Budget transactions

When preparing financial forecasts, based on the double-entry method, transactions are entered in the Budget table. Indicate origin and destination accounts for each one. The program has the information necessary to prepare Balance Sheets and Income statements, that will however relate to the future and not the past.

When one is planning with Excel, the Income statement is set up first, then the revenues and costs are listed. Generally, the liquidity and investment plan is prepared only later and on separate sheets.

When making forecasts with the double-entry method, we proceed instead as if we were keeping an accounting for the future. All the transactions that are expected to occur will be listed. The program will then automatically prepare the Balance Sheet and Profit and Loss account for the indicated period or periods.

Structuring of budget transactions

For the preparation of a financial plan, we generally proceed by listing the different elements in the following order:

- Capital injections.

- Third party capital injections.

- Setting up expenses.

- Investments.

In furniture, equipment. - Recurring fixed costs.

Rent, staff, social security charges, energy, subscriptions. - Recurring revenues.

- Variable revenues

The turnover which is typically seasonal. - Variable costs.

Commissions, costs of the goods sold and others, which are related to the expected volume of revenues. - Year-end transactions.

Depreciation, taxes, interest on loans, dividends.

By the time you enter sales and variable costs, you will already have the cost and capital structure. It will be possible to know instantly, whether the expected turnover will allow the company to generate sufficient profits and liquidity to guarantee its sustainability over time.

Amount and Formula column

As a rule, to prepare a budget, simply use the Amount column.

For more elaborate estimates, there is the possibility of indicating quantities, unit prices, or a formula. The program will automatically calculate the value in the Amount column.

Updating forecasts

With the double-entry method, thanks to the possibility of indicating each operation in detail, it becomes easier to update and improve the forecast. Initially, estimates of different costs or investments will be entered. As you get closer to the operational phase and there will be more precise data, just replace the existing ones. Even when the activity has started and exact elements are known, the forecast can be updated easily. Precise and reliable indications on profitability and liquidity are thus available.

Dates and repetitions in financial forecast transactions

The Data column

The value contained in the Data column is the one that will validate the forecast.

- If there is no date, the transaction will be taken into account at the beginning of the planning.

If you require a forecast indicating a period, the amounts will be taken into account in the balance value at the beginning of the period.

Due to the fact that it does not fall within the period, no amount will be displayed in the Total column. - Dates in the accounting period set in the file properties.

These are the ones commonly used. The total amount will be indicated in the Total column, taking into account repetitive movements, within the accounting period. - Dates prior to the period.

You can enter movements that precede the forecast period. However, you must be careful that they do not conflict with the opening balances entered in the account table.

Due to the fact that it is not within the period, no amount will be displayed in the Total column. - Dates after the period.

If you make forecasts over several years, they allow you to indicate transactions for the years to come.

Due to the fact that it is not within the period, no amount will be displayed in the Total column.

The End date

This is used in combination with repetition, to indicate the last date beyond which there is to be no repeat.

- Must generally be left empty.

If you enter a date when it is not necessary (for example the end of the accounting period) the forecasts for the following years will not include this operation. - For leasing transactions.

Indicate the date on which the payment of the last installment will be made as the end date. - For loan repayment.

Indicate the last expected payment date. - For changes in the amount at set deadlines.

In the case, for instance, that the amount of a recurring transaction is adapted at certain deadlines (salary increase).- Create a transaction row with repeat "M" and End date as per the last payment before the increase.

Create transaction rows with Data when the increase begins. - If the increase follows a precise and regular automation, this can also be programmed with formulas.

- Create a transaction row with repeat "M" and End date as per the last payment before the increase.

Repetitions

For recurring expenses or income, the repetition code is recommended (refer to Documentation on the columns).

- When calculating the forecast, the program creates copies of the operation and progressively increases the date, taking into account the indicated frequency.

- If there is no end date, the program will generate internal copies of the records for the entire period of the forecast indicated at the time of the report when calculating the forecast.

- If the start date is January, the frequency is monthly

- If the forecast period is the year, it will generate rows from February, 1 original row and 11 automatic rows, for a total of 12.

- If the forecast period is 10 years, it will generate rows starting from February, 1 original row and 119 automatic lines (11 the first year + 12 * 9 for the following ones), for a total of 120 lines.

- If the start date is January, the frequency is monthly

- If you want the program to automatically calculate forecasts for subsequent years.

- For recurring operations, indicate the relative repetition code.

- For transactions that occur only once a year (for example depreciation at the end of the year), indicate the repetition code "Y", so that the depreciation is also calculated in the following years.

