian

- Import VAT codes

Theory

VAT (Value-added Tax) is a tax that weighs on the final consumer. Every VAT subject must calculate and periodically deposit the tax to the Revenues Authority.

Every country has its own VAT rates that are established in different percentages depending on the type of merchandise or service. Certain merchandise and services are exempt or excluded.

The percentages vary according to the financial necessity of the country; therefore, there can be changes over the years.

VAT rate

In this document, to make calculations easier, we will use the following rates:

- 10 % normal rate

- 5% reduced rate

- 0% excluded operations or exempt operations

VAT calculation

Net Price x VAT Percentage / 100 = VAT Amount

Example:

Net price 300

Tax rate 10%

VAT amount = 300 x 10 / 100 = 30

Gross price calculation

Net price + VAT Amount = Gross Price

Example:

300 + 30 = 330

Sometimes the gross amount is known and it is necessary to find the net and VAT amounts.

Net price calculation

Gross Price / (100 + VAT rate) x 100 = Net Price

Example:

330 / (100 + 10) x 100 = 300

The net price represents the cost (purchase) or the revenue (sale) of the company

VAT amount calculation

Gross Price - Net Price = VAT Amount

Example:

330 - 300 = 30

or

330 - [330 / (100 + 10) x 100] = 30

The VAT amount represents the debit (sales) or the credit (purchases) towards the Revenues Authority.

VAT rate calculation

VAT Amount / Net Amount x 100 = VAT Rate

Example:

30 / 300 x 100 = 10%

or

[330 - 330 / (100 + 10) x 100]/100 = 10%

Another example:

20 / 400 x 100 = 5%

This way of calculating is used when the rate is not known.

VAT Codes Table

The VAT Code table setup allows the definition of all the parameters that are necessary to manage the transactions with VAT. The setup refers to:

- VAT due or recoverable

- Transaction amount recorded as net, gross, or VAT amount at 100% (Customs VAT)

- Freely definable applicable VAT rates

- Freely definable account in which VAT must be recorded

- Special rounding off for each code

- Definable grouping and totaling method

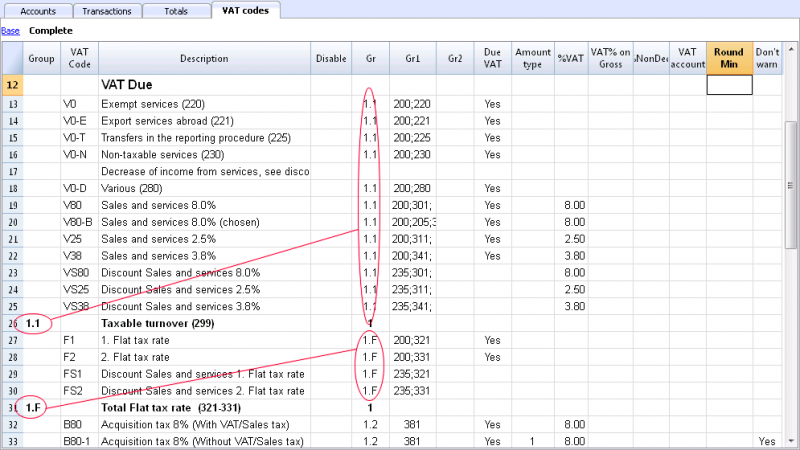

The VAT Codes table has a Base view and a Complete view (see top of the table hereunder). The difference between the two is the fact that the Complete view presents several columns that are not available in the Base view. These columns serve to accommodate some specific options.

How to calculate

The parameters indicated in the VAT Codes table are being used to calculate the VAT of the individual transactions. The parameters established in the VAT Codes table cannot be changed in the transactions. This modality guarantees that the VAT calculations are correct and uniform.

Please note: if the values of a VAT Code, which has already been used in the transactions, are being modified, the changes are not active immediately; in this case it is necessary to activate the Recheck accounting command (Account1 menu -> Recheck accounting). When the VAT Codes table is being modified, the program invites the user, through a message in the Info window, to execute a complete recalculation as a precaution.

The following table refers to the codes being used according to the Swiss legislation:

Detailed description of the columns

In the following columns, insert the following data:

- Group: a code or number that identifies the group to which the code belongs. In the example we have inserted 1 for the sales, 2 for the purchases, T for the total.

- VAT Code: the code to identify and carry forward the VAT code in the transactions.

- Description: a text for the description of the VAT Code or the group.

- Disable:

- Entering 1, the VAT code isn't displayed in the autcomplete list (Transactions table), but can still be used;

- Entering 2, the VAT code is disabled and cannot be used. - Gr: code of the "Group" in which the row has to be added.

