IFRS

Definition and principles of IFRS for SME

Definition of IFRS for SME

They are a set of accounting standards adopted globally for the financial statements of small to medium-sized companies with the goal of ensuring transparency, reliability, and comparability of the companies’ financial information.

They were issued by the International Accounting Standards Board (IASB), an independent organization based in London, composed of a group of experts with the function of defining accounting principles, preparing, reviewing, or using financial statements, and in accounting training.

When the IASB releases a new standard, there must be approval from the European Union, in the specific approval process, the responsibility lies with the European Commission with other consumptive entities.

IFRS Purposes

The main purpose is to create a common accounting framework for most companies operating within the European Community, offering the advantage of greater simplicity and transparency in relation to the balance sheets and financial information.

The objectives are characterized in various aspects as follows:

Transparency:

provide stakeholders with clear and detailed information on the company's financial status and performance.

Reliability:

financial reports that correspond to the business reality and are trustworthy.

Uniformity:

to report financial information that is comparable on a global scale.

Relevance:

to ensure that important information is provided to potential investors and other stakeholders.

Fundamental Principles IFRS SME

The characteristics of IFRS standards are based on principles as explained below:

Full Disclosure

All relevant information must be fully disclosed.

Substance over Form Principle

Transactions must be accounted for and presented based on their economic substance and reality, not just their legal form.

Principle of Prudence

Uncertainties and risks must be duly considered.

Fair Value Measurement

Numerous balance sheet items must be measured at their fair value, rather than at their historical cost.

Qualitative characteristics of financial information

Understandability

The presentation of financial statement information should be understandable in terms of the company’s commercial and economic activities. This principle does not allow for the omission of important information as it would become difficult to understand for some users.

Comparability

Information about an entity is useful if it can be compared with similar information from other entities. This characteristic allows stakeholders to identify and understand similarities and differences in business accounting realities.

Verifiability

Verifiability helps ensure a faithful representation of the company’s accounting and financial information. Quantified accounting information does not necessarily have to be an exact estimate to be verifiable.

Timeliness

Timeliness means having information available in time to make decisions. In this sense, the older the information, the less useful it is. There are exceptions, it is emphasized that for some information it can also be less timely since there is an evaluation over a longer period of time to study and identify trends.

References:

Composition of IFRS for SME

Introduction

According to Article 3.17 of the document "Exposure Draft IFRS for SMEs® Accounting Standard - Third edition of the IFRS for SMEs Accounting Standard - September 2022", it must include all of the following documents in order to have a complete set of financial statements:

- Financial statement.

- Income Statement.

- Statement of changes in equity.

- Cash flow.

- Notes.

References

Statement of financial position

It is a document that represents the balance sheet and financial situation of a company. The balance sheet is separated into current and non-current assets, and consists of assets, equity, liabilities.

Current assets comprise resources that are expected to be liquidated or used as part of usual business operations within one year from the date of the balance sheet. The distinction is particularly useful for investors who distinguish between net working capital and capital used for long-term operations in an operating cycle.

There is also another presentation, it is based on the degree of liquidity, but is suitable for banks and financial institutions that do not provide goods or services within an identifiable operating period.

Non-current assets are corporate resources that are expected to remain in use for an extended period beyond twelve months after the balance sheet date.

Short-term (current) liabilities are those due within the usual operating cycle or within twelve months after the balance sheet date. Trade payables must always be classified as short-term liabilities even if their settlement occurs beyond the normal operating cycle or more than twelve months after the balance sheet date.

Long-term (non-current) liabilities are those due beyond the normal operating cycle or more than twelve months after the balance sheet date.

Income statement

The income statement is the representation of the profit and loss account and is classified according to the by nature of expense method.

The classification by nature is one of the options available from the IFRS for SMEs, and since it is the simplest and most flexible for different business realities, it was decided to implement this approach.

The concept is that costs are aggregated according to their nature, such as depreciation, purchases of materials, transportation costs, etc.

There is also the classification by cost destination, where costs are distinguished between cost of goods sold and other costs, which provides more meaningful information but requires a considerable degree of discretion on the part of the financial statement preparer.

Statement of changes in equity

The statement of changes in the equity of a company between two financial years reflects the variations in the net equity due to the increase or decrease of its net assets for the period or the wealth generated, based on the specific valuation criteria implemented and indicated in the financial statements.

Cash flow

The IFRS for SMEs stipulates that entities must categorize their transactions into three distinct activities:

- Operating.

- Investing.

- Financing.

It further permits entities to present their operating cash flows using either the direct or indirect method. Ultimately, the framework’s goal is to furnish decision-useful information to users, aiding them in making informed economic choices.

Notes

The notes to the financial statements represent a fundamental part of financial reporting under IFRS for SMEs. They provide additional and detailed information that integrates and explains the data presented in the main financial statements.

