Transactions with VAT

In Banana Accounting, in the Charts of Accounts prepared for Switzerland, the VAT accounts and the VAT rates currently in force are already set. In particular, the 2201 "VAT according to VAT report" account (VAT account with automatic splitting) is set both in the Chart of accounts and in the File properties (basic data) → VAT section. In this case no VAT account needs to be inserted in the VAT Codes Table.

In case you are not using the Charts of accounts already available in Banana, make sure that the necessary VAT accounts are present in your own Chart of accounts. Our advice is to use the 2201 "VAT according to VAT report" account (VAT account with automatic splitting) and to enter it into the File properties (basic data) → VAT section.

In the VAT codes table, there are codes for the sales, the purchases and for services rendered. When entering the transactions, use the appropriate VAT code.

The software automatically splits the VAT amounts and records them in the "VAT according to VAT report" account or in the VAT account that has been indicated by the user in the File and Accounting properties.

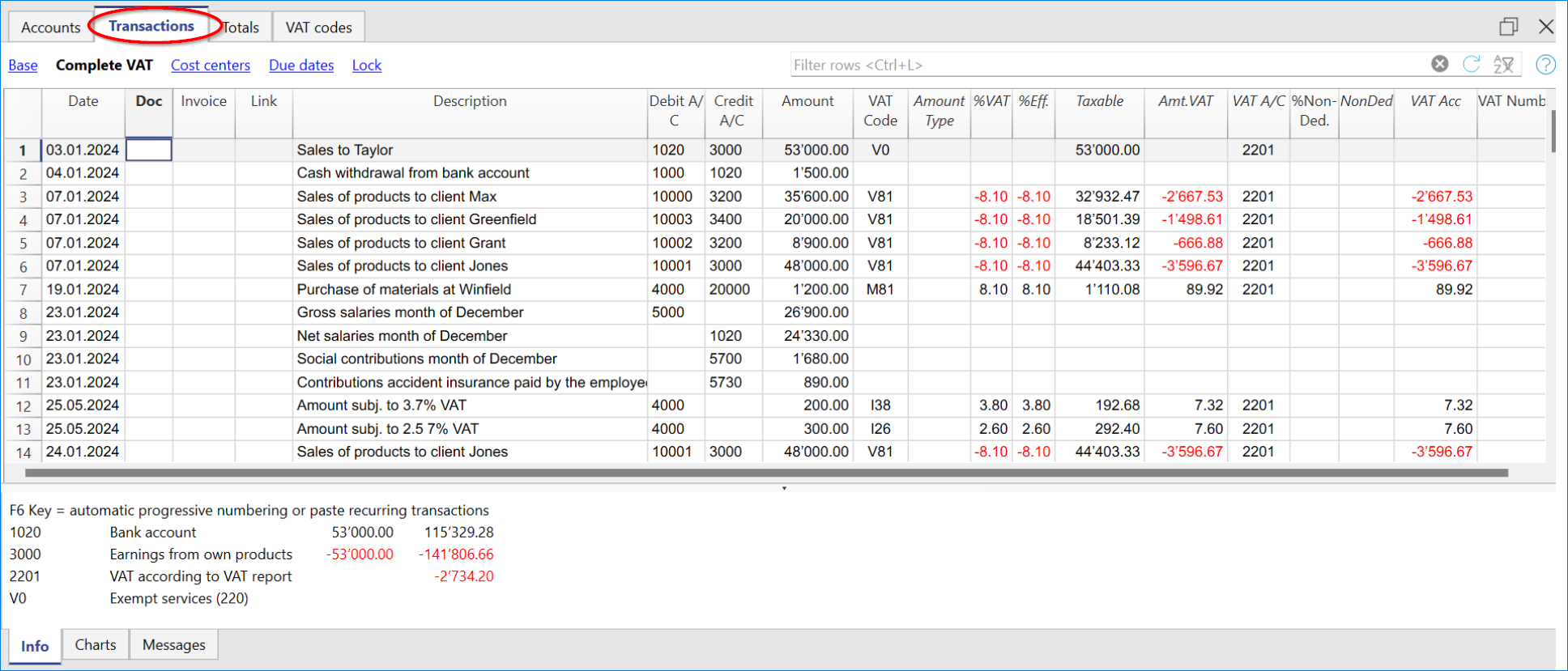

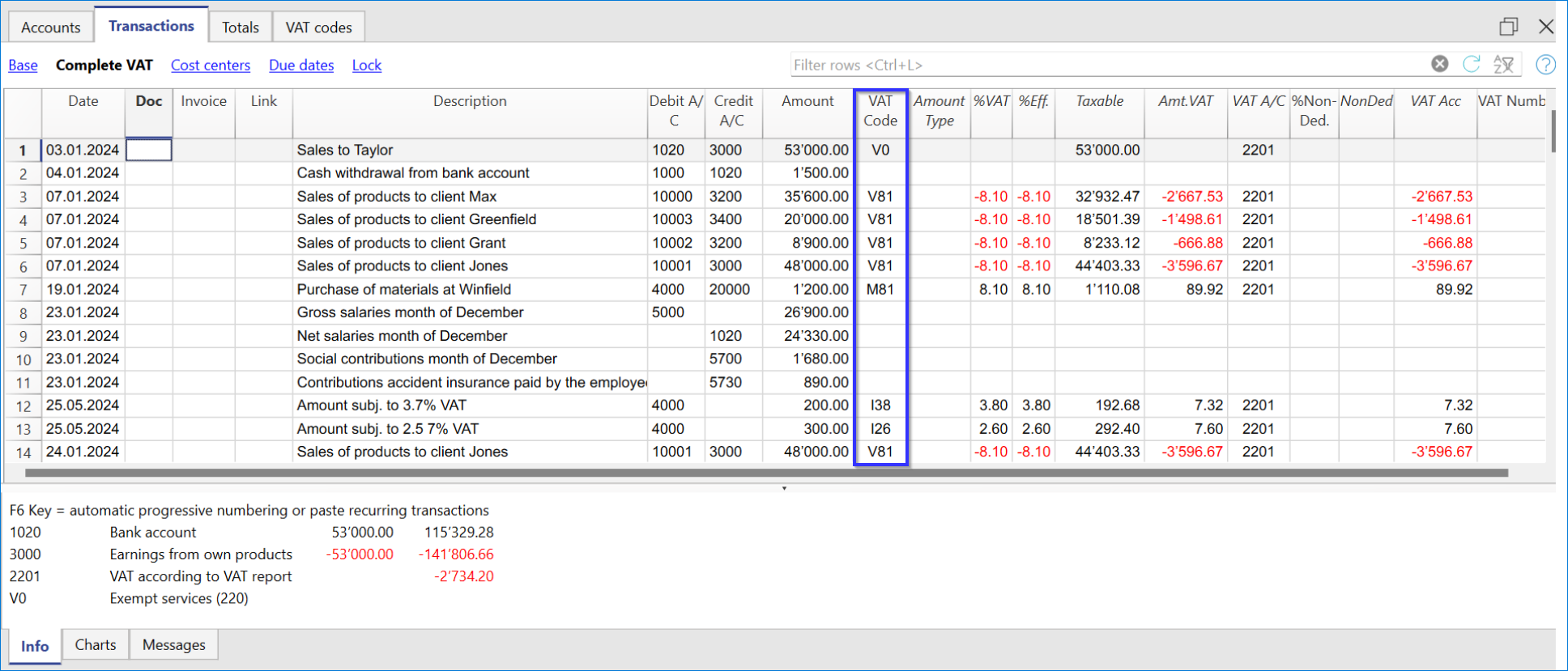

VAT columns in the Transactions table (Complete VAT view)

You can find the full explanation of the main Transactions table columns in the Columns and Views page.