- Gr1: In the image of the table above, the grouping codes representing the numbers for the Swiss VAT declaration are being shown.

- Gr2: code for additional groupings.

- Due VAT:

If the word Yes is being inserted, this means that the VAT is at debit (due to the State)

If the cell is empty, this means that the VAT is at credit (recoverable) - Amount type: indicates how the software considers the transaction amount:

0 (or empty cell) with VAT/sales tax (the transaction amount is considered VAT included)

1 = without VAT/Sales tax (the transaction amount is considered VAT excluded)

2 = VAT amount (the transaction amount is considered the VAT amount) - % VAT: VAT code percentage

- Non ded.: if, for a VAT code, it is not possible to deduct the full 100%, enter the non deductible percentage here (example 100%)

- VAT% on gross: is usually being left empty. In special cases, the word "Yes" has to be inserted only if the VAT percentage has to be applied on the gross amount (VAT included) and not on the taxable amount.

- VAT account: the account on which the calculated VAT is being automatically.

In the File and Accounting properties (File menu), a general account, that will be used as the VAT account, can be defined.

It is also possible to set up a specific account for every individual VAT code. - Round Min: minimum value for rounding, to be used only in particular cases. By preference, the rounding indicated in the basic data of the accounting (f.i. minimum rounding value 0.05) is being used.

- Don't warn: there are particular transactions that the software could interpret as mistaken, but which, in reality, are correct. In order to avoid for the software to signal error messages, insert the word Yes for the code that is concerned.

When the transactions with VAT are inserted, by applying the VAT Code in the VAT Code column, the software calculates automatically all the amounts related to the VAT and transfers them in the VAT account.

Rechecking of the accounting file

When rechecking the accounting file, if transactions are not locked, the program will reload the VAT parameters assigned to each code. If a VAT code setting has been changed, the change will be taken into account in the corresponding transactions columns (that cannot be edited by the user).

For this reason, when editing the VAT table, the program suggests to operate a full accounting recheck.

Adding a new percentage

When a new percentage is added, a new row has to be added; in the new row, insert the data of the new VAT code with the new percentage, while paying attention to insert the correct grouping. Don't change a code that has already been used in the transactions.

Groupings

By creating groups with multiple totaling levels, the user can obtain the totals that are necessary for the VAT declaration.

In the VAT report, by activating the option Use own grouping scheme, the software calculates the totals exactly as indicated in the sequence of the indicated groupings in the VAT Codes table.

The groupings are being used to obtain totals for groups of transactions, for example, the totals for all exportations or importations.

Related document: Import VAT codes

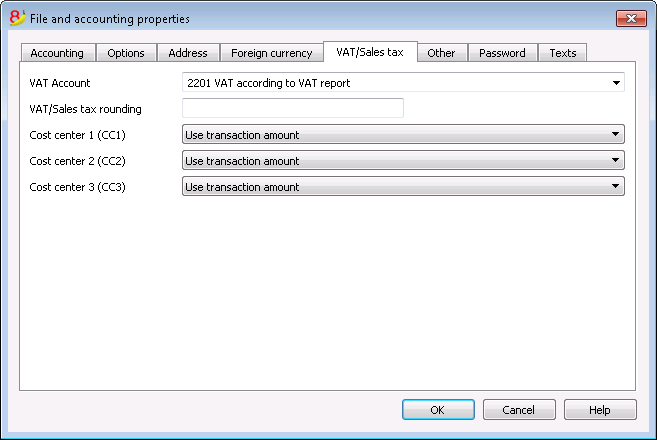

File properties (VAT/Sales tax tab)

This tab only appears if an accounting with VAT/Sales tax management is chosen.

VAT Account

The Automatic VAT account, that is present in the chart of accounts, is defined here as default. In this case, the VAT account does not need to be inserted in the VAT Codes Table.

VAT/Sales tax rounding

This is where the user inserts how the VAT/Sales tax amounts should be rounded; if, for example, the user inputs 0.05, the VAT/Sales tax amounts will round to multiples of 0.05.

Cost Centers 1 (CC1), 2 (CC2), 3 (CC3)

For each type of Cost Center, the user can select which amount to use for the transaction in the cost center.

- Use transaction amount

- Use amount inclusive VAT/Sales tax

(When cost centers are being used for Client/Suppliers accounts) - Use amount without VAT/Sales tax

(When cost centers are being used for Revenue and Expenses)

Note: If one of these parameters is modified, the accounting must be recalculated.