Furthermore, they play a crucial role in ensuring the transparency and completeness of financial reporting, allowing users of the financial statements to fully understand the company's financial position, performance, and cash flows.

In conclusion, the notes to the financial statements are therefore an essential tool for improving the transparency and comparability of financial reporting at an international level.

Reclassification IFRS with Banana

Reclassification IFRS with BananaIntroduction

On this page, there is a brief explanation of the templates created with the Banana accounting software and how to use them to print the income statement and balance sheet report according to IFRS standards for SMEs.

At the bottom of the page are links to download the templates.

Template IFRS SME

The template file is set up with the IFRS SME chart of accounts in which the Statement of financial position, Income statement and Statement of changes in equity are present.

This file refers to the document "Reclassification IFRS SME" to print the report according to the IFRS SME setting, with the use of the financial statements embellished by groups.

For more information on financial statement enhanced balance sheet with groups:

- Video of how-to do enhanced balance sheet with groups.

- Documentation about enhanced balance sheet with groups.

- Documentation about reclassification of financial statement and Income statement.

Reclassification IFRS SME

The document contains the basic settings to print the page layout (document title, company master data), amounts, totals, subtotals of the Statement of Financial Position and Income Statement accounts.

The accounts will be printed even if the amount is zero. If you want to change the setting of this printout or the style you can do so within this file.

Report creation with Statement of financial position and Income statement

To create a report with the Statement of Financial Position and Income Statement documents, follow the next steps:

- Open the template file and record all case-specific accounting transactions.

- Click on Reports -> Enhaced balance sheet with groups

- Enter the important data relating to the reference company (e.g. document name, company master data) in the Page-Header and Footer section.

- You can make other settings by reading the details on Banana's site on the enhanced balance sheet.

- Click OK.

At the end of the process a new file will be opened with the Statement of Financial Position and Income Statement inside.

Download IFRS SME per Banana

We make the models available without any liability, as stipulated in our Terms and Conditions of Use.

Excel file structure

Introduction

On this page, there is a full explanation of how to use the file, what to find in it and its logic.

In addition, there are illustrations and sample figures to help explain how to use the Excel file. The amounts shown in these images are purely for illustrative purposes and do not necessarily reflect actual or significant values.

Documentary reference

For the creation of the accounting structure within the Excel file, the indications of the documentation related to the IFRS standards for SMEs were followed.

Specifically, the documentation is:

- Accounting principles, notes and other: "Exposure Draft IFRS for SMEs Accounting Standard" of September 2022".

- The presentation of the accounts and the explanatory notes: "IFRS Taxonomy Illustrated IFRS Accounting Taxonomy 2023".

Description structure file

The Excel template is divided into ten main parts:

- General information.

- Financial Statement.

- Income Statement.

- Financial Statement detailed.

- Income Statement detailed.

- Statement of changes in equity.

- Cash flow indirect.

- Notes of financial statements.

- Notes of income statement.

- Notes of cash flow statement.

In order to have a complete set of IFRS financial statements for SMEs, it is mandatory to complete the sheets on General information, Financial statement and Notes of financial statements, Income statement and Notes of income statement, Statement of changes in equity and Cash flow indirect and Notes of cash flow statement.

The Financial Statement detailed and Income Statement detailed sheets, are an alternative to the compilation procedure specified above, as they integrate the entire aspect of the Financial Statement and Income Statement, with all accounts detailed by the notes, having a direct view of the composition and structure of an account with the notes.

Organitation of the file

File content

The file contains seven fields:

- Main field.

- Main account.

- Sub-category of the main account.

- Code.

- Formula.

- Note.

- Account amount.

In the main field, you specify the name of the main account, the document reference and generic company information.

The main account is the name of the main account.

The sub-category of the main account can only be displayed if the Statement Financial detailed and Statement Income detailed sheet is used. It is an account taken from the notes and serves to detail the structure of an account, as required in the IFRS notes for SME.

The code is used for Banana's accounting model and serves to identify the account.

The formula is applied for account totals and subtotals.

The note is account-specific and is entered for some accounts as per the IFRS documentation for EMS.

The account amount is a number to two decimal places without currency indication.

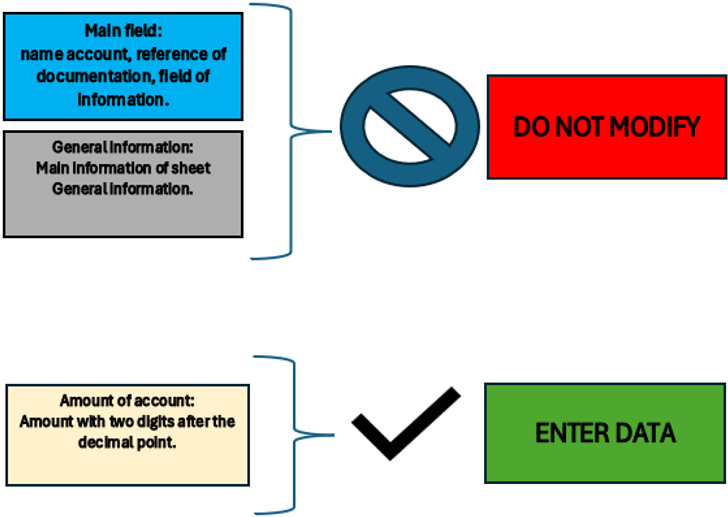

Some fields are not editable as they are an essential part of the file structure. The only part to be changed are the amounts to be entered for the various accounts and the descriptions in the note sheet.

