Asociaciones y ONG sin ánimo de lucro (Universal)

Modelos Universal Noprofit

Free Excel Standard INPAS Template

[This page is currently being updated]

INPAS key accounting documents

This page is dedicated to the chart of accounts template that conforms to the INPAS standard. The INPAS standard is designed to improve the transparency and accuracy of nonprofit associations' financial statements. It is also possible to download a complete Excel template that facilitates the compilation of all the documents required to comply with the standard.

The chart of accounts has been designed and interpreted based on the INPAS drafts and may require adjustments once the final guidance is published in 2025.

The compliance of the accounting with the INPAS standard always depends on the accountant and the auditor working on the accounts.

Updates may be possible following the final publication of INPAS in 2025.

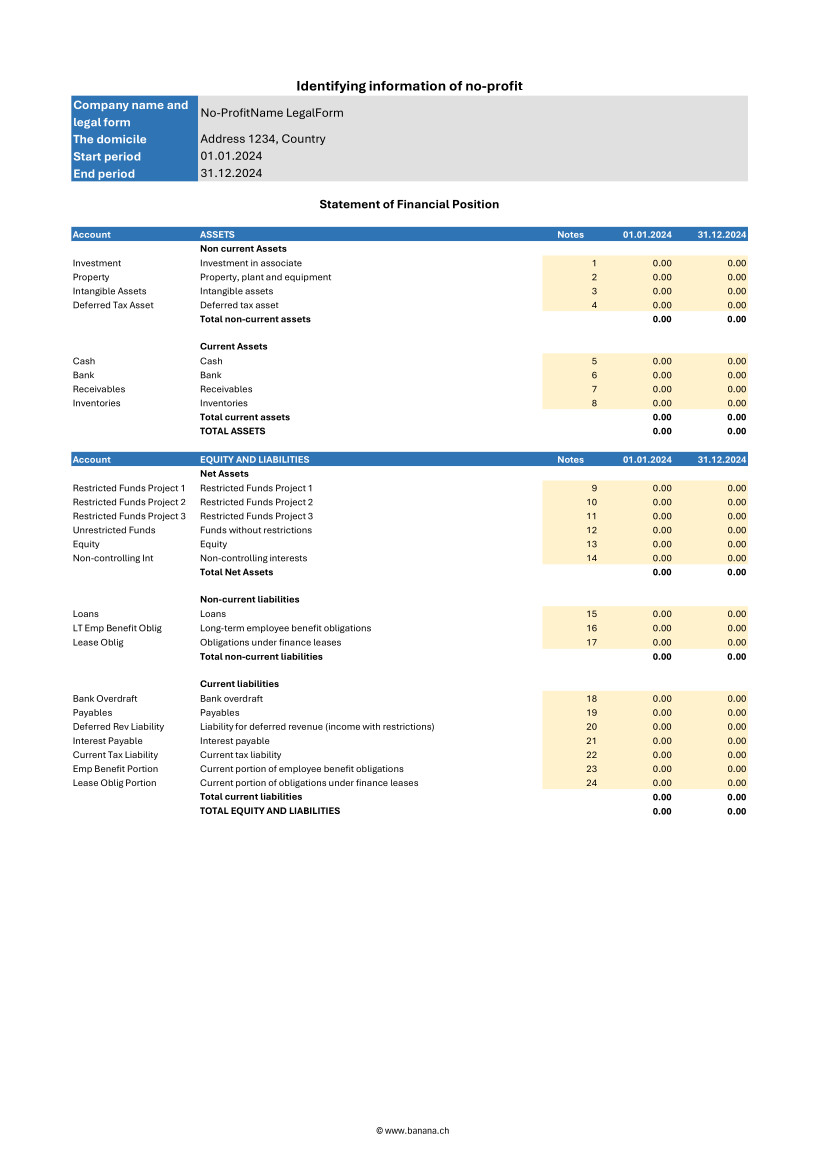

Statement of Financial Position

The balance sheet is an essential document that provides a detailed view of your organization's financial health, clearly showing assets, liabilities and net worth. Because of the flexibility of the INPAS standard, you can present the financial statements either vertically or horizontally, tailoring them to the specific needs of your nonprofit.

This document can be generated easily using Banana Accounting+ template.

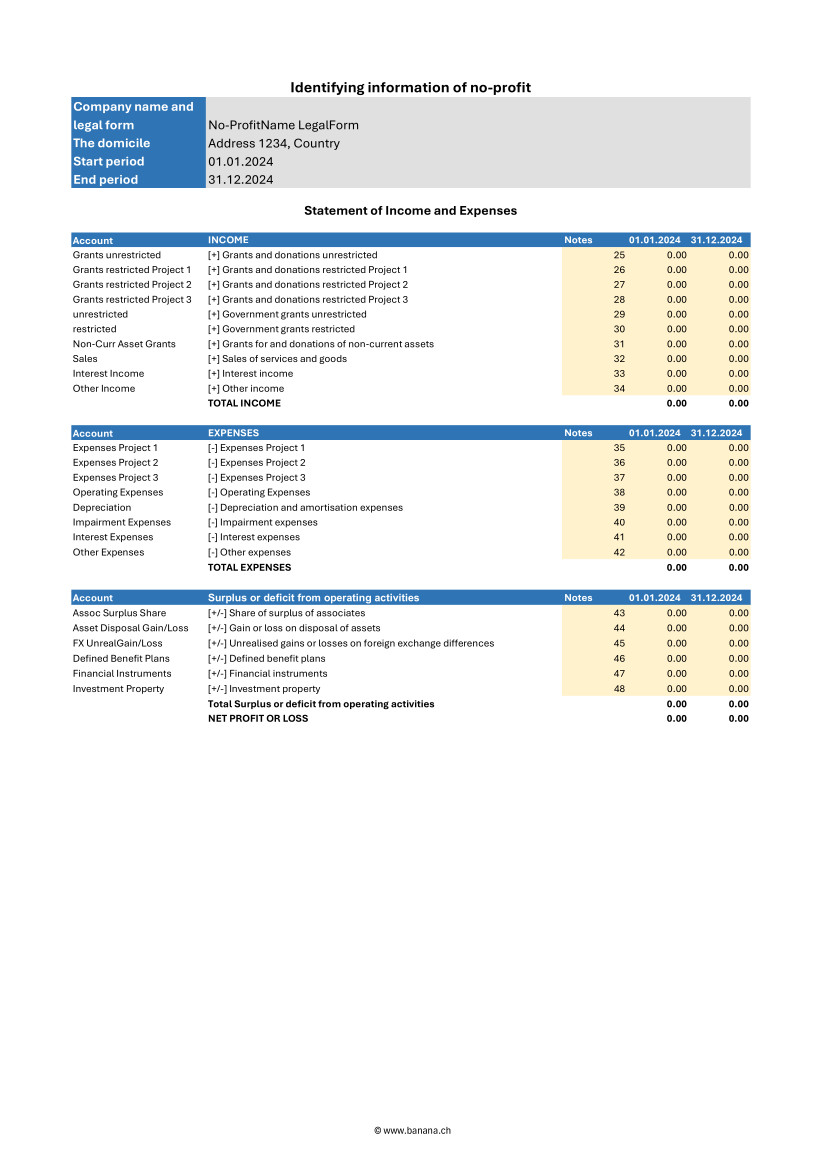

Statement of Income and Expenses

This document shows your organization's income and expenses during a period. Proper management of the income statement is crucial to demonstrate how resources were used to achieve missionary goals.

This document can be generated easily using Banana Accounting+ template.

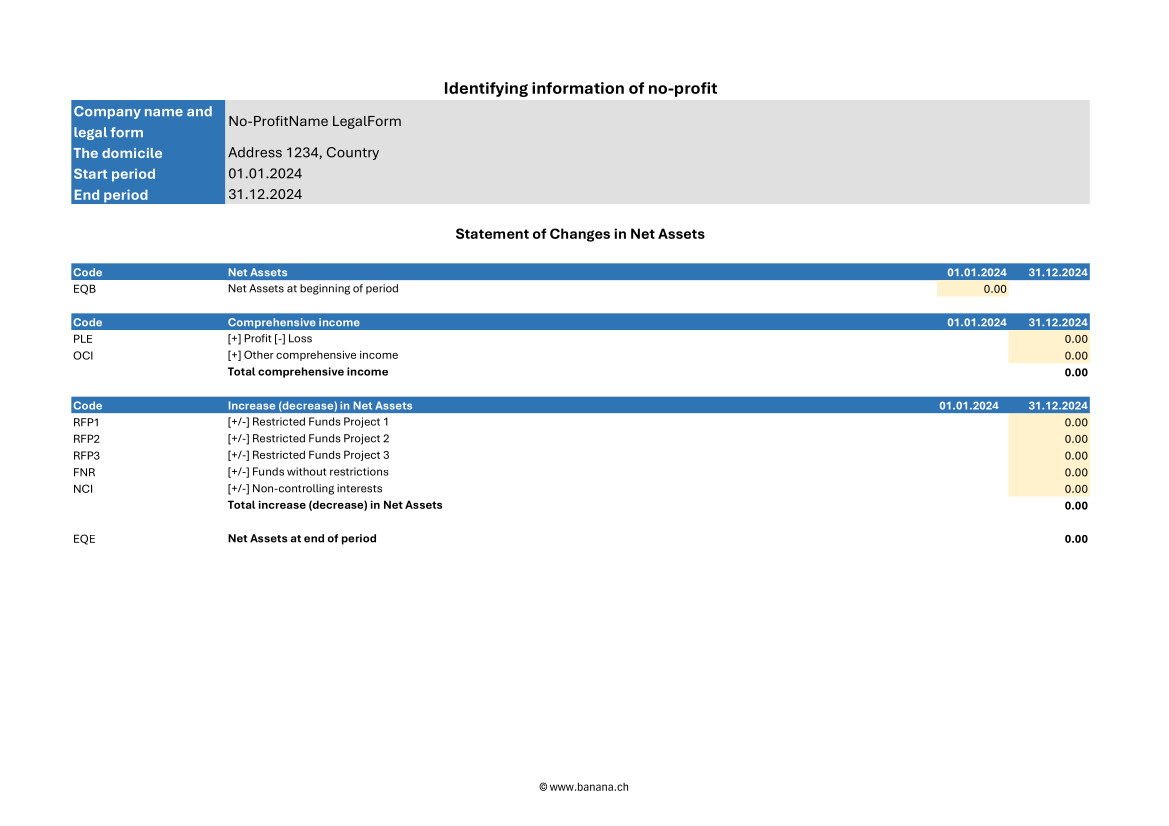

Statement of Changes in Net Assets

This document is critical to understanding the changes that have occurred in net assets during the fiscal year. The INPAS standard provides a sequence of elements that transparently reflects the changes, making clear the impact of financial activities on the organization's assets.