Related documents: VAT Management, Cost and Profit Centers

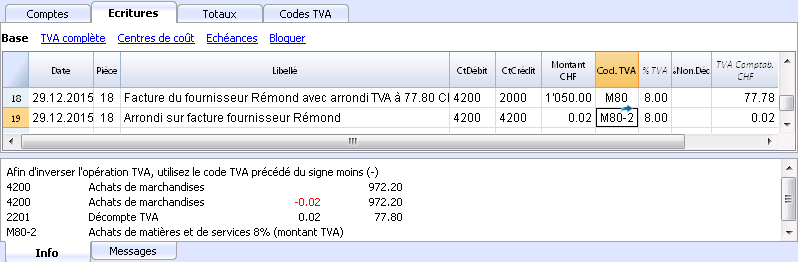

Arrondi IVA

Le système TVA suisse prévoit pour le calcul de la TVA que celle-ci se fait calculé au centime, sans arrondi.

Pour ceux qui ont la nécessité d'avoir un arrondi des montants TVA pour les centimes, la procédure suivante a été prévue:

- Dans le tableau Écritures, insérer les Écritures comme d'habitude, en appliquant le code TVA approprié

- Dans la ligne suivante, enregistrer le compte des charges ou des produits, utilisé dans la ligne précédente, en débit et en crédit

- Dans la colonne montant, enregister les centimes de l'arrondi

- Dans la colonne Code TVA, insérer un code TVA avec type montant 2 (montant TVA au 100%) par exemple M80-2

- Quand les centimes doivent être déduits, insérer le code précédé par le signe moins "-M80-2".

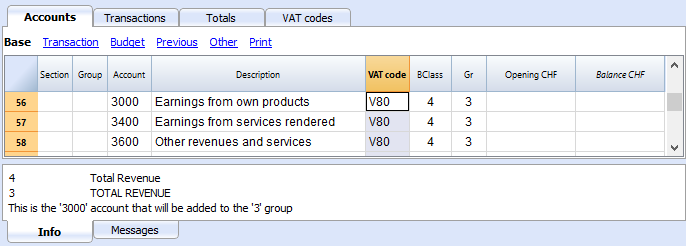

Associate VAT code to the account

In an accounting with VAT, in the Accounts table, it is possible to associate a VAT code to the income/expense accounts, so that, when the sales and purchases are being recorded, the program automatically inserts the VAT code and completes the columns with the VAT data while entering the account number.

In order to associate the codes:

- Click on the Other view. In this view, the VAT code column is visible by default.

In case you wish to display the VAT code column in the Base view, click on the Data menu, Columns setup command (see Related document at bottom of this page). - Insert the VAT codes for the income/expenses in the VAT code column.

.

.

Related document: Columns setup

Configurer les comptes TVA

Quels sont les comptes TVA?

Les comptes TVA sont des fiches comptables d'où on enregistre les montants TVA, calculés selon les configurations des codes TVA.

Quand on utilise un code TVA, le programme calcule automatiquement, selon les valeurs de l'écriture:

- le montant imposable et le montant TVA

- le montant qui doit être enregistré sur le compte Débit

- le montant qui doit être enregistré sur le compte Crédit

- le montant qui doit être enregistré sur le compte TVA

- comment doit être enregistré le montant TVA (en Débit ou en Crédit)

En déplaçant le curseur sur l'écriture, en bas de la fenêtre d'information, le programme affiche les montants enregistrés sur les différents comptes.

Configurer les comptes TVA

Compte TVA général (automatique)

Si configuré dans les Propriétés fichier (menu Fichier) comme prédéfini, ce compte TVA est utilisé à chaque fois qu'il y a une écriture pour un code TVA qui n'a pas de compte TVA défini.

Compte TVA pour le code TVA

Pour chaque code TVA, dans le tableau Codes TVA, colonne Compte TVA, on indique le compte qui doit être utilisé pour les écritures qui utilisent ce code TVA.

Utiliser un seul compte TVA ou plusieurs comptes?

Dans la comptabilité, il faut séparer la partie Actifs des Passifs. Toutefois, si la TVA récupérable est compensée par le montant de la TVA due, seulement le montant TVA effectivement dû est affiché dans le Bilan.

Du point de vue comptable réel, dans la plupart des cas il n’est pas indispensable d'avoir plusieurs comptes TVA; en fait il est préférable d’avoir un seul compte TVA.

