Accounting common features

Lock transactions

Blockchain data certification

Banana uses a digital certification system for the accounting data, using what is now called blockchain technology. Transactions can be locked and marked with digital codes that can guarantee, even after many years, that the accounting data are authentic. They also allow the user to make sure that the accounting data have not been modified.

Banana.ch was the first company in the world to use the blockchain technology in the accounting field. This method (US Patent No. 7,020,640) was developped and patented in 2002..

This method, based on the blockchain calculation system, is considered so reliable that it is employed to ensure the validity of the bitcoin and of all other modern crypto-currency.

This method guarantees one of the highest levels of data integrity and conformity to international law prescriptions. You can also see the evaluations on this matter of the audit company Ernst&Young, who verified the system conformity to the legislation requirements. The new versions of the Banana Accounting software don't use the MD5 method anymore (the one mentioned in the documents), but use the Hash SH256 method.

- Ernst&Young, compatibility check to Swiss legislation (pdf in German)

See also: Verordnung über die Führung und Aufbewahrung der Geschaftsbücher, 24.04.2002 (in German) - Ernst&Young, compatibility check to German legislation (pdf in German)

- Securing acccounting Data (2002). Introduction document to the blockchain technology used in Banana Accounting software.

The lock transactions command

With the Lock transactions command of the Account2 menu, the accounting transactions are locked and marked with control codes that can certify, over the years, that the transactions have not been modified.

- The validity of a possible already existing lock is being verified

- The transactions until the lock date are being numbered progressively and are being locked. For each transaction, the digital code of the row and the progressive one are being calculated.

The calculation of the digital codes is being done according to the sequence of the columns. - In the accounting is being indicated that transactions with an equal or earlier date than the lock date will no longer be accepted.

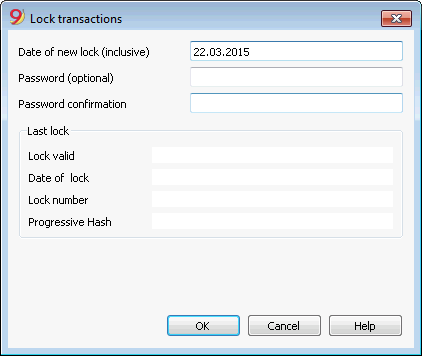

Date of new lock (inclusive)

Specify the date up until when the transactions will be locked.

Password (optional)

It is possible to insert a password to eventually unlock the transactions or to carry out a new lock in the future.

If the program finds no errors in the transactions included in the lock date, it will lock the transactions, calculate and assign individual numbers and codes to each row of transactions which can be viewed in the Lock view on the Transactions table.

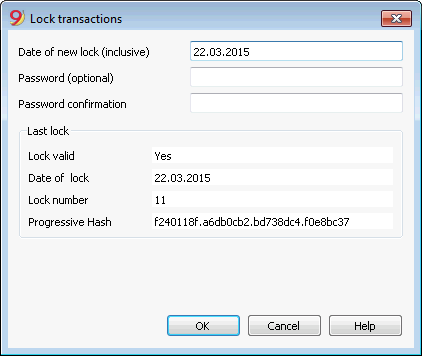

Last lock

The data of the following fields are automatically filled out by the program based on the last executed lock.

Lock valid

A "Yes" is shown if the lock is valid.

Date of lock

The date of the last executed lock is shown.

Lock number

This is the value automatically entered by the program in the last row of the LockNum column.

When the lock is repeated, if the value of the last row lock number is unchanged, it means that the lock is valid and that the data have not been altered; if however the value is changed, the program shows the following codes:

- (-1) if the lock is invalid from the first row

- (-2) if there are rows that have the same LockNum.

Progressive Hash

This is the control code present in the last transaction.

