In this article

Banana.ch a blockchain pioneer

Banana.ch has been a pioneer in blockchain in the financial field. In 2002, it was the first company in the world to introduce a security system within an accounting software with progressive digital seals, which also obtained a patent. Later, in 2008, with the advent of the Bitcoin virtual currency, the progressive digital seal technology took the name of blockchain.

Banana Accounting users have been able to appreciate this modern tool for many years. The success of the bitcoin cryptocurrency has allowed many people to understand the potential of this technology.

This document has been drawn up in preparation for a speech of Domenico Zucchetti, founder and CEO of Banana.ch, at the conference on e-commerce in Guanzhou (Canton, China) on October 11, 2016.

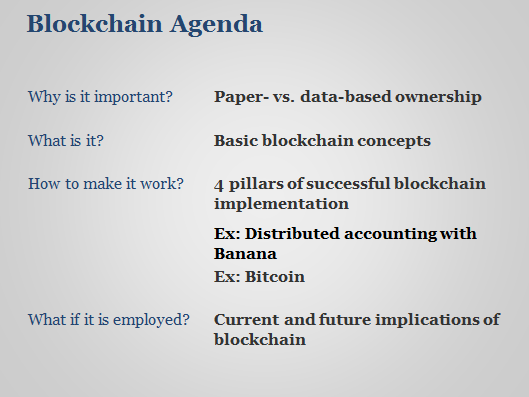

Blockchain agenda

The economy based on paper documents and trusted intermediaries

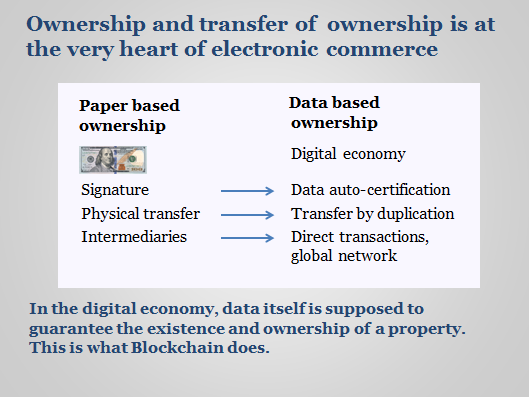

The essence of commerce is to exchange property. Paper and writing have been used for many centuries to prove the existence of a right or an obligation. Banknotes are the most obvious example of a value associated with a document. The paper support is used in any field: to prove the purchase of a car or a house, the lease of a flat, a marriage or a divorce. Also registers that certify the ownership of a land or a person's birth, nationality and voting right have been in paper form for many years.

Given the importance of paper documents, proper systems have been developed to keep them and prevent counterfeiting, being the signature the most common one (when parties enter into an agreement, they sign it and as many counterparts are signed as the number of the parties involved).

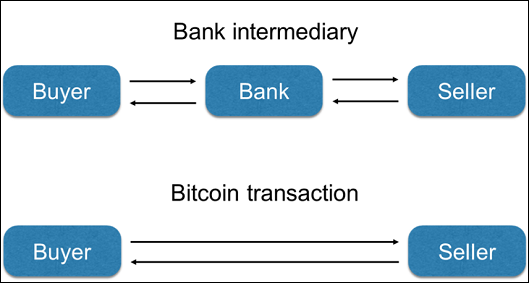

In order to transfer the value associated with a paper sheet (e.g., banknotes, shares or other securities), it is obviously necessary to transfer the paper sheet. Entering into an agreement needs people who sign the same document. In past centuries, when the international commerce developed, the transfer of paper was not always simple or possible. Therefore, the figure of the intermediary emerged. Instead of physically transferring the values, these were transferred to a bank, which was then instructed to ensure that the stated recipient could receive the amount. The bank, relying on other intermediaries and with accounting movements, with no risk of losing the amount, could make the fund reach the recipient anywhere.

The system implies a relationship of mutual trust. Indeed, the intermediary could use the deposited funds in a different way and the property could be lost. Moreover, the intermediation service has costs to be charged to the client. However, this system based on trust has proved to be quite effective in many fields. Services related to intermediation have exceptionally developed over time.