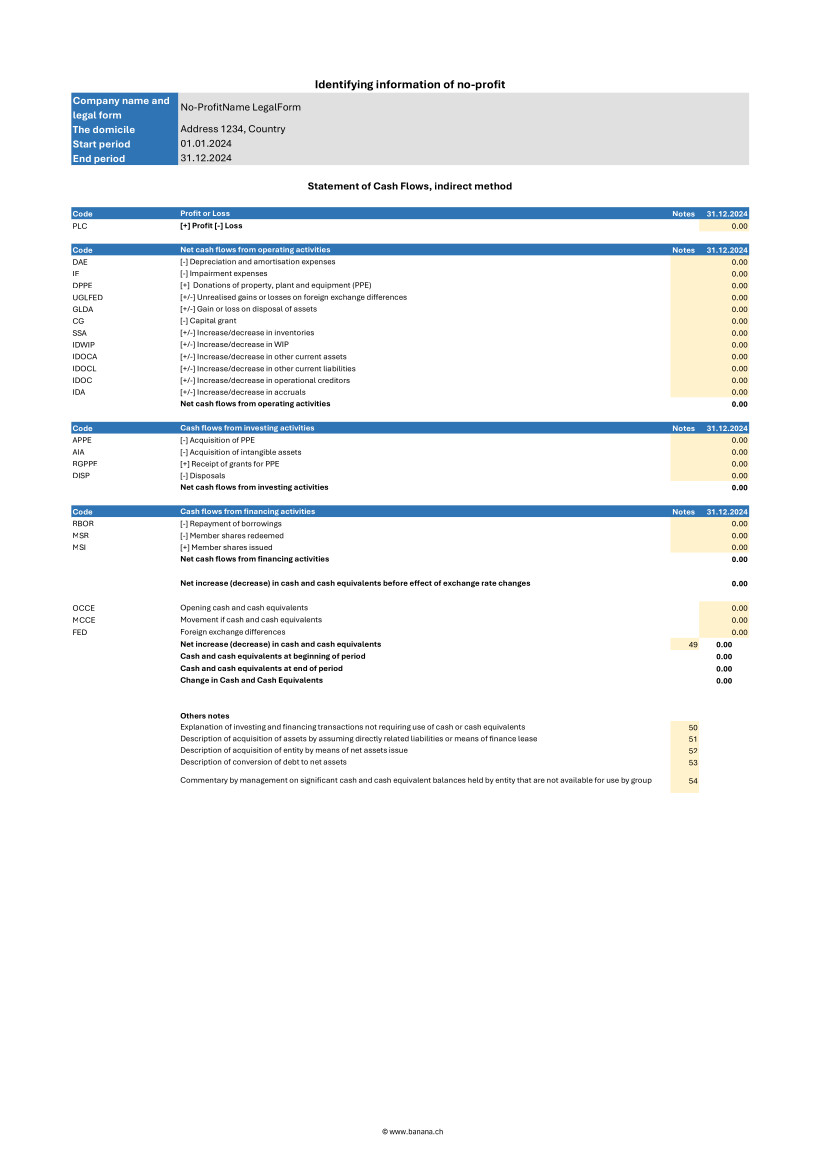

Statement of Cash Flows

The cash flow statement, which shows cash flows, is essential for monitoring your organization's liquidity and ability to fund its activities. With our INPAS template, you can present this information in a clear and accessible way, improving transparency to donors and board members.

Explanatory notes

Explanatory notes offer crucial details to fully understand the numbers presented in other accounting documents. They provide a clear description of adopted accounting policies and significant changes, contributing to a deeper and more accurate analysis of the institution's financial position.

Excel template to download

To facilitate the accounting management of associations, a complete Excel template can be downloaded to provide all the necessary documents according to the INPAS standard. In fact, this versatile and easy-to-use tool also allows you to create the Statement of Changes in Net Assets, Statement of Cash flows and Explanatory notes, completing the documentation with the Balance Sheet and Statement of Income and Expenses you can easily obtaine through Banana Accounting+.

Download the INPAS Excel Template

Statement of Financial Position

This document can be generated easily using Banana Accounting+ template. Here is what the statement of financial position must contain.

Current and non-current assets

Assets should be distinguished into current and non-current. Current assets are those that are expected to be converted to cash or used within one year. They include accounts such as cash and cash equivalents, short-term receivables, and inventories. Non-current assets, on the other hand, are those that are expected to be held for periods longer than one year and may include tangible assets, intangible assets, and long-term investments.

Current and non-current liabilities

Liabilities must also be classified into current and noncurrent. Current liabilities are payables and obligations that are expected to be settled within one year, such as accounts payable, accrued expenses, and other short-term liabilities. Non-current liabilities represent long-term commitments that the organization does not expect to settle within the next year, such as long-term debts and mortgages.

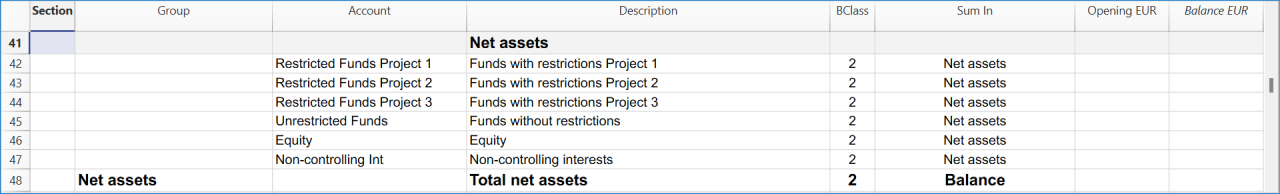

Shareholders' Net Assets

Net Assets represents the difference between the organization's total assets and total liabilities. In financial statements according to the INPAS standard, net assets should be divided into three main categories:

- Unrestricted funds: resources available for general use and not subject to specific restrictions. These funds may be used at the discretion of the organization to fund any activity or operational need.

- Restricted funds:

- Temporarily restricted funds: resources subject to restrictions imposed by donors or temporary conditions. These funds may be used only for specific purposes and for a specified period, after which, if conditions are met, they may be reclassified as unrestricted funds.

- Permanently restricted funds: resources that must be kept intact indefinitely, often to ensure a continuous source of income for the organization. These funds are typically associated with permanently restricted donations.

Statement of Income and Expenses

This document can be generated easily using Banana Accounting+ template. Here is what the statement of activities must contain.

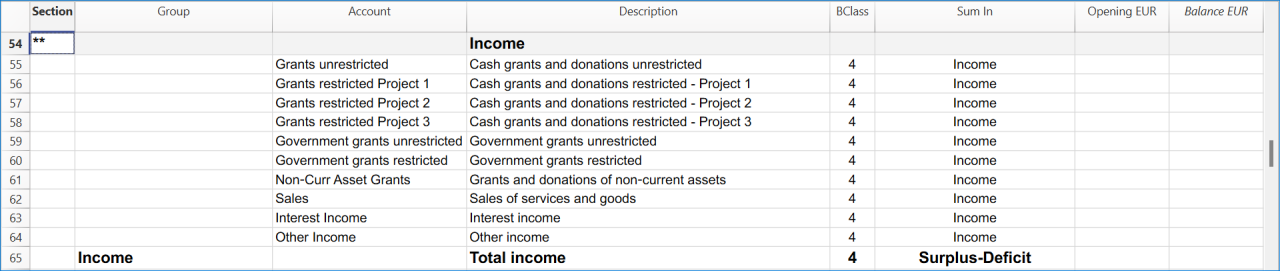

Revenue

Income should be divided between restricted and unrestricted to reflect donor or regulatory restrictions. This distinction is crucial to understanding the organization's flexibility in the use of funds received.

- Restricted income: funds earmarked for specific purposes, such as particular projects or specific periods. These funds may come from donations, grants, or funding with donor-imposed conditions limiting their use.

- Unrestricted income: funds that can be used at the discretion of the organization for any operational need. These include general donations, proceeds from nonspecific fundraising events, and other income that has no special restrictions.