In the Double-entry accounting with VAT or in the Income & Expense accounting with VAT, you will find the following VAT columns:

- VAT Code: for each transaction with VAT you need to enter one of the VAT codes from the VAT codes table. In Reverse Charge operations, two VAT codes can be used, separated by the symbol ":".

- VAT %: the program automatically enters the VAT percentage associated with the VAT code you entered. If the amount is preceded by a "+/-" sign, it is a Reverse Charge operation.

- VATExtraInfo: A code related to extra info about the VAT, to be used only in very exceptional cases.

It is possible to enter a symbol to identify specific VAT cases. The program suggests options, corresponding to the VAT Codes that start with a colon ":". - %Eff.: the program automatically enters the VAT percentage referred to the net amount (taxable amount). It is different from the percentage applied when the latter is calculated on the gross amount (balance rate).

- Taxable: once you enter the VAT code, the software automatically indicates the taxable amount (without VAT).

- VAT amount: the program automatically indicates the VAT amount.

- VAT A/C: the account where the VAT is registered is automatically indicated (for Switzerland, this is normally the 2201 "VAT according to VAT report" account) previously entered in the File Properties (basic data), VAT tab (from the File menu).

- Amount type: this is a code that indicates how the software considers the transaction amount:

- 0 (or empty cell) with VAT/sales tax, the transaction amount is VAT included.

- 1 = without VAT/Sales tax, the transaction amount is VAT excluded.

- 2 = VAT amount, the transaction amount is considered the VAT amount at 100%.

- Amount type not editable: Default mode.

- The column is protected.

- The program uses the associated value of the VAT Codes table.

- When you edit the value in the VAT Codes table and you recalculate the accounting, the program uses the new value associated with this VAT Code.

- Amount type editable: this option can be activated with the Add new functionalities command. The activation of the option cannot be undone.

- When you edit the VAT Code, the program uses the Amount type associated with this code.

- The value can be edited manually.

- When the accounting is being recalculated, the value indicated in the Transactions table is being maintained.

- Non. Ded. %: this indicates the non deductible %.

- The program uses the Non. Ded. % associated to a VAT Code that is present in the VAT Codes table.

- You can manually edit the value.

- VAT Acc.: this is the VAT amount registered in the VAT account.

It is calculated by the program according to the transaction amount, the Amount type and the non deductible percentage. - VAT number: this is the code or VAT number of your client/supplier.

When you enter a transaction with VAT, it is possible to enter the VAT number of your counterparty. If in the Accounts table, Address view, in your clients/suppliers register accounts, you enter their VAT number, this is automatically loaded in the Transactions table, in the VAT number column.

Transactions with VAT

Before entering transactions with VAT, you must keep in mind all the information on the Transactions page.

Entering a VAT transaction is very easy:

- Enter the date, document number and invoice number in the respective columns

- Enter the description, the Debit account and the Credit account

- Enter the gross amount (including VAT)

- Enter the VAT code provided for the type of transaction (purchases, sales, investments...) and present in the VAT Codes Table.

How to correct VAT transactions

In case of an error in a transaction with VAT, it is possible to correct it directly on the transaction row, provided that no VAT declaration has been submitted or no accounting lock has been executed.

If however your accounting file is locked or if you have already sent your VAT declaration, you cannot simply delete the wrong transaction, but you need to operate some cancellation-transaction and then re-enter the correct transaction.

In order to rectify VAT operation(s), you need to:

- Make a new transaction by inverting the Debit and Credit accounts used in the wrong transaction.

- Enter the same amount.

- Enter the same VAT code but preceded by the minus sign (ex.: -V81).

- Enter a new transaction with the correct accounts, amount and VAT code.

Depending on the entity of the mistake, you should consider informing your local VAT office; usually they ask you to download a specific form for correcting mistakes in the previous VAT period that you already declared.