Towards a digital economy

The use of computers started in the ‘50s. IT has simplified and accelerated processes and allowed for millions of orders to be processed, but until now it has not actually changed the system based on intermediation and trust.

Experiences made with bitcoin and other virtual currencies show that a new phase is beginning, that of a fully digital economy, where data themselves incorporate and ensure the existence of values and transfer them with no intermediaries.

This change is based on the combination of three elements:

- Transferring data by duplication. Data can be copied from a computer to another. Therefore, it is this function that allows to exchange documents with no physical movement.

- A global communication network. Each person can send information to any other person in the world. Thanks to the Internet, people can come into contact directly, with no need of intermediaries.

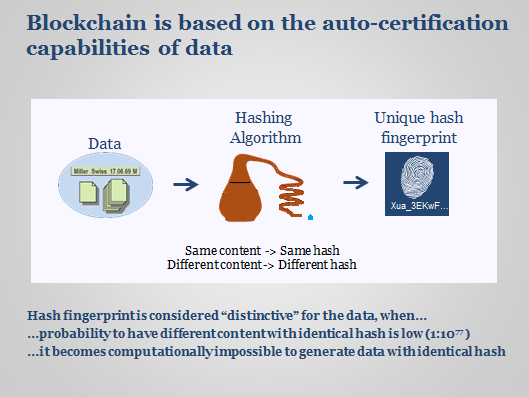

- Data auto-certification property. Computerised algorithms allow to calculate the digital fingerprint of data and verify the integrity of the content of a single document (hash) or a collection of documents (blockchain). Therefore, it is possible to incorporate values on data (as for banknotes) and make data themselves certify the existence of the value itself in a safe manner.

Payment through an intermediary and using bitcoin.

In the new economy - the digital one - data itself guarantees the existence of the value.

The digital fingerprint (hash)

Communication through computer networks is made fast and safe thanks to algorithms that pack, compress and verify the authenticity and integrity of data. All these functions developed thanks to the science of cryptography, whose primary goal was to hide the transfer of data to make them unintelligible to people not authorized to read them.

The basic algorithms of cryptography include functions that allow to obtain a digital fingerprint from any series of data. A digital fingerprint is a code consisting of a series of characters, for instance “XUMaKwFt.qNs6BLmR._q0Mxa5R.ydxufw8oT-Q3N8isOxY”, which univocally identifies the content of a digital document.

If the content is the same, the fingerprint will be the same; if the content is different, the fingerprint will be different.

The digital fingerprint is called hash because it does not allow reconstructing the original document (unidirectional property).

When a computer sends data to another computer, it sends also the hash. The receiving computer calculates the hash on the data received and, therefore, can check whether there have been errors in the transmission.

A hash can be calculated even on huge data volumes. Since the input data are larger than the hash, there can be different similar combinations. The probability of a different file having the same hash is very low (1 out of 10 raised to the 77th power). The probability is even lower with larger hashes. The hash algorithms used for certification have a fundamental characteristic: they make computationally impossible to create different documents with similar fingerprints (so-called collisions). The possibility of creating different documents with similar fingerprints would make the system totally unsafe. Indeed, original documents could be replaced by false documents.

Blockchain: digital fingerprint for growing data

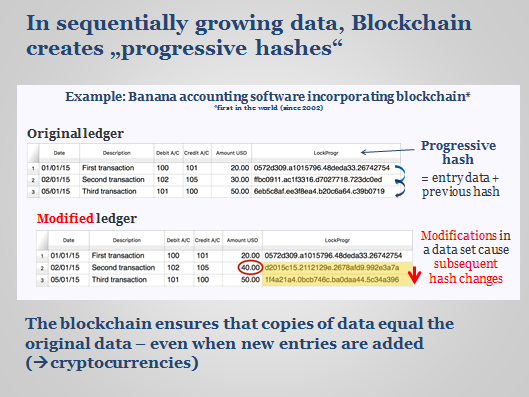

The hash system ensures the overall authenticity of data that do not change. However, in the IT reality we have to deal with collections of data that continually grow and where the sequence with which events are recorded is as important as the content itself. The ledger of the cash movements of a bank is a typical example of it. Customers make transactions at all times and the sequence is crucial, since funds are allowed to be transferred only if they previously arrived in the account.