Pour l’application de la déclaration, cependant, il est utile d’avoir différents types d’opérations de TVA distinctes. Dans les programmes qui n’utilisent pas les codes TVA, il faut séparer chaque opération sur des comptes séparés. Avec Banana, grâce aux codes TVA et au Résumé TVA, il est possible d'obtenir des détails beaucoup plus importants :

- mouvements et totaux (TVA imposable, TVA, TVA comptabilisée)

- mouvements et totaux par pourcentage TVA

- mouvements et totaux par compte TVA

- mouvements et totaux regroupés selon TVA due et selon TVA récupérable.

Pour des contrôles d'opérations TVA, il n'est pas nécessaire d'utiliser plusieurs comptes TVA séparés.

Banana Comptabilité laisse donc le choix d’utiliser le compte général ou plusieurs comptes TVA.

Avantages d’utiliser un seul compte TVA

- Bilan et compte de résultat beaucoup plus facile à lire (il n’ya pas beaucoup de comptes TVA).

- Possibilité d'avoir des comptes (par exemples, des produits) d'où enregistrer des opérations avec plusieurs taux TVA.

- Connaître immédiatement la TVA due, sans avoir à additionner les différents comptes.

-

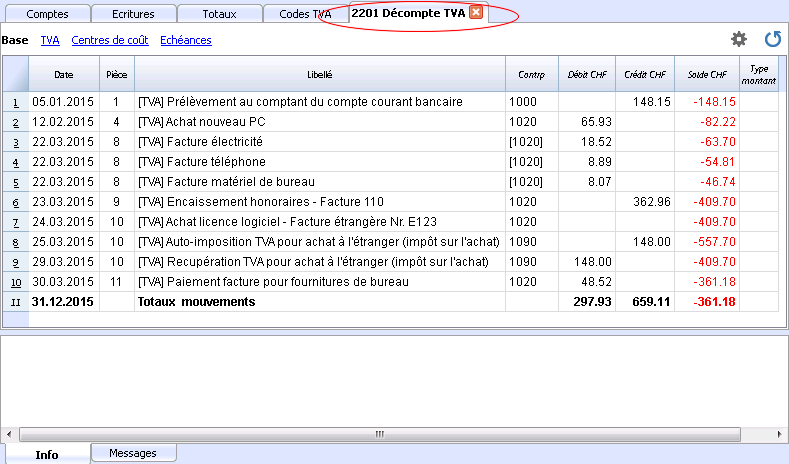

Vue immédiate de toutes les transactions TVALa fiche Décompte TVA montre toutes les opérations TVA en Débit et en Crédit.

Avantages de l’utilisation de plusieurs comptes de TVA

Comme dit, si l'on utilise des codes TVA, l'enregistrement sur un compte TVA spécifique est une répétition des informations qui sont déjà disponibles grâce aux codes TVA et leur Résumé TVA detaillé.

Dans les pays tels que l’Allemagne, il est habituel d'avoir un compte TVA différent pour chaque type d'opération, afin que la déclaration TVA puisse être faite à l’aide des soldes des différents fiches de compte TVA.

Dans ces cas, pour assurer la compatibilité avec ce système, on peut considérer qu'il est utile d’avoir des comptes TVA différents pour chaque code TVA.

Clôture comptes TVA à la fin d'une période

À la fin de la période de calcul pour la TVA, il est utile de clôturer les comptes TVA de Débit et de Crédit et de déplacer le solde sur un compte unique:

- On voit, de façon comptable, quel est exactement le solde dû

- Le compte "2201, Décompte TVA" recommence avec un solde zéro pour chaque période. Il est donc plus facile d'avoir le contrôle sur d'éventuelles différences et erreurs.

Pour la clôture périodique du compte "2201, Décompte TVA", consulter la page Clôture périodique et paiement TVA.

Transactions

Accounting Charts templates included in Banana Accounting are already set with the VAT accounts, the VAT according to VAT report account (automatic), both in the chart of accounts and in the File and accounting properties of the File menu - VAT tab (in this case you don't need to enter any VAT account into the VAT codes table).

In case you are not using the Charts of accounts already available in Banana, make sure that the necessary VAT accounts are present in your own Chart of accounts. Our advice is to use a "VAT according to VAT report" account and to enter it into the File and Accounting properties, VAT/Sales tax Tab.

In the VAT codes table, there are codes both for the sales and the purchases. When entering the transactions, use the appropriate VAT code.

The software automatically splits the VAT amounts and records them in the "VAT according to VAT report" account or in the VAT account that has been indicated by the user in the File and Accounting properties.