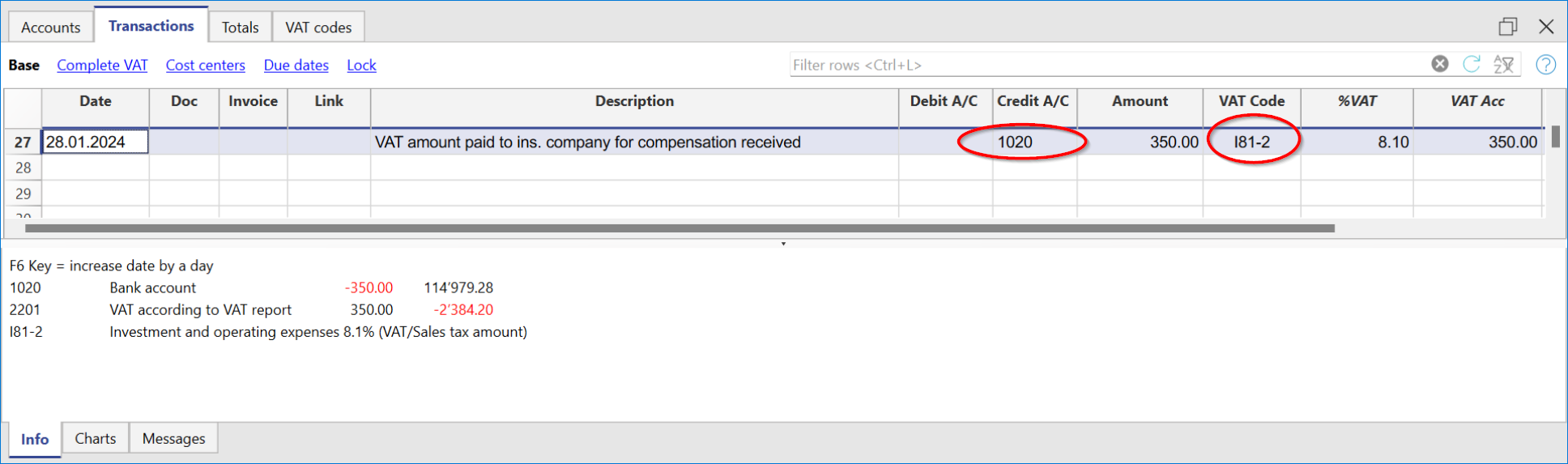

How to only enter the VAT amount

There are cases where only the VAT amount needs to be recorded, such as when you receive compensation from the car insurance.

In these cases, you can proceed as follows:

- Enter the date, document number and description in the appropriate columns.

- In the Credit A/C column enter the account used to pay the VAT amount (the Debit A/C column remains empty).

- In the Amount column enter the VAT amount to be paid.

- In the VAT code column enter the VAT code I81-2 (the code that refers to 100% amount VAT).