- Don't use the repetition only if the operation will not occur in the following year.

Total column of the Budget table

The Total column is calculated automatically and represents the sum of the amounts of the current row and the repetition amounts that fall within the accounting period. The Total column is empty if the transactions have an earlier date or extend beyond the accounting period.

Schedule with precise date and monthly logic

Forecast movements are entered in the Budget table indicating the date on which these are expected to occur.

However, it is not always possible to predict all revenues and expenses with a daily precision. When making a forecast it is therefore useful, in some cases, to use approximations, generally reasoning on a monthly basis. In any case, it is useful to always follow a specific logic so that reliable liquidity forecasts can also be obtained in the short term:

- Punctual operations (capital payment, investments) are indicated with the date on which they are expected to occur.

If there is no precise date, it is useful to indicate them on the 15th day of the month in which they are expected to occur. - Recurring charges that have a precise payment date are to be set with the expected payment date and the relative repetition code:

- Bank charges, interest, amortization are to be indicated at the end of the month, quarter or year that they will take place.

- Rentals on the due expected date of payment.

- Salaries and social security charges

- For the calculation and monthly payment on the day that wages are paid.

- For thirteenths, bonuses or whatever at the moment they are paid.

- Payments for advances and adjustments of social security charges on the expected payment date.

- Payments and VAT adjustments on the typical payment due day.

- Revenue Forecasting.

The preparation of the forecasts depends on the type of activity.

If you do not know the exact day, but you will know that it will happen in a certain month, it is recommended to indicate the 15th of the month- Punctual revenue.

They are to be indicated on the date on which it is expected to take place or mid-month. - Recurring revenue.

To be indicated on the date of entry or mid-month. - In many cases a monthly forecast is well suited. The revenue can be indicated on the 15th of the month.

- If the revenues are recurring, the revenue can be entered with the monthly repetition. Using formulas you can predict growth.

- If there are seasonal differences, it is helpful to have a sales forecast row for each month.

- Forecast of projects or major works.

If there is a calendar with receipts, a transaction row is to be indicated for each expected entry. It can be approximated by indicating the 15th of the month. - Forecast for customers.

For a consultant or commercial advisor, who works both with budgets and projects, it can prove very useful to set up a detailed revenue forecast for each client, with the expected payment dates. This forecast will also be very useful to check if the customer has actually paid.

- Punctual revenue.

- Variable costs.

- Constant expenses linked to the turnover (a restaurant for example ), are indicated with the same date as the turnover. With a formula you can also calculate as a percentage value of the turnover.

- Costs can also be linked to other elements, such as the number of employees, rented premises or other.

Forecasting with the cash principle

Planning for small business and cash activities (such as shops, restaurants) it is useful to proceed with the cash principle, then indicate the revenues with the date on which they will be collected and the costs when paid.

For important operations, such as the purchase of a machine whose payment is deferred over time, it is however useful to insert forecast movements with precise details:

- Purchase of machinery (asset registration with suppliers) with date of purchase.

- Payment of the machinery, with the date(s) on which payment is expected.

Forecasts with the accrual method

In this case, the insertion of the operations takes into account when the payment will be made.

- Cash transactions.

They are obviously registered normally. - Transactions expected to be settled in the near future.

For simplicity, the operations that fall within the forecast month or the one immediately following, it can be useful to use the cash principle. - Deferred payments.

If the dates are not known with precision, you can use the 15th of the month.- Transactions with precise payment terms.

- One movement indicates the purchase date with the counterpart in the supplier account.

- One of the other movements indicates payment on the scheduled dates.

- Transactions with precise payment terms.

- Deferred collections.

- With precise payment terms, as is the case with a project:

- A movement indicates the billing date and the customer account with the counterpart.

- One of the other movements indicates payment on the scheduled dates.

- Late payment.

This is the case when a part of the revenues is collected in the short term, a percentage is collected later. It can be done like this:- Enter the revenue as cash collection.

- With the same date, a movement is created that moves a part of the collection to the customer account.

- At a later date, the cash collection is indicated with the client account of the counterpart.

- With precise payment terms, as is the case with a project:

- Use of variables for deferred collections and payments( see Example use of variables)

When the same value must be reused at the time of payment, it can prove very useful to use the formula column and variables.- In the billing transaction, the amount is assigned to a variable.

- In the payment movement, the variable is inserted so that the amount is automatically taken over.

- Variables can also be used to define the percentage of the amount that will be deferred, for example.