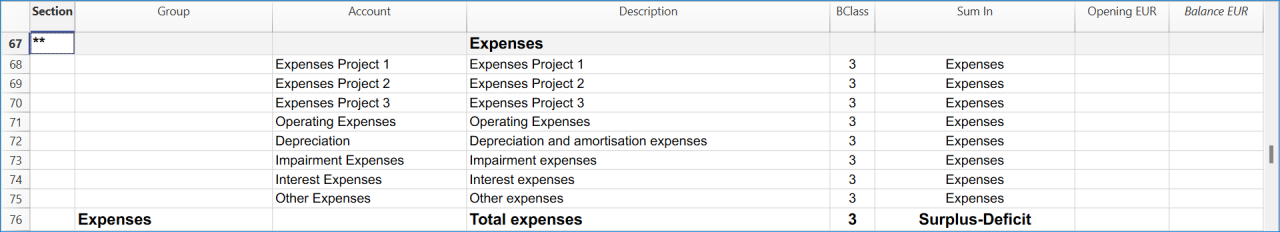

Expenses

Expenses should be broken down into major categories to give a clear view of how resources are allocated. This breakdown helps to better understand the organization's priorities and efficiency in managing funds.

- Programmatic expenses: costs directly associated with the implementation of the organization's core programs and activities. These include salaries of operational staff, costs of materials and equipment used in projects, and other expenses directly related to the organization's missions.

- Fundraising expenses: costs incurred for fundraising activities, including events, marketing campaigns, and salaries of dedicated fundraising staff. This category highlights the investment made to secure future financial resources.

- Administrative expenses: general costs of running and administering the organization. These include administrative staff salaries, office rent, consulting fees, and other overhead costs necessary for the day-to-day operation of the organization.

Changes in shareholders' Net Assets

The income and expenses statement should report changes in net worth during the reporting period, broken down by fund category:

- Unrestricted funds: changes resulting from the use or appropriation of unrestricted revenues and non-programmatic expenditures.

- Restricted funds:

- Temporarily restricted funds: changes due to the use of restricted funds according to donor-imposed conditions and their eventual transfer to unrestricted funds once conditions are met.

- Permanently restricted funds: changes related to new permanently restricted gifts or changes in the investment policies of permanent assets.

Statement of Changes in Net Assets

Here is what the statement of changes in net assets must contain.

Changes in shareholders' Net Assets by period

The statement should report all changes in net assets broken down by period, clearly showing increases and decreases in the various funds.

- Increases in net assets: these may result from new donations, contributions, grants received, or other sources of income. Each increase should be specified in terms of restricted and unrestricted funds to highlight restrictions on the use of funds.

- Decreases in net assets: decreases may result from the use of funds to cover programmatic, fundraising, and administrative expenses. Again, it is important to specify whether the decreases involve restricted or unrestricted funds.

Details on contributions, donations and other sources of funding

The statement should include a detailed description of all funding sources received during the period, broken down by type and restriction.

- Contributions and donations: specify donations received, indicating whether they are restricted or unrestricted, and describe any conditions or restrictions imposed by donors.

- Grants and funding: detail grants obtained, including conditions of use and periods of application.

- Other income: include any other sources of funding, such as income from fundraising activities, investment income, or income from ancillary activities, detailing any applicable restrictions.

Use of funds under restrictions

The statement should clearly show how funds have been used according to donor or regulatory restrictions, ensuring transparency and compliance.

- Restricted funds:

- Temporarily restricted funds: describe how these funds were used for specific projects or programs, and whether any restrictions were met, allowing the funds to be reclassified as unrestricted.

- Permanently restricted funds: highlight the use of income generated by these funds to support the organization's activities, keeping the principal capital intact according to the conditions set by the donors.

- Unrestricted funds: indicate how these funds have been allocated for general operating expenses and other needs without specific restrictions.

Mandatory elements of the statement of changes in Net Assets

- Beginning balances

- The beginning balances of each component of net assets at the beginning of the accounting period must be reported.

- Example: share capital, reserves, retained earnings.

- Changes for each component

- Detail all changes for each component of net assets during the accounting period.

- These changes may include:

- Profits or losses for the year.

- Increases in capital stock.

- Reductions in capital stock.

- Dividend distributions (if applicable).

- Contributions and distributions from owners

- If applicable, indicate contributions made by owners and distributions made to owners.

- Reserves

- Any changes in reserves, such as legal reserves, extraordinary reserves, revaluation reserves, etc.

- Ending balance

- Report the ending balances of each component of net assets at the end of the accounting period.

Steps to implement the statement of changes in Net Assets

- Identification of the components of shareholders' Net Assets

- Determine all components of net assets that should be reported in the statement, such as share capital, reserves, and retained earnings.

- Collection of initial data

- Collect the beginning balances of all components of net assets from the last closed financial statements.

- Recording of changes

- Record all changes that have occurred during the accounting period, such as capital increases, recorded gains or losses, dividend distributions, and other changes in reserves.

- Calculating ending balances

- Calculate the ending balances of each component of net assets taking into account the changes recorded.

- Preparation of schedule

- Compile the statement of changes in net worth with all the information collected, making sure that the totals are correct and that all changes are adequately explained.

Statement of changes in funds

The Statement of Changes in Funds is a crucial accounting document that illustrates the changes in an organization's funds during an accounting period. According to the INPAG standard, the Statement of Changes in Funds must include a detailed set of information to ensure transparency and accuracy in reporting.

Here are the required elements of the statement of changes in funds.

- Initial balances of funds

- The initial balances of each fund at the beginning of the accounting period must be reported.

- Revenue by fund

- Detail the income received for each fund during the accounting period.

- Expenditures by fund

- Detail the expenditures made for each fund during the accounting period.

- Transfers between funds

- Information on any transfers of resources between different funds.

- Ending fund balances

- Indication of the ending balance of each fund at the end of the accounting period.

- Variations in funds with restrictions

- Specific details on changes in time-restricted or donor-restricted funds.

Statement of Cash Flows

Here is what the cash flow statement must contain.

Cash flows from operating activities

This section reports cash flows generated or used by the daily operations of the organization. It must include:

- Income from donations and grants: cash flows from donations, grants, and other funding sources not specifically tied to investments or financing.

- Payments for operating expenses: cash flows used to cover programmatic, fundraising, and administrative expenses, including salaries, supplies, and other operating costs.

- Receivables collections and payables payments: cash flows associated with the management of short-term receivables and payables.

Cash flows from investing activities

This section covers cash flows related to the purchase and sale of long-term assets and other investments. It must include:

- Purchases of fixed assets: cash flows used to purchase tangible fixed assets, such as buildings, equipment, and intangible fixed assets.

- Income from sales of fixed assets: cash flows generated from the sale of long-term assets.

- Financial investments: cash flows related to acquisitions or disposals of financial investments, such as securities and other investment instruments.

Cash flows from financing activities

This section reports cash flows associated with the organization's financing activities, including changes in restricted and unrestricted funds. It must include:

- Receipts from long-term restricted loans and donations: cash flows from donations and loans restricted specifically for long-term purposes.

- Repayment of long-term debts: cash flows used to repay long-term debts and obligations.

- Interest payments and other financing costs: cash flows related to interest payments and other financing-related costs.

Reconciliation of net income to net cash flow from operating activities

This section is critical to linking net income with actual cash flows from operations. It must include:

- Net income: the net economic result of the organization for the period.

- Adjustments for nonmonetary items: for example, depreciation and amortization.

- Changes in financial statement balances: changes in accounts receivable, accounts payable, inventories and other operating items.

- Extraordinary items: any extraordinary non-recurring cash inflows or outflows.

Explanatory notes

Explanatory notes should include detailed information regarding the accounting policies adopted, explanations of major items in the financial statements, and details of material subsequent events that could affect the understanding of the financial statements.

Here is what the explanatory notes must contain.

Information on accounting policies adopted

The notes to the financial statements should provide a detailed description of the accounting policies followed by the organization. This information helps users of financial statements understand the principles on which the figures reported are based.

- Principles of recognition and measurement: description of the criteria used to recognize and measure assets, liabilities, income, and expenses.

- Depreciation methods: explanation of the methods used to depreciate tangible and intangible assets.

- Valuation policies: information on valuation policies for inventories, receivables, and liabilities.

- Revenue recognition: criteria adopted for revenue recognition, including restricted and unrestricted donations.

Additional details on items in the balance sheet and income statement

Explanatory notes should provide additional details that help to better understand the items presented in the balance sheet and income statement.

- Analysis of principal items: detailed explanation of major items of assets, liabilities, income, and expenses. For example, a breakdown of fixed assets, long-term debt, and major revenue categories.

- Significant transactions: description of significant transactions that occurred during the period, such as acquisitions, sales of fixed assets, or extraordinary events.

- Significant changes: explanation of significant changes from previous periods, providing a context for understanding changes in financial data.

Information on possible risks and uncertainties

Explanatory notes should include information on any risks and uncertainties that could affect the organization. This information helps assess the financial strength and risk management of the institution.

- Financial risks: description of key financial risks, such as credit risk, liquidity risk, and market risk, and the policies adopted to manage them.

- Contingencies and contingent liabilities: information on legal contingencies, contingent liabilities, or other uncertain events that could have a significant financial impact.

- Risk management: details of the risk management strategies and policies implemented by the organization to mitigate the effects of such risks.

Segment reporting if applicable

If the organization operates in different industries or geographic areas, the explanatory notes should include segment reporting information to provide a more detailed view of financial and operational performance.

- Information by segment: details on revenues, expenses, assets, and liabilities for each operating or geographic segment.

- Aggregation criteria: explanation of the criteria used to aggregate data for different segments.

- Performance by segment: analysis of the financial and operational performance of each segment, highlighting differences and relative contributions to the overall performance of the organization.

Accrual accounting requirement

The INPAG standard requires that all transactions be recorded on an accrual basis. This means that transactions must be recognized in the period in which they occur, regardless of actual cash flows. Adopting accrual accounting provides a more accurate and realistic view of an organization's financial position and performance, improving the transparency and reliability of financial information.

