Sections

In order to create automatically an Enhanced Balance Sheet with groups, the chart of accounts needs to be configured with special codes that are to be entered in the Section column:

| * | Title 1 | the asterisk separates the sections and indicates the main headers |

| ** | Title 2 | to be entered for the secondary headers |

| 1 | Assets | to be entered in the row of the Assets title |

| 2 | Liabilities | to be entered in the row of the Liabilities title |

| 3 | Expenses | to be entered in the row of the Expenses title |

| 4 | Revenue | to be entered in the row of the Revenue title |

| 01 | Client's Register | to be entered in the row of the Client's Register title |

| 02 | Supplier's Register | to be entered in the row of the Supplier's Register title |

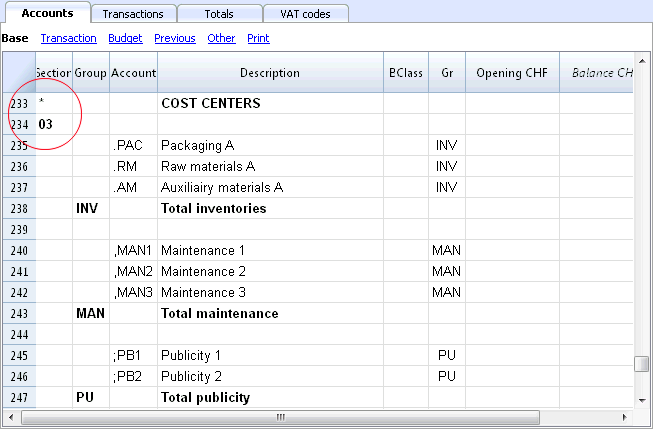

| 03 | Cost Centers | to be entered in the row of the Cost Centers title |

| 04 | Profit Centers | to be entered in the row of the Profit Centers title |

| # | Notes | to be entered in the row of the Notes title |

| #X | Hidden data |

to be entered in the row from whereon the data have to be hidden |

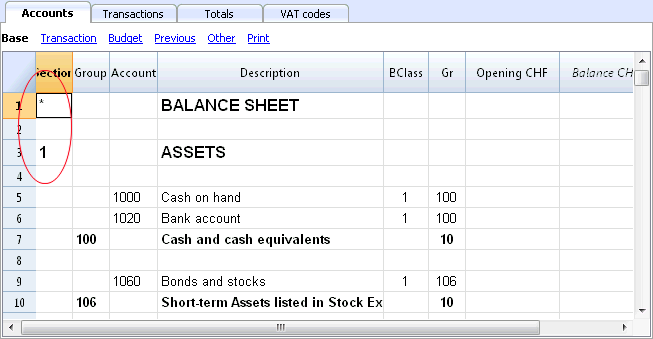

Sections in the Assets

- Enter a * on the same row as the Balance Sheet title

- Enter 1 on the same row as the Assets title

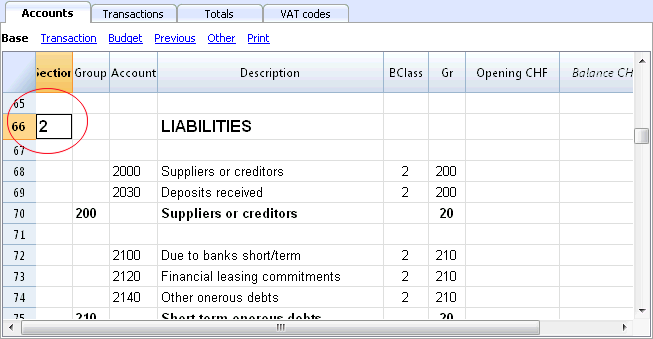

Sections in the Liabilities

- Enter 2 on the same row as the Liabilities title

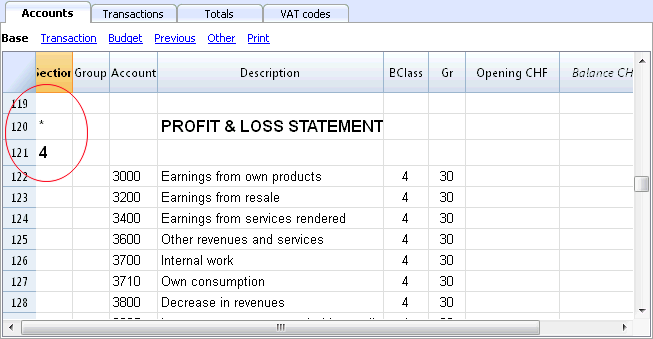

Sections in the Profit & Loss Statement

- Enter a * on the same row as the Profit/Loss Statement title

- Enter 4 on the empty row below the Profit/Loss Statement title

Note: when there is a clear distintion between Revenue and Expenses in the Chart of accounts, you need to:

- Enter 3 on the same row as the Expenses title

- Enter 4 on the same row as the Revenue (Income) title .