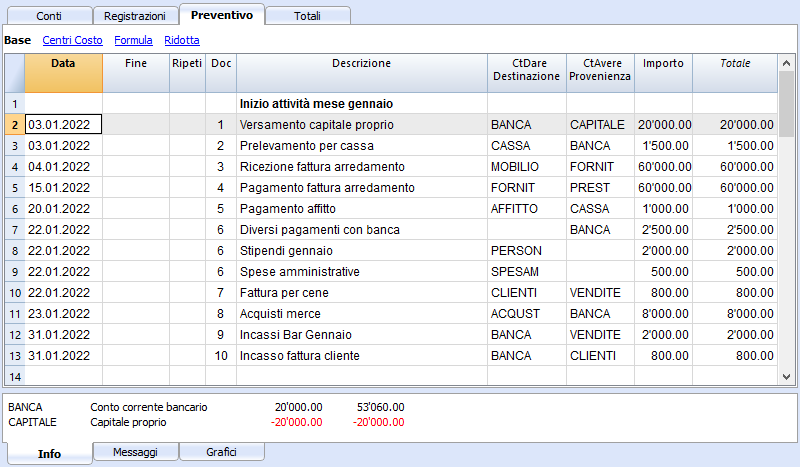

Esempi di movimenti di previsione finanziaria

I movimenti di pianificazione si inseriscono come delle normali registrazioni, con la data descrizione, importo, conto dare e avere.

In più si usa però il campo ripetizione, che consente di inserire le operazioni ricorrenti con una riga sola.

Qui di seguito sono elencati diversi esempi ripresi dal modello seguente a cui si rimanda per ulteriori spiegazioni.

Normali registrazioni di previsioni

Si tratta di registrazioni di previsione che sono come delle normali registrazioni.

L'esempio qui indicato è riferita all'inizio dell'attività, quindi operazioni che non si ripetono.

Registrazioni ripetitive mensili

Qui di seguito degli esempi di registrazione con ripetizione mensile, codice "M". La colonna Totale indica l'importo complessivo per l'anno.

Le prime due registrazioni si riferiscono all'affitto, che da febbraio a giugno è di 1'000 mensile, mentre da luglio è di 1'200.

C'é anche una data 2025, che è l'importo che si dovrà versare per il riscatto del leasing. In questa riga non vi è nulla nella colonna Totale, perché il movimento non rientra nelle date del periodo contabile definito nelle proprietà file.

Per le spese amministrative conteggiate dalla banca si è usato il codice ripetizione "ME" Fine mese (Month End). Per le registrazioni successive non sarà usato il giorno 28, ma l'ultimo giorno del mese, quindi marzo 31, aprile 30.

Fine trimestre

Qui indichiamo alcune registrazioni tipiche che si ripetono a fine trimestre. Inseriamo la ripetizione 3ME, che significa ripeti ogni 3 mesi, con data fine del mese.

Fine Anno

A fine anno ci sono delle operazioni. Qui usiamo il Ripeti "Y" in modo che queste operazioni saranno eseguite anche per gli anni successivi.

Previsione ricavi e acquisti merce

La previsione dei ricavi è specifica a ogni attività. In questo caso la previsione dei ricavi e degli acquisti viene indicata mese per mese, con un importo specifico.

A partire da marzo è indicata la ripetizione "Y" annuale, così che queste operazioni saranno ripetute negli anni successivi.

Ricavi anno successivo

I mesi di gennaio e febbraio nel primo anno di attività non erano considerati significativi per gli anni successivi, quindi non avevano una ripetizione.

Per i primi due mesi del secondo anno dobbiamo impostare le vendite. Mettiamo anche la ripetizione "Y" annuale così verranno ripetute l'anno successivo.

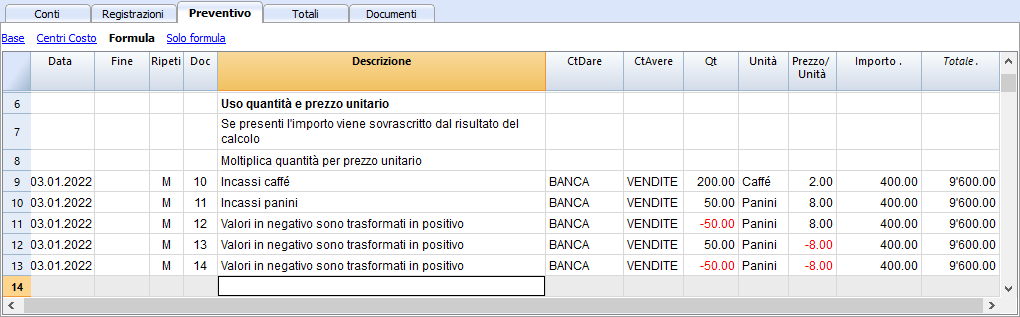

Forecasting with quantity and price

The Quantity, Unit and Unit Price columns of the Quotes table allow you to prepare forecasts faster.