In order to ensure the authenticity of these structures, systems are used to create blockchains that calculate the digital fingerprint of growing data collections.

There different ways to cryptically concatenate a set of data. Bitcoin uses a tree certification structure (Merkle tree) which is more difficult to explain.

The blockchain system is explained below with the approach used by Banana Accounting, which is easier to understand because it crypto-concatenates movements by using a linear structure.

In the accounting movements there is a column called Progressive hash. This column displays the hash calculated based on the registration data and the hash of the previous registration. The progressive hash is the digital footprint of all the accounting movements from the first to the current registration. When new registrations are added, the new hash is calculated without altering the previous one.

At the month or quarter end, after checking the accounts and drawing up the VAT return, records are blocked and the programme calculates the progressive hash of the blocked transactions. By entering the number of line and the hash of the last registration in the VAT return, it will be possible to prove afterwards that the registrations are exactly those of the day when the VAT return was drawn up.

If a transaction is changed the progressive hash will change for all the accounting data.

Therefore, this system meets the requirements on accounting data storage, since people in charge of accounts can easily prove the data integrity. It is also possible to copy data for safety purposes and recover them in the certainty that they are exactly the original ones.

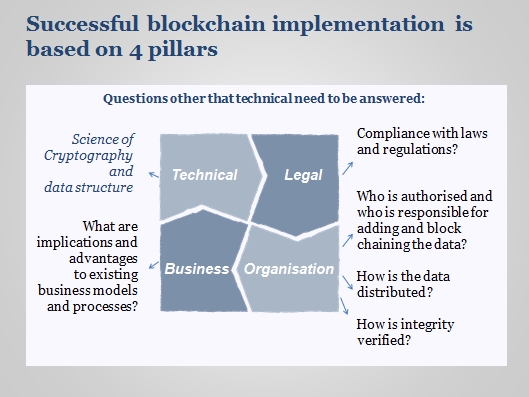

The 4 pillars of successful blockchain solutions

A successful implementation of blockchain must consider four different aspects

- Technical or cryptography

The science and algorithms that are behind the data auto-certification. - Legal

The legal framework that allows to relay on data. - Organisation

How the data is structured and who is responsible for adding, block chaining and verifying the data? - Business

The opportunities and advantages inherent in redesigned business processes.

Legal framework

In 2002, by a legal assessment requested by Banana.ch, Swiss and German auditing companies certified the compliance of the algorithm with legal requirements. Therefore, the system has been fully included into Banana Accounting.

Compliance to regulations is important because it means that data, even if stored on rewritable media, have legal validity and, therefore, can be used as evidence in courts.

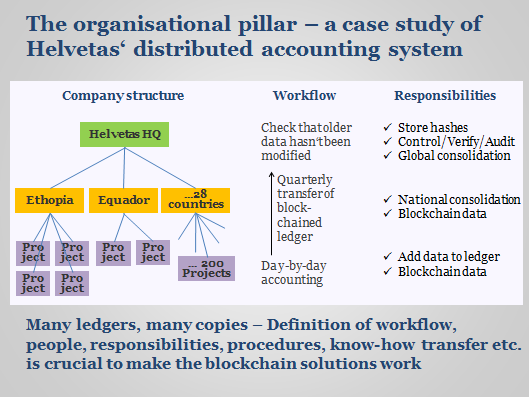

Organising a distributed accounting system

The blockchain ensures that the copies of data are equal to the original, even if new registrations are added. This is the characteristic that gave the conditions for creating cryptocurrencies. However, there are other fields where this technique offers significant advantages, such as the distributed accounting system explained below.