Examples for Income from donations

When a donation is promised but has not yet been received insert:

- in Debtor Account column the account Debtors from donations.

- in Creditor Account column the account Income from donations.

- in the Amount column the promised amount.

This record recognizes the income as a debt, reflecting the promise of the donation, even though the money has not yet been received.

When the donation is actually received insert:

- in the Debtor Account column the account Bank.

- in the Creditor Account column the account Donation debtor.

- in the Amount column the received amount.

This recording adjusts the accounts once the money is actually received, eliminating the previously recorded debt.

Examples for project expenses

When an invoice for project services is received but not yet paid insert:

- in the Debtor Account column the account Project expenses.

- in the Creditor Account column the account Creditors.

- in the Amount column the invoice total amount.

This entry recognizes the expense when the invoice is received, regardless of whether it has been paid or not.

When the invoice is actually paid insert:

- in the Debtor Account column the account Creditors.

- in the Creditor Account column the account Bank.

- in the Amount column the paid invoice total amount.

This entry reduces creditors once the invoice has been paid, reflecting actual cash flow.

Benefits of accrual accounting

Adopting accrual accounting, as required by the INPAG standard, ensures that revenues and expenses are recorded in the correct period. This approach provides a more accurate view of the organization's financial activities, facilitating better resource management and more accurate planning. Nonprofit organizations that follow these accounting practices can demonstrate greater transparency and accountability, increasing the trust of donors, board members and other stakeholders.

Accounting for restricted grants and donations

INPAG requires that funds be distinguished between restricted and unrestricted funds. This distinction should be visible in the financial statements or notes.

Accounting for grant and donation income according to the INPAG standard requires a specific structure to ensure proper recording and recognition. The accounting process includes the following steps:

- Identify whether there is an enforceable agreement that confers rights and obligations.

- Identify the enforceable obligations in the agreement.

- Determine the amount of the transaction.

- Allocate the transaction amount to the enforceable obligations.

- Recognize the revenue when (or while) the enforceable obligation is satisfied.

- These steps ensure that revenue is recognized appropriately, accurately reflecting the economic activity of the organization.

Example of accounting transactions for restricted donations

Receipt of a grant for a specific project with implementing obligations.

When you receive the amount insert:

- in the Debtor Account column the account Cash/Bank or Donation debtor if the donation was promised.

- in the Creditor Account column the account Liabilities for grants.

- in the Amount column the amount received.

At this stage the amount received is recorded as a liability because the organization has an obligation to meet the conditions of the grant.

When you fulfill the executive obligation insert:

- in the Debtor Account column the account Expense1.

- in the Creditor Account column the account Bank.

- in the Amount column the paid amount.

The second transaction must be insert:

- in the Debtor Account column the account Liabilities from grants.

- in the Creditor Account column the account Income from grants.

- in the Amount column the paid amount.

Once the enforceable obligation is fulfilled, the liability is reduced and the amount is recognized as revenue, reflecting the completion of the project or condition fulfilled.

Accounting for unrestricted donations

Unrestricted donations, which do not impose specific obligations on the organization, follow a simpler accounting process than donations with enforceable obligations. These receipts can be recognized immediately upon receipt.

Example of an unrestricted donation

When you receive the amount insert:

- in the Debtor Account column the account Cash/Bank or Donation debtor if the donation was promised.

- in the Creditor Account column the account Income from donations.

- in the Amount column the received amount.

In this case the amount is immediately recognized as income since there are no specific obligations to be met.

Foreign currency conversion

Managing foreign currency transactions is an essential part of accounting, especially for nonprofit organizations that receive international grants and donations. The INPAS standard establishes precise rules for managing these transactions, including disclosure of foreign exchange gains and losses and retranslation of foreign currency monetary assets and liabilities related to grant agreements.

Foreign currency transactions must be translated into the functional currency using the exchange rate in effect on the date of the transaction. Monetary items, such as debtors and creditors, must be retranslated at the balance sheet date to reflect current exchange rates.

Example of transactions for foreign currency conversion

Receipt of 10'000$ grant when the exchange rate is 1$ = 0.90€.

Initial acknowledgement:

- in the Debtor Account column the account Cash/Bank.

- in the Creditor Account column the account Liabilities for grants.

- in the Amount column the amount 9'000€ (10'000$ * 0.90€ = 9'000€).

In this case the grant is recorded in euros at the exchange rate in effect at the time of the transaction.

Retranslation on the balance sheet date with the exchange rate 1$ = 0.85€.

- in the Debtor Account column the account Loss on exchange.

- in the Creditor Account column the account Cash/Bank.

- in the Amount column the lost amount 500€.

At the balance sheet date the grant must be retranslated at the new exchange rate. The difference between the initial value and the retranslated value is recorded as an exchange loss.

Treatment of exchange rate changes on grants

Exchange rate differences on monetary items related to grants should be treated in a manner consistent with the nature of the transaction. For example, if a grant received is to be spent on a specific project and the exchange rate varies, the amount to be reimbursed could differ due to exchange rate fluctuations.

For example a grant received of 10'000$ must be spent on a specific project. If the exchange rate varies and the grant must be partially repaid due to exchange rate differences.

No INPAS adoption for certain transactions

When an organization chooses not to apply INPAS standard for certain transactions, it is essential to provide a clear explanation and details of the accounting management adopted. The INPAS standard requires disclosure of the following information to maintain transparency and understandability in financial statements.

Mandatory disclosures in the case of no INPAS adoption

- Disclosure of transactions not compliant with INPAS

- The organization must specify which transactions do not follow INPAS standards.

- Example: “Donations in kind were not accounted for in accordance with INPAS standards.”

- Accounting treatment adopted

- The alternative accounting treatment used for these transactions must be described.

- Example: “In-kind donations were recorded at appraised value rather than market value according to INPAS guidelines.”

- Rationale for non adoption of INPAS

- It is necessary to explain the reasons why INPAS standards were not applied.

- Example: “Valuation of in-kind donations according to INPAS standards required specialized skills that the organization does not currently possess.”

- Impact on budgets

- It must be indicated how the financial statements would differ if INPAS requirements had been applied.

- Example: “If in-kind donations had been valued according to INPAS, the total value of income would have increased by €10,000.”

- Quantification of differences

- Where possible differences between the accounting treatment adopted and that provided by INPAS should be quantified, without excessive costs.

- Example: “Donations in kind were recorded at €5,000, while according to INPAS the correct value would have been €15,000, resulting in a difference of €10,000.”

References

- International Financial Reporting For Non Profit Organisations: www.ifr4npo.org

International Non-Profit Accounting Guidance - INPAS Standard Template

International Non-Profit Accounting Guidance - INPAS Standard Template[This page is currently being updated]

The INPAS International template for associations provides a comprehensive framework for organizing financial transactions and reporting for associations adhering to international standards.

This chart of accounts template is designed to streamline accounting processes, ensure consistency in financial reporting and facilitate compliance with regulatory requirements. With a user-friendly format and customizable accounts name, associations can efficiently track income, expenses, assets and liabilities, enabling clear and transparent financial management. Whether managing donations, membership dues or program expenditures, this template offers flexibility and adaptability to suit the unique needs of diverse associations while promoting transparency and accountability in financial operations.

The chart of accounts has been designed and interpreted based on the INPAS drafts and may require adjustments once the final guidance is published in 2025.

The compliance of the accounting with the INPAS standard always depends on the accountant and the auditor working on the accounts.

Updates may be possible following the final publication of INPAS in 2025.

Using Banana Accounting Plus you can manage the balance sheet and the income statement. All other documents are easily obtained thanks to the Excel template.

Create your file

- Create a new file, starting from this template (Template ID +11255), using one of the methods explained.

- With the command File → File properties, set the period, the association name and the basic currency.

- With the command File → Save as, save the file. Enter the association name and year in the file name.

For example "no-profit-2024.ac2".

See also Organize accounting files locally, online or in the cloud

Customize the Accounts table

Once you have entered the transactions, you can check the Accounts table. You will have an overview of your assets, liabilities, income and expenses, which allows you to keep your balance under control.

Customize the Accounts table to suit your needs: you can add, delete and edit accounts, groups or descriptions.

Enter Opening Balances

In the Opening column enter the opening balances of the Accounts. Negative asset account amounts are entered with a minus sign in front.

Enter the balances of the previous year

If you are creating a new accounting and you want the amounts of the previous year to appear in the statements to be printed, you must insert the values in the appropriate column. Go to the Previous view and in the Previous Year column enter the values.

Enter the Transactions

Register the accounting transactions in the journal. Enter the date, the document number and the description. Enter the destination account into the Debit account column, and the account of origin in the Credit account. Then add the amount.

You can modify the journal at any time.

Manage funds, grants and donations, project and operating expenses

Manage funds in the Balance Sheet divided by project.

Manage grants and donations in the Income Statement.

Manage projects expenses and operating expenses in the Income Statement.

Get the Statement of Financial Position and the Income Statement

At any time of the year you can create your Balance sheet, which is a financial report of your assets, liabilities and equity and the Profit and Loss statement, which includes income and expenses. You will achieve optimal reports because you can always modify the data until they are perfect. You have the possibility to print out your statements or save them in PDF format.

Complete the documentation using the Excel Template

When you get the balance sheet and the income statement, complete the Excel template to get all the documents needed to comply with the INPAG standard.

Income & Expenses: INPAS Standard Template

Income & Expenses: INPAS Standard Template[This page is currently being updated]

The chart of accounts has been designed and interpreted based on the INPAS drafts and may require adjustments once the final guidance is published in 2025.