The value of the Amount column is calculated by the program by multiplying the Quantity by the Unit Price (under the condition that Formula column is empty).

The Quantity, Unit Price columns are set as visible in the Formula View.

Advantages of using the Quantity and Prices columns

The quantity and price columns are useful for making predictions based on quantities. For example:

- In the Unit column you can indicate what the price refers to.

- The Quantity column indicates the number of seats served daily.

- The Price column indicates the estimated revenue for each cover.

- The Amount column will be calculated automatically based on the values indicated.

With this approach offers several advantages:

- All elements of the planning can be precisely detailed in the Budget.

- We remember the quantities and prices used to make the estimate.

- Changing the schedule is very simple, you can change the element you want only.

- How the profit varies, can be seen with a change in the quantities sold or in the price.

Break-even analysis.

Calculs et formules

Fonctions pouvant être utilisées dans la colonne Formules du tableau Budget

Fichiers d'exemple:

Pour des exemples concernant les formules, reportez-vous aux explications suivantes :

- Modèle des écritures avec l'utilisation des colonnes quantité et formule

- Modèle des écritures pour la comptabilité multidevise qui utilisent la colonne formule pour la devise de base

Colonne Montant

À des fins de planification, la valeur de la colonne Montant fait défaut.

La valeur dans la colonne Montant :

- Peut être saisie manuellement.

- Peut être le résultat d'un calcul :

- Si une quantité et un prix sont saisis, le montant sera le résultat de la multiplication de ces valeurs.

- S'il n'y a que la quantité ou le prix, le montant sera 0.

- Si une formule est saisie, le montant sera le résultat de la formule.

- La formule a également la priorité sur la quantité et le prix. S'il existe une formule, le contenu des colonnes Quantité et Prix n'est pas pris en compte.

Insertion de formules de calcul

Langage Javascript

La formule doit être exprimée en langage Javascript (à ne pas confondre avec le langage Java).

S'il existe une formule (ou un texte quelconque), la valeur de la colonne Montant est définie en fonction du résultat de la formule.

Vous pouvez utiliser toutes les fonctions du langage Javascript, plus les API fournies par Banana.

Séparateur de décimales

Javascript utilise uniquement le point "." comme séparateur de décimales.Si vous utilisez un séparateur différent, celui utilisé pour les nombres dans le format local, il est probable que le nombre sera tronqué.

Séquence de calcul et absence de valeurs futures

Comme expliqué ci-dessous, les lignes sont triées par date et résolues en commençant par la plus basse.

S'il y a des opérations avec la même date, l'ordre est celui du moment de la saisie.

Lorsqu'une ligne est résolue, il n'y a que les résultats des lignes précédentes. Les lignes suivantes n'ont pas encore été traitées, de sorte que dans la formule de budget, vous ne disposez que des valeurs jusqu'à ce moment.

Le résultat de la dernière opération est repris.

La valeur saisie dans la colonne Montant est le résultat de la dernière opération effectuée.

- 10*3 //sera retourné 30

- S'il y a plusieurs opérations en séquences, séparées par des points et virgules ";" la dernière opération sera reprise.

10*3;7; // C'est le 7 qui sera repris - S'il y a un retour, la valeur est reprise après le retour.

retour 10; // C'est le 10 qui sera repris

Variables automatiques

- budgetCurrent

C'est un tableau qui contient les lignes du Budget juste après la création des répétitions.

Elles sont utilisées pour reprendre les valeurs, en conjonction avec le JReapeatNumber. - DEBUG est une variante qui peut être "true" ou fausse.

Si "true", tous les résultats des formules sont affichés dans les messages. - row

C'est un objet javascript qui fait référence à la ligne courante.

Les valeurs des cellules peuvent être reprises avec la fonction value ("columnNameXml").

row.value("date") retourne à la data de l'écriture.- row.value ("JRepeatNumber") retourne le progressif de la répétition.

La première répétition est 0.

- row.value ("JRepeatNumber") retourne le progressif de la répétition.

Fonctions Budget

En plus de l'API budget défini dans l'API de classe comptabilité, il existe des fonctions spécifiques.

budgetExchangeDifference(account,[date, exchangeRate])

Cette formule rappelle la fonction Banana.document.budgetExchangeDifference.

budgetGetPeriod(tDate, period)

Cette fonction est utilisée en combinaison avec l'utilisation de la répétition.