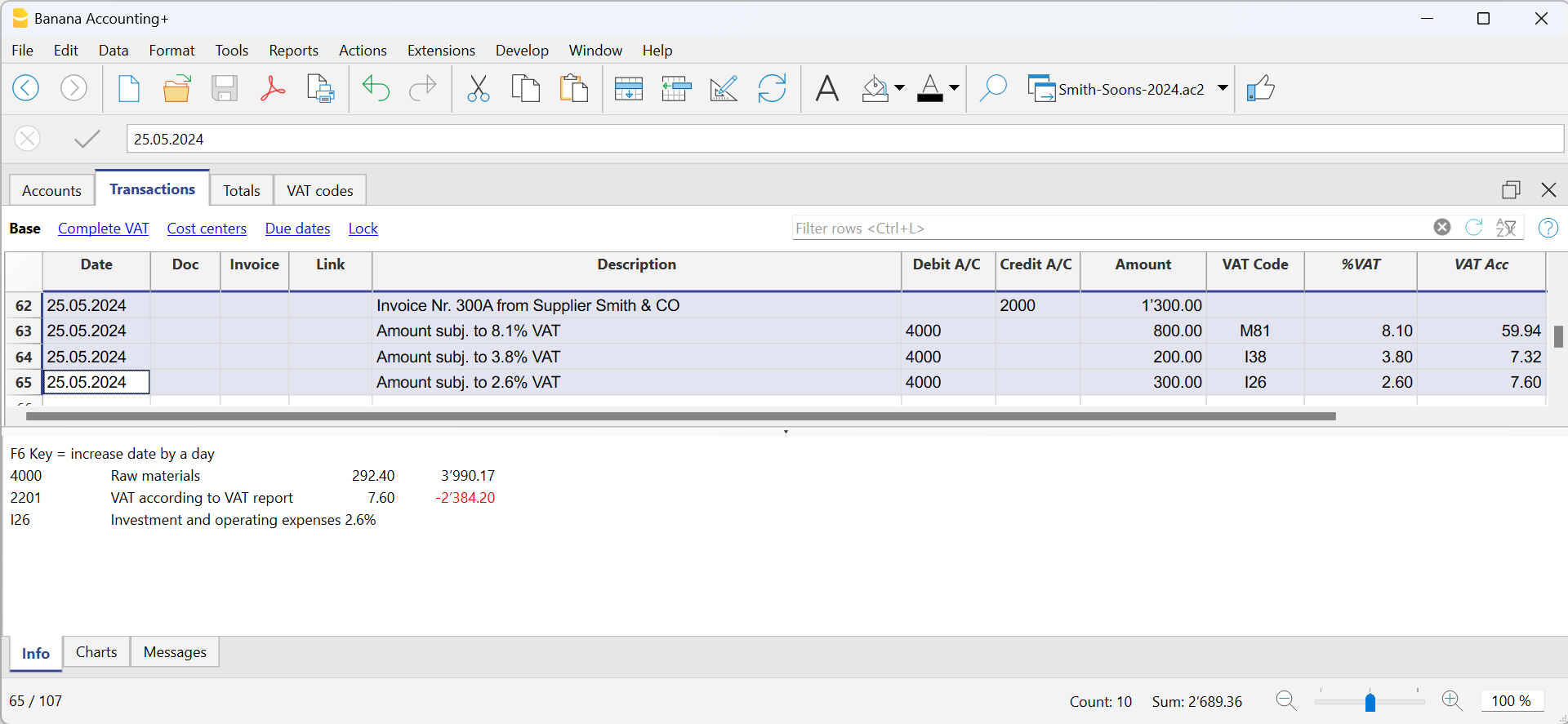

Transactions with different VAT rates

There may be cases in which the total amount is composed of several taxable amounts with different VAT rates. In this case the transaction is recorded on several rows.

For the transaction, it is necessary to:

- Subdivide the overall amount into the various amounts, each of which is subject to a specific VAT rate.

- On each row, enter the amount (amount with VAT) and insert the VAT code with the specific rate.

- Once the transaction is completed, check that the sum of the single gross amounts and the VAT amounts correspond to the invoice total.

Example

VAT EXEMPTION

When in the invoice the total amount subject to VAT is made up of a taxable part and a VAT-exempt part, it is necessary to register on more than one row as in the previous case, applying the exempt VAT code, present in the VAT Codes table.

Reversals/Credit note

When there are reversal operations for credit or debit notes, or simply to rectify previously recorded transactions whose amounts are subject to VAT, the VAT must also be reversed in the reversal transaction.

For the transaction:

- Reverse in the Debit and in the Credit column the accounts that were used in the previous transaction, to which the credit note refers.

To reverse the VAT there are two possibilities:

- Put the minus sign in front of the VAT code (e.g. -V81).

- Use one of the codes that refer to discounts, already set in the VAT Codes table.

With these procedures the VAT amount will be adjusted.

