Cash book

Introduction

The ideal tool to manage the cash account of small sized companies, associations, private enterprises or project planning.

It can be configured with or without VAT. On the other hand, it does not have the multi-currency functions.

Features

- Manages your cash account, or another estate account and income and expenses

- VAT option allows VAT calculations and VAT tax returns

- Process all your accounting records: accounting journal, account cards, periodical and annual reporting

- Manage the Cost Centers and Segments

- Several possibilites to submit and present your data

- Export to Excel, Html, Xml, Pdf

- Import various types of data files.

Tables and Properties files

The Cash book is part of the Income & Expense accounting type. It contains the following tables:

- Accounts

Where you find the Cash account or another estate account you manage and the relative opening balance. - Categories

Define the categories of Income & Expense here, the Cost Centres and their segments. - Transactions

Record your transactions here. - VAT Codes

If you have selected the VAT option, enter your VAT codes here. By selecting one of the VAT templates, VAT codes will be allocated correctly, allowing you to have a facsimile of your official VAT statement. - File and accounting properties

Manage the general settings of your accounting here.

Immediate information

The account balances will be displayed instantly in the Accounts and Categories tables, after the income and expense recordings.

Balances will be adjusted automatically after each registration of a transaction and you will not need to require a specific report to have an overview of your financial situation, which you can call up via the Accounts and Categories tabs.

Support

- Detailed information on the different functionalities of the program, with concrete examples and screenshots of the software, for your use

- Free support for one year included.

Topics similar to Double-entry accounting

Commands

Printouts

Getting started

To start working with Banana Accounting 8 software, proceed as follows:

- Download Banana Accounting 8 software

- Install Banana Accounting 8 software by inserting the license key.

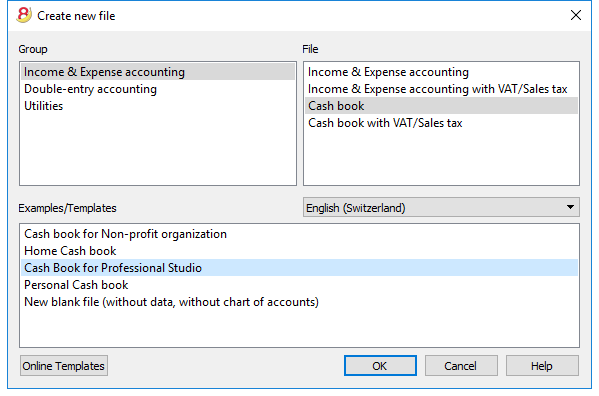

Creating a new accounting file

- From the File menu, activate the New command

- Select the Income & Expense accounting group and the Cash Book File (with or without VAT)

- Select the Examples/Templates according to your language and nation

Banana provides predefined templates.

You may download:

- from the program - select the language / country and choose the model that suits you

- Clicking the button Online Templates - you will access our Apps page internet site, where all existing accounting templates are available free of charge. You can run a detailed search by entering the language, country, and category of activity (company type, non-profit, independent ...).

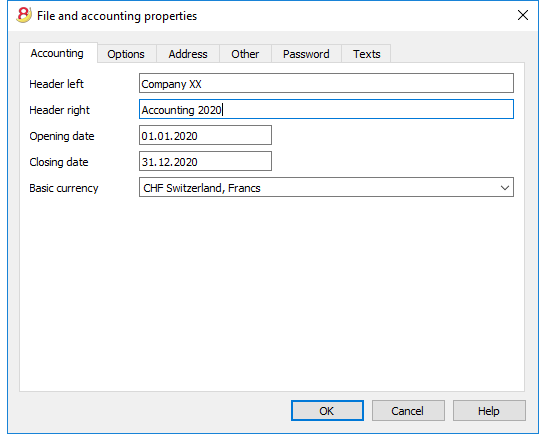

Setting up the File properties

Set up your own data from the File and Accounting properties command and save with your own file name.