Lorsque des répétitions sont indiquées, il est conseillé de se référer à une période de calcul et non à une date précise.

Paramètre tDate. Date à laquelle le calcul de la période se réfère. En règle générale, la date de la ligne d'écritures.

- Paramètre period.

Un sigle- "MC", "QC", "YC" pour indiquer le mois, le trimestre ou l'année courant.

- "MP", "QP", "YP" pour indiquer le mois, le trimestre ou l'année précédente.

- Valeur de retour.

Un objet composé de deux dates- startDate

- endDate

// example

t = BudgetGetPeriod ('2015-01-01', 'MP') retourne

t.startDate // 2014-12-01

t.endDate // 2014-12-31

Fonctions budgétaires spécifiques

Ce qui suit est similaire aux fonctions disponibles avec Banana.document, mais peut être utilisé sans indiquer l'objet Banana.document.

A tenir compte:

- Au lieu du paramètre startDate, vous pouvez utiliser une des abréviations "MC", "QC", "YC", "MP", "QP", "YP" expliquées dans le budgetGetPeriod.

- Si un sigle est spécifié comme date, la date de l'écriture en cours est utilisée.

- L'utilisation de la date de fin n'a de sens que si elle est antérieure à la date de la ligne

Si elle est égale ou supérieure, elle n'aura aucun effet car les valeurs après la ligne courante ne sont pas encore disponibles, car elles n'ont pas été traitées.

Liste des fonctions disponibles dans tous les comptabilités :

- budgetBalance(account, startDate, endDate, extraParam)

Le solde jusqu'à la ligne courante.

budgetBalance('1000', 'MP'); //retourne le solde de 1000 à la fin du mois précédent - budgetOpening(account, startDate, endDate, extraParam)

Le solde au début de la période. - budgetTotal(account, startDate, endDate, extraParam)

La différence entre les mouvements Débit et Crédit de la période

budgetTotal('1000', 'MC'); //Retourne le mouvement total du compte 1000 pour le mois courant - budgetInterest( account, interest, startDate, endDate, extraParam)

Calcule les intérêts sur un compte, pour la période indiquée (au maximum la date du jour)

Si vous utilisez pour calculer les intérêts sur un compte de fin de période, la ligne où la formule est affichée doit toujours être la dernière pour cette date.- Paramètre intérêt,

Indique le taux d'intérêt en pourcentage.- positif (2.5, 4, 10) calcule les intérêts sur le mouvement Débit du compte.

- négatif (-2,5, -4, -10) calcule les intérêts sur le mouvement Crédit du compte.

- Paramètre intérêt,

Fonctions pour la comptabilité multidevise :

Ils peuvent également être utilisés pour la comptabilité sans multidevise, dans ce cas le compte est toujours dans la devise de base.

- budgetBalanceCurrency(account, startDate, endDate, extraParam)

Le solde dans la devise du compte jusqu'à la ligne courante. - budgetOpeningCurrency(account, startDate, endDate, extraParam)

Le solde dans la devise du compte jusqu'à la ligne courante. - budgetTotalCurrency(account, startDate, endDate, extraParam)

crédit(montant)

-

Si le paramètre montant est négatif, il retourne le montant comme valeur positive.

credit(-100) // retourne 100 - Si le paramètre montant est positif, il retourne 0 (zéro)

credit(100) // retourne 0

Cette fonction est utile en liaison avec la fonction budgetBalance seulement sur les soldes nécessaire.

Si vous voulez calculer le pourcentage sur les ventes, l'utilisation de cette fonction est plus facile.

credit(budgetTotal('1000')) // insère la valeur que si elle est négative.

debit(montant)

-

Si le paramètre montant est positif, il retourne le montant.

debit(100) // retourne 100 - Si le paramètre est négatif, il retourne 0 (zéro)

debit(-100) // retourne 0

Utile si vous devez faire des calculs en utilisant seulement le montant du Débit en évitant d'utiliser celui du Crédit.

Include

Inclut et exécute un fichier javascript, avec la possibilité de créer des fonctions spécifiques et des variables qui peuvent être rappelées dans le script.

- inclure "file:test.js"

Exécute le contenu du fichier indiqué. Le nom est relatif au fichier sur le quel l'on travaille. - inclure "documents:test.js"

Exécute le document texte contenu dans le tableau documents

Doit être un fichier de type "text/javascript"

Variables

Il est possible de définir et d'utiliser des variables directement à l'intérieur des lignes.