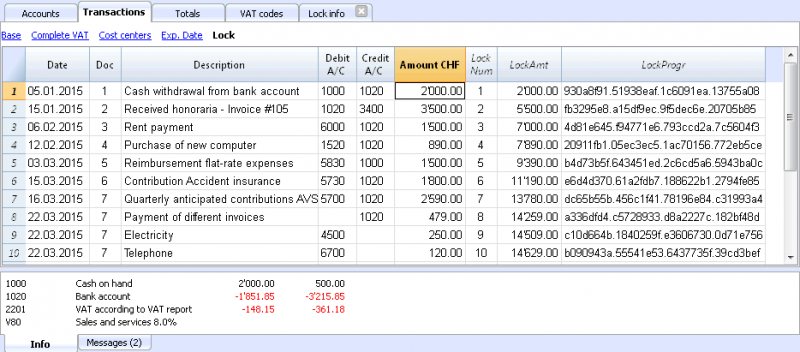

Lock View

All digital codes are shown along with all the information that the program used to create the digital signature.

- LockNum: the progressive number that identifies the row

- LockAmt: the cumulative transactions total, similar to the total at the end of the page, as required by some national regulations

- LockLine (hidden column): the digital code calculated according to the row values.

- LockProg: the global electronic signature (SHA-256).

The digital code LockProg

This is the main element of the certification; it uses the blockchain methodology.

The digital code is calculated according to the following values:

- The contents of the current entry, including amounts, descriptions and the description of the account at the moment of the lock

- The progressive number (LockNum)

- The cumulative balance (LockAmt)

- The progressive code of the preceding entry (LockProg).

In case the accounting data undergo even the slightest modification (for example, a date or an amount is changed), the digital code will be different. If the control number remains the same, it implies that the data are original and therefore have not been changed.

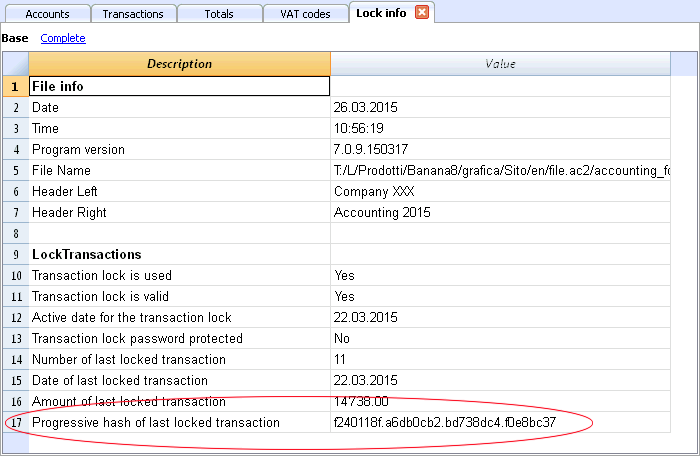

Check Lock

With the Check lock info command of the Account2 menu, the program verifies the validity of the lock and displays the data.

- The program recalculates the digital control codes and verifies if they correspond with the ones related to the transactions.

- If the codes correspond, the lock is considered valid, and therefore the data are original

- If they do not correspond, it means that the data have been changed and that they are not the original ones calculated at the time of the lock.

Unlock transactions

The Unlock transactions command removes the lock and the control codes. If the lock was set with a password it will be necessary to reenter the password in order to remove the lock.

If later on you want to relock the transactions, and they have not been modified, the control numbers will be the same as the ones of the earlier lock; if however some data have been changed, the control numbers will be different.

Partial lock

If the transactions have been locked, it is possible to unlock them even partially, from a specified date. If a lock password has been set, in order proceed unlocking the transactions, you need to enter it in the specific field.

Why unlock the accounting?

In principle, the locked accounting should not be unlocked. It might happen that, after the lock, you find errors in the accounting and see the need to make corrections.

To have the opportunity to make further changes, users kept a copy of the file before the lock. If they found errors, they would restore the previous situation. In the meantime other transactions had perhaps been made, so often it happened that restoring previous versions of the accounting proved wrong. To avoid this unnecessary waste of time it was decided to make the Unlock transactions command available.

The certification must not be confused with data security. The data certification is a methodology that ensures that the accounting data are original. To prevent data from being modified, the methodology is the one related to data security. Data security procedures, however, can only be implemented in an environment that limits data access.

If the file is fully available to the user, such as when it is on a PC, people have complete control of the data. They can thus replace files easily. With a certification one cannot prevent that the data are being altered, but it will allow you to know if the data are the original ones.

The person who keeps the books is responsible for the accounting and decides whether a change is permissible or not.

Organizing the certification and data verification

Once you locked the transactions of the period, you need to:

- Print the lock information or print the last certified transaction row with its specific certification number (LockProgr).