The legend below summarises what the fields correspond to and which are and are not editable.

Figure of Excel in the sheet Legend

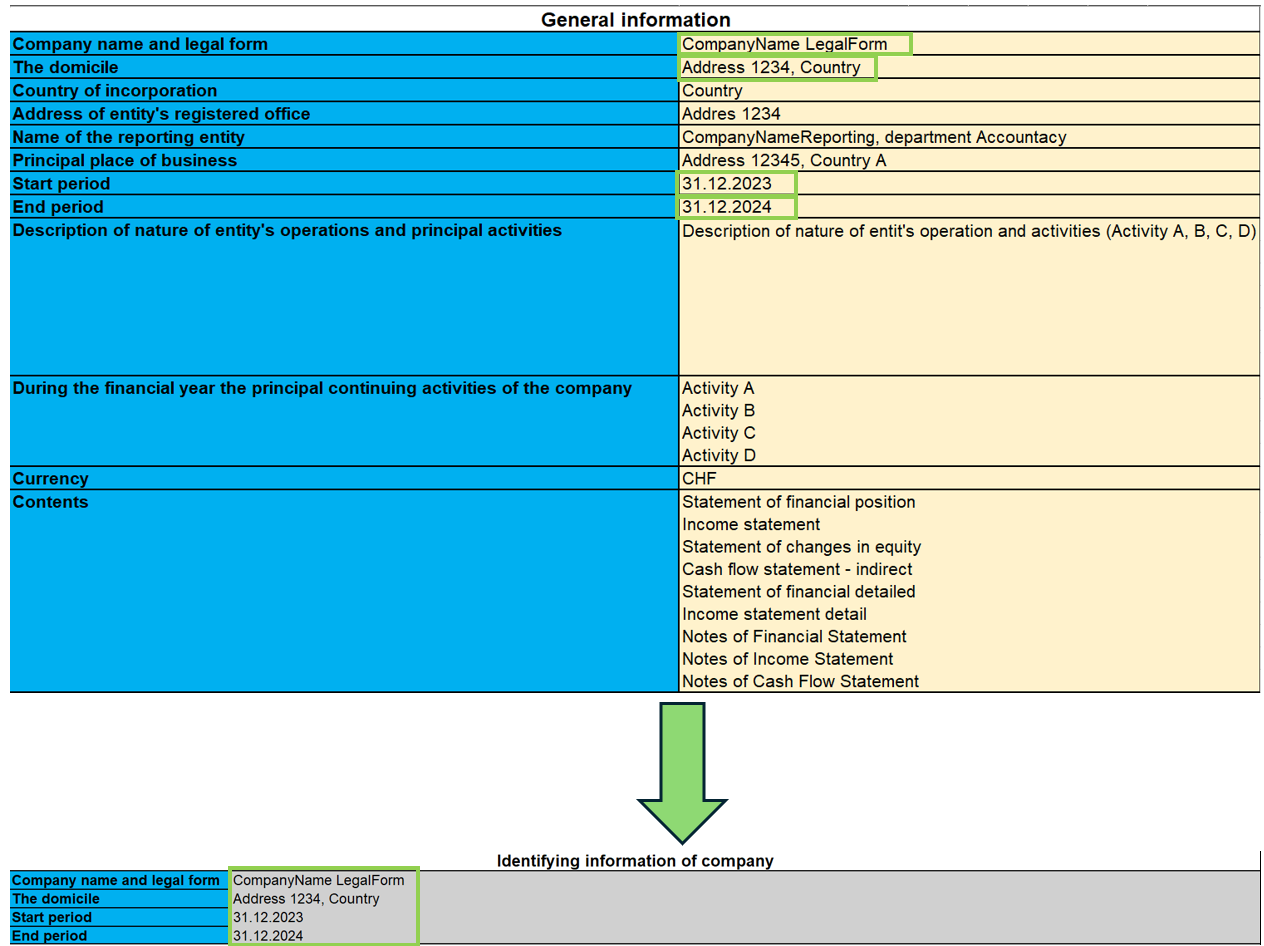

In the General information sheet, the essential information required by IFRS for SME is entered.

The essential information is useful to understand the biographical data of the company, the relevant accounting period, the currency used, the main activities and the content of this file, which is the complete structure of the financial statement.