La variable doit pour autant avoir été définie au préalable.

price = 10; total = price * 5;

Fonctions définies par l'utilisateur

L'utilisateur peut définir des fonctions avec le langage javascript et les rappeler dans les formules.

Il est possible de définir des fonctions:

- Directement dans une formule

- A l'intérieur d'un fichier attaché du type code javascript, indiqué dans un document qui a comme ligne id le nom "_budet.js"

- A l'intérieur d'un texte dans le tableau documents et inclu avec la commande inclure.

function calcolaImposte(utile)

{

var aliquota = 10;

if (utile > 50000)

aliquota = 10;

else if (utile > 100000)

aliquota =20;

return utile * aliquota / 100;

}

Séquence de calcul et de recalcul

Chaque fois qu'une valeur dans la tableu Budget est modifiée ou que l'on fait un nouveau contrôle manuel (Maj. +F9), le programme:

- Si il existe, le contenu du document "_budget.js" vient avant tout.

- Recalcule les lignes du tableau Budget:

- Le programme génère les lignes répétées sur la base de la colonne Date début, Date fin et Répétition.

Si en janvier il se trouve une ligne avec répétition mensuelle, 12 lignes identiques seront créées, mais avec la date per chaque mois de l'année. - Les lignes du budget sont donc élaborées par ordre de date (si elles ont la même date dans l'ordre d'insertion.)

- Le calcul du montant de l'écriture sera calculé sur la base de la quantité et du prix unitaire ou si il y a une formule, sur la base du résultat de la formule.

- Pour la comptabilité multidevise c'est d'abord la formule Montant en devise qui sera exécutée et ensuite la formule Montant en devise de base.

S'il n'y a pas de formule Montant en devise de base, le programme reprendra le change historique et calculera l'équivalent en devise de base. - Pour la comptabilité avec la TVA, la TVA est calculée sur base au montant de l'écriture

- Les lignes élaborées précédemment servent pour les calculs des lignes suivantes.

Les soldes des comptes à la date de la ligne du budget contiendront seulement les montant élaborés précédemment.

Si dans une écriture de février on utilise une formule pour le calcul du solde pour toute l'année, on n'aura quand même que le solde jusqu'à février.

- Le programme génère les lignes répétées sur la base de la colonne Date début, Date fin et Répétition.

- Recalcule les valeurs du budget dans le tableau comptes, sur la base des lignes de budget et des soldes initiaux.

- La valeur de la colonne total est mise à jour dans le tableau budget.

Si la date de début/fin de la comptabilité est modifiée, ou d'autres valeurs qui sont nécessaires pour le calcul des valeurs du Budget (par exemple, le tableau TVA), il faut recalculer la comptabilité manuellement (Commande Contrôler la Comptabilité)

Si vous avez beaucoup de lignes avec beaucoup de répétitions, ainsi qu'une une longue période de calcul, le recalcul du tableau Budget pourrait rallentir la saisie. Dans ce cas, il faudrait activer le recalcul manuel dans les propriétés du fichier.

Examples of the use of formulas in financial forecasts

Below you will find some examples of how to use formulas to automate financial forecasts.

Please refer to the specific documentations:

- Javascript formulas in the Budget table

- Templates with transactions using the Quantity and Formula column

Parameters

When planning, it can be useful to define variables that can and will be used later.

It is useful to create a parameter section with a posting date of January 1st, or another date that corresponds to the first day of the Budget. The parameter variables will then be used in the following rows.

// 30% costOfGoodsSold = 0.3 // 5% interestRateDebit = 0.05 // 2% interestRateCredit = 0.02 // 10 % latePaymentPercentage = 0.1

This way, all parameters that can be set are displayed instantly. When a parameter is changed, the forecast is recalculated.

Repetitions or values per month

By using the repeat column, you can plan for the whole year on one recording row.

If however, the activity has seasonal variations, it is recommended to use a forecast by month. For each month, a row is created with the sales amount for the month.

If you wish to make forecasts automatic for several years, it is useful to insert the repetition "Y" in this row, so that the row of the year is also used for the next one.

Prices and sales quantities

When making a sales plan it will be easier to enter values using the quantity and price column. For example, a restaurant can enter the number of covers served per day, week or month and the program automatically calculates the amount. By changing the number of covers or the price, the impact on liquidity and on the result for the year is instantly displayed.

Use of formulas with variables for growth

Use formulas, which are expressed in the Javascript language:

- The variable must be defined before being used, hence the line, in which it is defined, must be a date preceding the the line in which it is used.

- Thousands separators in numbers can't be used.

