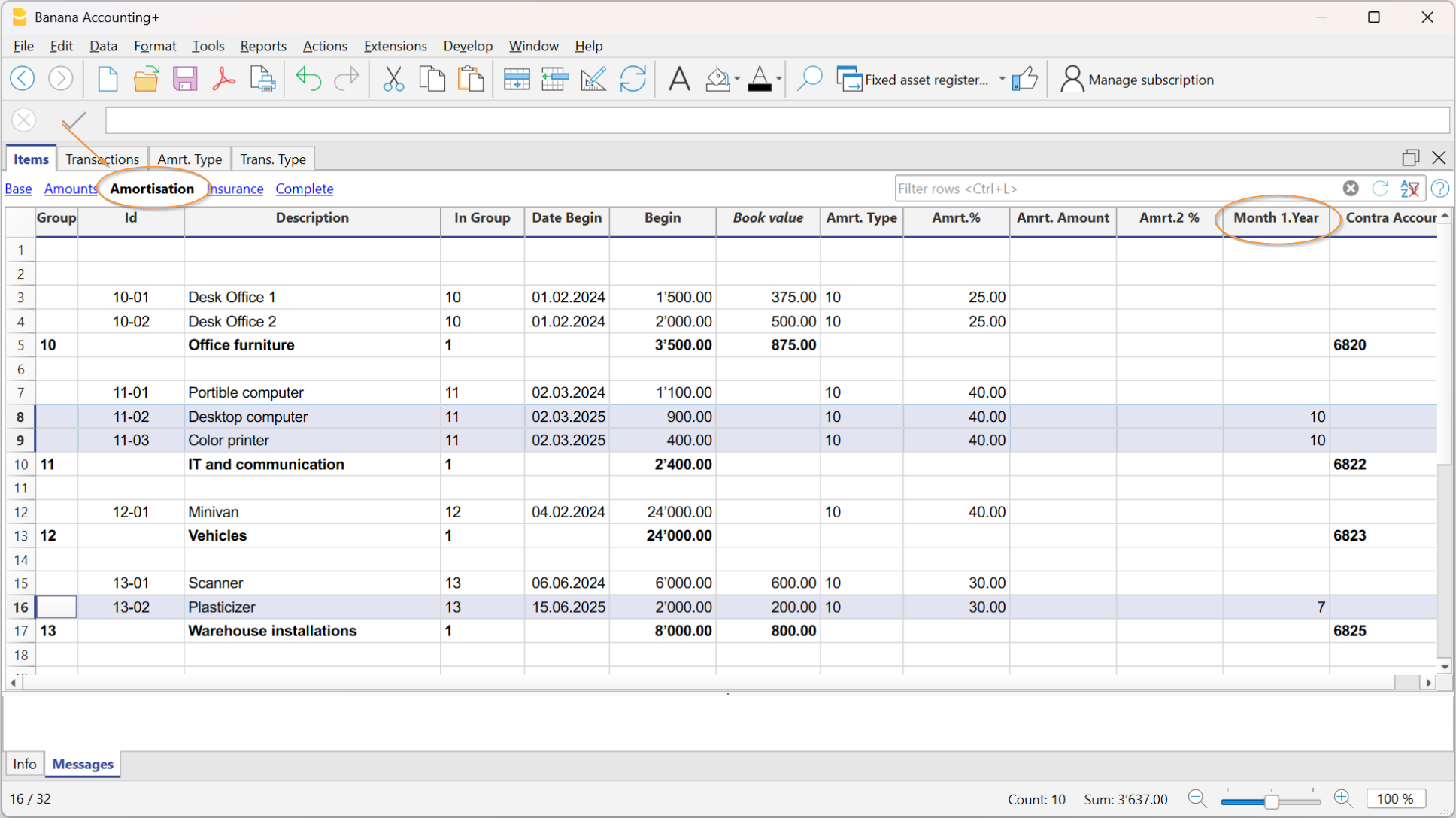

Amortisation of assets purchased during the year

When a depreciable asset is purchased during the year, it is necessary to set the number of months over which the depreciation should be calculated.

Proceed as follows:

- In the Items table, go to the Amortisation view, column Month 1.Year

The column can also be activated and then displayed in the Base view from the menu Data > Columns setup ( AmortisationMonthFirstYear). - In the row where the vehicle purchase is recorded, enter the number of months over which depreciation should be calculated in the Month 1 Year column.

On 31.12, when amortisation is calculated, all depreciable assets that have a value in the Month 1 Year column will be depreciated not for the entire year, but only for the number of months specified in the column.