- Sign and store this information along with the accounting documentation or in any other safe place.

In order to check that the accounting data are the original ones, you need to proceed as follows:

- Impart the Show lock info command.

- Go back to the document that shows the digital control number

- Check whether the row identified with the LockNum still has the same digital control number

- If the number matches , the accounting data are the same as those certified

- If the number does not match , it means that the accounting data have been modified.

Banana works on developing applications that make it possible to compare two files and obtain indications regarding data that have been altered.

Data security

Digital certification ensures that the data are still the original ones. It does not prevent the modification of data.

It is the responsability of the accountant to ensure that the data are not altered. Each administration must be organized according to its size and needs.

Those who want to make sure that the data are not being altered by unauthorized persons , must employ other methods and tools, such as :

- Save the data to a secure system (protected network drive), password protected.

- Keep the copies of the data.

- Encrypt archives.

Long-term archiving

The accounting file contains the entered data. In order to open the file and obtain a report or an account card, you need to have the program at your disposition.

Banana Accounting gives the possibility to export all the accounting data, and its printouts as well, to Pdf, Html and Xml.

The generated file can be saved on a CD and accessed on any computer even after many years, even by persons who do not have the Banana Accounting software.

Check and recalculate accounting

Avoid mistakes with Banana Accounting Plus

In order to facilitate checking your accounting work and to immediately find differences, in Banana Accounting Plus, our new version, we added the Balance column in the Transaction table. You can now see potential differences on each row and you can correct them right away. It is a very useful feature when closing the accounting period.

Many of our clients have already tried it and are enthusiastic about it. We advise you to switch now to Banana Accounting Plus and take advantage of the many new features.

You can recalculate and check your accounting in different ways:

- with the Shift + F9 keys (Windows and Mac) or Cmd + 9 (Mac)

Primary accounting recheck - with the Check accounting command from the Account1 menu

this solution includes several extensive control options - Extensive accounting recheck

If there are error messages or differences you should correct them.

Primary accounting recheck

This command will execute the following operations:

- it will reset the accounts balances, as well as the cost centers and segment balances

- it will verify and report if there are errors in the various tables (Accounts, Transactions, VAT Codes and Exchange rates tables)

- it will re-enter all the operations as if they were being entered for the first time

- for the multi-currency accounting, it will recalculate the opening balances in the basic currency using the latest exchange rates

- if the transactions rows are not locked, it will recalculate all transaction rows:

- the VAT percentages are taken from the VAT Codes table and the VAT amounts are recalculated again

- it will update the account balances, as well as the cost centers and the segment balances

- in the Cashbook the progressive account balance in the Transactions table is recalculated

- it will recalculate the Accounts and Categories table totals (income and expenses)

- it will update the Diff. Budget and the Previous year columns

- in the multi-currency accounting, it will update the Calculated balance with the latest exchange rate and the exchange rate difference

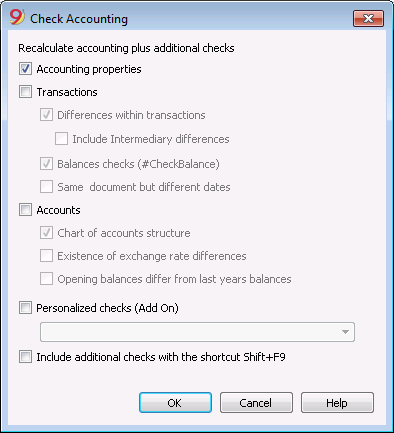

Extensive accounting recheck - the Check Accounting window

On top of the basic accounting recheck, additional checks are executed.

Recalculate accounting plus additional checks

This is one of the most useful features: the entire accounting file is being rechecked, all the balances are recalculated and the user is notified if errors are found.

Accounting properties

This option is being activated by default. The program verifies whether the data entered into the File and accounting properties correspond to the actual accounting (for example: opening and closing date, VAT account, accounts for exchange rate differences, etc.).