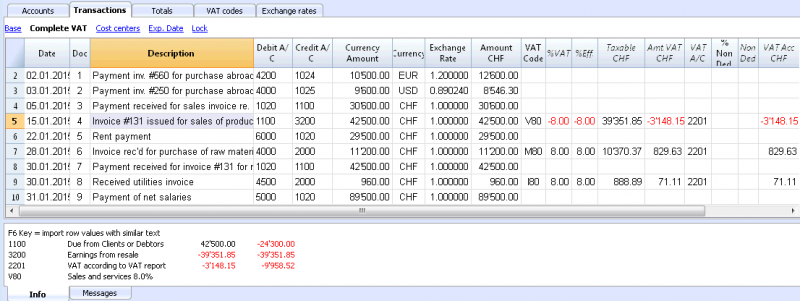

VAT columns in the Transactions table (Complete VAT view)

You can find the full explanation of the main Transactions table columns in the Transactions page.

In the Double-entry accounting files with VAT or in those of the Income & Expense accounting with VAT, you will find the following VAT columns:

- VAT Code: for each transaction with VAT you need to enter one of the VAT codes from the VAT codes table

- VAT %: the program automatically enters the VAT percentage associated with the VAT code you entered

- VATExtraInfo: A code related to extra info about the VAT, to be used only in very exceptional cases.

It is possible to enter a symbol to identify specific VAT cases. The program suggests options, corresponding to the VAT Codes that start with a colon ":". - %Eff.: the program automatically enters the VAT percentage referred to the net amount. This percentage is different from the normal percentage when this one is referred to the gross amount.

- Taxable: once you enter the VAT code, the software automatically indicates the taxable amount (without VAT)

- VAT amount: the program automatically indicates the VAT amount

- VAT A/C: the account where the VAT is registered is automatically indicated (for Switzerland normally is the 2201 VAT report account); this account was previously entered in the File Properties, VAT tab (from the File menu).

- Amount type: this is a code that indicates how the software considers the transaction amount:

- 0 (or empty cell) with VAT/sales tax, the transaction amount is VAT included

- 1 = without VAT/Sales tax, the transaction amount is VAT excluded

- 2 = VAT amount, the transaction amount is considered the VAT amount at 100%

- Amount type not editable: Default mode.

- The column is protected

- The program uses the associated value of the VAT Codes table

- When you edit the value in the VAT Codes table and you recalculate the accounting, the program uses the new value associated with this VAT Code.

- Amount type editable: this option can be activated with the Add new functionalities command. The activation of the option cannot be undone.

- When you edit the VAT Code, the program uses the Amount type associated with this code.

- The value can be edited manually

- When the accounting is being recalculated, the value indicated in the Transactions table is being maintained.

- Non. Ded. %: this indicates the non deductible %.

- When you enter or change the VAT Code, the program uses the Non. Ded. % associated to this VAT Code in the VAT Codes table.

- You can manually edit the value

- VAT Acc.: this is the VAT amount registered in the VAT account.

It is calculated by the program according to the Transaction amount, the Amount type and the non deductable percentage. - VAT number: this is the code or VAT number of your client/supplier.

When you enter a transaction with VAT, it is possible to enter the VAT number of your counterparty. If in the Accounts table, in your clients/suppliers register, you also enter their VAT number, this is automatically loaded in the Transactions table, in the VAT number column.

Transactions with VAT

Before entering transactions with VAT, we advise you to visit the Transactions page.

The most common way of entering a VAT transactions is to enter the gross amount (amount including VAT), then apply to it the appropriate VAT code, choosing it among the ones included in the VAT codes table and according to your transaction type (Purchase, Sale, Discount, ...).

How to correct VAT transactions

If you see the mistake right away, you can just edit the transaction row; this is only possible if you haven't sent your VAT report yet and if there is no transactions lock.

If however your accounting file is locked or if you have already sent your VAT report, you cannot simply delete the wrong transaction, but you need to operate some cancellation-transaction and then re-enter the correct transaction.

In order to rectify VAT operation you need to:

- make a new transaction by inverting the Debit and Credit accounts used in the wrong transaction

- enter the same amount

- enter the same VAT code but preceeded by the minus sign (ex.: -V80)

- enter a new transaction with the correct accounts, amount and VAT code

Depending on the entity of the mistake, you should consider informing your local VAT office; usually they ask you to download a specific form for correcting mistakes in the previous VAT period.