The compliance of the accounting with the INPAS standard always depends on the accountant and the auditor working on the accounts.

Updates may be possible following the final publication of INPAS in 2025.

Contabilidad libro de caja para organización sin ánimo de lucro

Contabilidad libro de caja para organización sin ánimo de lucro rebecaContabilidad ingresos y gastos para organización sin ánimo de lucro

Contabilidad ingresos y gastos para organización sin ánimo de lucro rebecaContabilidad partida doble para organización sin ánimo de lucro

Contabilidad partida doble para organización sin ánimo de lucro rebecaContabilidad multidivisa para organización sin ánimo de lucro

Contabilidad multidivisa para organización sin ánimo de lucro rebeca非营利组织

非营利组织 fei非营利组织会计

非营利组织会计 feiModelos universales Organizaciones religiosas

Contabilidad ingresos y gastos para organización religiosa

Contabilidad ingresos y gastos para organización religiosa rebecaKirchengemeinde (Einnahmen-Ausgaben-Rechnung)

Kirchengemeinde (Einnahmen-Ausgaben-Rechnung)HRM2-Kontenplan mit den typischen Konten für das Führen einer Buchhaltung einer Kirchgemeinde mit den üblichen Kategorien. So können Einnahmen und Ausgaben der Kirchengemeinde gebucht werden, ohne über Kenntnisse der doppelten Buchhaltung zu verfügen und zwischen Soll und Haben unterscheiden zu müssen.

Die Tabelle Konten enthält die Bilanz-Konten, während sich in der Tabelle Kategorie die Kosten und Einnahmen befinden.

Die Kosten und die Einnahmen sind in mehreren Untergruppen aufgeteilt und in der Tabelle Kategorie gibt es zwei Arten von Kostenstellen, welche erlauben, die Kosten der Kirchengemeinde und die des Oratoriums separat zu verwalten.

Die Konten und die Kategorien können je nach persönlichem Bedarf personalisiert werden.

Für Informationen betreffend der Führung einer detaillierteren Buchhaltung, empfehlen wir folgende Seiten: Doppelte Buchhaltung für Kirchengemeinde.

Contabilidad partida doble para organización religiosa

Contabilidad partida doble para organización religiosa rebecaContabilidad multidivisa para organización religiosa

Contabilidad multidivisa para organización religiosa rebeca非营利协会或组织会计

非营利协会或组织会计 fei非营利协会或组织会计

非营利协会或组织会计 feiDonations statement for Associations

Donations statement for AssociationsA donation certificate certifies a voluntary donation to an association. Usually, all associations print donation certificates for their members and volunteers, because these are often tax deductible.

The extension presented below makes it possible to create a donation certificate for donors registered in Banana Accounting (Accounts table).

It is essential to have the members/donors set up with cost centres by using cost center CC3.

Installation and usage of the Extension

- Install Banana Accounting (version 9.0.5 and above).

- Install the Banana extension Donations statement for associations (visit the Manage Extensions documentation).

- Once installed, the App is visible and ready to be used from the Extensions menu .

How to create a statement of donation

- Insert all the Association's data on the address tab of the accounting file.

- From the Menu Extensions select the Donations statement for associations extension.

- Insert a period in the dialog window.

- Complete the dialog fileds and click Ok.

Settings dialog

To enter the data, double-click in the 'Value' column field.

- Insert account member (empty = print all)

- Insert an individual account (e.g. "10001").

- Insert multiple accounts separated by a "," (e.g. "10001,10002,10005").

- Let empty to print a donation statement for all the registered members.

- Minimum amount of the donation: accounts with balance below this amount are not included. Default value is "1.00" (e.g. accounts with zero balance are excluded). Insert "0.00" to include accounts with zero balance.

- Texts

- Use standard texts: check the box to use the default texts (any personal texts will be overwritten).

- Title (optional): insert the subject of the letter.

- Text 1 (optional): insert the text of the first paragraph.

- Text 2 (optional): insert the text of the second paragraph.

- Text 3 (optional): insert the text of the third paragraph.

- Text 4 (optional): insert the text of the fourth paragraph.

- Include donation details: check the box to include a summary table of donations.

For all texts:

You can mark one or more words or even the full text in bold.

To get the desired word in bold, enter it in double asterisks (e.g. **word**).

To get the full text in bold, insert two asterisks at the beginning of the text (e.g. **text...).

If the following values (in english) are inserted in the text lines, they will be replaced by the corresponding values (e.g. <Account> is replaced with 10001):

<Period>: selected period

<Account>: account of the member

<FirstName>: name of the member

<FamilyName>: surname of the member

<Address>: address of the member

<StartDate>: start date of the selected period

<EndDate>: end date of selected period

<Currency>: currency

<Amount>: amount of donations.

- Signature: insert the name and surname of the person issuing the statement.

- Location and date: insert location and date of the statement issue.

- Signature with image: check the box to use an image as signature.

- Image: insert the image to be used. There are two possible ways to do this:

- documents:<id_name>: to use an image saved in the Documents Table, where <id_name> represents the name entered in the ID column of the table (e.g. "documents:signature") ; or

- file:document/<image_name>: to use an image saved outside Banana, but in the same folder as the .ac2 file. Also indicate the extension of the image .png or .jpg (e.g. "file:document/signature.png").

- Image height (mm): change the height of the image to resize it. The height is in millimeters.

- Styles

- Logo: include the logo in the header. The logo is defined with the command File → Logo setup.

- Logo name: enter the name of the logo customization to be used.

- Font type: define the type of the font. Default type is "Helvetica".

- Font size: define the size of the font. Default size is "10".

The data entered are used to generate the report, which you can then save and print.

Dialog example:

Example of statement:

Example of statement with details:

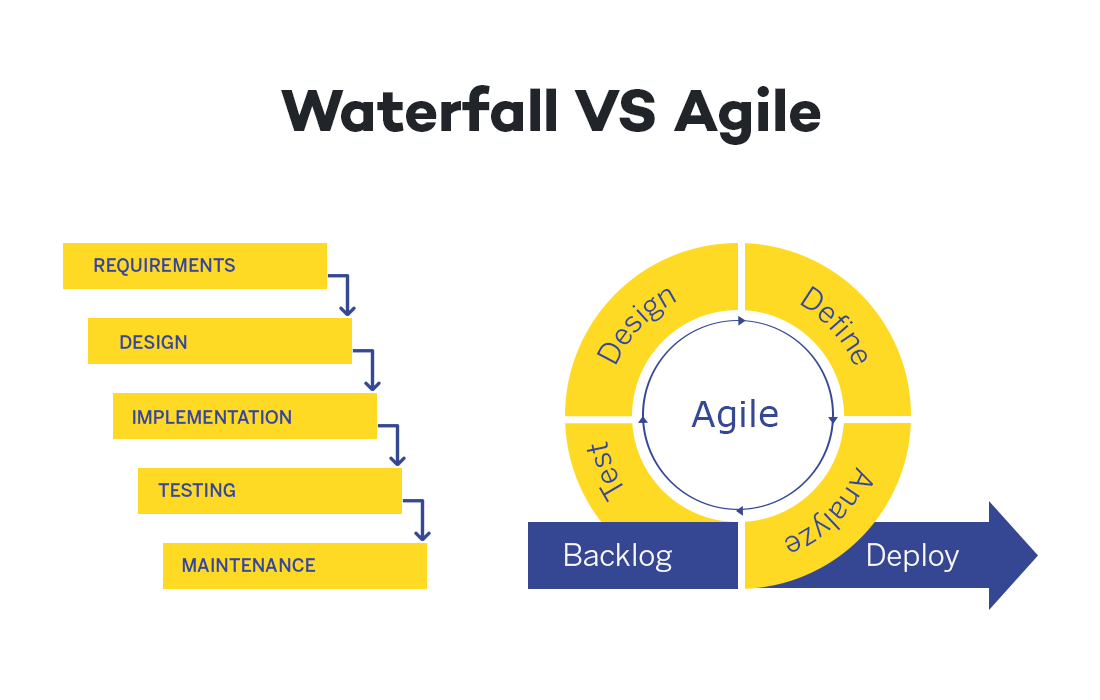

How the Agile method can help NGO projects

Learn what Agile methodology is and how it can lead to effective and dynamic implementation of projects related to NGOs and international cooperation.

Nowadays, inside an NGO it is common to see project management that follows very defined and rigid models. But what are the effects of the Agile applied in the cooperation field? Banana Accounting offers a complete example on how Agile, slowly integrated in a non-profit project, can simplify its management. As a result, you can also obtain more flexibility, adaptability, and efficiency.

Discover the numerous advantages of Agile integration with us. Our experience with the goal to offer accounting training to all the young students in Congo, shows how Agile can be effective also for NGO projects.

Introduction

Most certainly, you already heard about the Agile methodology, often opposed to rigid project management models. In particular, companies mainly focused on making profits prefer to apply this model. But mostly, start-ups and software development companies cannot renounce to Agile for its numerous advantages.

And what do non-governmental organizations think about an agile project management? Unfortunately, at the moment they seem to lack trust on this innovative method. In addition, the institutions that financially support the projects keep adopting the traditional methodology. As a result, it becomes difficult to obtain some money that is used, as it happens in start-ups, to experiment with method procedures from small to large scale.

Yet Agile methodology could be a solution to simplify international cooperation projects, which usually have complicated management. In fact, they often operate in very difficult contexts, with precarious logistical situations, limited financial resources and in very different cultures and environments. The lack of predictability is similar to the one found in dynamic and innovative fields, such as software development and start-ups. But Agile could be integrated with current NGOs models to lead to a smooth management and greater flexibility.