Transactions

Differences within transactions

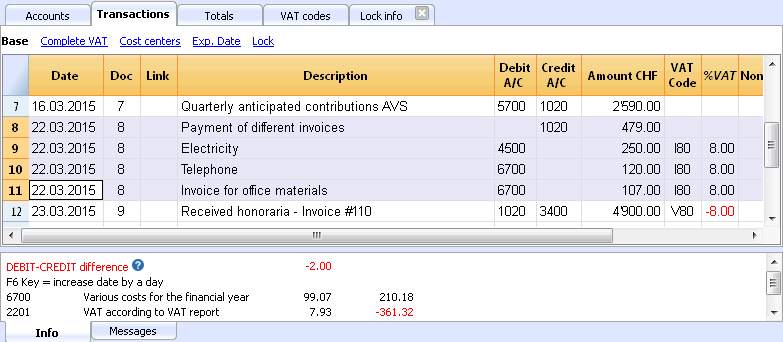

If this option is activated, the program verifies whether there are differences between Debit and Credit or between Accounts and Categories in the Income & Expense Accounting. The rows where the differences occur are being indicated in the Messages Window. Also, the program shows the total difference amount in the Information window at the bottom of the screen (only when being positioned in the Transaction table).

Include intermediary differences

If this option is activated, the program verifies whether there are differences between Debit and Credit, in composed transactions (transactions over multiple rows). Often differences are caused by incomplete entries or errors in the amounts (as for example in the following example, in the transaction n. 8).

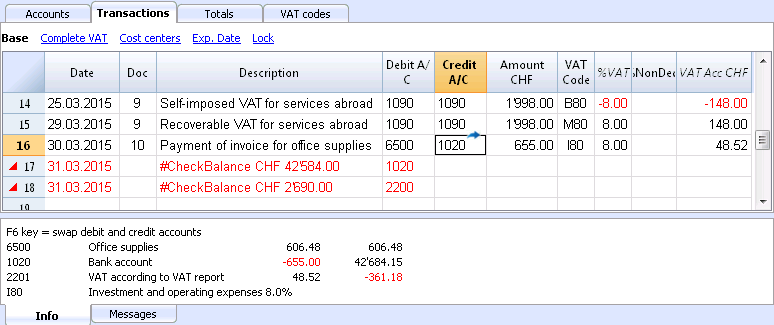

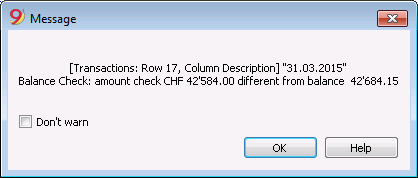

Balances checks (#CheckBalance)

By activating the Transactions option as well as this one, The program checks whether an account balance is equal to the one being inserted for verification (for example, between the bank account balance on the bank statement and the balance of that same account in the accounting file). In case the balances don't match, the program indicates the error.

In order to proceed with this check, one has to:

- In the Transactions table: enter #CheckBalance in the Description column, as well as the currency code and the balance of the account (example: #CheckBalance CHF 28'000..00). Into the Debit column, enter the account to be checked. The Amount column remains empty. The amount to be checked has to be entered with the same number of decimals as the one of the account to be checked.

- Activate the option through the Account1 menu

- While the accounting is being checked, when there are differences between the checking balance and the account balance, the program shows the error while indicating the row.

The program has detected a difference between the checking balance and the account balance in the file

Same document with different dates

f this option is activated, the program will alert if transactions with the same Doc number have a different date. On composed transactions (=transaction on more than one row), where there is no correspondence between Doc and Date, the program cannot correctly determine the counterparty.

Accounts

Chart of accounts structure

If this option is activated, the program checks whether the chart of accounts structure is correct.

Existence of exchange rate differences

If this option is activated, the program checks whether there are unrecorded exchange rate differences.

Opening balances differ from last year's balances

If this option is activated, the program verifies whether the opening balances of the new year match with the closing ones of the previous year.

Personalized checks (Add On)

If this option is activated, the program runs checks on the functions that have been added by user (Add Ons), for customized verifications.

Include additional checks with the shortcut Shift + F9

When this option is activated, the program will run all the checks activated in the dialog window, when pressing Shift+F9. Otherwise only an accounting recalculation will be done (Mac version: Shift + Cmd + 9).

Link to a document

Connecting digital documents to your accounting transactions

With Banana, you can enter, for each transaction, links to digital documents stored on your computer.

- Arrange a folder where you will save all your digital documents. It can be the folder where you keep your accounting file or subfolder.