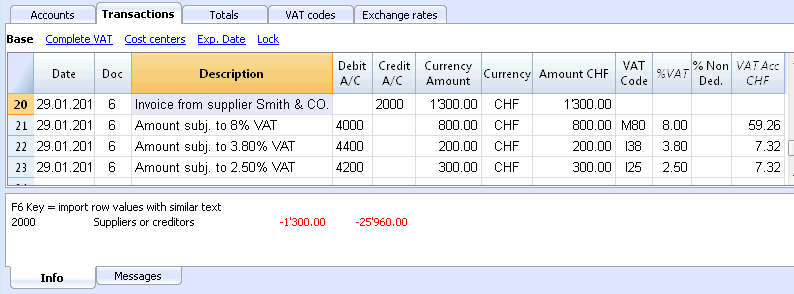

Transactions with different VAT codes

When the total amount of an invoice is composed by several amounts with different VAT percentages, you need to register as follows:

- each amount with a specific VAT percentage needs to be entered on a different row with its own VAT code (enter the gross amount)

- once you finish the multiple registration, check that the sum of the differents amount and the VAT amounts correspond to the invoice total.

Here is an example:

VAT EXEMPTION

If in your invoice you also have some items VAT exempt, you need to operate as above, choosing the VAT exempt code from the VAT Codes table.

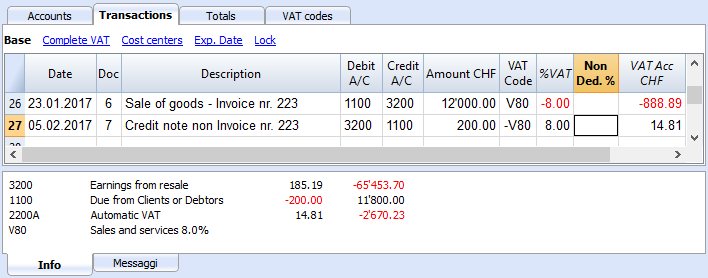

Credit note

In case an operation, that has been entered at an earlier date, needs to be cancelled, the same VAT code that has been used for the initial operation needs to be entered with the minus sign (-). In this way the VAT is being rectified.

Instead of using the minus sign prior to the VAT code, it is also possible to use the specific VAT codes for discounts that have been configured in the VAT Codes table.

Example of a credit note on a sale

When a client finds a defect on a sold product, usually a credit note on his behalf is being issued. The credit note implies a decrease of the income and as a result a recovery of the VAT (Sales tax).

For example, we enter a sale amount of 12'000 including a 8% VAT. We then issue on the client's behalf a credit note of CHF 200.- for a product defect.

For a recovery of the VAT on the amount of the credit note, the VAT code of the sales has to be entered with a minus (-) sign.

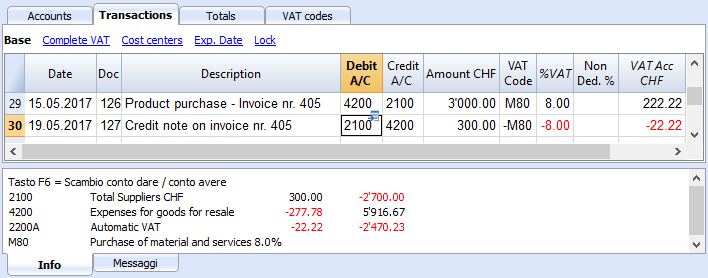

Example of a credit note on a purchase

When we receive a credit note from a supplier, the same process as explained above applies: we use the same account codes but reverted, and we use the same VAT code with the minus (-) sign.

For example, we enter a purchase amount of 3'000 (invoice payment) including a 8% VAT. We then receive a credit note of CHF 300.- from our supplier for a product defect.