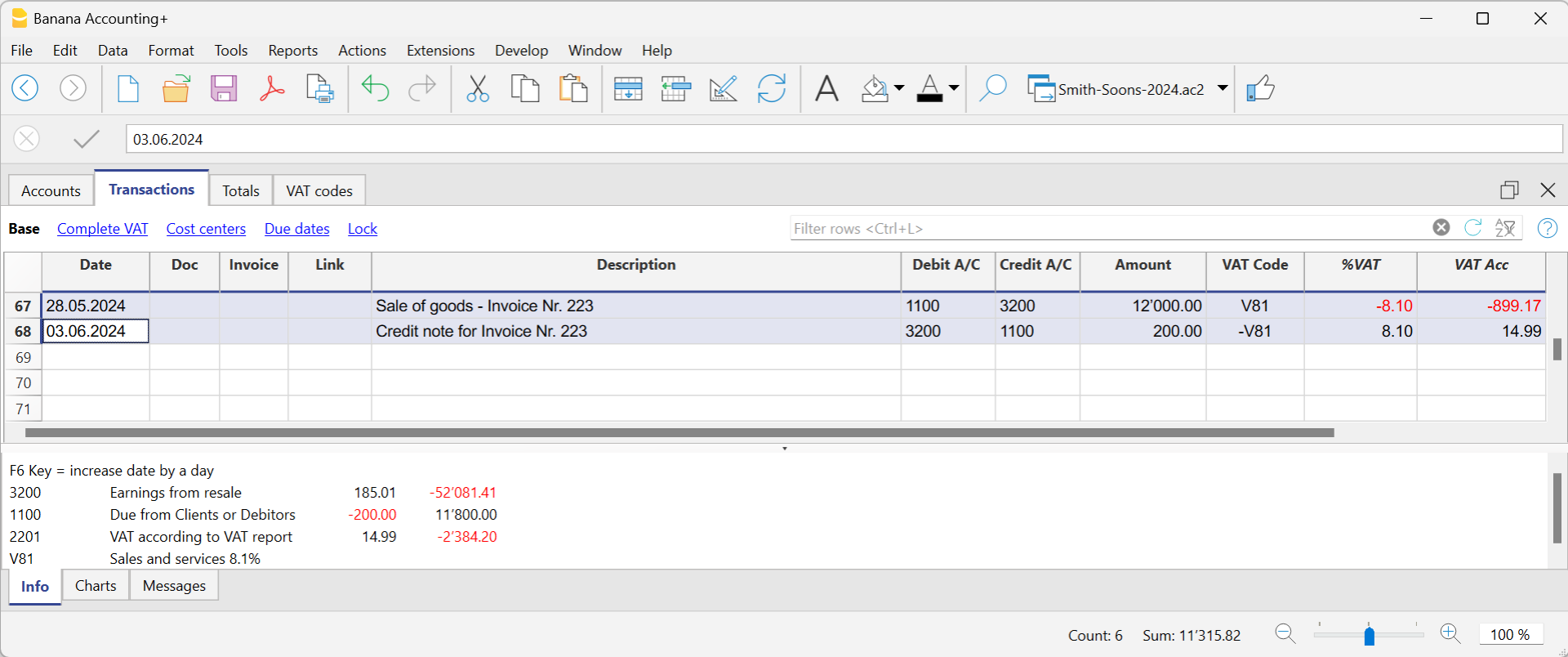

Example of a credit note on a sale

When a client finds a defect on a sold product, usually a credit note on his behalf is being issued. The credit note implies a decrease of the income and as a result a recovery of the VAT (Sales tax).

For example, we enter a sale amount of 12'000 including a 8.1% VAT. We then issue on the client's behalf a credit note of CHF 200.- for a product defect.

In the transaction of the credit note issued to the customer:

- The accounts of the sale, to which the credit note refers, have been reversed

- For VAT recovery on the credit note, the VAT code of the sales is recorded, preceded by the minus sign.