- The decimal separator is always the "." (Full stop)

- The names are different for uppercase / lowercase.

You can assign a value to a variable (this name can be freely chosen) and enter the variable name in the following lines to resume the value.

By changing the value assigned to the variable, all the lines, in which the variable is used, are automatically modified.

As an example, you may set the expected sales amount, proceeding with the following months, by using a formula to increase the amount.

- Create a "S" (sales) variable , by entering the following text in the Formula column.

Sales=1000

The value 1000.00 will be inserted in the amount column - In the following lines use the variable by simply inserting the variable name in the formula:

Sales

The value 1000.00 will be inserted in the amount column - You can add 10% to the amount (multiplying by 1.1)

Sales*1.1

The value 1100.00 will be inserted in the amount column (The value of the Sales variable does not change) - You can increase the value of S

Sales=Sales+200

The value 1200.00 will be inserted in the amount column (The value of the Sales variable will change) - If the variable is used in the following line, there will be the new calculation

Sales

The value 1200.00 will be inserted in the amount column

You can also define a variable to define the percentage of growth.

- Percentage=1.1

- Amount=200

- In formulas you can use the variable name instead of the number

- Sales*Percentage

- Sales=Sales+Amount

Variables and repetitions

Let's say you expect the turnover to rise by 5% every month.

- Enter two lines where you assign the value to the variable, without putting any account with the start date of the year.

Sales=1000

Increment=5 - Then create a line with the repetition where you enter the accounts and the formula

Sales=Sales*(1+Increment/100)

Each time the row is repeated the value of the variable S will be increased by 5% and consequently also the amount of the transaction. By simply changing the growth percentage, the forecast will be recalculated.

In a row you can also insert multiple Javascript instructions, by separating them with a semicolon ";"

Sales=1000; P=5

Use of budget formulas

There are functions that allow you to access the balances and movements of the accounts for planning up to the row that is calculated.You can enter a formula that through the budgetTotal function, recovers the value of the sales account "SALES" of the previous month.

credit( budgetTotal("SALES", "MP") )

The budgetTotal function takes account numbers and periods as arguments. An abbreviation can be used instead of the period.

- MP stands for previous month.

- QP stands for previous quarter.

Revenues show in Credit, therefore the value returned by the function will be negative and will not be accepted as an amount in the double entry accounting.

Therefore use the credit () function, which uses the negative value and turn it into a positive value.

Variables for monthly sales

Sales may vary for each month. In this case it is useful to use separate registrations for each month with the variable name.

sales_01 = 1000 cost_01 = sales_01 * costOfGoodsSold sales_01 = 1100

Deferred payments

If you want a very precise liquidity plan, it is useful to separate the sales, which are paid immediately and those that are deferred.

One approach may be to record all sales as if they were paid cash, assigning the value of the monthly variable to the amount.

sales_01 = 1000

A registration is then entered, which reverses the sales that are deferred, calculating the amount with the formula.

sales_01 * latePaymentPercentage

A payment registration with the same formula will then be inserted for the following month.

Selling costs

There are costs that can be related to sales (cost of goods) or to other costs (social charges, in relation to wages).

Cost calculation with variables

If the sales are defined with variables, the sales costs can also be indicated as a percentage of the sales.

- You can define variable S for sales and variable C for the percentage of the cost.

Sales=1000

Cost=60 - The formula for the calculation will be:

Sales*Cost/100

You can also use the same approach to calculate social security charges.

This formula can possibly be entered in a repetitive row.

Sales cost calculation with budget functions

When the costs are related to sales, the budget formula can also be used.

credit( budgetTotal("SALES", "MC") )*60/100

When the costs related to sales, "MC" stands for the current month.

This formula will return the sales value of the current month, turn them into a positive and multiply them by 60 and divide by 100.

The date must be beyond the sales registration dates, obviously.

It may be used it in a repeat row, inserting the month end date. Therefore, the costs of the sale will automatically be calculated based on the sales entered with the transaction.

The formula can be combined with variables.

- At the beginning of the year define the percentage of costs.

Cost=60 - Therefore, the formula C is used.

credit( budgetTotal("SALES", "MC") )*Cost/100

When you change the contribution percentage or any sale, the schedule will be updated automatically.

Sales commission calculation at the end of the year

At the end of the year, you calculate the commissions of 5% on the total net sales with this formula:

credit( budgetTotal("SALES", "YC") )*5/100

The bugetTotal function returns the movement of the sales account for the period "YC", current year. With the credit () function, the amount is turned into a positive value and then multiplied by 5 and divided by 100.