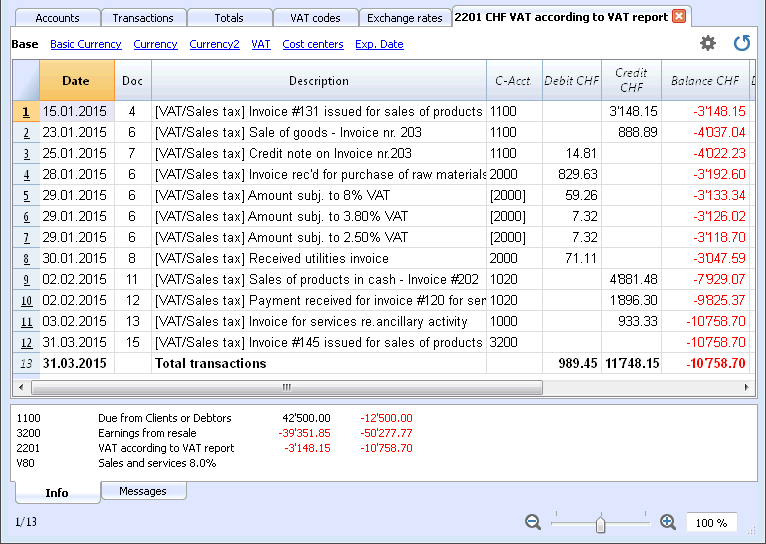

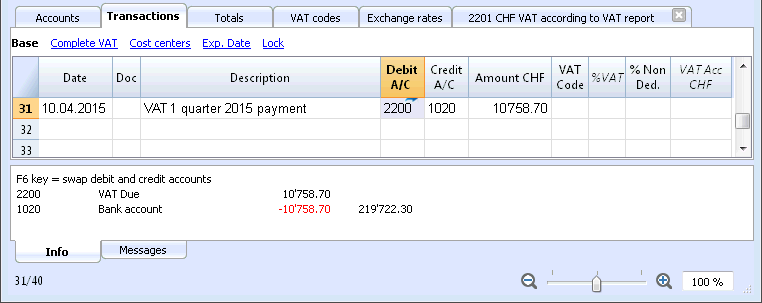

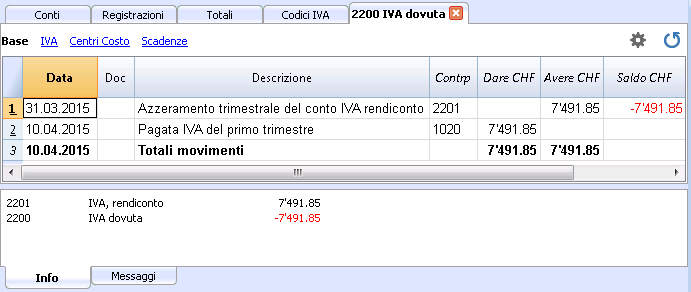

Period closing and VAT payment

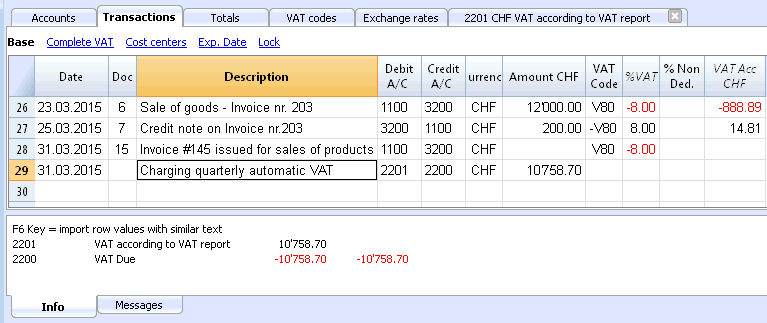

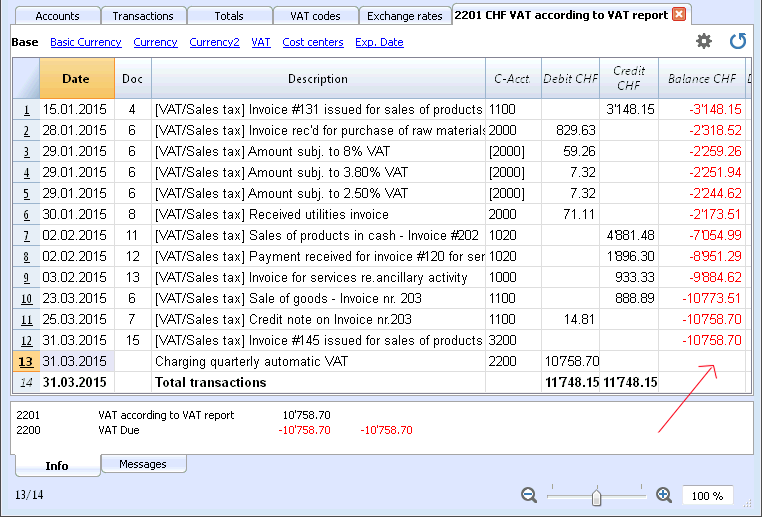

VAT account reset at the end of the quarter report

At the end of the period, the VAT account balance will be charged to the Due VAT account (or to the Treasury VAT account).

VAT account card before charging the period balance to the Due VAT account

Transaction for charging the quarter balance to the Due VAT account

VAT account card after charging the period balance to the Due VAT account

VAT payment

The Due VAT account (or the Treasury VAT account) will have a zero balance when you pay the due VAT.

With this system you can control your balance each quarter and in case of mistakes you can find in which period the balance does not correspond any more.