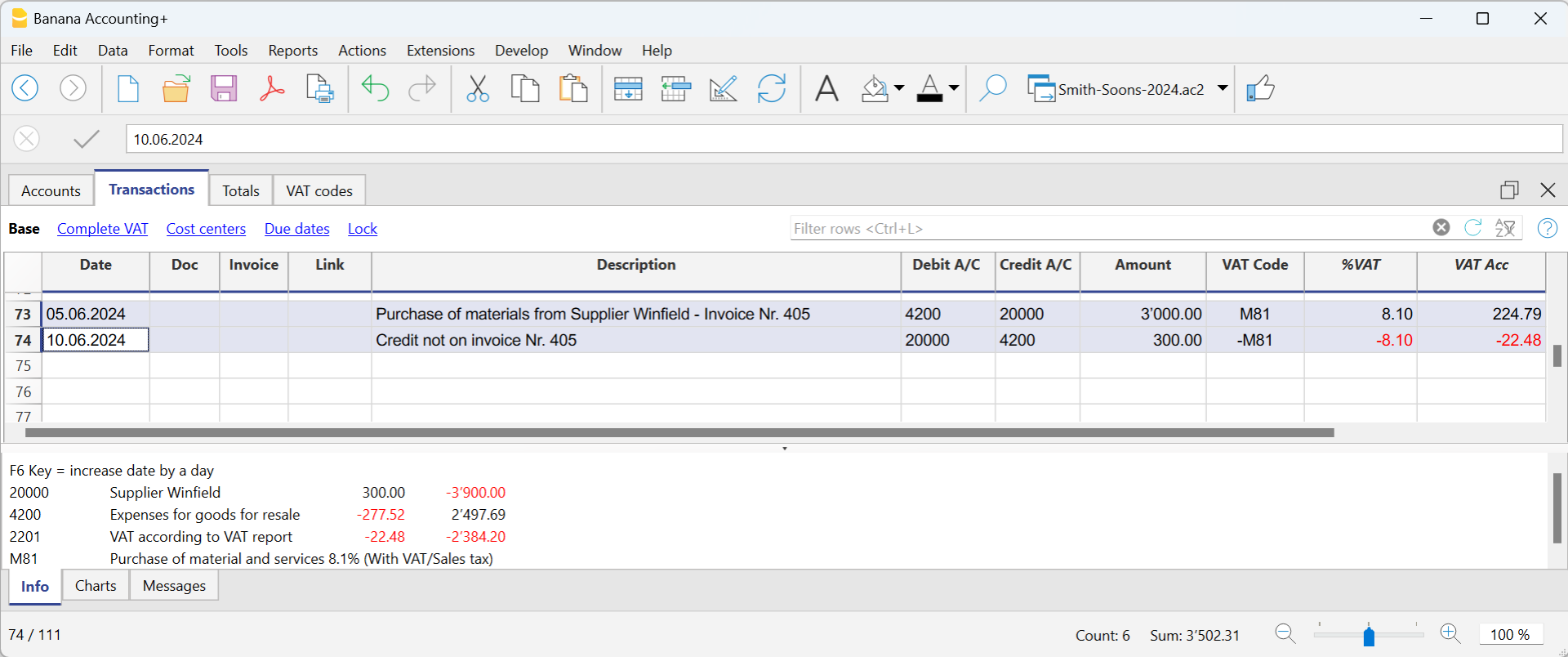

Example of a credit note on a purchase

When we receive a credit note from a supplier, the procedure for the transaction is similar:

- The accounts used for the purchase are reversed.

- Enter the same VAT code used for the purchase, preceded by the minus sign.

For example, we record an invoice for the purchase of goods for CHF 3'000 including a 8.1% VAT. We then receive a credit note of CHF 300.- from our supplier for a product defect.

In the transaction of the credit note received from the supplier:

- The accounts of the purchase, to which the credit note refers, have been reversed.

- For VAT recovery on the credit note, the VAT code of the purchases is recorded, preceded by the minus sign.