Certain information such as company name, company name, domicile and accounting period is reported on all sheets specifically for the Identifying information of company.

General information

As shown in the image, the information entered on this sheet is carried over to all sheets, so that the company can be identified on each IFRS document, such as: the full name of the company, the address and registered office, and the beginning and end accounting year to be taken into account for accounting purposes.

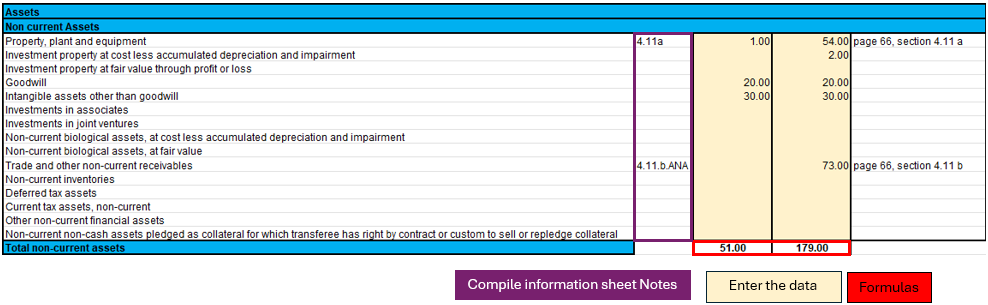

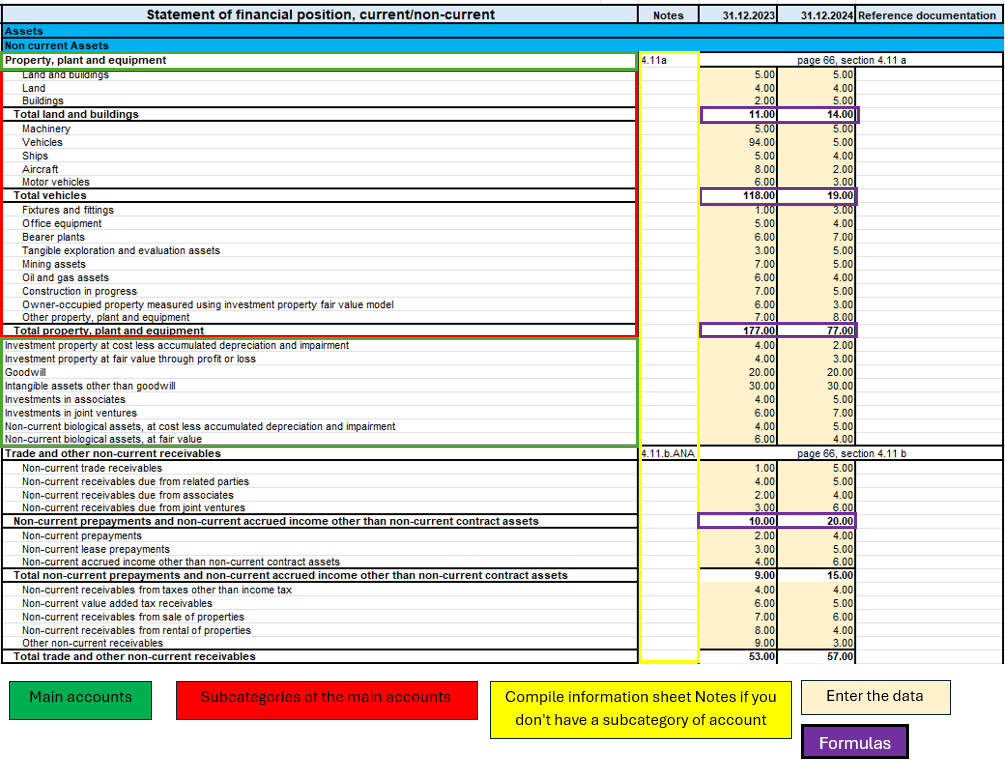

Statement of financial position

The Financial Statement contains all account items relating to the current and non-current positions of the business for the years 2023 and 2024.

In this part you are required to enter the budget amounts in the specific accounts. Totals and subtotals are calculated automatically by the formulas.

It should also be noted that for some accounts it is mandatory to complete the Notes. This is done by entering the amounts and other descriptive notes in the ‘Notes of Finacial Statement’ sheet.

If an account has notes, its amount for the last year refers to the corresponding cell of the account total put in the notes, so it is necessary to fill in the amounts in the notes first.

For the notes, there is also the possibility of consulting the documentation indicated in the ‘Reference documentation’ field, specifying the page and section where the information on the notes can be found.

Finally, there is a final check part to see if the total assets and liabilities are equal.

Modalities of use

In the picture shown, a part of the Statement of Financial Position is selected as an illustrative example to guide the user. There are three highlighted parts in the image:

- Notes.

- The formulas.

- The data to be filled in.

Each part has its own specific function and in some cases the data are directly linked to each other.