Inserting the opening balance of the account

Enter the account you wish to manage in the Accounts table of the Cash book and the initial amount in the Opening column.N. Activating the Creating a new year ... command in the Account2 menu will automatically generate the opening balances to be carried forward.

Only one account can be entered at a time.

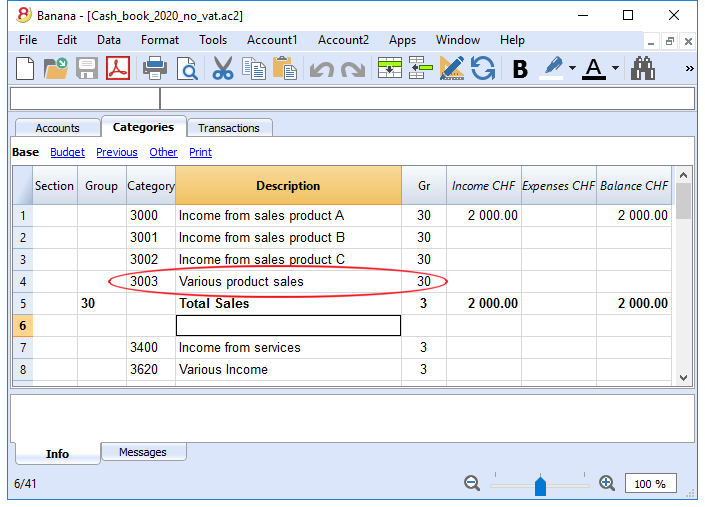

Customizing the Categories table

In the Categories table, customize the income and expense categories, according to your own needs. It is possible to:

- change the category numbers

- change the description

- delete categories

- add categories

- insert subgroups

- delete subgroups

All balances of the categories will determine the result of the accounting year (profit or loss) and must therefore not contain any balances.

Add new categories

If new categories need to be added in an already existing group, proceed as follows:

- Insert an empty row (Edit menu, Insert rows ... command) before the Total of the Group

- Insert the number or sign for the category in the Category column

- Insert the Description that identifies the category

- Insert the identical Gr of the other categories belonging to the Group Total in the Gr column.

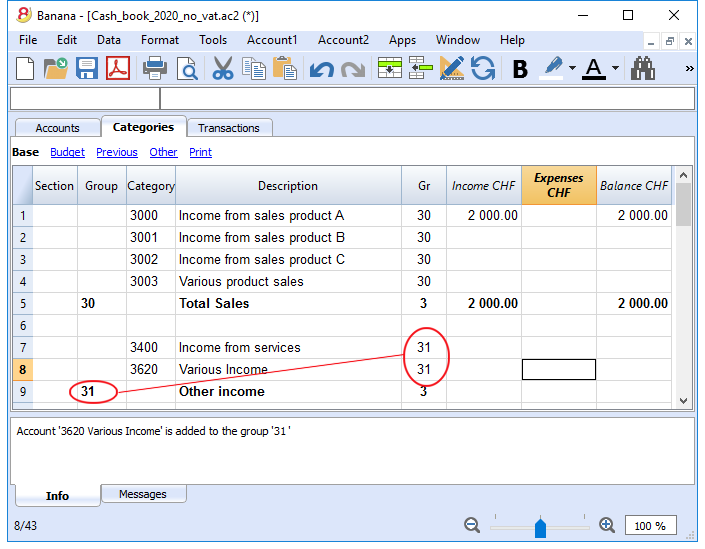

Add subgroups

To add new subgroups, proceed as follows:

- Insert an empty row (Edit menu, Insert rows ... command) where wish to add a new subgroup

- Insert a number or sign in the last empty row of the Group column (in our example 31 - Other income)

- Insert the Description that identifies the new subgroup

- Insert the Group Total number in the Gr column (in our example 3 - Total sales).

Delete categories or subgroups

Select the categories or subgroups you wish to delete and proceed in the Edit menu, Delete rows ... command to eliminate.