If you make forecasts over several years, remember to insert the repetition "Y" in the row, so that the same formula will be also calculated for the previous year. As indicated above instead of entering the 5 directly in the formula, you can assign it with a variable.

- Commission=5

- credit( budgetTotal("SALES", "YC") )*Commission/100

If the percentage changes from one year to the next, it is sufficient enter a transaction with the following year date that resets the variable for commissions.

Inflation with variables

If you want to forecast over several years, you can also take inflation into account.

- At the beginning of the planning, assign a base variable for prices and inflation (2%).

Base=1;Inflation=2 - When you use the Sales variable, you multiply it by the inflation rate

Sales=Sales*Base - At the beginning of the following year, with annual repetition, you increase the price base

Base=Base+Base*Inflation/100

Depreciation calculation

Thanks to the formulas, the calculation of depreciation can be automated.

If you change the value of your investments in planning, depreciation will be automatically recalculated. Make sure that the date of the depreciation calculation line has a date superior to that of the investments. Date is generally 31st December .

Depreciation calculation on book value

To calculate the depreciation of the "EQUIPMENT" account, insert a line at the end of the year with the following formula and the debit and credit accounts appropriately set up to register the depreciation.

budgetBalance("EQUIPMENT")*20/100

The budgetBalance function returns the balance to that date. The amortization of 20% is then calculated on this.

Use the debit function, in case you think the asset account can go into credit.

debit(budgetBalance("EQUIPMENT"))*20/100

Calculation of depreciation on the initial value

To calculate the initial value of the investments, it is necessary to use variables to remember the value of the initial investment.

Equipment=10000

If the depreciation is spread over 5 years, the formula will be inserted in the year-end depreciation line

Equipment=10000/5

The annual repetition "Y" and the end date, which corresponds to the date of the last installment of the amortization, will be inserted in the row to prevent the amortization from running on indefinitely.

For each investment you will have to create a variable and a specific row of depreciation. Numbers can also be entered in variable names.

Equipment1=10000

Equipment2=5000

Interest calculation

The budgetInterest( account, interest, startDate, endDate) function allows you to automatically calculate interest based on the actual use of an account.

The parameters are:

- Account

Whose movements are used to calculate interest, in case it will be the bank account or the loan. - Interest

The interest rate in percentage.

If the value is positive, interest on the debit balances is calculated.

If the value is negative, interest on the credit balances is calculated.. - Initial date, which may also be an acronym.

- End date, which may also be an acronym.

- The returned value is the interest calculated for 365/365 days.

Interest expense on the bank account

To calculate the interest expense of 5%, insert a line with the end date of the quarter and the repetition "3ME", which contains the formula

budgetInterest( "Bank", -5, "QC")

The interest rate is negative, because "QC" means current quarter. The debit and credit accounts must be the usual ones for recording interest expense. If the interest decreases the bank account balance will also be used in the registration. However, another account can be used if it is paid with another account.

It is important that the "3ME" repeat is used so that the date used will always be the last of the quarter.

To calculate the interest of the month use the abbreviation "MC"

budgetInterest( "Bank", -5, "MC")

Interest on the bank account

For interest income of 2%, use positive interest instead.

budgetInterest( "Bank", 2, "QC")

Interest on fixed-term loan accounts

For fixed-term loans, interest will be calculated and recorded on the specified date.

- Create an separate account for each loan.

Use the budgetInterest function indicating exactly the start and end dates .If the date is indicated as text, the notation "yyyy-mm-dd" should be used, then "2022-12-31" - Use variables.

As indicated for depreciation, the loan amount can be assigned to a variable. The interest calculation will be done with a Javascript calculation formula,- Define the loan variable

Loan=1000 - 5% interest calculation, for 120 days.

Loan*5/100*120/365.

- Define the loan variable

Profit tax calculation

Profit is the total of the group's profit for the specified period.

To calculate a 10% profit tax, use the following formula.

credit(budgetTotal("Gr=Result","MC"))*10/100

- Use the the budgetTotal function parameter in the "Gr = Result" group, which indicates that instead of an account it has to calculate the movements for the group.

- MC, current month, is indicated as the period.

- The budgetTotal function will return a positive value if there is a loss and negative (credit) if there is a profit.

- the credit function takes only negative values into account, therefore if there is a loss the tax will be zero.

Payments with deferred or different deadlines

For deferred payments or with different deadlines, you can proceed in two ways:

- Use variables to which payment amounts are to be assigned.

Use the variable in question when recording the payment. - Create customer or supplier accounts for different credit deadlines.

Other cases

Please tell us about your other requirements, so we can add more examples.