Helvetas, one of the most important charitable organizations in Switzerland that works in tens of countries in the world, aims to train people and make them independent. Therefore, they had the idea to give accounting management to people in charge of projects in the same place. Banana Accounting software proved to be a very versatile and easy to learn tool that allowed for each project to manage accounts in the local currency, according to the project requirements. Of course, it was also necessary to have a central system of supervision and consolidation of financial data. (See Helvetas - Blockchain decentralized accounting)

There was also the problem of having a control on locally managed data and consolidating the financial data of projects, at first at a national level and then at a central level. Thus, they started to use the certification system. In order to be sure that the data were perfectly synchronized and there were no accounting differences, it was sufficient to check that the hash of the previously consolidated data was not changed.

The blockchain system allows to rely on the data themselves. The data integrity does not depend on the assurances of data managers and is not necessary to compare the data with copies.

In order for the system to work effectively there was a need to define the workflow from the organisational point of view. Helvetas, next to define the people that were in charge of accounting keeping, auditing and consolidation, had to define who and which procedures were responsible for block chaining the data, verifying the integrity in timely manner. This organisational aspect is important in the success of the solution. There has been a need to train all the involved people on the working of block chain and how to use it.

Bitcoin: trust relying on the ledger data

The blockchain system allows to certificate data collections to which other data are constantly added. The hash of the last movement or block added allows to verify the authenticity of the whole data series.

The reliability of cryptocurrencies is given by the use of hashes that certificate the authenticity of movements as a whole. Therefore, one can trust that the values assigned to these data are correct.

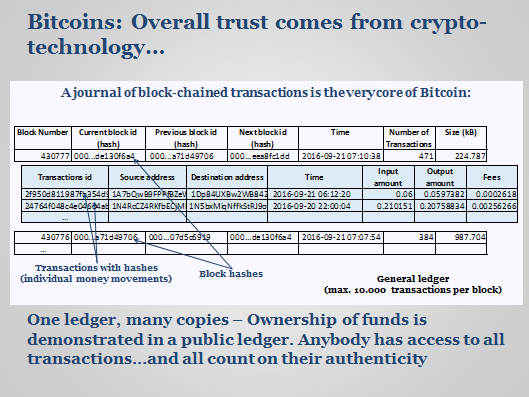

Bitcoin is basically a general journal recording all money movements and organized in such a way that each registration is cryptographically concatenated to the others. Registrations are added in the journal in blocks of maximum 10,000 registrations and each block also has a hash, which is the expression of all the data contained therein. Therefore, this journal can be copied anywhere, in the certainty that the data are the same for all.

In Bitcoin, the demonstration of the fund ownership is given by the movement journal. Indeed, it is sufficient to look through the journal movements to know the available funds of each holder of an account, which in the bitcoin system is called address. When bitcoins are transferred to another address, a registration is created in the journal and the receiver can know it by reading the journal. Therefore, there is no need for intermediaries any more, but only for computers that verify the transfer of amounts and add them in the journal.

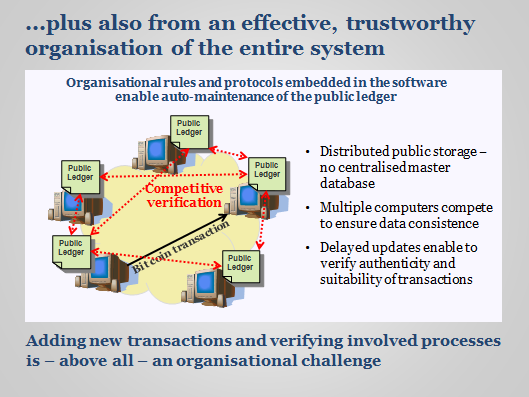

The success of bitcoin does not come just from having an open ledger that is secured by a blockchain crypto-technique. The trust on blockchain is based also on the fact that there is an organisation in place that assure that only authorized people can spend the bitcoin once and the transfer of bitcoins goes only to designated people.

