The multi-currency chart of accounts

The Chart of accounts of the multi-currency accounting is the same as the one of an accounting without foreign currency, except for the specifics that are indicated here below.

Basic currency

In the File and accounting properties, the basic currency should be defined and in the Exchange rates table, the foreign currencies should be defined.

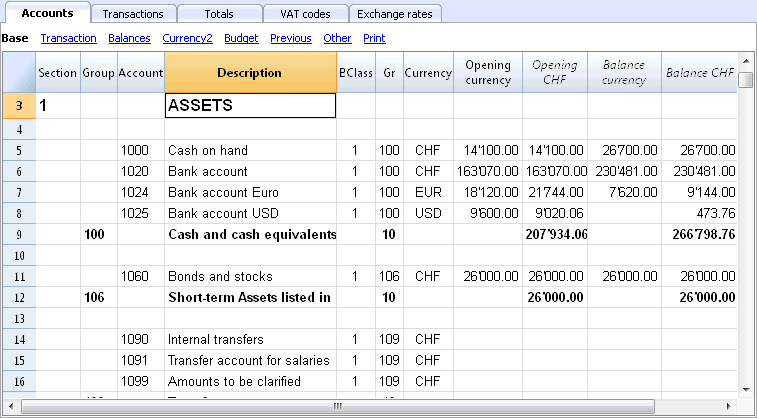

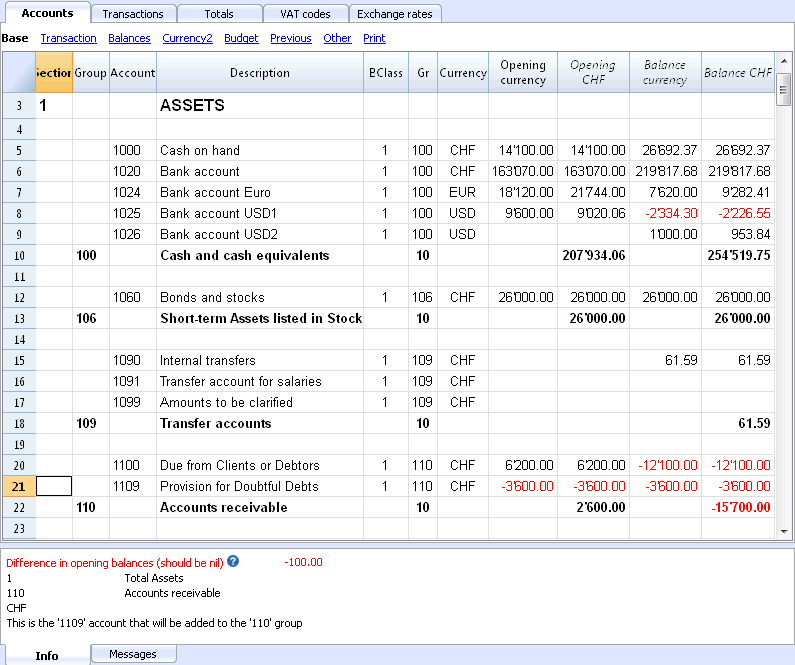

In the example here below, the basic currency is the CHF, which, as can be seen, appears in the column headers with the amounts in basic currency.

Account currency

- The Assets and the Liabilities (Balance sheet accounts) can be in basic currency or in foreign currency.

-

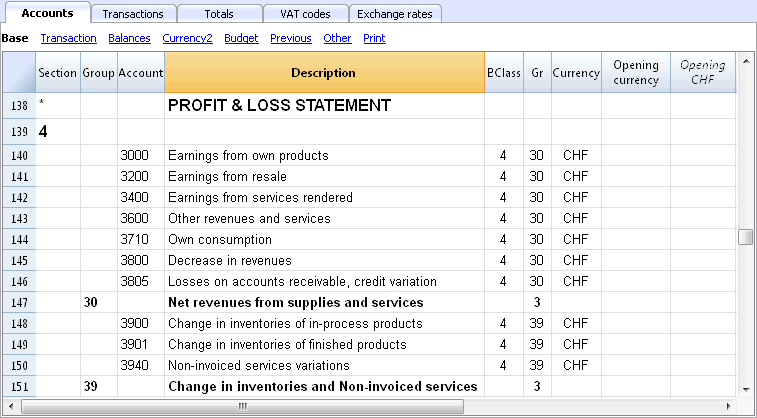

The Costs (Expenses) and Revenue accounts must be in basic currency.