Specifically, if an account has notes, it means that in the ending balance (31.12.xx) there will be the total of the amount calculated in the ‘Notes of financial statement’ sheet. This implies that in order to change that amount, one must fill in the account data on the "Notes of financial statement" sheet.

In this sheet one must therefore:

- Verify that the account is not linked to notes and enter the amount in the account.

- If there are notes, then only the ‘Notes of financial statement’ part of the sheet must be filled in.

The formulas integrated in this sheet will make the totals and subtotals of the accounts in the Statement of financial position.

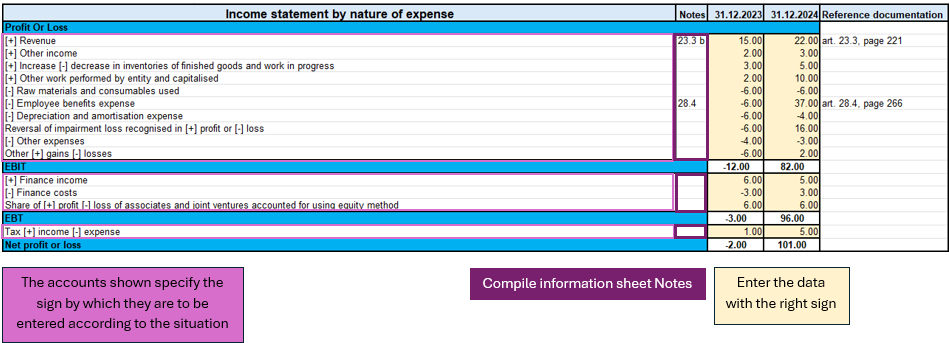

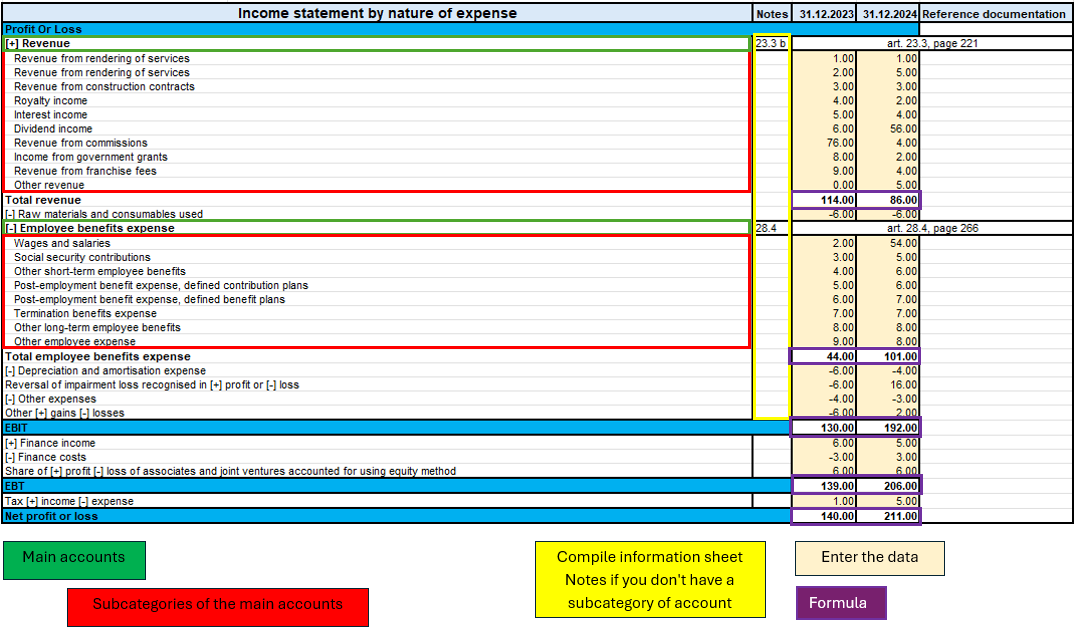

Income Statement

The income statement is presented according to the classification ‘by nature of expense’.

This classification is an aggregation of costs according to their nature (e.g. depreciation, purchase of materials, transport costs, salaries, advertising costs, etc.) and are not allocated according to their purpose within the company.

The implementation of this classification was decided upon because it is simple and widely applicable for SMEs. The other classification was according to costs by function, where a distinction was made between costs of sales versus other costs (e.g. distribution costs or administrative costs) and this representation requires a considerable degree of discretion on the part of the end user.

As previously done for the Financial Statement, there are the amounts to be entered while the totals are already calculated by means of the formulas applied in the sheets.

In addition, a further breakdown has been made for EBIT (earnings before interest and tax) and EBT (earnings before interest).

Modalities of use

This figure highlights the important parts of the income statement.

Looking at the accounts, there are indications of the signs (+/-) to be used in the various circumstances, which implies that for accounts that have both positive and negative signs, there is an assessment of the positive or negative impact of that amount on the result of the income statement.