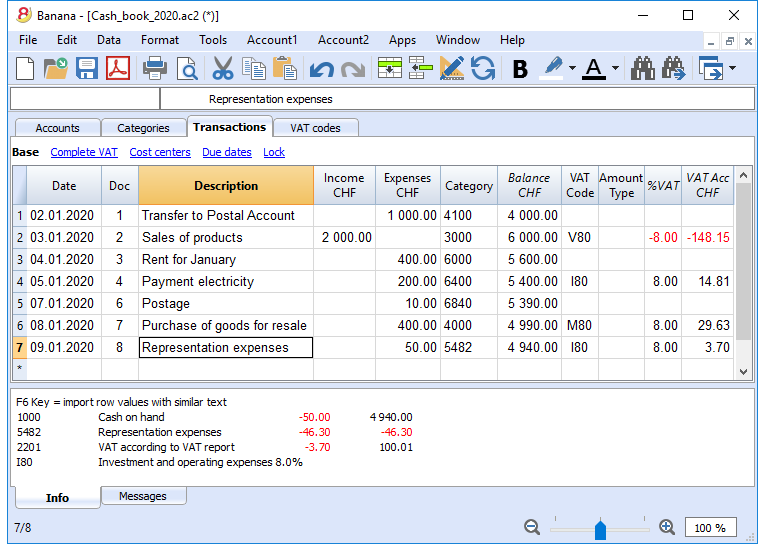

Transactions

In the Transactions table, income and expense transactions are entered, indicating the category to which the income or expense is attributed.

Speeding up the recording of the transactions

In order to speed up the recording of your transactions, you can use:

- the Smart fill function that allows the automatic autocomplete of data that have already been entered at an earlier date.

- the Recurring transactions function (Account2 menu), used to memorize recurring transactions into a separate table.

- import of your bank or post office statement.

Transactions with VAT

In order to enter transactions with VAT please proceed as follows:

- from the File menu, choose New command and choose Income /Expenses accounting - Cash book with VAT/Sales tax

- Choose one of the existing templates for your nation.In order to enter transactions with VAT, please refer to the Transactions page.

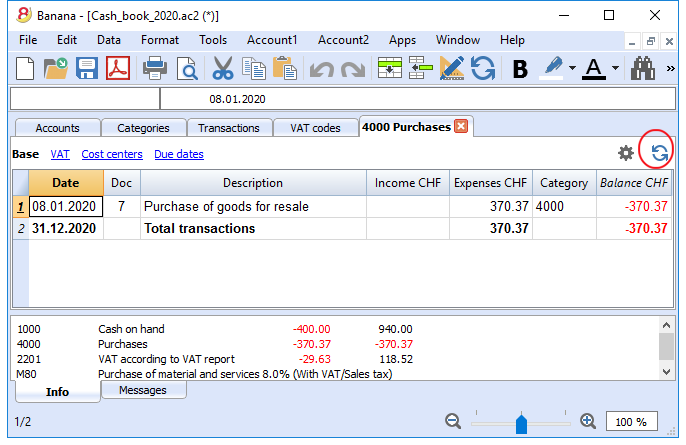

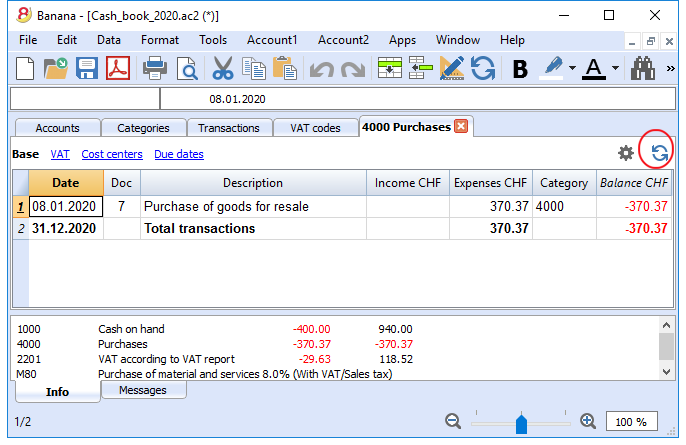

The Category or Group card

The Category or Group card allows you to have a complete list of accounting entries relating to the same category or group.