Agile methodology has been applied since the 1990s, however different non-profits are reticent or not very familiar with this option that could be combined with traditional models without disrupting the current management system, thus leading to a better projects achievements.

With this Agile dossier, we would like to present you a project in which Banana.ch plays a relevant role. Being a company that develops software, we always apply the Agile method in our projects. Thanks to it, we have achieved continuous success. But at one point we asked ourselves:

"What if we apply the same model, little by little, in an industry where rigid models are the norm?".

In 2017, we began a collaboration as technology partners with the Ministry of Education of the Democratic Republic of Congo, with the goal to better the teaching of accounting. This aim was clearly quite different from the ones we usually set. But, even in this case, we decided to use the Agile methodology, with the approval of the client who, although unfamiliar, was open to the possibility for a dynamic management. With the Agile methodology we made progress, overcame several difficulties and obtained important results, despite the difficulties in terms of logistics and available resources. In general, we achieved several goals on the accountants training project, managed by the Ministry of Primary, Secondary and Professional Education of Congo.

The method proved to be very suitable for this cooperation project, which operates in complex situations that require great flexibility and adaptability. The educational project was not stopped by cultural differences, the distance between the various stakeholders, very limited resources, unforeseen events and scarce funding. And that's due, in large part, to the adoption of a methodology that is not very known in the non-profit field. Agile was not imposed and the application was gradual so the commissioner could get familiar without getting wary of this alternative management model. After overcoming the initial wariness, thanks in part to the enthusiasm of the Ministry of Education, we were working with management almost based on Agile.

Our journey into Agile methodology for NGOs and non-profits will start by explaining the principles and history. Then we will move on to the accounting education project in Congo. You will discover together with us how Agile can be the solution for an efficient, flexible and optimal management for projects in the nonprofit sector, this to the benefit of all stakeholders involved, but most importantly to all people who will see an improvement in their lives.

It is good to underline that Agile does not have to be broadly applied to the NGO sector. It can be used to manage certain projects, or alongside traditional models and it certainly doesn't have to disrupt the current cooperation frameworks. However, by using the Agile method here and there, you will slowly discover the advantages and features also for the non-profit sector.

As you will see from our example, gradually opening up to new management possibilities can help you achieve certain goals without huge changes.

We will start our journey into Agile methodology for NGOs and non-profits by explaining the principles and history. Then, we will move on to the accounting education project in Congo. You will discover with us how Agile can be the solution for an efficient, flexible and optimal project management in the non-profit sector, to the benefit of all involved stakeholders, and most importantly for people who will benefit from it.

The agile methodology: birth and characteristics

An anarchic computer scientists manifesto

You can manage projects inside profit and non-profit oriented companies by following different methodologies.

The model we're going to explore in depth originates from the software development industry. The Agile methodology has been developed since the 90s thanks to the Agile movement initiated by a group of computer scientists.

The Agile method contrasts with the Waterfall method, one of the classic project management models. Let’s take a look at a real example of Waterfall: a house construction. As the first step, the architect prepares the detailed drawings. Next, the enterprise will get a quote, plan all work phases and deliver the house, as designed. The planning follows a series of clear steps: it will start with the preparation of the site, continue with the excavation and the creation of the basement and the roof. The interiors will be built and the technical systems, fixtures and fittings will be installed in a well-defined sequence and with a progress status that is predicted with precision. This model, however, has great limits, for example a major change in progress is problematic and leads to a high increase in costs. Moreover, the house will stay the same for years.

This waterfall model was the standard in the field of software development. Until, in 2001, some "anarchist" developers decided to make a big change in the software industry by publishing the Agile Manifesto. Their purpose is to create organizational models "based on people, collaboration, and building communities in which we would like to work."

The foundations of Agile

Currently, the four principles of the Agile methodology are being applied outside of the world of IT. Let's take a look at these values:

- Individuals and interactions over processes and tools

The Agile method encourages direct communication between people, so as to reduce possible misunderstandings. There must be a reduction of steps and obstacles between the different members working on the project. - A satisfactory product over detailed documentation

The main indicator of project success is when the product meets the needs of the client. Documentation of the procedure and steps is relevant, but the product is more important. - Collaboration with clients over contract negotiation

Customers usually know their needs better than the software developer or any other product. Therefore, collaboration is essential to determine the next steps in product development. This point is central to the Agile methodology. - Responding to change over following a plan

Updates and changes are inevitable and encouraged. With each round of feedback, the product will be more responsive to customer needs. You need to be flexible and responsive first, the plan is secondary.

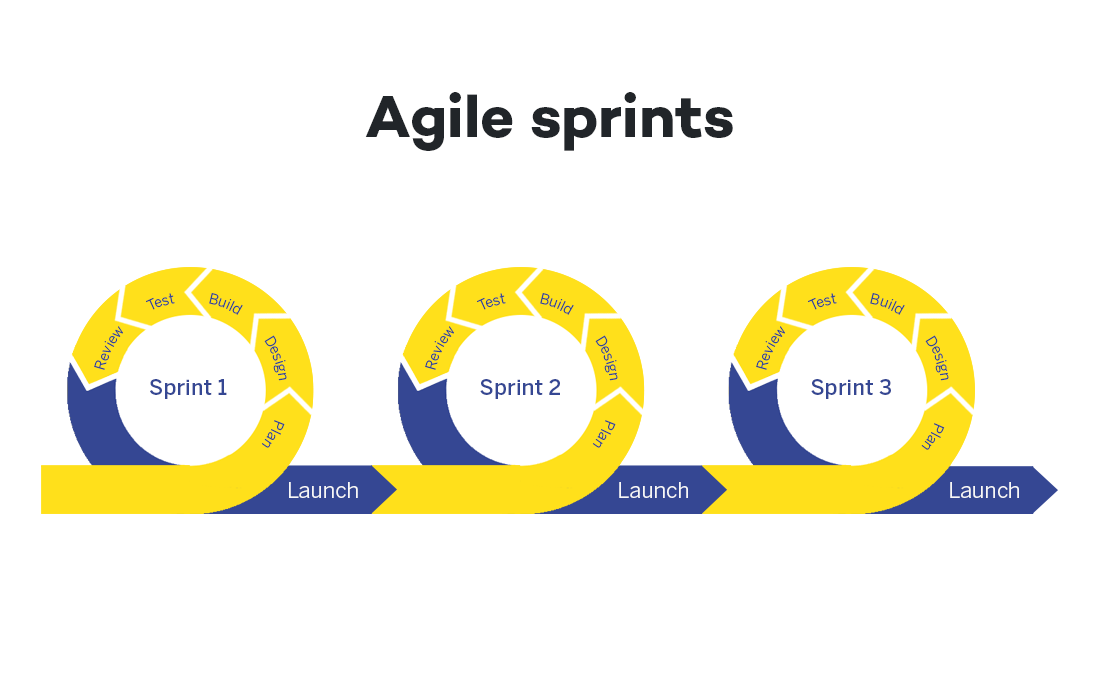

In the Agile method you define a goal, but requirements are stated and implemented step by step. Development occurs in several cycles called "sprints", in which product changes happen quickly. This is obviously in contrast with a project that shows the full solution right away.

Usually projects related to the digital world do not have a predefined sequence and the product is often not physical, so Agile is an ideal method. Initially what matters is a Minimum viable product, which is a first version of the product with minimum requirements. The client then interacts with the developers, provides feedback, reports problems and prioritizes. The final result comes from all the interactions and changes that occur in the different cycles.

A concrete example: website design

Obviously, Agile requires a careful organization of the project. You have to divide it in different phases and find a logical order to implement them. In that way, you can go from the minimum working product to the final product.

To better understand how the methodology works, let's take as an example a company that wants its own website.

- To create an online presence, the firm decides not to ask the website design company to deliver the final product. Instead, following the Agile model, the firm will start by defining its key needs and resources. The choice will probably fall on creating company presentation pages with minimal content.

- In a very short time, the company will have a functional product (i.e. website) and will start collecting data on users.

- These statistics will then be used to determine, in close cooperation with the client, the further development. By assessing the needs, capabilities and resources, it will be possible to define what to achieve in the next "sprint". For example, priority is given to the creation of technical content, or the video presentation, or a online shop or integration with the management system.

- The result may look completely different from what you initially imagined, and the website next improvements will then continue by using Agile.

A methodology that helps all start-ups

The Agile methodology is also very suitable for tackling complex problems, where there isn’t yet a clear final solution. After being applied in the software industry, Agile has become the preferred project management method for start-ups and has also been adopted by large companies to manage projects in very innovative areas.

Start-ups need to be very flexible, so they usually never implement their projects by rigidly fix everything from the beginning. In fact, these young companies proceed step by step, setting up a product prototype to see if the technology works. Then they move on making the MVP to understand if it can meet customer needs. Later, the start-up will improve the product, at some point bring it to market, and so on.

Typically, start-ups work with little resources, so you are constantly checking if you are following the right path and investing in the right places. Thanks to the Agile method, if you don't achieve the expected results or face unexpected problems, it will be quite easy to adapt to a different approach. Experience and results from different project cycles will help set new goals, plan next steps, and decide what investments to make.

Progressive financing

Among its many advantages, Agile uses fundings in a way that well adapts to the start-up world, often faced with great variability and unpredictability, always keeping risks to a minimum. An innovative company like a start-up does not receive funding to run the project in one go, but in a series of rounds.