As previously seen in the ‘Statement of financial position’, there are also notes to be entered in the relevant sheet ‘Notes of income statement’ in order to be able to correctly define the amount, as the latter depends on the total in the notes.

In summary, what you need to do on this sheet are the following steps:

- Evaluate the circumstances of the account with both positive and negative sign and understand whether you are in a situation where it has a positive or negative impact on the result.

- Verify that the account is not linked to notes and enter the corresponding amount with the correct sign.

- If the account is correspondent with the notes, then only the ‘Notes of income statement’ sheet must be completed.

Statement Financial detailed

This document differs from the Statement of financial position in that there is more detail on the accounts. The official presentation of the accounts can be found in the ‘Statement of financial position’ sheet in terms of how the accounts are summarised; in this sheet, however, we have more detail, with the aim of avoiding filling in the notes directly in the specific sheet. The use of this sheet excludes the use of the ‘Statement of financial position’ sheet because they refer to the same notes.

The main difference is that not only the main accounts required as a presentation by IFRS for EMS are shown, but they are detailed in sub-categories of accounts that are the same as those found in the notes, so that using this document one can avoid filling in the notes, using only the sub-categories of accounts, except in some cases where the account requires descriptive textual type details, without using calculation formulas or amounts. For this reason, not all parts of notes are integrated, as some accounts require a textual type description.

To distinguish the main accounts from the sub-categories of accounts, the main categories are coloured dark, while the light categories are the accounts related to the notes.

If there are no subcategories of accounts (coloured light), then it is sufficient to go to the specific Notes of Statement or financial position sheet.

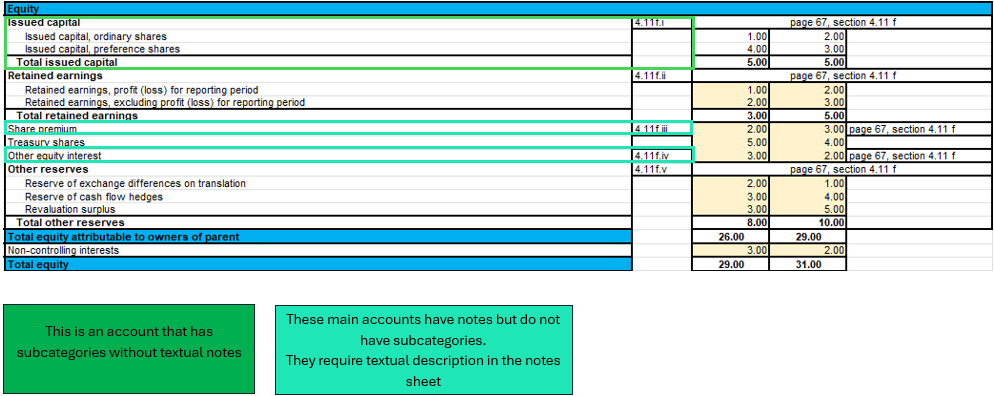

Modalities of use

In this image, you can see four essential parts of the document:

- Main accounts.

- Subcategories of the main accounts.

- Notes.

- The amounts to be entered.

- The formulas.

This part, there is more detail only if an account has notes, otherwise it is the same as the Statement of Financial Position. What requires attention is the verification of an account if it is an account with notes and has no sub-categories of accounts, if you find yourself in this situation then it means that the account requires an additional textual description to define some peculiarities in the ‘Notes of financial statement’ sheet.

On the other hand, for accounts that have notes but also account sub-categories, only the amounts of the sub-categories of the specific account need to be filled in. In this way, having filled in all the amounts of the sub-categories of the account, the formulas applied to the sub-categories will calculate the subtotals and the total of the main account.

So to summarise, the procedure for filling in this sheet is:

- I enter the amounts in the main accounts if there are no notes to refer to.

- If the main account has notes, I check that it has sub-accounts, if it does not, then I go to the ‘Notes of financial statement’ sheet and fill in the text description.

- If, on the other hand, the main account has notes and has the subcategories of accounts, then I only fill in the amounts of the subcategories.

In this example image in the Equity part, a case is illustrated where an account has notes but no account subcategories, which requires a textual description in the ‘Notes of financial statement’ sheet, and a normal case where there are notes with account subcategories.

Income statement detailed

Income statement detail is based on the same logic as the Statement of financial detailed, with the aim of providing a single document for its function, detailed by the accounts of the notes, without having to fill in the Notes of income statement.

There are the main accounts and when there are notes, they are detailed by the sub-categories of accounts that are part of them.

Modalities of use

As illustrated in the figure above, there are four equal parts to the ‘Statement of financial detailed’ sheet with the same logic.

The only difference is that there are no descriptive notes, so all accounts with notes are already with their sub-categories without requiring additional compilation on the ‘Notes of income statement’ sheet.