- To open an category or group card you click once on the account number cell and then click once on the small blue arrow appearing in the upper right corner of the cell.

- To open multiple category or group cards you must select the Account cards command from Account1 menu.

- To update the category or group cards, following changes in the Transactions table, you must click on the two circular arrows symbol, located at the top right corner of the account card.

Account cards per period

To open an category cards with account balances at predefined dates, click on Account1 in the menu, Account/Category cards ... and click Period selected in the Period tab to insert your selected period.

Consult the Period page for further information.

Print the Category card

To print a Category card, open it from any table (Accounts or Transactions) and start printing from the File menu.

To print out several or all the Account/category cards, click Account1 menu, select Account/category cards and select the accounts/categories you wish to print. The filter in the window allows you to select automatic selection of all categories, cost centers, segments, groups etc ...

For further information refer to the Account Cards page.

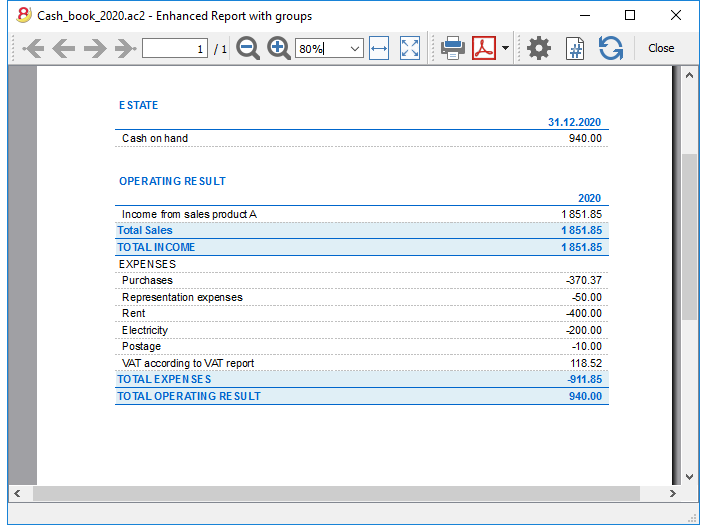

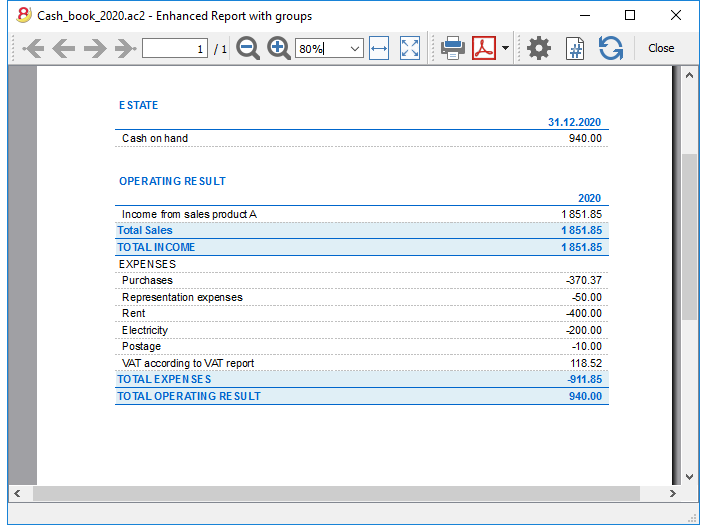

Enhanced Statement

To view the Enhanced Statement and the Enhanced Statement with groups, choose the Account1 menu and then the Enhanced statement or Enhanced statement with groups command. You can also obtain statements by period.