- It starts by funding a prototype. If the prototype meets expectations, then an MVP (Minimum Viable Product) is financed. The solution can now be on the market and the start-up verifies the interest and response of the first customers.

- You move on to the next round, where you improve the product and, through a marketing strategy, expand the customers’ number. The initial amounts are limited and are generally available without special procedures. The idea, its potential and the capabilities of the start-up team are now evaluated. It often happens that the start-up decides to explore products or markets different from the ones initially imagined.

- In the following rounds there is an increase of fundings, but only if the previous rounds were successful. If the start-up fails to realize the prototype or the product finds little customer interests, the investments are suspended.

Use of Agile methodology in non-profit organizations

We saw that Agile methodology is effective not only for software development companies, but also for the start-up world and in large companies as well. Two decades after the publication of the Agile Manifesto, this model has led to the success of many companies and has been widely used by all kinds of profit-oriented organizations.

Unfortunately, at the moment Agile is not well known among non-profit organizations. In this context the Agile methodology and also other methodologies that use similar concepts such as Design Thinking can be easily adopted and bring important benefits.

In the context of international cooperation the issue is more complicated, because there are public actors, laws, references and others that are difficult to adapt. There is a strong static nature and in addition, unlike the business environment, communication between the different levels: NGOs, funders, local partners and project beneficiaries, is much more complicated and cannot be easily simplified and speeded up. However, there are also attempts to introduce new methodologies in this area, one of which is Adapting Development. Normally, established working standards such as Logical Framework Methodology and Theory of Change are used in the context of cooperation. In order to ensure a successful outcome, it is important to define the phases in as much detail as possible and to set up monitoring and control systems in advance. However, this leads to projects becoming more complex, expensive and less able to adapt to actual circumstances,

In the field of international cooperation, it is unlikely that Agile can supplant existing methods. However, Agile methodology can certainly be very useful as a complement, to manage certain phases of projects. The Agile method could help to:

- Move forward in a progressive way

- Collect feedback constantly

- Plan objectives and approaches in a more informed way

- Cope with problems and unexpected events in a fast and flexible way.

Introducing more dynamism at certain stages of projects would also help improve transparency, communication and trust between the different parties involved.

We now want to present you a well-detailed case of a Banana project created and implemented in collaboration with an NGO.

From "profit projects" to NGOs: the Banana case

Fortunately, over the last few years, the drive to manage "agile" projects has also arisen within some non-profit organizations. They take the experiences of companies that use the Agile methodology as an example, and they noticed that small changes can bring benefits. Even a partial application of the Agile model gives the ability to effectively react to the uncertainty of emergency situations.

Agile methodology could bring numerous benefits to NGOs and more generally, it makes high operational flexibility possible.

- You obtain important feedback on every cycle to adjust the program integrity

- Identify new operating ways that meet humanitarian goals better

- Understand what could be the future developments and respond quickly

- Ability to make mistakes without regret, and learn from them to improve strategy

- Administration and accounting that quickly adapts to change

- Nurture trust among the various stakeholders involved in the project through increased transparency and communication

Among the many Banana.ch projects, we also have a strong example on how the Agile model applies almost perfectly to a project related to non-profit organizations.

In 2017, Babana.ch took part to a project as a technology partner in the Democratic Republic of Congo.

Before explaining the details and developments, we'll start by giving you a context in which Banana.ch had to fit it.

Congo and the education of students in the digital world

The Democratic Republic of Congo (DRC) is a nation with a vast territory located in the center of Africa and it has over 100 million inhabitants. Like other countries in sub-Saharan Africa, the DRC is faced with a large number of difficulties, including logistical, financial and health problems. The population is very young and one of the main challenges is strengthening the educational system and adapt it to digital transformation, so as to reduce the existing technological gap.

In Congo, schools are managed and funded by the counties. On the other hand, the Ministry of Primary, Secondary and Professional Education (MEPST), based in the capital Kinshasa, is responsible for the education coordination in the whole country and is in charge of defining the curricula and teaching materials.

After joining the Organization for the Harmonization of African Business Law (OHADA) in 2012, the RDC adopted the common accounting rules and the Ministry of Education modified the training programs in accordance with the new modalities. Taking into account that most Congolese firms keep or will keep their accounts digitally, the MEPST decided to review the accounting training in professional schools. For this reason, they introduced the use of computers, productivity software (spreadsheets such as Excel, word processors) and accounting programs.

Unfortunately, with the current system it is not possible to solve the digital divide. Currently, students only learn theoretical concepts. This means that once they start working, they have to be trained to use computers and software. Instead, students should receive comprehensive training on some IT tools. This would not only facilitate the access in the working life, but the students themselves could become the promoters of digital modernization in the Congo companies and public agencies.

The Cellules's plan facing a major limitation

In order to solve the digital divide, the Ministry of Education entrusted in 2015 the Cellules des Branches Commerciales of the Direction des Programmes Scolaires et Matériel didactique (also called Cellules) to implement a plan to improve digital skills in more than 4 thousand schools. This project is part of the Ministry's broader strategy to promote digitalization, which also involves the primary, secondary and professional sectors.

Unfortunately, there was one major limitation: a large number of the schools did not have computer classrooms. In addition, the Government of DRC, as well as its provinces, has limited financial resources, and free education for pupils is already a great challenge. However, it remains essential that schools are equipped with computers, especially if students want to get familiar with certain software.

Accounting in Congo: the OHADA system

Among the various steps of the educational project, the Cellules had to select an accounting software, which complies with OHADA regulations and is also suitable for teaching. Thus, in 2017 they contacted our company Banana Accounting.

Our software caught their attention since it is suitable for small businesses, it is used in several countries and has obtained very important references in the field of accounting. Besides that, Banana software is also available in French, the official language of Congo, and offers a free license for educational purposes. The Cellules realized that Banana Accounting software was well suited for teaching in Congolese schools.

Another essential aspect in the selection was the compatibility with the accounting system, therefore the program must be aligned with chart of accounts and the reporting used by OHADA. This system is used by large companies, has a specific numbering and also includes fixed schemes for the balance sheet presentation, the profit and loss account and the capital flow account. During the preliminary stages, the Cellules requested the collaboration of the Conseil Permanent de Comptabilité au Congo (CPCC). From then on, the Banana's project to train students on our accounting software has begun.

The begin of the project and the first difficulties faced with Agile

In normal situations, we organize meetings between the different stakeholders and the developers. In that way, we can clearly define the project functionalities

But the project with the Cell did not start in a smooth way. Domenico Zucchetti, CEO and founder of Banana.ch travelled to Nairobi (Kenya) for a brief training session, but after it was no longer possible to meet in person. Other means of communication were very limited, so it was not easy to efficiently collaborate and carry out the project. Therefore, we proposed the integration of an alternative solution.

Within Banana.ch we have always applied the Agile methodology for any project, it is normal for us to follow a progressive, tackling one problem at a time. We are aware that going step by step, with close interaction between stakeholders is essential to work remotely and with very different cultural and operational contexts. That is why we decided to suggest a new method for the project in Congo, and we convinced the Cellules to apply Agile.

Thanks to the Agile modeling, Banana.ch and the Cellules of the Minister of Education have been able to face the hard project path. Slowly, this methodology was applied to each phase of the project.

Regarding the first phase, that is developing a software that meets OHADA's accounting rules, we solved the various snags thanks to Agile.

- COMMUNICATION

As the main contact, Zucchetti turned to Didier Kinano, the Cellules Director. Directives were typically reported via email and phone calls. In turn, the Banana Accounting CEO explained the Banana functionalities to achieve certain results and then he gave directions to his software development team. - THE FIRST CRITICAL STEPS

Even though there was a good collaboration, the division of tasks was too complex and the communication possibilities were not fully exploited. In addition, we had to face limited work progressions. After numerous iterations, the chart of accounts was finally completed with the corresponding balance sheet printouts and income statement. - THE COMPLEX PHASE

Banana.ch then tackled the most complex part, that is the creation of the capital flow account, with the related revision of the chart of accounts. Mr. Kinano gave instructions and then checked the results’ correctness. - A FLEXIBLE VERIFICATION SYSTEM

Having reliable test is an important element of the Agile methodology. In the case of the project with the Cellules, our developers had difficulties because they were not familiar with the OHADA system and did not know how to test the functionalities. Hence, Kinano had to prepare accounts that were used as tests. This facilitated rapid progression because the developers could avoid regressions, without being in contact all the time. - A NEW DEVELOPER

Banana.ch was also able to make progress at the level of capital flow reporting. Later, we started a collaboration with a developer based in Kinshasa, who received instructions directly from Kinano and turned to Banana.ch for the programming part. - THE LAST STEPS

Finally, Banana.ch was able to realize other reports and to implement the management and printing part of the VAT statement according to the templates required by the local tax authorities.

Agile: winning collaboration for the accounting project in Congo

Using the Agile method to implement the accounting project in Congo turned out to be a winning choice.

Our role was limited to technical assistance for the installation and use of Banana Accounting, as well as the adaptation to the OHADA System. Moreover, not being on site, we had a very limited view of what was going on and we were not particularly familiar with the educational system of Congo. Although we did not have a clear management view (the Ministry was in charge), the Agile method allowed us to achieve goals.

Didier Kinano had become our reference person. The talks were focused on technical aspects, but sometimes we discussed the project in a broader way. Little by little, Domenico Zucchetti got a better view of the various stakeholders, the context in which they operated and their available resources. At one point we could start with the implementation of the new digital accounting system in Congo.

The implementation of the digital accounting system in Congo

As a first step, the Ministry's plan was to provide schools with computers, then install the software and train teachers and students. However, most of the schools did not have computer rooms, and some did not even have electricity!