A great achievement of bitcoin is the technique that let different distributed computers, compete together to assure the consistence of the public ledger. The organisational part of bitcoin, namely the process verification and adding new transactions is the most delicate of the bitcoin system, since it is necessary to ensure that people do not spend the same money several times and that the funds actually go to the people stated as the recipient. This document only mentions the importance of the organisational part of bitcoin. It is not possible to go deeper into this subject for the fact that the technique used to organize computers together is very complex.

A large number of people and companies own bitcoins and feel sure of the values, not because the data are stored in super protected IT systems, but precisely because the journal is publicly available and anybody can verify if they are actually the holder of a certain value.

Bitcoin is proving that people trust on open IT systems and data certification technologies and begin not to feel the need to rely on trusted intermediaries any more. This is the condition for the development of the digital economy.

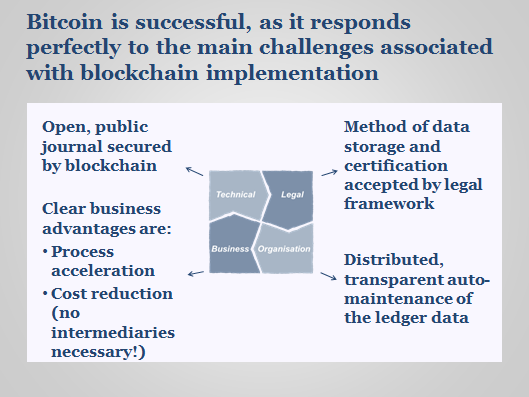

The success of bitcoin relay on the 4 pillars. The blockchain crypto-technique that allow to create trusted distributed databases. The legal framework that accept this methods of data certification. The organisation, rules and protocols embedded in the software that let many computers auto maintain the ledger. The business advantage that allow people to send money directly without the need to relay on intermediaries.

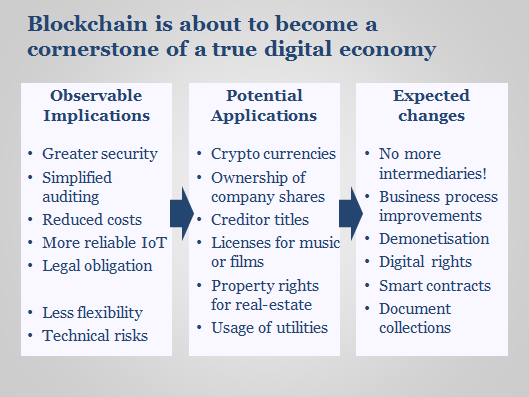

It is also possible, of course, to create similar organisation based on open journals to certify the ownership of a company shares, the fact of being a creditor of a company, of having the right to listen to a song, of living in a certain flat at a certain date, of going to a concert or of using a certain amount of electricity. Also the transfer of these rights may occur by simply adding an accounting movement in the relevant public journal.

Therefore, there is the possibility to go beyond the system based on trusted intermediaries. Transactions are simplified and, of course, the intermediation cost disappears.

Blockchain a cornerstone of a true digital economy

Blockchain can make IT systems more secure

Attention to the blockchain is currently focused on the opening of new business possibilities. Therefore, it is important to note that this technique will be used, first of all, to improve the current IT systems and adjust them to the new digital era requirements.

The use of the blockchain in the current IT will be influenced by several factors:

Greater security

Currently, it is very difficult to understand if data have been modified. People that are enabled to modify data or are able to bypass safety measures can make changes that are quite difficult to detect. This situation causes significant losses to companies.

Simplified auditing

In order to make sure the data have not been modified it is sufficient to check the hash. There will be no need for continuous and repeated data checks any more.

Cost reduction

The possibility to make true copies makes data management much simpler. It is possible to immediately find out whether any procedures or other operations have changed the data and recoveries also are simpler. Transactional systems can be optimized for writing and use copies for analysis and checking purposes. It will be possible to use decentralized accounting systems that able to synchronize without any problem.