- The Enhanced statements displays all accounts and categories without any subgroups

- The Enhanced statements with groups displays all accounts and categories also with subgroups

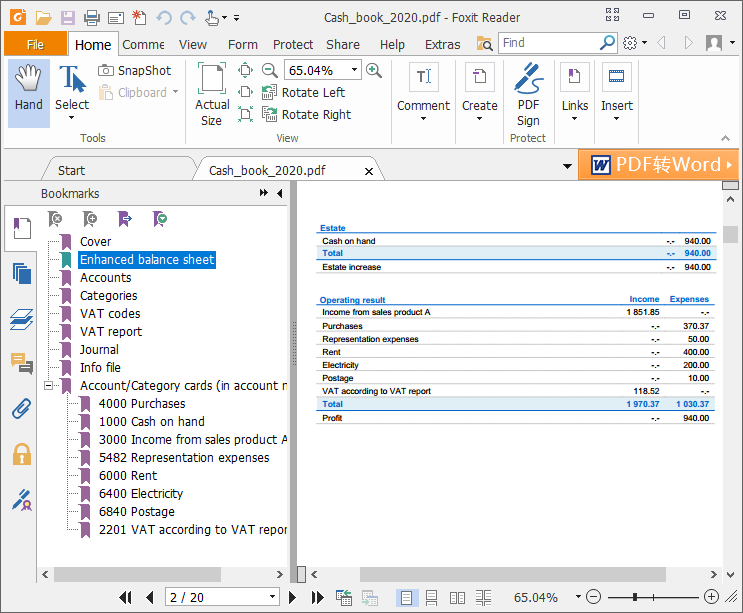

Archive data in PDF format

At the end of the year, when the accounting is done, corrected and revised, you can store all accounting data with the Create Pdf dossier command from the File menu.

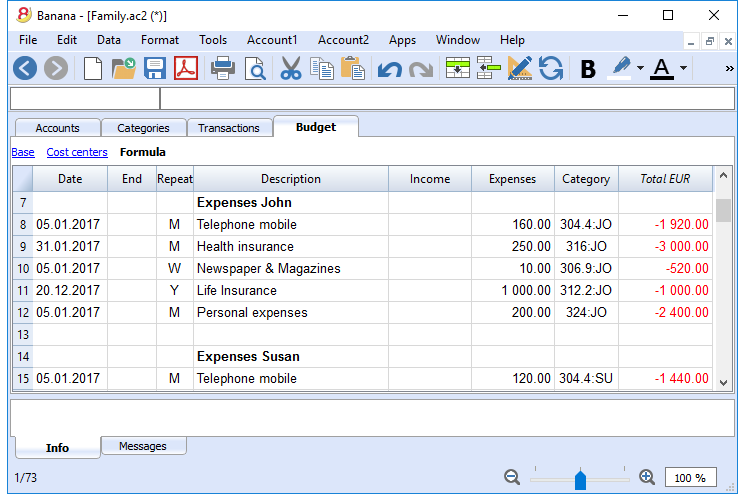

The Budget

Before starting your accounting year, you can create a budget with your assumed expenses and revenue, in order to have control over the financial and economic situation of your company.

The budget can be set in two different ways:

- From the Budget column of the Categories table. For each account the yearly budget is indicated.

In this case, when you process the budget from the Account1 menu, Enhanced statement with groups command, the Budget column shows the amounts that relate to the entire year. - From the Budget table, that you need to manually activate using the Add new functionalities command from the Tools menu.

In this table all estimates are entered as budget transactions, either income or expenses. If you activate this table, the Budget column of the Accounts table is automatically deactivated.

In the Budget table you can setup a detailed budget that takes into account possible variations during the year and in different periods of the year.

Printouts

Instant information

The account balance and those of the income and expense categories are on ready display in the Accounts and Category tables.

After each entry of a transaction, balances are adjusted automatically and there is no need to run a report, as you can simply display the Accounts or Categories tables.

Advanced printouts

All printing is run from the Account1 menu, where the different functions for prining are located:

-

Journal - command to define the period. You can display and print the whole table or just a specified period.

-

Account/Category cards command. You may select all cards or define your selection.

Define the required period in the Period tab and click the required settings in the Options tab. Print settings can be saved in the Composition tab so they can be resumed without them to be having defined again. -

Enhanced statement command. You may also print a defined period and various options and compositions may be included.