Therefore, to summarise, it is essential to follow these steps:

- Enter the amounts of the main accounts if they have no notes.

- If the main account has notes, enter the amounts only in the subcategories of the account.

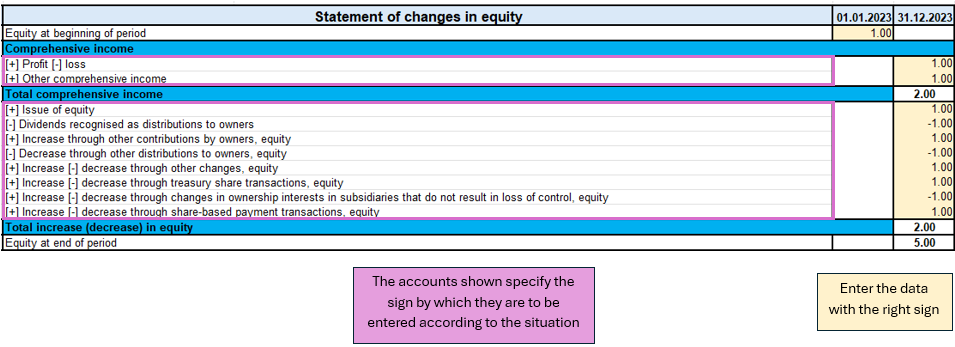

The Statement of Changes in Equity

The Statement of Changes in Equity reflects changes in equity.

This part provides insight and transparency into decisions and their effect on the value of equity. It is also a useful tool for investors and other stakeholders to understand how the company has generated and utilised equity capital.

Modalities of use

In the sheet ‘Statement of changes equity’ as shown in the image, there is one part to pay attention to.

The first is the evaluation of the change in the account item, whether it increases or decreases, and then according to the sign (+/-) the amount must be written with the correct sign.

Unlike other documents, this one does not require notes.

So the process of completing the document is:

- Evaluate the account change and follow the indications on the sheet on the sign to be taken in the various circumstances (increase or decrease in the account).

- Enter the amount with the correct sign.

Cash flow indirect

This document draws up the entity in four parts:

1. Cash flow from operating activities;

2. Cash flow from investing activities;

3. Cash flow from financing activities;

4. Net cash flow.

The document is independent of the other sheets, so you have to do your own calculations to deduct the various amounts to be included in the cash flow items.

The accounts are taken from the IFRS for SME taxonomy, first there are the profit or loss adjustments and then the operating activities are calculated.

Investing activities are characterised by the purchase or sale of fixed assets such as equipment, real estate, joint venture participations and others.

Cash flows from financing activities are related to the company's sources of financing, such as leasing, share issues, debt repayments or financing income. There is also the payment of dividends to shareholders.

In the last part of cash flow there are some clarifications to be made. The net change in cash is assessed in two steps, the first is calculated before the effect of the exchange rate change and the second after this change. In addition, as a form of control, the change in liquidity is also calculated, showing the changes in the period of activity, by calculating the difference between the initial and final liquidity balance.

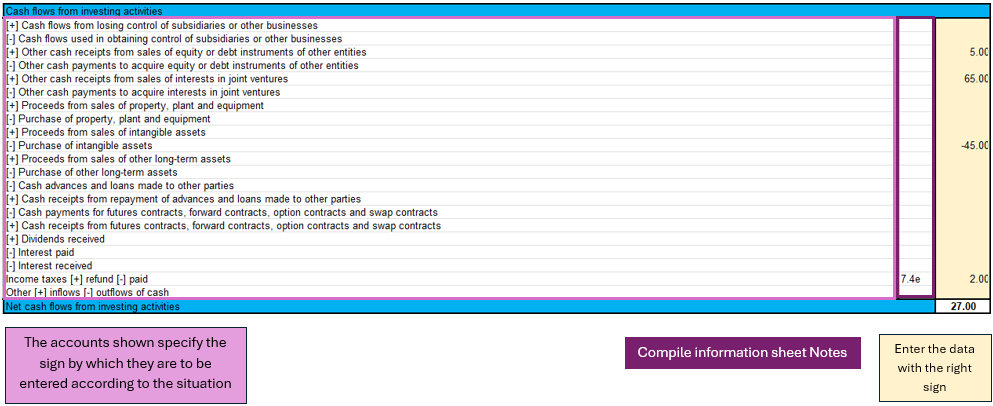

Modalities of use

As shown in the figure of the cash flow for investing activities, three main components can be identified:

- The main accounts show the sign depending on the situation.

- For some accounts, the notes of cash flow statement are required.

- Entering the amounts requires attention with respect to the sign.

In the cash flow statement, reasoning on the implications of the balance sheet and profit and loss accounts is required in order to conclude which amount to enter in the specific item of the cash flow statement, so the conclusion depending on which cash flow statement has been analysed, could be an increase or decrease of an asset, a payment for property purchase, payment of dividends to shareholders,...