Explanation of the columns of the multi-currency accounting

- The opening balance in basic currency.

A protected column, calculated by the program based on the opening balance in currency and the opening exchange rate (exchange rate of the exchange rate table indicated in a row without date). - The current balance in currency.

Calculated by the program, using the opening balance in currency and the currency amount indicated in the transaction rows. - The current balance in basic currency.

Calculated by the program, using the opening balance in basic currency and the amount in basic currency indicated in the transaction rows. - The calculated balance

Is the balance in the account currency converted at the current exchange rate (exchange rate of the exchange rate table indicated in a row without date).

-

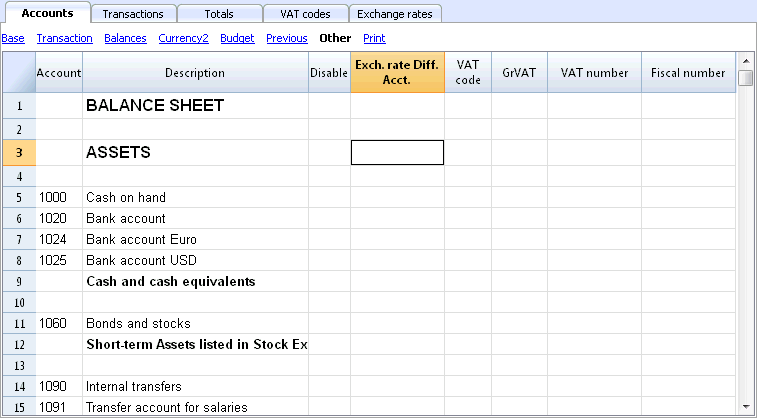

In the Other view from the Account table, there is the Exch. rate Diff. Acct.

In this column, for specific account/accounts, you can enter an account (or several accounts, separated by a semicolon) in order to enter the exchange rate differences. These are different accounts from those in the File and accounting properties (account for exchange rate profit and loss).

If in the Exch. rate Diff. Account column there are no accounts, the program will register exchange rate differences on the accounts indicated in the File and accounting properties; if however accounts are indicated both in the File and accounting properties and in the Exch.rate Diff.Acct. (Other view), the program will only consider the accounts indicated in the Exch.rate Diff.Acct., and ignore the File and accounting properties indications.

Opening Balances

- Before entering the opening balances, the opening exchange rates for the different currencies have to be indicated in the Exchange rate table.

The opening exchange rate is the one indicated in the Rate Opening column in the row of the exchange rate without date.

The opening exchange rate must be equal to the closing exchange rate of the preceding year. See Differences in the Opening Balances. - The Opening balances have to be inserted in the Accounts table, in the Opening currency column, Base view. This operation needs to be done for both basic currency and foreign currency accounts.

- The Opening Basic currency column is protected; the program automatically calculates the value in the basic currency on the basis of the opening exchange rate shown in the Exchange rate table.

- The opening balances for the liabilities have to be entered with the minus sign (-) in front of the amount.

- The opening balances of assets and liabilities have to balance out; for more information please visit the Recheck the accounting page.

Revaluation accounts and historical exchange rates

The basic currency amount of an account is being calculated using the opening exchange rate and the exchange rates that are indicated in the transactions. Because this value corresponds to equivalent of today's exchange rate, it is necessary to revaluate the account.

The revaluation takes place by calculating the exchange rate differences. We need to record on the account just an amount in basic currency (exchange rate difference), so that the balance in basic currency results equal to the equivalent (calculated balance)

There are accounts (related to, for example, investments) for which a so-called historic exchange rate is being used. By an historical exchange rate we mean un exchange rate that doesn't vary over time.

In order to have exchange rates that don't change, an extra currency symbol (for example EUR2) must be created in the Exchange rate table. To this currency, the same exchange rate is always being applied.

You can create as many currency symbols as you need for the different accounts with historic exchange rates.

Group totals in foreign currency

Normally, the columns with amounts in foreign currency don't have totals, as it has little sense to calculate totals for values in different currency.