Making the Internet of Things reliable

The use of the blockchain in events recorded by computers and electronic devices will allow to verify that the values are those saved at the time of the event and have not been modified later.

Legal obligation

For some time, legislations have been providing for certain types of data (e.g., accounting data) to be protected by measures ensuring their authenticity and origin. These provisions are not currently applied particularly rigorously. However, due to the development of these technologies, the legal obligation is likely to be applied more rigorously in the future.

Notary separated by data

In order to ensure the authenticity of data by a third party (an electronic notary) it is sufficient to provide them with the checking hash. It is not necessary to provide them with the data.

New applicatios and new business

We are just at the beginning of the blockchain and, in any case, there is great enthusiasm for this technology that promises to lead to an increasingly digital economy.

In the coming years, we will have a clearer idea of its new applications and businesses. However, by analysing current trends we can already anticipate changes in the following fields.

No more intermediaries

This is the sector that attracts more attention. The possibility of having digital instruments that incorporate values (currency, shared, bonds, licences, smart contracts) exchangeable with no intermediaries opens completely new prospects. This kind of system will make disappear intermediation and, therefore, also the costs for the errors and misuse related to this activity. Financial institutions and all companies related to intermediation of values are obviously paying particular attention to the fact that part of their business could disappear in the medium and long term.

Therefore, financial institutions have been implementing initiatives aimed at applying these technologies to take advantage of the strong reduction in costs and remain competitive in the market. At the same time, new initiatives have been launched by new market players that offer completely new solutions. It is therefore in this context that other digital currencies appear.

Improvement of processes within the business

Blockchain will improve and facilitate the exchange of data within the company and the possibility to use more effectively distributed data management systems. Today, the same data are codified and managed several times by different people, often within the same organization.

In China, companies issue invoices through an IT system placed at their disposal by the tax authorities (Golden Tax System). This system simplifies VAT return and recovery, but makes companies manage data on their IT systems (ERP) and the tax authorities' system in parallel. Integration is not always perfect and very often requires manual reconciliation. This situation is a drag on the proper collection of taxes and the development of e-commerce. The move to a data management system distributed and certified by blockchain could give interesting advantages.

Demonetization

Today, exchanges are carried out mainly by converting the value of goods into cash. In many cases, it would be more efficient to directly exchange goods of the same or different type (barter) without converting them into cash (demonetization). IBM and other IT companies are offering the possibility to create and manage value management and exchange platforms based on the blockchain technology. With this system, energy producers may exchange the energy produced. At the same time, people who make home deliveries could exchange the home delivery of goods to optimize the routes.

Digital rights

The possibility to incorporate the right of use in an easily transferable digital certificate could open new trade prospects. The right to listen to a song, watch a video, use a software, live in a flat or use a car for a certain period of time could be associated with a digital certificate that can be freely traded and transferred.

Smart contract

Smart contracts are digital values that can be customized through applications suitable for different situations. The calculation of the car insurance could be made based on the actual use of the car and the supply of heating fuel automatically made at the price agreed in advance based on reference values.

Management of collections of documents

The issue and collection of a letter of credit requires to submit and check a whole series of documents by different subjects. The Singapore port authority and Chase Manhattan Bank are developing a platform for the digital management of documents that, thanks to the blockchain, certifies also the sequence and the set of documents and provides the subjects involved with a legally reliable base for making decisions.

Git, the most used version control system in the world, uses a data model that crypto-concatenates all data in such a way that the identifier of the most recent version is the expression of the whole previous history.

Public electronic registers are already certifying not only individual documents but rather the whole sequence.

Limits and defects of blockchain

Reliability depends on the presumed impossibility to find collisions

The authenticity of a document is based on the calculation of a unique digital fingerprint (hash). Creating documents with different contents and the same hash is presumed computationally impossible. Therefore, the whole data safety system is based on the practical impossibility of creating collisions. Some hashing algorithm was found to have defects and allowed to create documents with different contents but the same hash.

Therefore, this situation would allow for a collection of data where blockchain is the original one, though with altered data. In such a situation, the whole system giving trust on data would fall.

