In this article

Starting from the third quarter of 2023, the new 2024 VAT form is already available on the VAT portal. Here, you can input both the VAT data for 2023 and those with the 2024 tax rates.

VAT data can be submitted in one of the following ways:

Manually enter the VAT data in the AFC portal

- View and print out the VAT return facsimile and check that the data is correct.

- Log in to the Federal Tax Administration portal with your account details.

- Manually enter the data from the VAT Facsimile in the online VAT report.

- Check all data before sending.

- Proceed with the submission.

Online submission of VAT data with Xml file

From 2025, it will no longer be possible to send the VAT report in paper format. Banana Accounting Plus is already prepared according to the new 2024 VAT rates for the transmission of VAT data via Xml file.

For the creation of Xml files, please refer to the information at https://www.banana.ch/apps/en/node/9023.

Before entering the data on the FTA portal, proceed as follows:

- View and print the VAT Return facsimile and check that the data is correct.

- Create the XML file for the VAT for the quarter or the semester you are interested in.

- Log in to the Federal Tax Administration portal with your account data.

- Choose to import the data in XML format.

- Check the data automatically displayed in the online form against the data in the VAT facsimile.

- Validate the data and proceed with the submission.

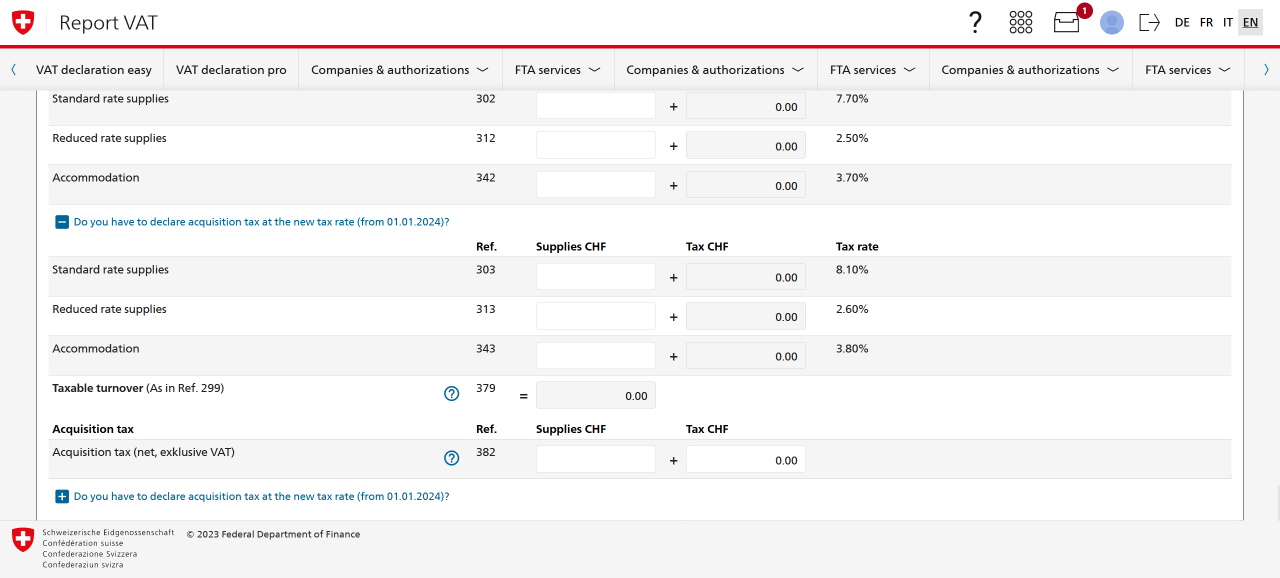

For those who need to include the 2024 VAT rates in the VAT reports for the third and fourth quarters of 2023, as shown in the image below, by clicking onto Do you have to declare acquisition tax at the new tax rate (from 01.01.2024)?, the boxes for the new figures will appear, allowing you to enter the VAT data with the new 2024 rates.

Net or gross sales

When manually entering data into the AFC portal, it is important to correctly choose the net setting at the top of the form.

If, on the other hand, you directly submit the XML file generated by Banana Accounting Plus, the information is already included in the file itself through the <eCH-0217:grossOrNet> tag.

Error Messages

This extension does not work with your current version of Banana Accounting.

This extension works from version Banana Accounting Plus 10.1 or higher, Advanced plan.

The VAT number of your company is invalid or missing.

Set or correct it with the File menu > File properties (Basic data) > Address tab.

The VAT number must consist of 9 digits. You can also indicate the text CHE, the important thing is that you indicate the 9 digits. For example, you can write CHE-211.311.311 or 211.311.311.

The VAT number must be entered in the File Properties (Basic Data) dialogue, Address tab, VAT field, via the menu command File > File Properties (Basic Data).

At digit xxx the rate xxx is not allowed. Check VAT code xxx

For the digits 302, 303, 312, 313, 342, 343, 382 and 383, the VAT rates are checked according to what the Federal Tax Administration has published (VAT rates from 1 January 2024).