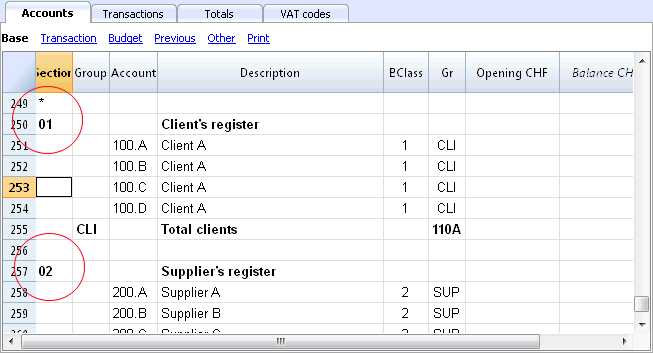

Sections in the clients/suppliers register

- Enter * in the same row as the Clients/Suppliers register title or on a empty row (as in the following example)

- Enter 01 on the same row as the Clients register title

- Enter 02 on the same row as the Suppliers register title

The amounts will be shown in the same way as for the Assets and the Liabilities.

This encoding is also valid when the clients and suppliers are configured as cost centers.

In case there are cost or profit centers configured, enter the following elements

- An * on the row of the Costs and Profit Centers title, or on a empty row

- 03 on the same row as the Cost centers title or on an empty row preceeding the Cost Centers

- 04 on the same row as the Profit centers title or on an empty row preceeding the Profit Centers

The Cost Centers amounts will be shown as positive (in black) like the expenses; the Profit Centers amounts will be shown in negative (in red) like the revenue;

For more information please vist the Sections logic page

Related document: Enhanced Balance Sheet with groups

The Sections logic

The sections different encoding entered in the Section column determines how the printout will come out.

Each section is printed as a separate table.

The directories

- * Title 1 creates a level 1 directory.

It can contain level 2 sections or directories.

It is useful to group sections that need to be printed together, such as the Balance sheet, which contains Assets and Liabilities. - ** Title 2 creates a level 2 directory.

The Base sections

The section number or code determines:

- how the amounts are printed; the amounts can be visualized just like in the Balance sheet or inverted.

If the Credit amounts (in negative) are inverted, they will be visualized in positive, and the positive amounts will be visualized in negative. - which amount columns will be used; the Balance column or the Period Movement column are used.

The Balance column indicates the account balance at a specific date (balance at Jun 30th).

The Total Period Movement column indicates the movement amount on the indicated period.

It is used for the Profit and Loss Statement and indicates the costs or the revenues for a certain period.

Here is the explanation of the different sections

- 1 Assets (amounts as in the accounting plan, balance column)

- 2 Liabilities (inverted amounts, balance column)

- 3 Costs (amounts as in the accounting plan, total movement column)

- 4 Revenues (inverted amounts, total movement column)

This section can be also used alone and it can include both costs and revenues (in case of a Profit & Loss Statement that starts with the total Business result and that subtracts the costs). In this case revenues would be displayed in positive and costs in negative.

These sections must be unique. Therefore there can only be one 1 Assets, or one 2 Liabilities section. For other sections, like clients/suppliers register or cost center similar sections can be used.

Derivatives Sections

Those are Sections that are similar to the Base Sections

- 01 Similar to Assets (amounts as in the accounting plan, balance column)

It is used for the clients register. - 02 Similar to Liabilities (inverted amounts, balance column)

It is used for the suppliers register. - 03 Similar to Costs (amounts as in the accounting plan, total movement column)

It is used for Cost Centers. - 04 Similar to Revenues (inverted amounts, total movement column)

It is used for Profit Centers.

Other Sections

There are other kinds of sections

- # Indicates a Notes Section (it prints only the Description column)

It is used for the Balance sheet attachments - #X Hidden Section. This section is not included in the sections selection and it is not printed.

It is used to indicate parts not to be printed.

Column width in printout

The columns width is automatically set by the program.

Sections 1, 2, 01, 02 have the same column width

Sections 3, 4, 03, 04 have the same column width.