There is no sheet for this purpose, the user must reason with the amounts available, entered in the balance sheet and profit and loss account, and come to his own conclusions.

Next, having an amount, one must distinguish the situation as indicated in the sheet, in order to enter the amount with the correct sign.

Finally, in the event that it is required, fill in the notes of cash flow statement with the specific amounts in the case.

Notes

The notes are divided by the three IFRS documents:

- Notes to the Financial Statement.

- Notes of the Income Statement.

- Notes to the Cash Flow Statement.

As mentioned in the introductory section, the notes serve to supplement the information taken from the financial documents.

The note sheet contains four essential parts: the note code, reference account, amount and notes (text).

The note code is the reference for each part of the documents that serves to understand in which account the notes are to be completed.

The account represents the account taken from the document (Financial Statement, Income Statement, Cash Flow) to be detailed in the notes.

The amount is singular for the detailed account and is not always required because in some cases only a textual description is needed.

Notes as text are necessary if there are cases where only a description or more detailed customisation is required to explain an account.

Modalities of use

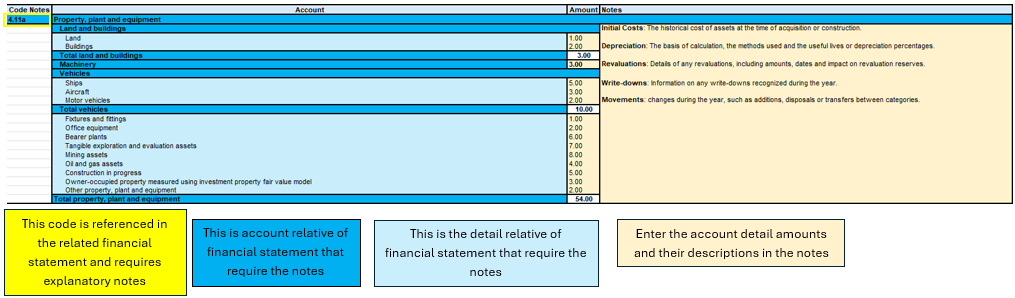

Case for the Financial Statement

Figure of Excel in the sheet Notes of financial statement

In this image, four main components can be seen, the account reference code, the account, the detail grouping the sub-categories of accounts, the amounts to be entered with any textual notes.

The starting point for completing this sheet is then the financial statement, where we list which accounts need more detail, and then move on to complete the information in the notes sheet.

The data entry part concerns the amount of the detail account and any descriptive text.

The account totals and subtotals are calculated from the formulas, the account total is shown on the main sheet of the financial statement, so it is essential that if an account needs notes, it is only on the notes sheet.

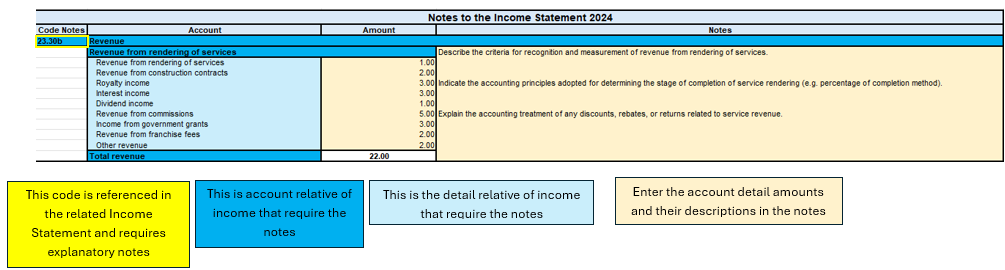

Case for the Income Statement

Figure of Excel in the sheet Notes of income statement

As seen above, the structure does not change for the Income statement notes. The main parts are always the same, as also for the cash flow notes.

To summarise therefore in this process one must:

- Depending on which sheet you are compiling, you must check that the analysed account of the financial statement, income statement or cash flow note is there.

- All the necessary data and information must be filled in.

- If there is a sub-account in the notes that is not needed or not used, you can simply leave it blank or enter a zero amount.

Objectives of the file

The process of creating the IFRS structure for SMEs took the official documentation and reconstructed a structure in the Excel template, with the aim of allowing the user to follow the IFRS reporting logic by entering the main information in the parts of the file.

The basic characteristics of such a file is the completeness of the document by having all the main parts required for IFRS, the usefulness of preferring the most widely used models that are more suitable for several companies, and excluding other more specialised models only in certain contexts.

The end result is to have a financial and economic view of the company's situation in the specific period, in compliance with the IFRS standards for SMEs.

In addition, the aim of IFRS for SMEs is to improve the comparability of financial data between different companies, to facilitate the analysis and interpretation of financial results by stakeholders outside the company, and to promote the adoption of IFRS for SMEs by providing a practical and accessible tool.

Free Excel model for the IFRS-SME

We make the model available without liability as per our Terms and Conditions of Use.