- Use this folder to save all files containing documents, invoices, receipts, etc.

- Link the transaction to the digital document.

- From the Account 2 menu choose the Link -> Open Link command to view the contents of the digital document.

The DocLink Column

The DocLink column (Transactions table) makes it possible to enter a link to an external file (usually a scan of a receipt or an invoice).

- The DocLink column is usually not visible.

In order to display it, use the Columns setup function. - Once the Link column is visible, you can edit the file name.

- The file name is related to the accounting file; if the documents are in a sub-folder, the file name - in the DocLink column - will be preceded by the directory name.

- It is equally possible to manually enter a web address in the Link cell.

In order to open the linked document, click on the Open link command of the Account2 menu, or click on the small square that appears on the upper right hand corner of the cell that contains the link.

Entering a link to a file

There are two ways to enter a link to a document:

- Place yourself on the row of the Transactions table and the activate the Add link command from the Account2 menu -> Links;

- Select the file that corresponds to the document which needs to be linked and click on the Open button; the program inserts the link automatically.

The program enters the file name in the DocLink column, even if this last one would be invisible.

Or

- Display the DocLink column in the Transactions table. See: Columns setup;

- Click on the small square at the upper right hand corner of the cell;

- Indicate the path where the file can be found and select it.

Editing a link

Proceed in the same way as when entering a new link.

Opening the link

There are two ways to open the link:

- Place yourself on the row of the Transactions table and the activate the Open link command from the Account2 menu -> Links;

- Place yourself on the DocLink cell and click on the icon to open the link.

For security reasons, the program opens only files with an extension that is considered secure, see Program Options -> Advanced, from the Tools menu.

Removing the link

There are two ways to remove the link:

- Place yourself on the row of the Transactions table and the activate the Remove link command from the Account2 menu -> Links;

- Delete the contents of the DocLink cell.

Displaying expiry dates

Customers & Suppliers Management

In order to manage the invoices issued or received, we advise you to use the Customers Menu and the Suppliers Menu.

Associate an expiry date to a transaction

As an alternative to the customers and suppliers management, or for simpler checking purposes, you can also enter the payment date in the transaction row.

This is an operating mode that consents simplified checkup.

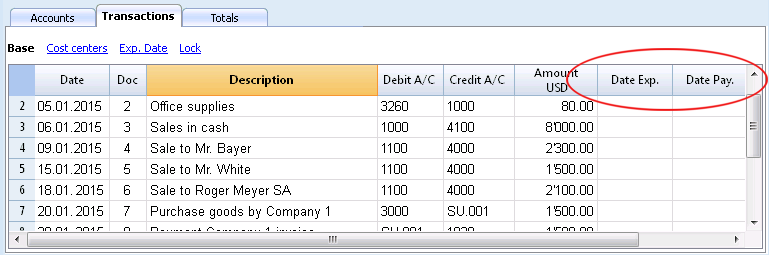

With the Columns Setup command (from the Data menu), you should make visible the Date Exp. and Date Pay columns.

You should then enter the invoice expiration date in the Date Exp. column, and the invoice payment date in the Date Pay. column.

Show expiry dates

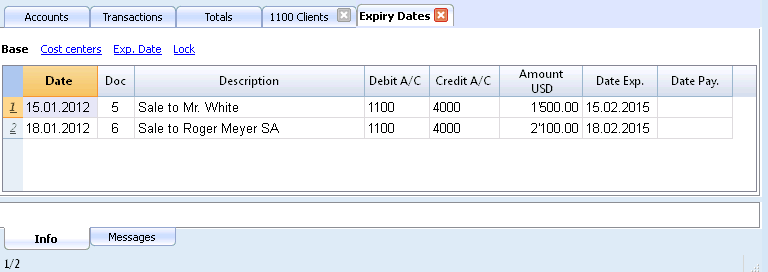

With the Show expiry dates command from the Account2 menu, the program displays the transaction rows that have an expiry date but no payment date.

Sort transactions by date

The command Sort transactions by date:

- Sort all rows in the Transactions table in ascending order of date.

For rows with the same date, it keeps the existing sequence. - Deletes the empty rows that are inserted at the beginning.

There is no automatic reorder function, because sometimes users choose to keep records in a different order.