Therefore, the cryptographic algorithm on which certification is based is crucial. However, it must be taken into account that the processing power of computers is increasing and that new attacks can emerge and defects can be found. For instance, within data encryption, people already believe that with the availability of future quantum computer the whole current system will fall. It is possible that the same will happen also for hash functions.

For accounts with separate files for each year, the issue is different. Once accounts have been closed, it is possible to create a pdf dossier containing all the data, including the print of financial statements, extracts and other. All operating systems have an integrated pdf reader and, therefore, it will be possible – even after many years - to have access to accounting data, even on computers without the data installed in.

Make organisation less flexible

In the log of events of a medical device it is certainly useful to calculate the hash after each adding. The same is true when documents are added to a data storage system or fully automated transactional systems (network of devices for cash withdrawal) of which the origin of data is exactly known.

The situation is different when it is necessary to verify the data. In the bitcoin system, the public journal is updated every 10 minutes. Transactions are not directly recorded in the journal, but are collected firstly by miners to verify their authenticity and suitability. It would be impossible to manage a decentralized payment system without this lapse of time.

In Banana Accounting, it is the person who enters and checks the accounting data and decides when it is the moment to block accounts with the hash, obviously taking into account also legal requirements.

Introducing the obligation to certify accounting registrations quickly may make the accounts check and strength more difficult. Tax authorities tend to impose strict rules trying to fight against tax evasion. However, in the case of small businesses the increase in difficulties leads to the opposite. Indeed, they keep or make third parties keep accounts for tax purposes only.

A technology still at the beginning

The use of blockchain has taken its first steps with the bitcoin currency. Much research is being carried out in this field, with the aim to improve and extend its functions. An issue that is attracting attention is also energy consumption. Today, bitcoin uses a large number of computers to update the journal. This solution is quite energy-consuming.

Banana.ch SA patent

Banana.ch applied for a patent on the certification of transactional data in 2002. The patent was registered by the patent office in 2006 (US Patent No. 7,020,640) .

The method developed by Banana is very simple to apply to transactional databases. The blockchain technology can be applied to existing IT systems in a short time and with a few modifications. Significant results can be obtained with limited investments: complying with directives on data storage, increasing security, reducing the management costs of IT systems and increasing the efficiency of many procedures. Banana.ch is at your disposal for information and support.

The patent territorial scope is limited to the US and Banana.ch grants non-free licences for the use of the method and free licences for projects with no commercial purposes. For further information, please contact us

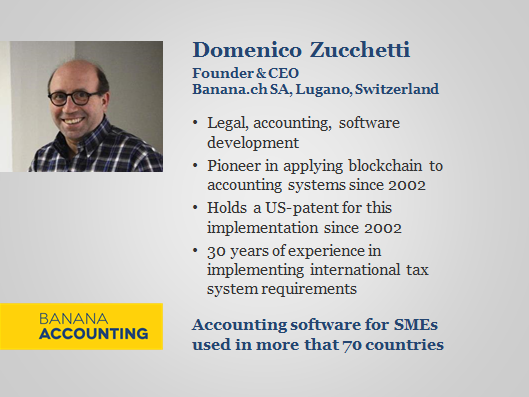

Domenico Zucchetti

Domenico Zucchetti (1960), CEO of Banana.ch, is a book-keeper, jurist and programmer. He studied accounting and graduated in law in 1986 with a degree thesis on e-commerce. After working for five years in a financial institution, he established the company Banana.ch. He started professional programming at the age of 19 and still directly follows the developments of Banana Accounting, which is used in over 70 countries.

In 2002, he was the first in the world to use the blockchain technology in the accounting field and apply for a US Patent No. 7,020,640). This new technique, besides complying with legal requirements, proved to be effective in creating accounting managements that are located on all continents though fully integrated.

He has developed over 30 years of experience with different tax systems and coordinated the development of tools that simply the adjustment to national requirements and the easy setting up of sophisticated financial and liquidity planning.