The available resources were very limited and it was not possible to ask more from the Congo Government, since it was already busy ensuring the free basic education. Support from third parties was also unlikely, so the prospect to have more computers appeared remote. There was a lot of concern on the project realization. But with Zucchetti's suggestion, something began to change:

"The situation didn't seem that bad to me. In fact, the Ministry was in the same situation as many start-ups, where you find very ambitious and transformative ideas, united by great motivation and capacity, but with many obstacles and very limited financial resources. I told that it would probably be very beneficial if the Ministry adopted start-up-like operation modes, that aims to make the most of existing resources."

Unexpectedly, this remark aroused a lot of interest, which is quite uncommon in government departments that have operating modes very different from the start-ups ones. Instead, in the following meetings, the Ministry became open to approach problems in a different way.

One reason for this acceptance of the Agile may lie in the different level of predictability between Europe and Africa. In Europe, the degree of unpredictability is very low and, especially, there is little flexibility in public administration. On the contrary, in Africa, the population and public officials are faced with great unpredictability. Unforeseen difficulties force them to come up with new solutions. In essence, Banana.ch saw that in Congo people are more willing to adopt and use the Agile methodology.

Exploiting available resources for great results

The next step in the project included defining the path implementation through existing resources.

The Democratic Republic of Congo has a large territory, even though most schools did not have appropriate infrastructure, a few of them had computer classrooms. As we could expect, there weren’t the next generation of computers, but they were perfectly suited to install and use Banana Accounting.

We then provided the software in some schools in the capital Kinshasa. The accounting teachers showed great interest and requested training in order to familiarize with Banana Accounting. The Cellules prepared the informative material, being very competent in its role. Thus, in a short time, they set up a 13-day training course, both for the software and for the OHADA system. The teachers who attended the course were very satisfied, so, the Ministry set a plan to train more teachers with the existing resources.

Thanks to the gradual change in methodology towards Agile, the project progressed without major hiccups. We didn’t have to wait for all schools to be equipped with computers. With time, Banana Accounting was installed in several computers and the number of trained teachers was raising too. We then moved on to the phase of teaching to students, with considerable success. Installation and software training expanded to other provinces, always with great interest.

New issues arose regularly, but by applying the Agile methodology, the Ministry was able to solve them shortly. We developed small-scale solutions, making adjustments quickly and then implementing them in other schools. For example, Congo's program involved using handwriting for exams. The Ministry then introduced the option to have exams with computer to schools with suitable classrooms. This experience then served as a basis for solving new or similar problems, improving the system and then introducing it to other schools. The strategy was constantly improved sprint after sprint, reducing unforeseen problems and making the best use of available resources.

From small goals towards a long-term vision

Usually Agile helps achieving short-term results, but it is also extremely effective for a long-term vision.

Keeping in mind that technological development rapidly evolves, we are aware that some solutions can become obsolete in no time. Therefore, it is very important to update the long-term project vision and check whether we are going in the right direction.

In large-scale projects such as the accounting in Congo, one of the most important tasks of the technological partner (Banana.ch) is to find lasting solutions to integrate new technologies. In this case, as seen above, the main problem was the difficulty to equip all Congolese schools with computer classrooms.

How to solve the IT classrooms’ problem

Banana.ch has been providing its software to Swiss schools for many years. However, in Switzerland a shortage of computer rooms is not a problem at all; moreover, all the students of professional schools already have a laptop. So, in Switzerland, schools are adopting the Bring Your Own Device (BYOD) model and are no longer investing in IT classrooms. On the other hand, in Congo the situation is different because the buying power is lower and teachers and students cannot afford a laptop.

Working closely with ministry officials, we came up with an alternative scenario. In the DRC, all teachers and students from professional schools have a cell phone. Thanks to technological advances, we predicted that students will soon have smartphones as well. So, we adapted to their current situation and we have focused on:

- Improvements of Banana Accounting on the mobile operating systems (Android and iOS) until it is almost in line with the desktop version.

- Possibility, also on mobile, to keep the accounting without connecting to the Internet, since in Congo the connections are not always fast and have significant costs.

Keeping accounts on a cell phone is certainly not the ideal solution. But knowing that learners will have a smartphone, we are sure they will keep accounts by using ERP functions (enterprise resource planning software), even without connecting to the Internet. As a result, by the time students find a job, they will already be ready to use accounting software.

We have noticed an increase in the use of the mobile version of Banana.ch in Congo, a sign that the strategy is working.

Adaptation to new technologies: the BYOD model in Congolese schools

At the moment, we see a convergence between the use of mobile and desktop software. The Ministry of Education in Congo presented a new technology available, for now, on high-end smartphones. Teachers can activate the Android Desktop Mode by connecting a monitor and keyboard to the latest generation smartphone. The small device is thus transformed into a real computer.

In the years to come, thanks to technological progress, this feature will certainly be available also for less expensive smartphones. Even Congolese students will have the chance to use a phone that becomes a computer. In that way the BYOD model can be adopted, and we will eliminate the problem of computer classrooms.

This scenario seems more and more realistic, and the Ministry is looking for a new plan to train teachers with the new modalities. In the future, when desktop mode will be possible on smartphones, Ministry officials should be ready to deliver a training that fits this new technology.

The MEPSP has already set up a plan for training several people in the different provinces, who in turn will train teachers on the OHADA accounting system and on the use of Banana Accounting.

With time, the Agile methodology has become integral in the collaboration with the various stakeholders, but we also used it to experiment with new technologies and new interesting solutions. You don’t need to change the current NGO project management system to see results with Agile, but in our case a wide application made the achievement of many objectives a lot easier.

Financing the project in Congo

In the case of the educational project in Congo financing, the Ministry had not a lot of money source. Then there was the COVID pandemic in 2020, which brought the finances of many states, including the DRC, to their knees. We had to find other ways, so we decided to present the project to possible financing entities. Following the Agile method, we develop a documentation and fundraising structure starting with very limited funding, necessary to offer the training and to find new solutions. Then, in later stages, these solutions can eventually be applied on a larger scale. We divided the project for extending the training in new provinces into blocks, making the figures affordable for many foundations and organizations.

| Indicative budget for seminary in the provinces |

| Activities | Cost |

|---|---|

| Accomodation for 2 educators (13 nights) | $ 800 |

| Catering for 2 educators | $ 400 |

| Lunch break for 52 participants (12 days) | $ 6.000 |

| Remuneration 2 educators (14 days) | $ 4.000 |

| Round trip 2 educators | $ 1.500 |

| Total investment for 1 seminary | $ 12.700 |

| Total investment for the 37 provinces | $ 427.000 |

| Fundraising (50% of costs) * |

$ 223.500 |

However, we encountered a major limitation: the Agile methodology is not well known in the international cooperation sector, and funding is usually granted for complete projects, with rather complex and bureaucratic decision-making processes.

In our case, all the stakeholders could see that the project managed with Agile was valid and suitable. In fact, the different phases made possible the consolidation of the existing school system. The positive impact of the project is evident because the beneficiaries, or the new generations of students, will be better prepared for their job and will have a greater chance of finding employment.

Despite the results, at the moment we have not yet found support from foreign fundings. The amounts required are small, but unfortunately in the cooperation world it is still complicated and expensive to develop funding strategies, since planning is only done with the waterfall method. Contrary to the world of start-ups, there is not yet a predisposition on granting support in a progressive manner, open to the development of new solutions.

A perspective towards widespread use of agile in NGOs

The successful project management of digital accounting in Congo is just one of the examples that show the effectiveness and suitability of Agile in the non-profit area. We are not there yet, but so far we have considerably progressed in a difficult context. This model made possible to make the most from available resources, skills and organizations that are already well structured and widely present in the area.

Agile applied to NGOs opens perspectives that were unthinkable a few years ago. Surely, the integration of this method will be very useful to international cooperation projects, all characterized, more or less, by a high degree of difficulty, variability and unpredictability. Agile can become a project management option, without affecting the currently-used non-profit methodologies.

We hope that this project in which we are involved demonstrated you the high potential of the Agile methodology. NGOs could consider to apply it to improve the effectiveness of interventions and to facilitate the granting of small amounts for humanitarian projects.

With the hope that Agile will be integrated in many non-profit projects, we invite you to reach us if you have any questions on the educational accounting project in Congo or about the use of Agile in the cooperation sector.

References

Helms, B. (2019, 10 settembre). Can the Development Community Adopt Agile?. DAI. https://dai-global-developments.com/articles/can-the-development-community-adopt-agile.

Manifesto for Agile Software Development. (2001). Agile Manifesto. https://agilemanifesto.org/

Modernisation de la formation en comptabilité au Congo RDC. (2020, gennaio). Banana.ch. https://www.banana.ch/fr/formation/comptabilite-rdc.

Terbeche, M., Carrier, M. (2019, 26 marzo). An “Agile Manifesto” for humanitarian and development projects. Groupe URD. https://www.urd.org/en/review-hem/an-agile-manifesto-for-humanitarian-and-development-projects/.

(2018, 2-4 ottobre). Humanitarian Aid on the Move No. 20. [Relazione a convegno]. Groupe URD. Autumn School on Humanitarian Aid. https://www.urd.org/en/review-hem/humanitarian-aid-on-the-move-n20/.

Shafiq, M., & Soratana, K. (2019). Lean and Agile paradigms in humanitarian organizations' logistics and supply chain management. LogForum, 15 (1).

Trish. ( n.d.). Agile for Nonprofits: A Project Management Method. Springly. https://www.springly.org/en-us/blog/agile-method-project-management-method-nonprofit/.