Due VAT account card after quarter payment

Note: the VAT payment process we just explained refers to the Swiss effective VAT payment method and the Swiss flat rate payment method with VAT separation.

If you use the Swiss flat rate payment methos without VAT separation, you can find specific information on the VAT payment and accounting assestment page (available only in Italian, German or French).

How to register a credit note (Switzerland)

If at the end of a period, when calculating the VAT report, the previous VAT is bigger than the due VAT, your VAT report has a Debit balance.

In order to charge the VAT report account you need to enter a transaction as follows:

- put in Debit A/C the Due VAT account

- put in Credit A/C the VAT report account

Usually in Switzerland the VAT credit is reimbursed, without having to move the credit to the following period.

When your VAT is reimbursed you need to enter a transaction as follows:

- put in Debit A/C your equity account

- put in Credit A/C your Due VAT account (where the balance should go to zero)

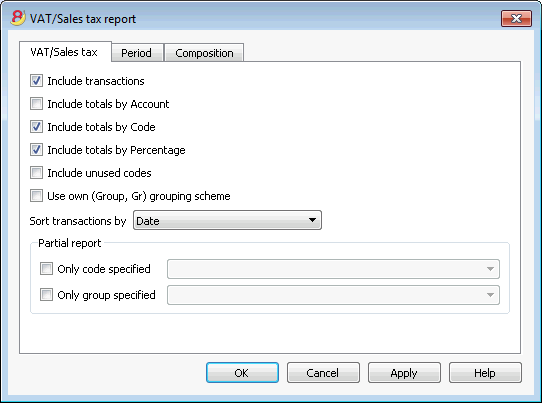

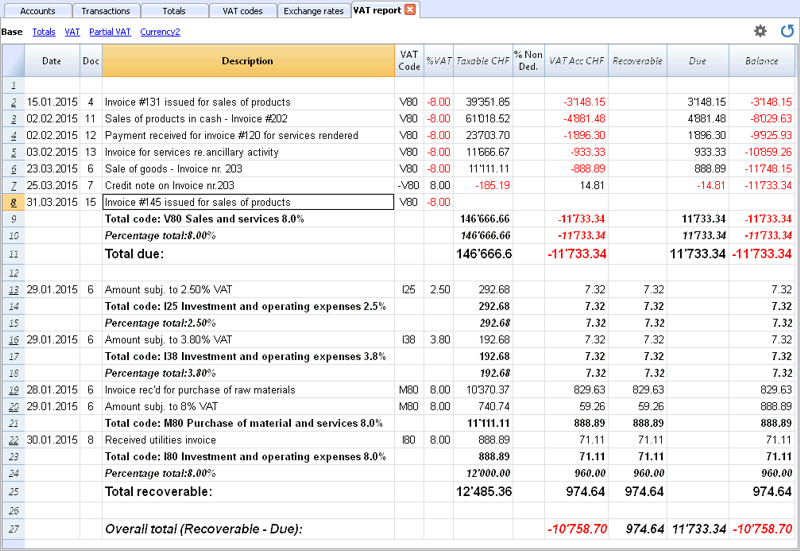

VAT Report

The VAT Report elaborates and displays the VAT calculation according to the selected period and parameters.

Procedure:

- Select, from the Account1 menu, the VAT report command

When activated, the following options allow the user to include the following data in the VAT report:

All the transactions with VAT/Sales tax are included.

Include totals by Account

All totals of operations with VAT/Sales tax, grouped per individual account, are included.

All totals of operations with VAT/Sales tax, grouped per individual VAT code, are included.

Include totals by Percentage

All totals of operations with VAT/Sales tax, grouped per individual percentage, are included.

Include unused codes

Also the unused codes of the VAT Codes table will be listed.

Use own (Group, Gr) grouping scheme

The operations with VAT/Sales tax are grouped according to the groupings of VAT Codes table.

Sort transactions by

By activating this cell, the transactions are sorted on the basis of a preselected option (Date, Doc., Description, etc….).

- only code specified (by selecting from the list)

- only group specified (by selecting from the list).

Other sections

The information relating to the other sections are available on the following internet pages:

VAT Report / transactions with totals by code

The overall total in the last row of the VAT report has to correspond with the amount for the end of period of the Automatic VAT account, Balance column, on the condition that both of them refer to the same period.

The data of the VAT report can also be transferred to and elaborated by other programs (f.i. Excel, XSLT) and be presented in formats that are similar to the forms of the tax authority

For Switzerland, one can automatically obtain a document similar to the form that has to be sent to the VAT office. This form shows the amount to enter for each number. Please consult (in German, French, or Italian) Swiss VAT Report.