-

Enhanced statement with groups command. You may also print a defined period and various options and compositions may be included.

-

Accounting report command. The required options are displayed in the Accounts table. Reports are possible for current, previous periods or previous years; each period may contain subdivisions and the compositions can be saved.

Example of printout of Enhanced statement with groups

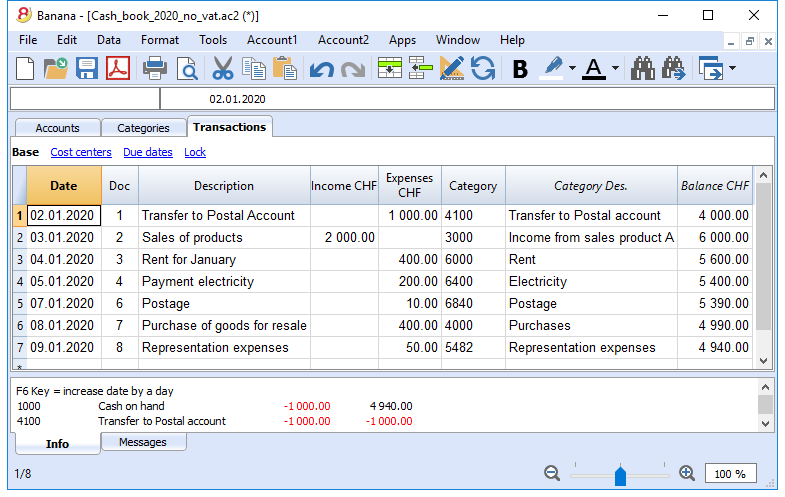

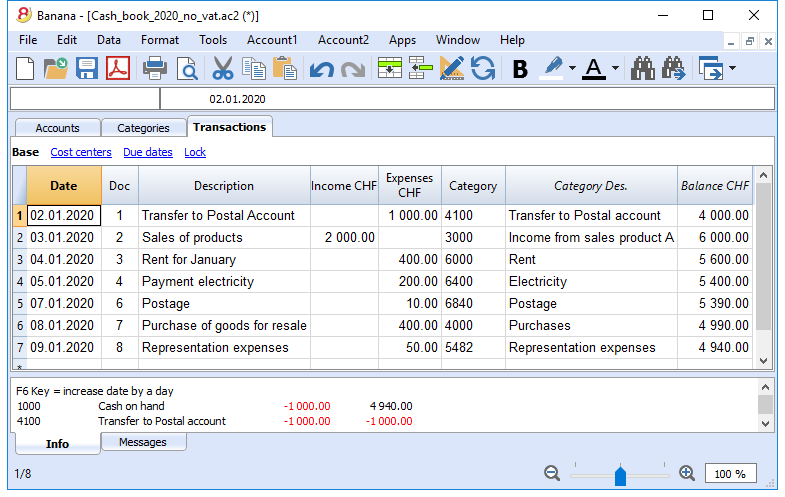

Transactions

The transactions are entered in the Transactions table.

For further information relative to the columns used in the Transactions table of the Cash book, refer to the Transctions (Income & Expense accounting) page.

For each operation enter the following:

- the date

- the document number

- the description

- the income or expense amount

- the category relevant to the income or expense in the Category table

- should the transaction be subject to VAT tax, enter the VAT code in the VAT code column.

The VAT codes are listed in the VAT codes table.

Speeding up the recording of the transactions

In order to accelerate the recording of the transactions, you can use

- the Smart fill function that allows the automatic autocomplete of data that have already been entered at an earlier date.

- the Recurring transactions function, used to memorize recurring transactions into an appropriate table.

- importing bank or post office statement.

Examples of transactions without VAT

Examples of transactions with VAT

Category card

To display the entries of a category, click once on the small blue arrow appearing in the upper right corner of the cell.

The display of entries in the Categories table is identical to the one in the Transactions table.

To update the category or group cards, following new entries or changes in the Transactions table, you must click on the two circular arrows symbol, located at the top right corner of the category or group card.