If you have a group that includes only accounts in a specific currency, the currency symbol can be indicated at a group level and, in the Accounts table, the program totalizes these amounts. If there would be accounts with various currency symbols, there would be no amount indicated (the program would not report an error either).

Differences in the opening balances

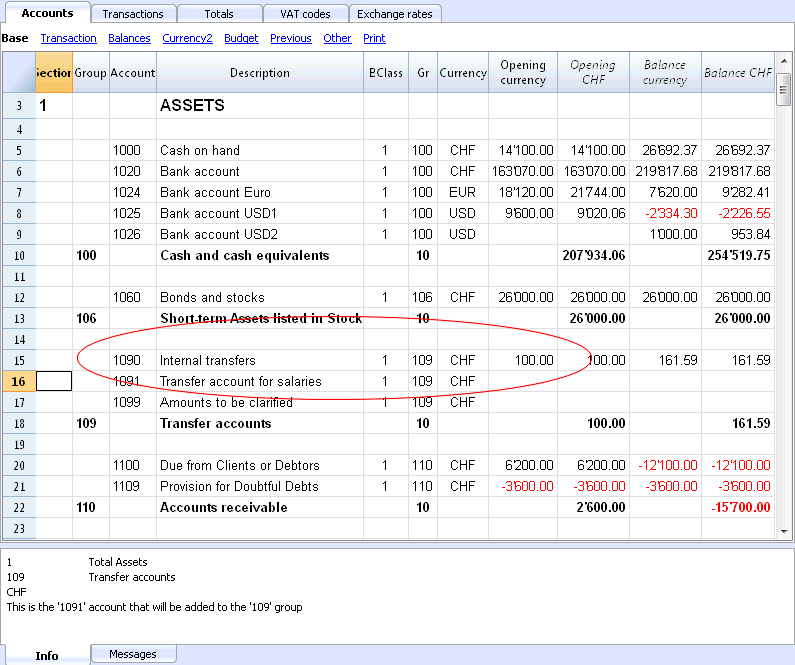

When, in the preceding year, the exchange rate differences have not been calculated, the program signals, in the New Year, a difference in the opening balances.

In order to resolve this problem, there are two possibilities:

- Insert in the Exchange rate table, Exchange rate column, the official exchange rates at 31.12

- Activate, from the Account2 menu, the Create transaction for exchange rate variation command

- Open the file for the New Year and update the opening balances

- Open the file of the New Year

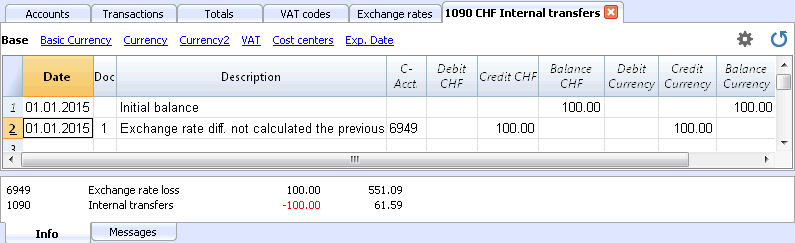

- Insert in the Assets or the Liabilities (Accounts table), according to the situation, a new account Unrecorded Exchange rate differences or record the amount in the 1090 Internal tranfers account (as in the following example)

- In the Opening Currency column, insert the amount corresponding to the exchange rate difference

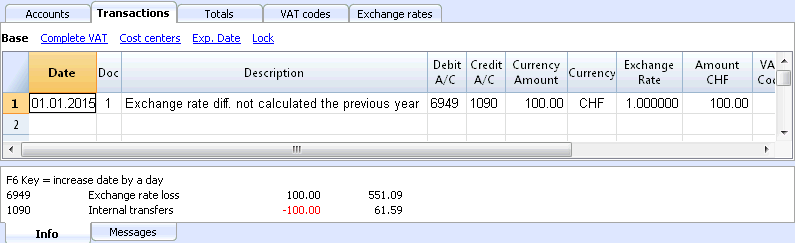

- At 01.01, the exchange rate difference account has to be put to zero by means of a transaction (Transactions table), using the account related to the exchange rate differences (Exchange rate profit/loss) of the profit/loss statement as its counterpart.

After the transaction to arrange the exchange rate differences has been made, the account that has been used should have a balance of zero, or equal to the amount corresponding to the balance prior to the transaction.